SolStock/E+ via Getty Images

Investment Thesis

Rocket Lab (NASDAQ:RKLB) has a successful launch record that makes it a partner with NASA in its Artemis Mission. It also has numerous contracts in the U.S. defense program along with other commercial customers. It is on track to grow into an all-around rocket company with strong momentum in revenue growth. We recommend investors take a long-term view of this stock and buy it for their children or grandchildren as a “ticket to the moon”.

Company Overview

Rocket Lab was founded in New Zealand by engineer Peter Beck in 2006 and established a headquarter in California in 2013 to develop the expendable Electron rocket. The company is an end-to-end space company that delivers launch services, spacecraft components, satellites, and other spacecraft and on-orbit management solutions. It has two Products & Services: Launch Services and Space Systems. (It’s important to look at both segments, and we will do so below.) The company aims to make it faster, easier, and more affordable to access space with an established track record of mission success. Its Electron rocket deployed customer satellites for Earth imaging, weather monitoring, and ship tracking. The company went public in August 2021 on Nasdaq through a SPAC merger.

Strength

In light of the recent NASA Artemis Mission to the moon, we want to take a look at Rocket Lab, the only publicly listed rocket company of its kind currently. It is a close partner to NASA in this mission. The company successfully completed the translunar injection via Photo that sent NASA’s CAPSTONE (Cislunar Autonomous Positioning System Technology Operations and Navigation Experiment) spacecraft to the moon. The spacecraft’s main mission is to test a unique, elongated lunar orbit as a pathfinder for Gateway. This Moon-orbiting space station is part of NASA’s Artemis program, which will ultimately pace the way for human exploration of the Moon, Mars, and beyond.

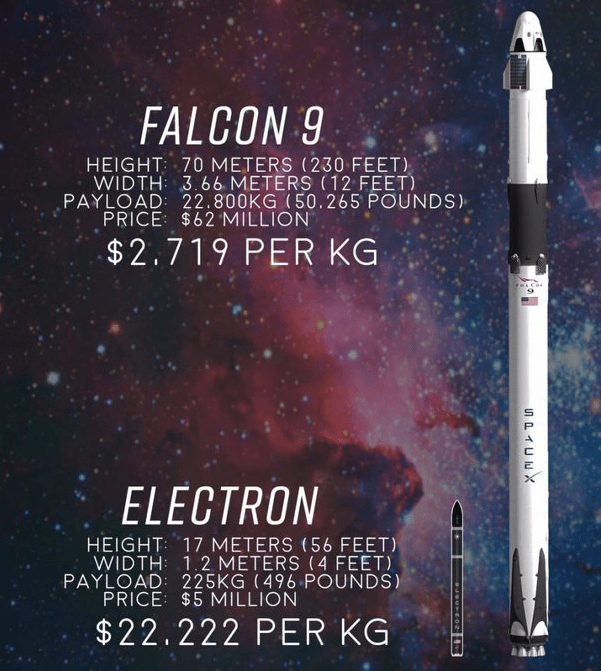

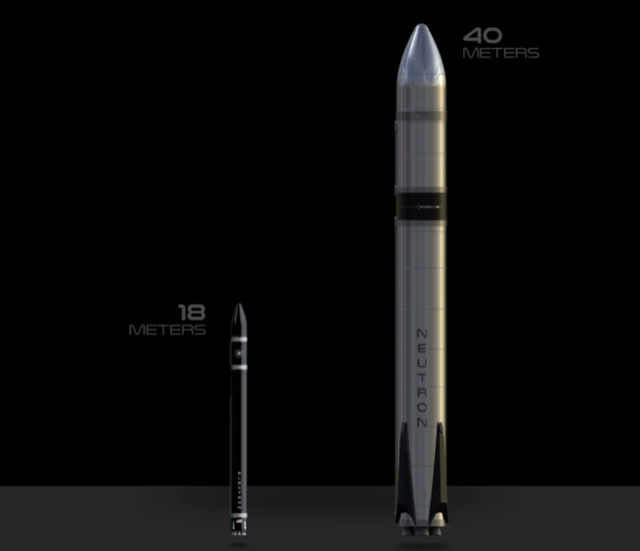

Rocket Lab is specialized in smaller payload missions. Usually, most smaller satellites had to piggyback on rockets dedicated to their larger kin for a ride to reach the orbit. These launches of large rockets are more likely met with weather or technical issues. With its specialty in supporting the small satellite industry, Rocket Lab aims to provide “frequent, dedicated launch opportunities to customers’ preferred orbits”, whose payload may not need to be large. Compared with Blue Origin’s New Glenn and SpaceX’s Falcon 9, which are huge rockets, Rocket Lab’s Electron rockets are only 56 ft tall with payloads of 497 pounds (225kgs). Therefore, the company is not really a direct competitor to these larger players but complementary in fulfilling the needs of customers, large and small, to access the space. See a comparison below.

Rocket Lab Electron vs SpaceX Falcon 9 (Source: Everyday Astronaut)

Rocket Lab is expecting to launch its first Electron rocket on U.S. soil in the day range of Dec 9-20. It follows the Dec. 1 announcement that the company has launched a new US subsidiary, Rocket Lab National Security, to specifically focus on defense and intelligence business from the US and its allies. This is to further strengthen its ties with the U.S. government and NASA after years of services relationship. But overall, the company has a diverse client base in defense, civil and commercial areas. For example, in 2021 and 2020, approximately 8% and 25%, respectively, of its total annual revenues were derived from contracts with the U.S. government and related agencies and contractors.

In its presentation, Rocket Lab stated that it had achieved nine successful launches in 2022 so far. We estimate each launch could bring in about $6.5 to $8 million of upfront revenue. The company wants to achieve ten launches in 2023 as a goal. If that is to be the assumption, it will bring in $65-80 million in revenue as a result. That is about an 11% increase for 2023. While on the upside, its LC-2 and LC-1 launch complex can support 130 launches a year. Its goal is to reach a weekly launch schedule. If we estimate all the launches with a 90% success rate, it will be 117 launches per year, which is $760.5 to $936 million in the top estimate of the revenue potential of its core business. Although that might take several years to materialize, it nonetheless gives a picture of some of the upsides this company can achieve.

Needless to say, NASA’s back-to-the-moon Artemis mission and the U.S. government aerospace and defense industrial support are key for Rocket Lab. We estimate its 2022 full-year revenue would be around $200 million, a 320% jump to its revenue of $62.3 million in 2022.

Not only does having the U.S. government as its major client prove to be a recession cushion for Rocket Lab, but it also has its own more predictable part of the revenue stream. Most investors might think of a rocket company with a high risk of make-or-crash in their launch services. But Rocket Lab also positions its business as a platform of end-to-end overall space services. On top of launching rockets, Rocket Lab also has integrated Space Systems services to serve different client demands. The company’s spacecraft component solutions, which are the building blocks for spacecraft, include creation wheels, star trackers, magnetic torque rods, Solar panels, Radios, Separation Systems, Command and Control spacecraft software, and power solutions. In particular, its Photon spacecraft is configurable for a range of low Earth orbit, geosynchronous orbit, and interplanetary missions. The customers they serve, such as government and commercial users, can utilize their components and systems to construct, design, and manufacture their own spacecraft and on-orbit operations. It strives to provide a streamlining platform for customers to procure launch services, spacecraft, ground services, and on-orbit management from one source. This is quite interesting from an investor’s point of view because once there is a virtuous cycle formed on its platform, the growth could accelerate further.

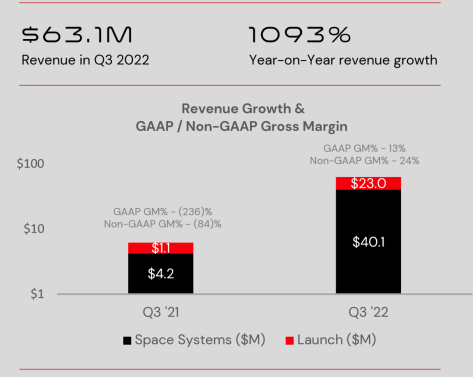

To highlight a few orders in this space systems segment: Rocket Lab signed the largest order of satellite separation systems in its history with the U.S. Department of Defense’s next-gen Tranche 1 Tracking Layer (T1TL) constellation in Q3 that’s worth $14 million. It was awarded a contract to supply solar power to Lockheed Martin for three large missile warning satellites for the U.S. Space Force. More noticeably, it has ongoing support for the important DARPA mission to provide data transfer, mission operations, star trackers, reaction wheels, and separation systems. And DARPA has achieved a significant milestone in Q3 with its Mandrake-2 mission. This business positioning outside of launch services gives Rocket Lab a much more predictable and stable cash flow and revenue. Its Space Systems actually has a diverse mix of commercial, aerospace prime contractors, and government customers. Below is a segment breakdown between Launch Services and Space Systems. Both have had strong YoY growth, and the Space Systems revenue accounted for more than 50% of its Launch Services in Q3. That is basically one-third of its revenue stream being in a stable and predictable manner. See the breakdown below. In its guidance, it expected Q4’s revenue to be in the range of $51-54 million while within which Space Systems would be $34-37 million.

Rocket Lab Segment Breakdown (Rocket Lab Segment Breakdown (Rocket Lab Q3 Presentation))

Rocket Lab’s reusability program for its rockets has gained more progress as its refurbished pre-flown Rutherford Engine successfully test-fired for the first time in Q3. And it is also trying to lower costs by automating the rocket-building process with robots. The bots can manufacture complete tanks within days, with minimal human labor and less material and waste than traditional metallics. Its automated fiber placement of Neutron’s advanced composite material can be optimized for performance, speed, and cost.

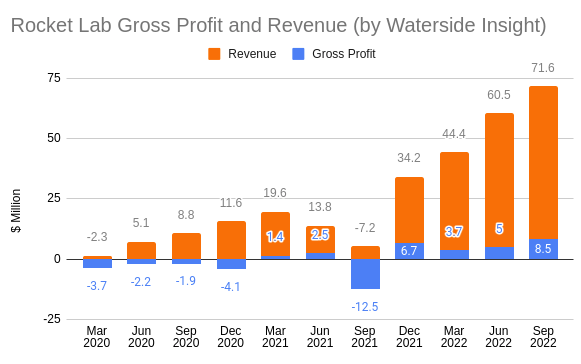

Overall, Rocket Lab has had strong revenue growth since its IPO. It has managed to maintain a positive gross profit in the past four quarters

Rocket Lab Gross Profit vs Revenue (Rocket Lab Gross Profit vs Revenue (Charted by Waterside Insight with data from Rocket Lab))

Weakness/Risks

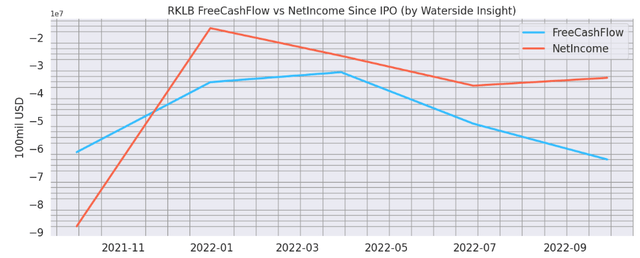

Rocket Lab’s Net Income has been negative most of the time, except for Q4 of last year. And its Free Cash Flow stayed in the range of negative $30-60 million every quarter.

Rocket Lab Free Cash Flow vs Net Income (Rocket Lab Free Cash Flow vs Net Income (Calculate and Charted by Waterside Insight with data from Rocket Lab))

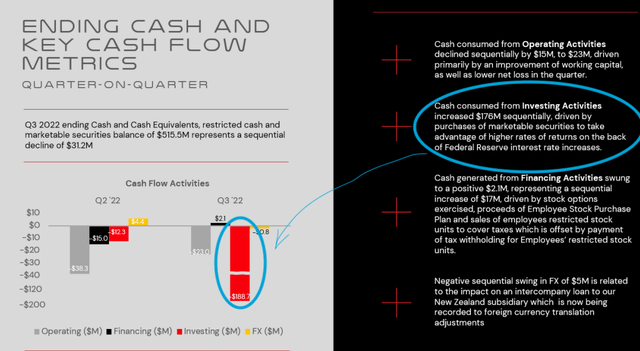

The decline of Free Cash Flow in Q3 also has a lot to do with the company making $169.9 million of short-term investment. We find it quite curious as, in its presentation, it explained that it is to “take advantage of higher rates of returns on the back of Federal Reserve interest rate increases”. We can only speculate that these could be short-term fixed-income investment products. So perhaps in a few quarters, we will see some positive cash flow in investing activities showing up? We are not sure, but just putting it out there for investors as info.

Rocket Lab Cash Flow (Rocket Lab Cash Flow (Rocket Lab Q3 Presentation))

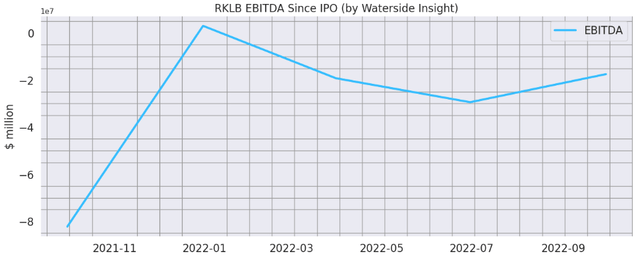

Back to its rocket business. As we know, the defense budget and NASA’s annual budget are all carved out years ahead. By winning contracts and accomplishing successful missions, Rocket Lab’s strong relationship with NASA and the U.S. government will give it cash flow visibility for several quarters ahead. Therefore, its liquidity can be managed with careful planning. And this is exactly what the company is doing. It’s been managing its current ratio around 4-5 times this year. The rocket business is highly competitive and scientifically oriented. The company must invest in research and development to keep its leading positions. So long as it is bearing fruition, we are not too concerned about its liquidity. Moreover, compared to some other high-tech high-burned-through companies, its EBITDA isn’t faring too far below zero with an improving trendline.

Rocket Lab EBITDA (Rocket Lab EBITDA (Calculate and Charted by Waterside Insight with data from Rocket Lab))

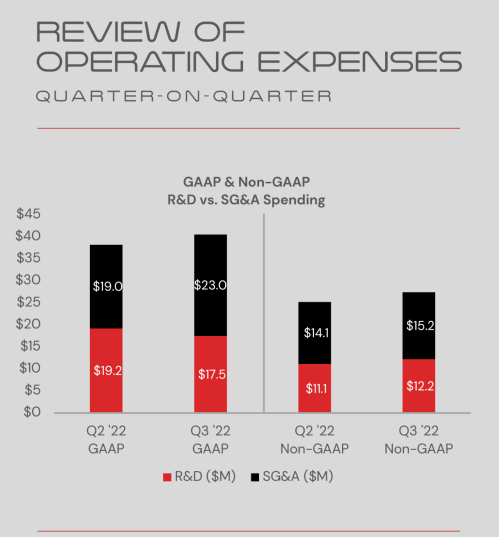

Although investors do care about the operating expenses, we don’t necessarily want a rocket company to be too cost-cutting in its work, as safety and quality are the lifelines. In a review of its operating expenses, both R&D and Operating spending have stabilized in recent quarters.

Rocket Lab review of Operating Exp (Rocket Lab review of Operating Exp (Rocket Lab Q3 Presentation))

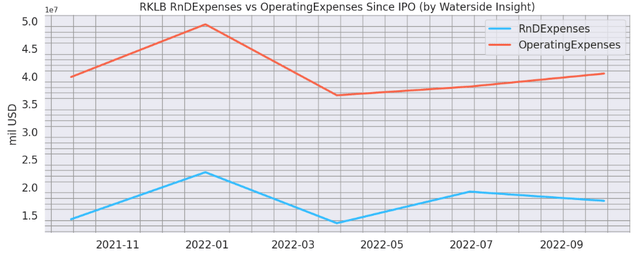

The company’s R&D expenses have always been slightly more than half of its operating expenses, while both have been in a narrow range.

Rocket Lab R&D Exp vs Operating Exp (Rocket Lab R&D Exp vs Operating Exp (Calculated and Charted by Waterside Insight with data from Rocket Lab))

In other words, we don’t necessarily view these as weaknesses or risks. As a rocket company, the capital-intensive input in acquiring a leading position early on is probably more important than saving cost and quick monetization to ensure long-term success. We think investors should mostly focus on its technological capability and innovation through research and development. More importantly, as most VCs would value any capital-intensive products, investors should pay more attention to whether the company has the proprietary and unique tech to achieve clear differentiation and prevent future market share erosion in the space. In the case of Rocket Lab, it has laid a trail of proven success.

Valuation

We don’t expect the company to have positive cash flow in 2023 or even 2024 because, as its CFO Adam Spice explained in the Q3 earnings call, it needs more time to absorb the costs and to see the profit from its Neutron rocket development, which we will explain more below. With that assumption, any significantly positive Net Cash Flow will be pushed beyond 2024. We use our proprietary models to make a ten-year forward-looking projection of the company’s growth. In our bullish case, the company’s research development is going as planned and achieving steady growth in commercial applications, it would eventually reach the range of $100 -150 million Net Cash Flow annually in 5 to 10 years, and we found its valuation to be $3.18. In our most bearish case, when some headwinds are due to economic uncertainty and the nature of research development, it is priced at $2.74. While in our base case, where the company is still in negative net cash flow but strong growth sets in soon enough, it is priced at $2.98. The market is surprisingly non-inflationary in pricing Rocket Lab’s stock price, as the current stock price is quite close to our fair valuation. You might say these prices are fairly close to almost make no big difference to me. We agree, as most of the growth would come heavily in three to five years or beyond. But bear in mind, there could be more upside risk to our valuation as dealing rockets as a commercial business is still in its nascent stage for mankind. We can humbly admit that we cannot anticipate all the potential and possibilities, as we haven’t even begun to explore the applications of all these cutting-edge technologies in other earthy industries, such as telecommunication, pharmaceuticals, medical services, etc.

Forward-Looking and the Big Picture

Rocket Lab has a few things lining up in its pipeline and business backlog.

First, Rocket Lab is building a larger reusable rocket called “Neutron” for launching satellite constellations. The company said it would be capable of human spaceflight missions, indicating an ambition to make it its first human-rated spacecraft. See the comparison with its current Electron rocket below. Neutron could significantly expand Rocket Lab’s customer base, and it’ll also improve costs and economics versus what Electron can do now, thanks to a design focused on efficiency and reusability. It could be a serious rival to SpaceX’s Falcon 9 as it is expected to be about two-thirds the height of a Falcon 9, but weighs only a third (480 tons vs. 1,420 tons). This medium-lift category, with its unique positioning, is generating a lot of interest from both private and public organizations. Its engine, called Archimedes, is on schedule for its first test in 2023, according to the company. It has signed agreements with U.S. Transportation Command to explore the uses of these rockets in cargo transportation, on-orbit depots & point-to-point travel.

Rocket Lab Electron vs Neutron (Rocket Lab Electron vs Neutron (Rocket Lab))

Secondly, in its Space Systems segment, more contracts are expected to come in 2023. The company’s Motorized Lightbands has a 100 % mission success rate and the highest Technology Readiness Level by the U.S. Government. In the backlog of its business, it will provide Motorized Lightbands to Lockheed Martin (LMT) & one other undisclosed customer for T1TL. It is also set to supply NASA’s Jet Propulsion Lab (JPL) with its industry-leading solar cells to power shoe-box-sized mobile robots (CADRE) to explore distant planets and the Moon. And it has a high-volume reaction wheel production line established to supply mega constellation customers with the capability of delivering 2000 units per year beginning in Q1 2023.

Totally, its business backlog for 2023 is estimated to be $140 million already. More cushion has been gained to be recession-proof for next year.

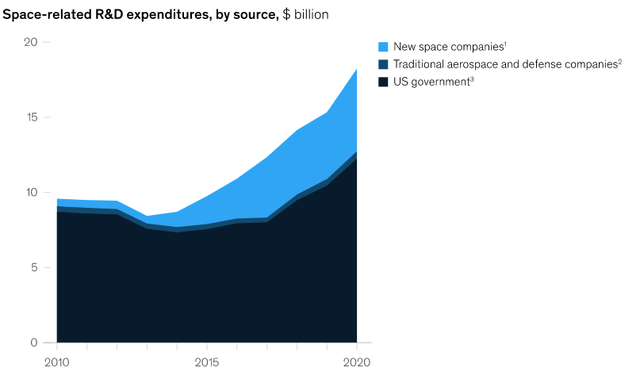

For skeptical investors who think this rocket business is more of a scientific experiment, we want to share a chart below that shows the composite of space-related R&D expenditure. The private investment in this space has taken off since 2015 to be about one-third of the U.S. government’s share. On the one hand, it shows the viability of the growth of the space sector; on the other hand, it also shows the commercial prospect that large investors envision for the space industry. This is the big picture investors should keep in mind.

Space-related R&D Expenditure (Space-related R&D Expenditure (McKinsey Insights))

Conclusion

Rocket companies are essentially managing the business of the future. Analyzing Rocket Lab’s earnings and profit with a scope of quarter-to-quarter perhaps is a bit short-sighted, we reckoned. Some of the investments may not come to fruition for the next two to three years or even longer. However, on top of its rapidly growing launch business, Rocket Lab has one-third of its revenue in more predictable space systems businesses that have proven successful. With its goal to disrupt the medium-lift category coming in 2024 and beyond, the company’s downside risks are limited, while the upside potential could greatly reward long-term investors. If you are so inclined, buy Rocket Lab at around $3 for your children or grandchildren as a long-term holding. And it is just in time for a Christmas present.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!”

Be the first to comment