Alex Wong

JPMorgan (NYSE:JPM) ticked up higher on Friday after reporting very strong earnings results. In spite of the doom and gloom on Wall Street, the company saw strong credit and delinquency performance, leading to robust earnings growth (after normalizing for credit reserves). While CEO Dimon was more tempered and maintained an understandable level of conservative optimism, this is a company which trades well below historical earnings multiples and is set to resume share repurchases early next year. In the meantime, the 3.7% dividend yield adds additional reason to continue holding a proven growth compounder.

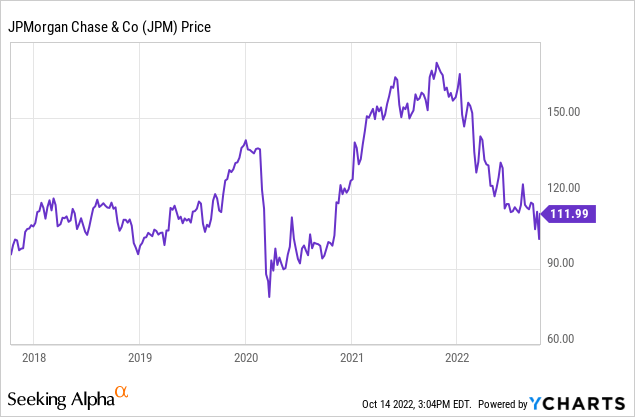

JPM Stock Price

JPM is as far from an unprofitable tech stock as it comes, but the stock is still down over 30% from recent highs.

I last covered JPM in September and the stock has since fallen 5%. I rated the stock a buy then, but it is clear that I was too conservative as the company has proven far more resilient than even I anticipated.

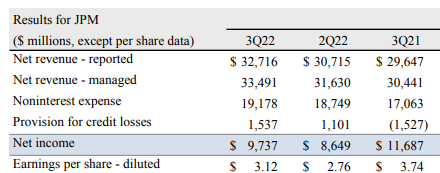

JPM Stock Key Metrics

The latest quarter saw a strong increase in revenues as the firm benefited from rising interest rates. Reported earnings per share of $3.12 was higher sequentially and lower year over year, but it should be noted that the 2021 third quarter benefited from a release of pandemic credit provisions. Assuming more normalized provisions for credit losses, earnings per share grew by around 12%.

2022 Q3 Press Release

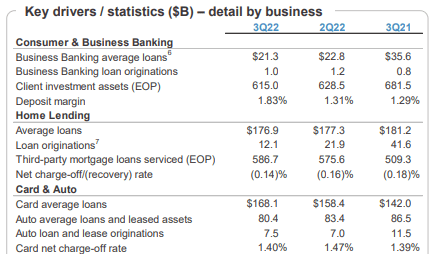

Perhaps to the surprise of many, consumer credit metrics remained strong – very strong actually – as charge-off rates and nonperforming loans remained steady.

2022 Q3 Presentation

On the conference call, management noted that chargeoff rates were below pre-pandemic levels but “normalizing.”

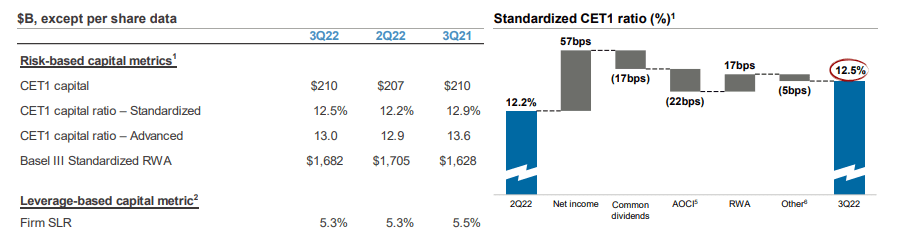

JPM made further progress on strengthening its balance sheet, with its CET1 capital ratio standing at 12.5%. Management continues to guide for 12.5% and 13% for the fourth quarter and 2023 first quarter, respectively.

2022 Q3 Presentation

Management also noted that they hope to be able to resume stock buybacks early next year upon achieving that target 13% CET1 ratio. For those new to the name, it is worth noting that JPM historically maintains a fortress balance sheet with a considerably higher CET1 ratio than peers.

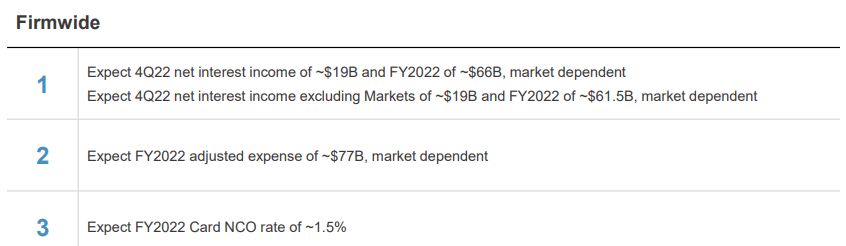

Looking ahead, JPM guided for another quarter of strong net interest income growth (net interest income was $13.7 billion in the fourth quarter of last year).

2022 Q3 Presentation

Management noted on the conference call that they previously guided for a fourth quarter net interest income ex markets run rate of $66 billion with expectations for some upside in 2023. Current guidance implies a run rate of around $76 billion and management expects a modest decline from that for 2023.

Is JPM Stock A Buy, Sell, Or Hold?

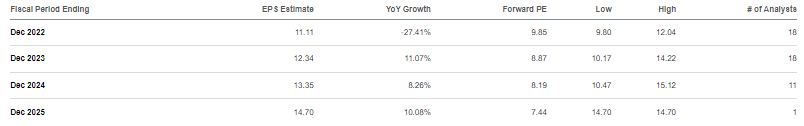

This isn’t 2008. That is an important detail to remember as bank stocks continue to trade with weakness. Consensus estimates call for double digit earnings growth over the next 3 years.

Seeking Alpha

JPM’s 5-year average is around 12x earnings so the stock appears undervalued at just 10x this year’s earnings. I am of the view that even 12x earnings is too conservative for a company that has historically distributed all of its earnings through dividends and share repurchases.

Is the economy out of the woods? CEO Dimon seems to be making every effort to level expectations.

I think, we’re in an environment where it’s kind of odd, which is very strong consumer spend. You see it in our numbers, you see it in other people’s numbers, up 10% prior to last year, up 35% pre-COVID. Balance sheets are very good for consumers. Credit card borrowing is normalizing, not getting worse. You might see — and that’s really good. So, you go in a recession, you’ve got a very strong consumer. However, it’s rather predictable if you look at how they’re spending and inflation. So, inflation is 10% — reduces that by 10%. And that extra cap — money they have in the checking accounts will deplete probably by sometime midyear next year. And then, of course, you have inflation, higher rates, higher mortgage rates, oil — volatility war. So, those things are out there, and that is not a crack in current numbers. It’s quite predictable. It will strain future numbers.

In other words, while the company performs strongly, CEO Dimon doesn’t want investors to get too enthusiastic as things can always get worse. But even he may be too pessimistic – at least from a stock point of view. Given the high 13% target CET1 ratio, the ramifications of any apocalyptic scenarios are unlikely to be bankruptcy or even dilution but instead more likely to simply be needing a couple of quarters to build up the balance sheet. This is because the 2008-2009 Great Financial Crisis led to banks being highly regulated such that financial crises of similar magnitude can probably never happen again. With that view in mind, I view the current 10x earnings multiple as being overly pessimistic, as the downside scenario is actually far safer than intuition might imply. This is the kind of stock that I could see re-rating to a range of 15x to 25x earnings over the long term, with 15x being my target multiple after market crashes. That suggests 50% potential upside from multiple expansion just to the low end of that range.

What are the risks here? Maybe something worse than the Great Financial Crisis happens – though that is arguably not the most likely risk. Instead, it is possible that the big banks are getting disrupted by more nimble online banks that offer higher yields on checking and savings accounts. JPM often receives high marks from the investment community due to the higher margins, but that does not imply a stronger consumer experience. From my anecdotal experience, JPM has more account maintenance fees than competitors and last year I was unable to import stock transactions into TurboTax – a problem that many others faced. I can not say with great confidence that JPM will continue to aggregate deposits moving forward as it has in the past unless it is willing to invest further in the consumer experience. It is possible that over time, JPM begins to experience multiple contraction relative to more nimble peers, putting pressure on the stock price.

Nonetheless, the strong balance sheet and executive leadership warrant the relative premium for now and at 10x earnings the downside appears more than priced in. I rate the stock a buy.

Be the first to comment