Justin Sullivan/Getty Images News

Investment Thesis

Walgreens Boots Alliance (NASDAQ:WBA) has had its margins under pressure for some time now, largely due to a tight labor market and inflation, but also increased competition.

These operating headwinds combined with rising rates have resulted in the stock cratering – returning -40% since the year began even when accounting for the dividends paid out to investors.

All things considered, Walgreens appears to be extremely cheap on all traditional valuation metrics, however, the stock continues to underperform the broad market and cause pain for investors.

In this article, I outline why I believe Walgreens is a great ‘pot-odds’ pick with substantial upside potential if things just go OK, and limited downside risk if they do not go that well as it appears further margin contraction is largely priced in already.

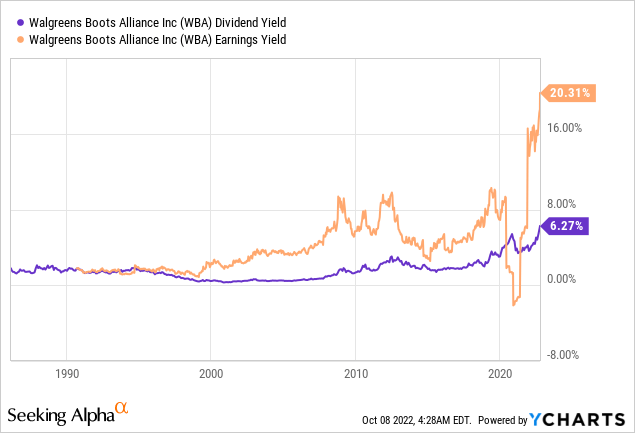

On the surface, Walgreens is cheaper than it ever has been – on almost all metrics – sporting the highest dividend yield it ever has at 6.27% and a record 20.31% earnings yield.

That’s enormous, so enormous in fact it’s suspicious – not once have I ever seen such ridiculous mispricing of a stock. There has to be more to the story than being a cash cow and spitting off tons of dividends.

Walgreens appears very cheap on the surface

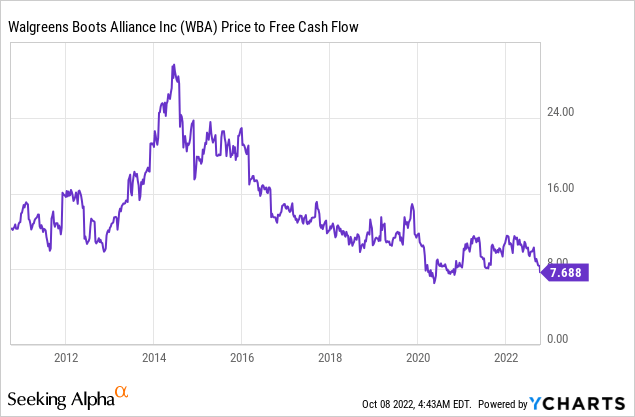

Looking at some other valuation metrics, like P/FCF the story becomes less clear – while relatively cheap to the historical P/FCF there have been cheaper prices during the last few years.

However, when taking a less analytical approach to the chart and listening to the story it tells rather than just glancing at the relative value a nastier picture begins to form. Walgreens is definitely historically cheap, however, they’ve been on a long-term downtrend in P/FCF.

This screams something is deeply wrong with the company – what exactly needs to be explored more but something is wrong.

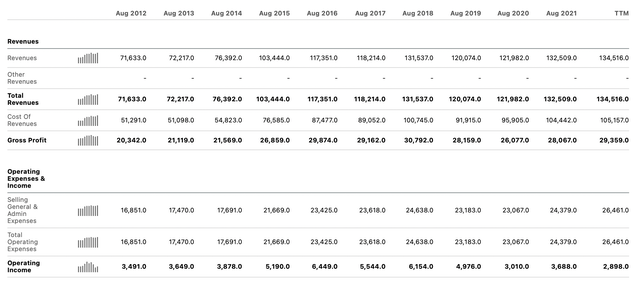

To explore what that might be let’s check out their Income Statement:

Operating performance raises concerns

Diving into these numbers you can see total revenues exploding higher over the last 10 years moving from 71.6B to 134.5B, however likewise the cost of those revenues have exploded from 51.3B to 105.2B.

Walgreens nearly doubled its revenue since 2012, increasing revenues by 87%, but more than doubled (105% increase ) the cost of those revenues? That’s not good, but, hey, their gross profit is up 50% all in, so who’s to complain as a shareholder of Walgreens? What’s not to like?

Well, the operating expenses went up substantially, so it wasn’t just the revenue and cost of revenues going up, but also management expenses. Net-net the operating income of Walgreens has gone down over the last 10 years, showing the company is far less efficient and bloated than it was previously.

So, what is this story sounding like? To me, it sounds like profit margin contraction, poor execution, a bloated increasing bureaucratic company, and/or declining margins. Most likely a combination of them all.

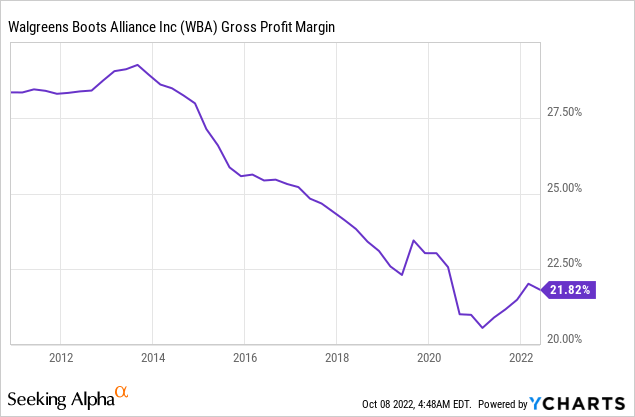

Margins expose the problem with Walgreens

Gross profit margins are collapsing – this chart is the same time frame as the P/FCF chart shown above – do you see the similarities?

In my opinion, this is the root cause of Walgreens problems – the cause for its extreme surface-level undervaluation and declining P/FCF ratio.

Many may argue gross profit margins do not matter and that operating margin, the actual take-home margin, is what matters – I’d disagree as it shows the declining yield on revenues is NOT a supply shortage issue related to covid, but rather has been persistent for years.

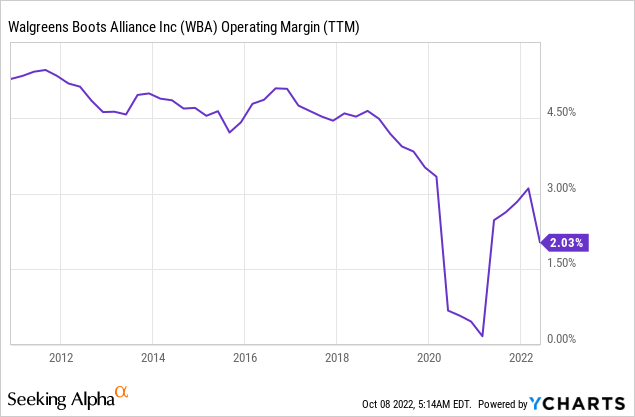

Regardless, let’s examine the operating margin:

The story is the same here – they’ve been on a steady decline setting lower highs and lower lows for years and years with no real indication of reversal.

In fact, it seems like COVID combined with current macro headwinds have kicked Walgreens operating margins into the gutter. This chart looks very bleak. Concerning would be an understatement.

It’s clear the problem isn’t just a yield-on-revenues issue with cost of goods going up, but rather it’s a systemic issue within the company. Maybe management isn’t able to allocate capital efficiently, despite their best efforts.

Maybe labor markets are just super tight and it’s killing profitability when combined with lower yield on revenues – maybe it’s not management’s fault.

I can’t say for sure what the cause of this is, nobody can, but when you have CVS still 30% above its 2020 lows while WBA is over 15% below its 2020 lows it’s clear this isn’t a sector-wide problem. It’s not just a macro problem. It’s a Walgreens problem.

Bearish on the company, bullish on the stock?

This article reads like a bear thesis, so you may be wondering why I rated this stock a buy – as I’ve more or less told a story of poor performance vs peers, declining fundamentals, and generally a company in trouble – so why would I be bullish on the stock?

The answer is simple – the stock is cheap.

In my opinion, Mr. Market has priced in operating margins collapsing further to 1%, which would largely balance out the surface-level cheapness in P/E to WBA’s historic range.

The stock is priced for disaster – essentially a worst-case scenario, and thus the pot odds for going long here are outsized relative to the risk.

What if disaster strikes?

Maybe everything goes wrong, management screws up where to reinvest, labor markets remain tight, post-covid traffic slumps, and inflation continues and margins go down to 1%.

It’s a possibility, and we could visit the low 20s if that occurs, no doubt – but I don’t see Walgreens going the way of Rite Aid (RAD) as despite growing digital competition their revenue continues to grow steadily and their P/FCF continues to stay strong – which was not the case with Rite Aid. WBA’s P/FCF may not be stellar, it may be declining consistently – and for good reason – but it’s not even comparable to the situation Rite Aid has been in. Walgreens story is consistent poor results in terms of margins, but consistent growth and consistent increases in gross profit – which was not at all what rite aid experienced or continues to experience.

Inevitably labor markets will ease and inflation will calm down, and with it, Walgreens margins should expand – and with margins being priced for disaster already the upside could be substantial.

What if disaster doesn’t strike?

If margins simply stay flat and post-covid slowdown fears, fears around inflation and labor markets, etc, do not manifest more than expected then the stock has substantial upside potential over the next couple of years. I’m looking for a 40% -> 50% upside in a continued high-rate environment or 65% -> 80%+ in the event of a monetary policy pivot.

You may say that’s obscene, outrageous, and overly optimistic.

I’d disagree, as in these scenarios the stock would be yielding above bonds, compensating investors for the risk they’re taking, while also having most of the risks/fears currently present in the stock subside or become substantially less concerning.

Ultimately investing in Walgreens at these levels looks to offer a fantastic risk-reward scenario, especially if one decides to initiate a position using puts rather than raw stock.

Actionable ways to go long the stock

I always do the leg-work trying to figure out how I’ll get in on my thesis before writing an article on the thesis – here are ways I considered getting net-long and what I considered them to be:

- Long the stock raw – Medium-high risk/Medium-High reward, must be very bullish at these prices

- Short Nov 18th 30 puts – medium-risk/medium-reward, ideal if not very bullish

- Short Nov 18th 27.5 Puts – Low-Medium risk/medium reward, ideal for Portfolio-margin accounts or high-cash positioned investors

- Short Jan 20th 2023 27.5 Puts – Low risk/medium reward, ideal for folks wanting to long the stock a little lower and do not want active-management

I personally went with a combination of the above strategies. I would not go out beyond Jan 20th 2023 as likely peaks in rates and a declining macro environment is likely to begin manifesting near that time in my opinion, which exposes investors to additional risks. The premiums also decline substantially that far into the future, so selling further out in time doesn’t make much sense in my opinion – if an investor isn’t comfortable going long at the price minus premiums received at that time, they’re likely better off waiting for a further price decline (if one occurs) before initiating a position.

Risks to keep in mind

I want to be clear when I say while I think downside is most likely to be limited in this stock there is a chance, a chance I believe to be small, that the stock goes the way of rite-aid and struggles to remain profitable in a worst-case scenario, particularly if rates stay elevated along with inflation and tight labor markets. Never rule that off the table.

I would not be investing in this stock if I was close to retirement or risk-averse, as I do not believe a stock with such margin contraction can be considered a safe place to park capital. It may be a good place, that returns high, but with that reward potential comes extra risk.

Finally, it’s important to realize Walgreens is highly leveraged as a company, owing 133% of its current market cap in debt. If rates continue past expectations, 4.5~ Fed funds, then profitability and margins would be further under pressure. We’d also likely see a further discounting of valuation and risk as bond yields rise, which could substantially hurt the stock price.

Conclusion

While I believe Walgreens to be oversold at these levels, and likely undervalued in the long-term, there are substantial risks in regards to investing in the stock. I don’t believe it’s suitable for risk-averse investors.

With that being said, Walgreens is extremely cheap currently and while there’s definitely risk to the downside in a worst-case scenario the upside potential far outweighs the risks to the downside in my opinion.

If management and the company can generally hold things steady and not sink the ship, I suspect the performance here will beat the broad-market over the coming year or two, and thus I rate the stock as a buy.

I’ve initiated multiple short-put positions as well as long shares this week, accounting for a notional exposure around 15% of my entire investment portfolio.

Be the first to comment