Ian Tuttle/Getty Images Entertainment

In no huge surprise, Roblox (NYSE:RBLX) reported May monthly metrics and the numbers didn’t impress one bit. As gamers turn to travel and leisure events, the market has known for a while now that numbers over the Summer will likely be weak. My investment thesis is turning more Bullish on the stock with the solid bounce on more weak monthly bookings totals.

Focus On Users

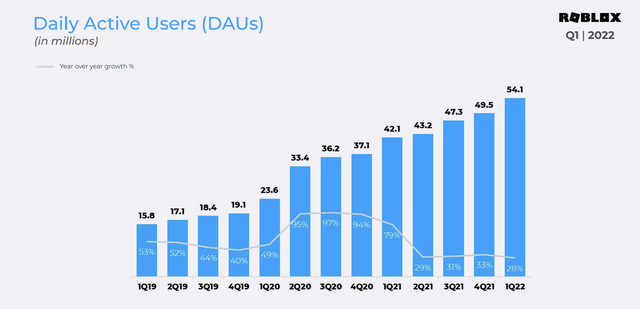

At the end of the day, Roblox will go the path of the user base. The daily active users (DAUs) have continued to grow throughout this crisis with May users up 17% to 50.4 million.

The numbers were actually down from the 54.1 million average during Q1’22 and 53.1 million during April. May tends to be a weak month with numbers last year dipping 1% to 43.0 million DAUs from April 2021.

Source: Roblox Q1’22 presentation

Clearly, the DAUs were up YoY, but the numbers show a potential for the Q2’22 metric to dip from the big boost during Q1’22. Due to seasonality and the Omicron variant, Roblox clearly saw a final boost in users during the last quarter.

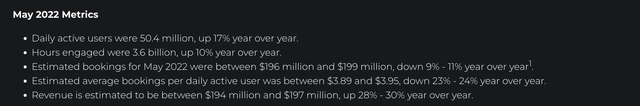

The stock is rebounding sharply as the market viewed the May numbers at levels to probably set a low for the cycle. Average bookings dipped up to 24% to $3.89 per user, down sharply from the $4.19 estimate for April. The key is that the average bookings dip improved from the 25% to 26% dip in the prior month.

Source: Roblox May ’22 monthly metrics

The market clearly likes the indication bookings are at levels where Roblox can build a base here. Not to mention, the bookings totals aren’t overly relevant due to the irrational boost during the COVID lockdowns.

Roblox had only topped quarterly bookings of $200 million in the quarter prior to the arrival of COVID in Q1’20 and the amounts quickly jumped to over $600 million. If the company can stabilize bookings around $200 million per month or $600 million per quarter, Roblox will have far higher bookings numbers now providing for a normalization at much higher levels.

As the calendar turns towards 2023, the U.S. users will start spending similar or higher amounts than these trough levels during 2022 and international users will have grown substantially to provide a tailwind to the bookings totals by just spending a similar amount.

Ultimately, Roblox has a trend for 20% user growth even during a tough comp period. The global Metaverse platform only needs up to 5% average bookings growth in the U.S. next year to start pushing revenue growth towards 30%.

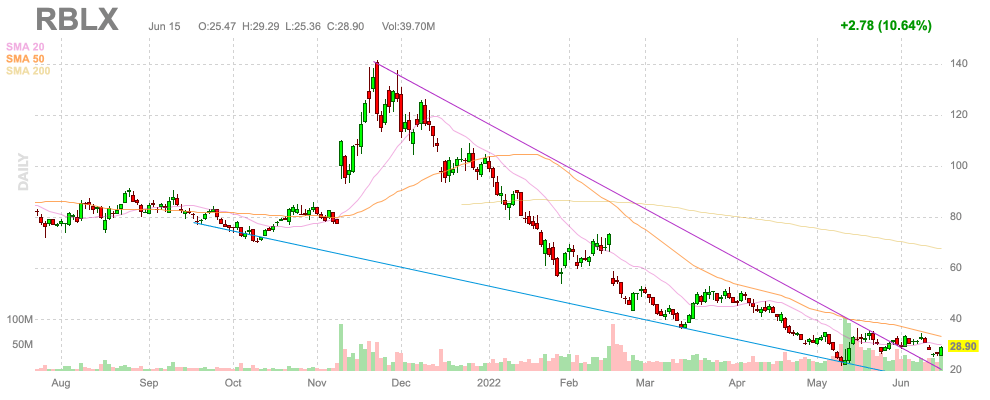

Washed Out Stock

Anytime a stock rallies on bad news, the equity has likely hit bottom. Roblox reporting average bookings per DAU falling 24% definitely qualifies as bad news, but the stock was up over 10% on the day after initially falling back to $25.

Source: FinViz

In addition, the volumes soared the last time Roblox dipped below $25 following weak Q1’22 results. The stock has now jumped twice with increased volumes on signs the market now expects better monthly metrics in the months ahead, making $25 a buying point. Daily volumes surged to 100 million shares in May and the current volumes for June 15 are already ahead of the average daily volume at 28 million shares.

The stock isn’t absurdly cheap, but Roblox has a bright future in the Metaverse with a global platform and expanding user base to older age groups. The stock only trades at ~4.6x 2023 sales targets for a cheap multiple with revenue growth returning to 20% rates.

Analysts don’t forecast profits anytime soon, due in large part to stock-based compensation for software and data engineers, but the company has $2 billion in net cash on the balance sheet. When the stock dips to $25, the enterprise value dips below $13 billion, providing another cushion for investors to load up on Roblox.

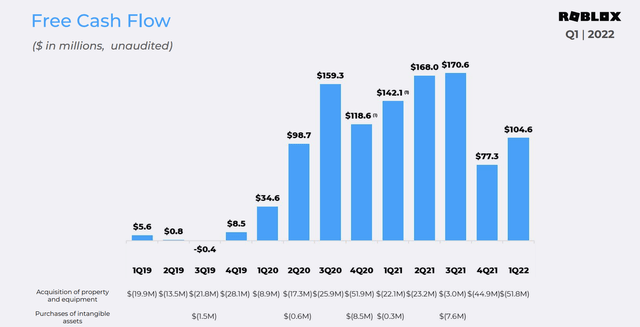

The company is a cash flow machine due to the bookings in advance of spending and the stock-based compensation hiding a strong margin profile. Roblox has produced over $100 million in free cash flow on a quarterly basis since Q3’20 outside of the dip to $77.3 million during Q4’21.

Source: Roblox Q1’22 presentation

The biggest risk to any company or stock during interest rate hikes and a potential recession ahead is the lack of liquidity. Not only does Roblox have plenty of cash, but the company generates strong cash flows on a quarterly basis providing the gaming platform with the ability to invest in new technologies and talent during any downturn.

Takeaway

The key investor takeaway is that Roblox appears washed out here with the stock rallying again on more bad financial metrics. Investors don’t want to aggressively chase any rally here, but the stock is definitely one to buy on dips during a summer where monthly metrics should remain relatively weak.

Be the first to comment