Ian Tuttle/Getty Images Entertainment

Price Action Thesis

Roblox Corporation (NYSE:RBLX) stock rode the metaverse hype train and crashed. We were skeptical over its valuation until late last year. However, we turned bullish too early, failing to pay sufficient attention to its price action analysis.

We were also caught up in the metaverse commentary generated by Meta (META) CEO Mark Zuckerberg. After their double top bull traps in November, the market has slaughtered many metaverse stocks. The market wanted to remind investors not to confuse “pipe dream” with reality as investors poured into stocks with metaverse ambitions.

Our detailed price action analysis indicates that RBLX stock is at a near-term bottom. However, its recovery from its May bottom faced a bull trap and has since been rejected. Furthermore, we have not observed any double bottom bear trap that can help stanch its bearish momentum, helping sustain a trend reversal.

Our valuation analysis suggests that RBLX stock could struggle to meet its revenue targets at the current levels. Therefore, we believe it’s apt for investors to wait for price action resolution before deciding to add exposure.

The Double Top Bull Trap From The Metaverse Hype

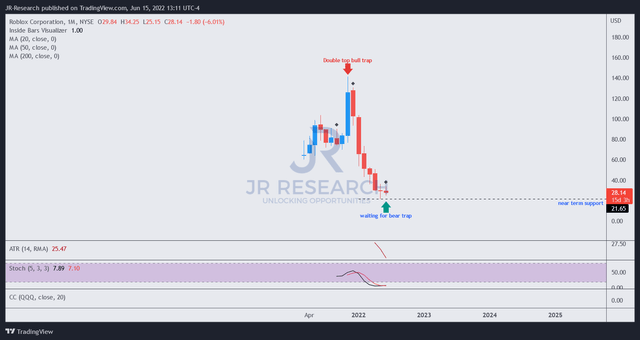

RBLX price chart (monthly) (TradingView)

In November, the unmistakable double top drew in investors who bought into the bandwagon rapidly, as Zuckerberg fanned investors’ interest in what a future in the metaverse could resemble.

However, it also represented the “final flush up” for RBLX stock, as the market started to digest its gains subsequently.

RBLX stock is currently supported by its near-term support. However, we have not observed a robust bear trap price action that could undergird its support zone.

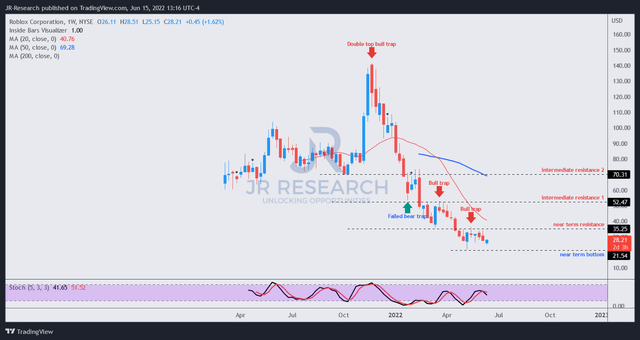

RBLX price chart (weekly) (TradingView)

RBLX’s double top bull trap unveiled its potency on its weekly chart. It set the stage for its steep decline from November, one that it has failed to overcome.

Unfortunately, we did not previously heed its double top signal, which resulted in us upgrading our rating way too early. Therefore, we urge investors to pay significant attention to such price action signals, which could portend helpful warning signs of the market’s intentions well ahead of time.

Furthermore, a series of subsequent bull traps hampered any recovery momentum in RBLX stock. The most recent bull trap in May was formed after RBLX attempted to stage a recovery from its near-term support but has since been rejected.

Therefore, we are still waiting for a double bottom bear trap that could help stage a sustained reversal in trend from its dominant bearish bias. However, nothing is in view yet, suggesting that the market remains tentative in turning its momentum around.

Valuation Remains Aggressive At The Current Levels

| Stock | RBLX |

| Current market cap | $16.75B |

| Hurdle rate (CAGR) | 25% |

| Projection through | FQ2’26 |

| Required FCF yield in FQ2’26 | 2.5% |

| Assumed FCF margin in FQ2’26 | 18% |

| Implied TTM revenue by FQ2’26 | $5.68B |

RBLX stock reverse cash flow valuation model. Data source: S&P Cap IQ, author

Our valuation analysis indicates that RBLX remains aggressively valued at the current levels. We used parameters appropriate for “high-growth” plays. However, Roblox’s consensus estimates have been revised downward as it faces significant reopening headwinds.

Notwithstanding, RBLX stock received a jolt earlier today as it reported May’s DAU metrics, which showed revenue increased by 30% YoY. However, its bookings declined by 10% YoY (midpoint) as its pandemic tailwinds turned into headwinds.

Our model also suggests that Roblox needs to post a TTM revenue of $5.68B by FQ2’26, which seems pretty aggressive. Roblox reported a TTM revenue of $2.07B in FQ1’22. Therefore, we require Roblox to post a revenue CAGR of 26.82% through FQ2’26 to justify adding exposure confidently at the current levels.

Consequently, we think its current valuation is aggressive, even if we assume its growth could normalize through FY23 after lapping challenging comps for FY21.

Is RBLX Stock A Buy, Sell, Or Hold?

We revise our rating on RBLX stock from Buy to Hold. Admittedly, we should not have upgraded our rating on RBLX stock. Our failure to consider its double top bull trap and its subsequent shift in momentum has cost us.

Therefore, we urge investors to be patient with RBLX stock and wait for a more attractive entry point. We prefer to watch for a double bottom bear trap price action signal at a more appropriate price level before considering adding exposure.

Be the first to comment