SrdjanPav/E+ via Getty Images

Investment thesis

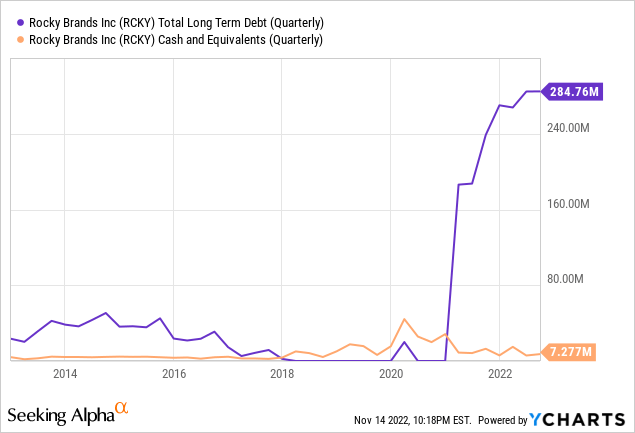

Operations of Rocky Brands (NASDAQ:RCKY) are stabilizing after a post-pandemic demand surge and the company’s debt pile is skyrocketing as a consequence of the acquisition of five brands from Honeywell International (HON) in 2021 and the subsequent accumulation of inventories, which have produced abnormally low cash from operations. Furthermore, profitability was also impacted by current margin deterioration as the macroeconomic landscape is getting more complex due to supply chain issues, inflationary pressures, labor shortages, and increasing interest rates.

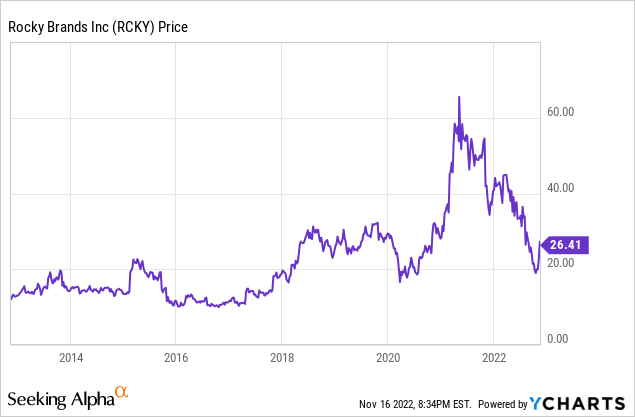

As a consequence of these headwinds, the share price has recently plunged by ~59% despite the fact that the company has enormous inventories and enough margins to generate cash from operations to cover almost all of the current interest expenses, capital expenditures, and dividends. Therefore, the company has a lot of room to withstand current headwinds, but to these, we must also add increasing fears of a potential recession as a consequence of rising interest rates.

A brief overview of the company

Rocky Brands is a designer, manufacturer, and marketer of premium quality footwear and apparel under a wide range of brands, including Rocky, Georgia Boot, Durango, Lehigh, The Original Muck Boot Company, XTRATUF, Servus, NEOS, Ranger, and the licensed brand Michelin. These brands operate in the outdoor, work, duty, commercial military, military, and western industries. The company was founded in 1932 and its market cap currently stands at ~$200 million, employing over 2,800 workers.

Rocky Brands (Rockybrands.com)

Certainly, Rocky Brands is a company that can be bought and held for decades as its brands are quite timeless. The company sells its products in very wide price ranges (from $20.00 to $462.00) in order to absorb a large market share in the industry. Many of its products are used in the workplace, making them essential products for millions of workers.

Currently, shares trade at $26.41, which represents a 58.69% decline from the recent spike of $63.93 on May 7, 2021. This decline responds to a recent worsening of the company’s operations marked by a stabilization of demand after a post-pandemic surge, a weakening of profit margins as a consequence of current supply chain issues, inflationary pressures, and labor shortages, rising fears of a potential recession in the medium term, and a huge debt pile as a result of a major acquisition in 2021. Even so, I believe that the company has enough resources to manage its current level of debt and face current headwinds as its balance sheet is ready for a reduction of inventories that once converted into cash will allow a significant reduction of the debt.

Acquisitions and divestitures

Acquisition moves have been slow in recent years as the company eliminated all of its debt in 2018. In November 2017, the company divested its Creative Recreation brand for ~$4.4 million, a brand for which the company paid $11 million in 2013, in order to focus on more profitable core brands.

Then, the company made a major movement in March 2021 when it acquired the performance and lifestyle footwear business from Honeywell International, which includes five brands: Muck, XTRATUF, Servus, NEOS, and Ranger, for $230 million. Later, in October 2022, the company sold the NEOS Overshoe brand to SureWerx.

Since the acquisition, net sales have skyrocketed and Rocky Brands has entered a new phase that will be marked by the need to pay off the debt incurred in order to make this leap possible without the need to cover large interest expenses at the end of each period, a phase that should last for years as the debt is even higher than the current market capitalization. Still, the benefits of the acquisition should kick in as soon as the company starts paying down its debt as declining interest expenses will release new resources that will make it possible to gain some margin to pay the debt more easily, increase the dividend, repurchase shares, or target other acquisitions.

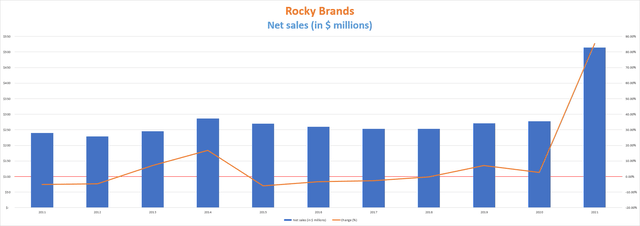

Net sales are on a new level

The lack of acquisitions caused a stagnation in net sales until 2021. In part, this is because the company was reducing its debt pile until 2018 when it became completely debt-free. Certainly, the company achieved net sales growth during the coronavirus pandemic crisis as they increased by 2.55% in 2020 after a 7.01% increase in 2019, but the newly acquired business from Honeywell International caused a net sales increase of 85.43% in 2021, putting the company on a new level.

Rocky Brands net sales (10-K filings)

Furthermore, the company reported a net sales increase of 90.52% year over year during the first quarter of 2022 as the company still didn’t own Honeywell’s brands in the same quarter of 2021, 23.13% during the second quarter, and 17.51% during the third quarter. In this sense, net sales are stabilizing after a post-pandemic demand surge and are expected to stand at $607 million for the whole of 2022, which is 6.04% lower than the current trailing twelve months’ net sales of $646 million. It is also expected that net sales will stabilize at $589.20 million in 2023, which still represents a 112.47% increase compared to 2020 when it still didn’t own Honeywell’s brands.

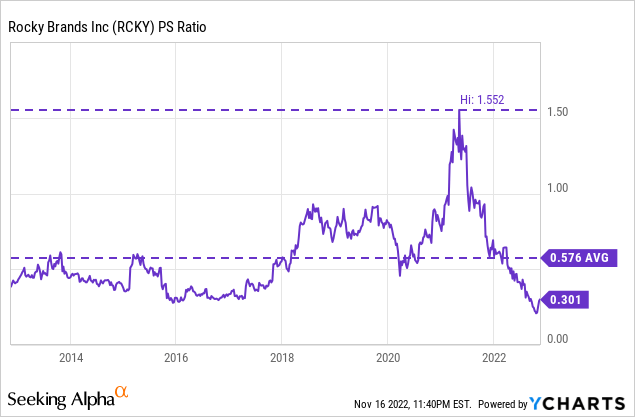

The recent surge in demand after the coronavirus pandemic crisis together with the net sales increase coming from the acquisition of Honeywell’s lifestyle footwear business and the recent fall in the share price as a consequence of the stabilization expectations for the end of 2022 and the year 2023, increased debt, and declining margins, have caused a sharp decline in the price-to-sales ratio to 0.301.

This means that the company generates net sales of $3.32 for each dollar held in shares by investors, annually. This ratio is 47.74% lower than the average of 0.576 of the past decade but net sales are expected to decline by just 8.79% by the end of 2023, which suggests that the recent increase in debt, as well as the current deterioration of profit margins as a result of supply chain issues, labor shortages, and inflationary pressures, are preventing the share price from holding at higher prices.

Nevertheless, both margin contraction and increased debt are temporary situations that do not represent a paradigm shift in the nature of the company in the long term, and the brands acquired in 2021 will remain in the company’s portfolio and generate profits year after year in the long term, which suggests that the price-to-sales decline is also temporary.

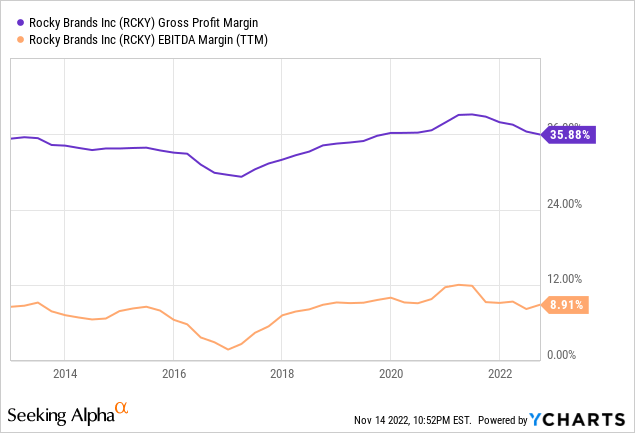

Margins are temporarily depressed

In 2016, the management made an agreement to pursue operational and cost efficiencies in order to maximize shareholders’ returns and reduced the U.S. workforce in order to save around $3.0 million in annual operating expenses, and since then, profit margins have been increasing until 2021, which made it possible to eliminate all of the existing debt by 2018, raise some cash, and make the Honeywell’s acquisition.

Still, the current macroeconomic headwinds have had a direct impact on the company’s operations by causing a trailing twelve months’ gross profit margin decline to 35.88% and an EBITDA margin decline to 8.91%. Said deterioration has intensified in the past quarter as the company reported gross profit margins of 35.21% and EBITDA margins of 7.88%, both lower than the current trailing twelve months and at similar levels of late 2019.

The management is currently optimizing marketing spending by selectively running ad campaigns on social media platforms while increasing organic traffic through SEO initiatives, and in June 2022, it closed the Boston office acquired in the Honeywell deal with the target of reducing the non-manufacturing headcount of the business by 13% in order to save from $3 to $4 million per year.

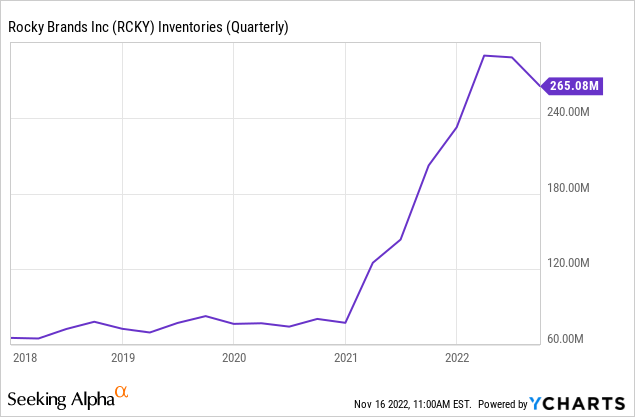

Currently, trailing twelve months’ cash from operations stands at -$35.7 million while interest expense is expected to keep increasing to over $16 million per year as total interest expenses were $4.18 million during the third quarter of 2022. On the other hand, the trailing twelve months’ capital expenditure currently stands at $10.9 million. Still, the inventory increased by $62.9 million in the past year to $265.08 million and accounts receivable by $25.6 million to $118.2 million while accounts payable have only increased by $16.6 million to $101.7 million.

This places the company at a robust starting point to manage its currently high long-term debt as it has highly inflated inventories that should soon be converted into cash from operations with which to cover interest expenses, as well as capital expenditures, and thus be able to begin reducing its debt pile. But considering the company generated cash from operations of $18.09 million in 2019 with similar margins (but half the sales) to current ones and that the company increased inventories by $62.9 million in the past twelve months by using only $35.7 million of cash from operations, I highly believe that the company generates enough cash to cover almost all of the interest expenses of slightly over $16 million, capital expenditures of ~$11 million, and dividend payouts of ~$4.5 million by itself despite current headwinds and that inventories will make a major debt reduction possible, which will ultimately lead to much lower interest expenses.

Long-term debt is the most immediate risk

Since the Honeywell acquisition in 2021, the long-term debt increased from zero to $285 million while cash and equivalents have been reduced to $7 million. This is the most immediate risk, which will gradually be reduced if the company manages to stabilize margins and convert current inventories into cash with which to pay down a significant portion of the debt. Considering current profit margins and using 2019 as a reference due to the fact that margins are at roughly the same level, I expect cash from operations of ~$30 million per year at current (depressed) margins, with which a debt reduction of ~30%, which is possible with ~32% of inventories, would dramatically decrease the company’s overall risks due to declining interest expenses.

Considering cash from operations of $17.57 million in 2018, $18.09 million in 2019, and $31.44 million in 2020 despite inventory growth of $7.2 million, $3.9 million, and $0.9 million, respectively, I consider that reaching the $30 million mark in the medium term is something widely feasible considering net sales more than doubled after the acquisition.

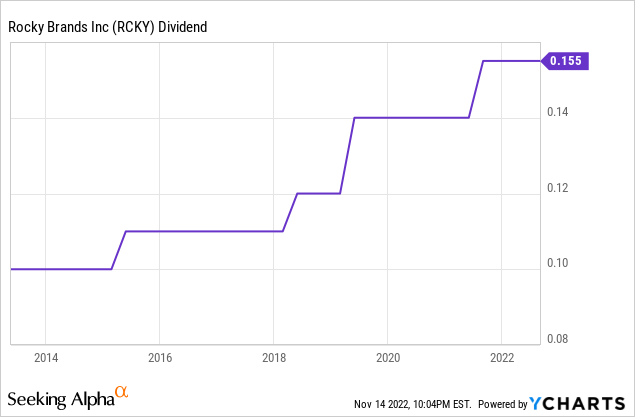

The dividend payout is actually very low

In May 2013, the company initiated a quarterly dividend of $0.10 per share, and the dividend has increased by 55% since then to the current $0.155 per share. The last quarterly increase took place in August 2021 when the company announced a 10.7% raise to the current $0.155.

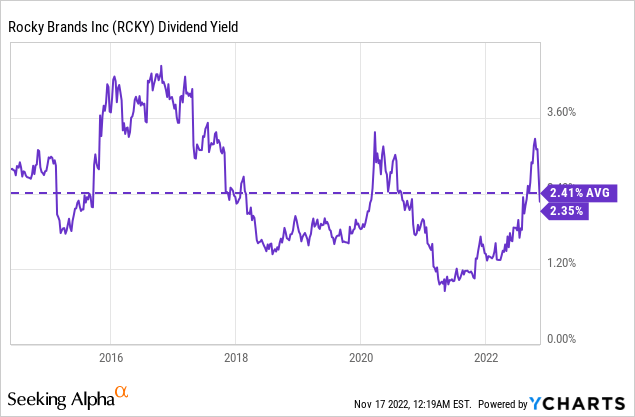

Recently, the dividend yield has increased to 2.35% as a result of the fall in the share price, but this yield is still slightly lower than the average of 2.41% in the past decade. This is explained by the fact that although the share price has fallen by 58.69% in 2021-2022, the share price is still at levels similar to those of 2018-2020.

The difference is that now the dividend growth potential is even higher than before because net sales have doubled, and as soon as the company begins the deleveraging process the balance sheet will enjoy the cash flows from the Honeywell acquisition. In the following table, I have calculated the company’s cash payout ratio by calculating what percentage of cash from operations has been used in the past few years for covering the dividends paid and interest expenses. In this way, we can determine the company’s ability to cover the dividend with actual cash.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in millions) | -$2.45 | $12.98 | $23.24 | $21.30 | $17.11 | $17.57 | $18.09 | $31.44 | -$54.88 |

| Dividends paid (in millions) | $2.25 | $3.02 | $3.25 | $3.30 | $3.27 | $3.48 | $3.99 | $4.09 | $4.30 |

| Interest expenses (ni siquiera en miles) | $0.69 | $0.94 | $0.70 | $0.62 | $0.39 | $0 | $0 | $0 | $10.1 |

| Cash payout ratio | – | 30.51% | 16.99% | 18.37% | 21.38% | 19.83% | 22.04% | 13.02% | – |

Historically, the company has used a low portion of the cash generated from operations to cover the dividend and interest expenses, which allowed it to reduce its debt to zero in 2018 and raise some cash before the Honeywell acquisition. The trend was broken in 2021 as the company declared negative cash from operations due to very high inventory accumulation, a trend that lasted until the second quarter of 2022.

During the past quarter, the company reported cash from operations of -$0.8 million as inventory declined by $22.7 million but accounts payable by $28.5 million. Furthermore, accounts receivable increased by $2.4 million. Without all these differences between inventories, accounts payable, and accounts receivable, the company would have achieved $8.2 million more in cash from operations and it would have stood at $7.4 million in a quarter with depressed margins. At current margin levels, the company can then achieve cash from operations of ~$29.6 million per year despite current headwinds, which is enough to cover almost all of the $16 million in interest expenses, $11 million in capital expenditures, and ~$4.5 million in interest expenses. This means that the company has wide room to withstand current headwinds and use inventory levels to successfully pay down a big portion of the debt and thus reduce interest expenses, which would make debt much more manageable.

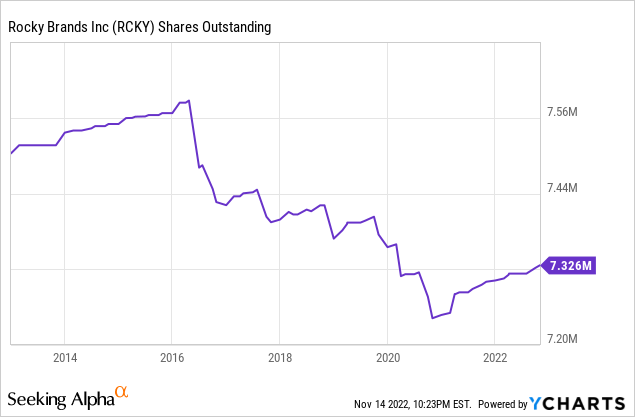

Share buybacks will be likely paused for some more years

The company reduced the number of shares outstanding by 4.39% from February 2016 to February 2021, improving thus per-share performance as each share represented a slightly bigger portion of the company, and announced a share repurchase program of up to $7.5 million in March 2021, but negative cash from operations caused the number of shares outstanding to actually increase by 1.04%.

This shows that management has the predisposition to return part of the profits to shareholders in the form of share buybacks despite the recent increase as a consequence of current headwinds. Still, I don’t foresee more share buybacks in the near term as the company’s current objective should be to reduce long-term debt as fast as possible in order to reduce risks and release resources that can be directed to growth initiatives or to pay off debt more easily.

Risks worth mentioning

- Further reductions in margins could force the company to use inventories to cover interest expenses and capital expenditures since it could not do so with cash from operations. This would make a successful deleveraging phase difficult as the company needs to reduce interest expenses as fast as possible by reducing the debt pile with current inflated inventories.

- A potential recession could have a significant impact on the company’s balance sheet as its situation is very delicate due to the interest expenses that the debt contracted for the major acquisition of 2021 entails.

- The dividend could be frozen in the short and medium term to speed up the company’s deleveraging process. This would mean short-term pain for shareholders in order to ensure a more robust and healthy dividend in the long term.

Conclusion

I strongly believe that the recent decline in the share price of ~58.69% is actually justified as the risks involved in investing in Rocky Brands are much higher than in 2021 as a result of declining profit margins at a time when interest expenses are eating up roughly half of the cash from operations that the company generates (discounting changes in inventories, receivables, and payables). Fortunately, the company has inventories that are almost as large as the company’s long-term debt, which will make possible a very significant debt reduction that will bring it to much more manageable levels in the medium term, thanks in part to a capacity of generating around $30 million in cash from operations per year despite current headwinds.

The company’s net sales more than doubled since 2020, and as soon as the inventories are converted into cash with which to reduce the debt the cash payout ratio will gradually decrease as a consequence of lower interest expenses, with which the company will have more and more resources at its disposal at the end of each period. For this reason, I believe that the current dividend yield on cost of $2.35% represents a good opportunity for long-term investors, despite a justified selloff, as the company will have a lot of room to raise it as current interest expenses are actually almost four times the dividends paid.

Be the first to comment