imaginima

Description

I still think Rocket Lab USA, Inc. (NASDAQ:RKLB) is worth a lot more than it is right now, as I mentioned in my original post. The same argument stands: RKLB can continue to grow within this very large total addressable market (“TAM”) because it offers solutions to customers who need a reliable and quick way to access space services.

Q3 2022 Review

RKLB had a record Q3 in terms of revenue, with adjusted gross margins of 24% compared to the market consensus of 22%, along with adjusted EBITDA of $7 million compared to the market consensus of $8 million. Following a customer’s decision to move a planned launch from the fourth quarter to 2022, the company has completed nine launches so far this year and anticipates one more to close out the year. RKLB should continue to lead the small launch pack and increase profitability as launch pricing remains stable, in my opinion, thanks to the 152 payloads delivered to orbit on 32 launches. In addition, a slew of recent government contract awards at Space Systems are validating RKLB’s early M&A strategy.

I think the timelines set for Neutron are ambitious, but progress has been steady so far. I’d like to remind readers of RKLB’s proven ability to deliver on time.

Upcoming launches in Q4 2022

After completing three launches in 3Q22, RKLB announced on its Q3 2022 earnings call that it would be planning three launches in 4Q22. Since the company has already completed two missions in 4Q22, I feel comfortable saying that the 4Q22 manifest is now much less risky. Even though RKLB expects $17 million in revenue at launch in 4Q22, I feel it’s important to point out that the launch in November was a subsidized R&D mission (i.e., helicopter recovery attempt).

Management has reported that prices are stable at $7 million to $7.5 million per launch, which is roughly in line with my estimates. The company now expects 14 launches in 2023.

Another failed attempt, but a good lesson learnt

A Swedish atmospheric science satellite was orbited by an Electron rocket launched by RKLB on November 4th. As part of the “Catch Me If You Can” mission, RKLB intended to use a helicopter to retrieve the rocket’s first stage. However, a telemetry issue made that impossible.

To give more context, in May 2022, the company successfully retrieved a first stage by helicopter before deciding to dump the rocket into the ocean after the pilot observed load characteristics that were different from those experienced during testing. I strongly believe that helicopter recovery of Electron boosters remains an unrivaled opportunity for RKLB to lower launch costs and potentially increase its competitive advantage over other small launch providers.

Complex 2 launch is on track

The original launch date for RKLB at Virginia’s Complex 2 remains December 2022. The business announced the arrival of Electron at the location last month. I think it’s great that between Complex 1 and 2, RKLB will be able to support over 130 launches per year; this gives passengers more options and strengthens RKLB’s value proposition in comparison to more affordable rideshare services. Another positive is that RKLB signed a contract for a second Complex 2 launch in January 2023, making it the second launch in a series of launches agreed upon with Hawk Eye 360.

Recognition from NASA is a good thing

In order to power small, mobile robots that will explore inaccessible regions of the moon, NASA has contracted RKLB to supply solar panels for the recently announced Cooperative Autonomous Distributed Robotic Explorers program. The inverted metamorphic multi-junction solar cells developed by SolAero will be used by RKLB in CADRE because of their superior efficiency compared to conventional space-grade solar cells. In my opinion, this honor is further proof that the purchase of SolAero was a wise investment.

Valuation

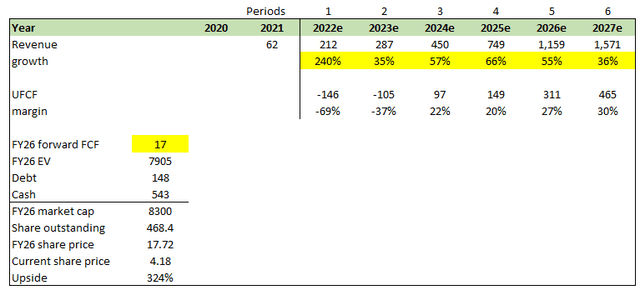

I continue to believe RKLB is worth much more than it is today. My model has been updated to reflect the consensus’ slightly lowered estimates over the next 2 years. However, my long-term projections for FY27 remain the same as management’s long-term guidance.

There are no changes to my price target for FY26 of $17.8, which still represents significant upside from where RKLB is trading today.

Summary

As of this writing, Rocket Lab USA, Inc. is still undervalued at its current share price. While many investors and the general public do not believe RKLB will achieve their goals in the timeframe they have set, I believe they will. This belief stems from their strong execution history, and the Q3 2022 earnings report has given me even more confidence in Rocket Lab’s ability to execute.

Be the first to comment