Kimberly White

Thesis

Robinhood Markets, Inc.’s (NASDAQ:HOOD) September quarter was better than expected. But arguably, the quarter was still very bad in relation to the company’s +$10 billion valuation. Investors should consider that Robinhood’s strategy has shifted aggressively from “growing to profitability” to “shrinking to profitability” – which is reflected in almost all of Robinhood’s core business metrics. And, accordingly, I doubt that it is reasonable to value Robinhood at a proud growth multiple of x7.3 P/S and x1.5 P/B.

In my opinion, I continue to believe that a stock brokerage firm is fairly valued at about x1 P/B. And following Robinhood’s Q3 results, I see no reasons to think why HOOD should trade at a premium to this multiple. For me, HOOD stock remains a “Sell,” and I estimate the fair implied target price at about $7.5/share (ca. x1 P/B).

Robinhood’s Q3 Results

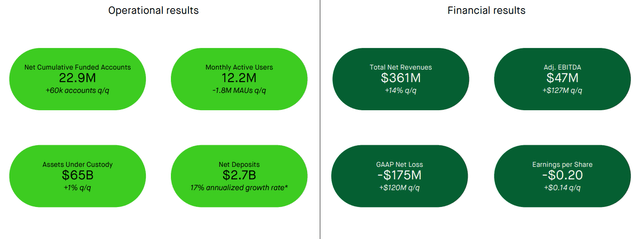

Robinhood’s Q3 2022 surprised analyst consensus estimates, as revenues increased about 14% vs Q2 2022. From July to end of September, Robinhood generated total revenues of $361 million, which compares to $365 million for Q3 2021 (ca., 1% year over year negative growth) and analyst consensus estimates of about $361 million (-4 million miss). The top line was driven by:

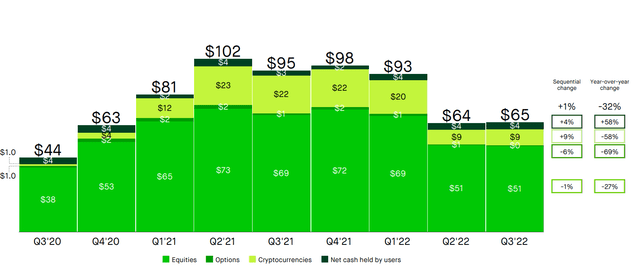

- Transaction-based revenues increased 3% sequentially to $208 million.

- Options increased 10% sequentially to $124 million.

- Cryptocurrencies decreased 12% sequentially to $51 million.

- Equities increased 7% sequentially to $31 million.

2. Net interest revenue increased 73% sequentially to $128 million

The company’s net loss narrowed versus the same period one year earlier, down to a loss of $175 million (as compared to consensus estimates having anchored on a GAAP loss of about $335 million).

Adjusted EBITDA – which excludes share based compensation as well as impairments and restructuring charges- was positive $47 million, and jumped about $127 million quarter-over-quarter. Founder and CEO Vlad Tenev commented:

In the third quarter, we achieved our goal of reaching adjusted EBITDA profitability, a quarter earlier than planned.

And Jason Warnick, Robinhood’s Chief Financial Officer, added:

We remained focused on serving our customers and driving long-term shareholder value in Q3 …

… We drove positive Adjusted EBITDA by increasing revenues and reducing expenses.

Shrinking To Profitability?

Robinhood’s business strategy has completely switched during the past 12 – 18 months. While Robinhood has previously aimed to grow into the company’s rich valuation, the business is now trying to shrink to profitability. Here are a few major metrics to consider:

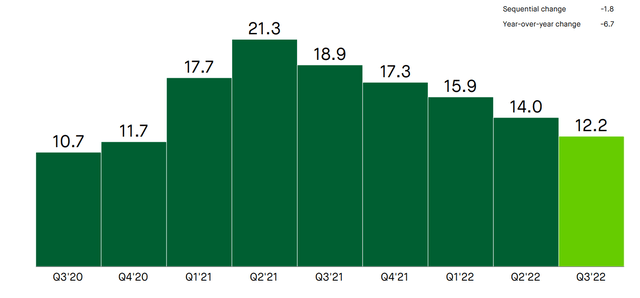

1. Active monthly user count of the Robinhood platforms decreased by about 35% year over year, dropping from 18.9 million in Q3 2021 to 12.2 million now in Q3 2022.

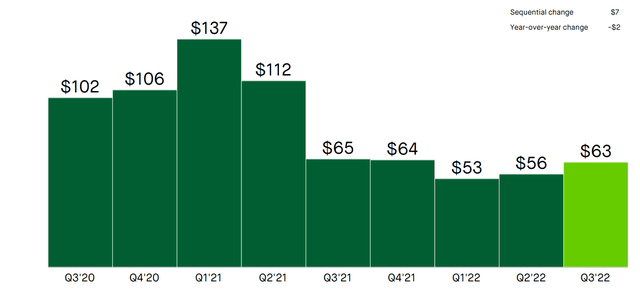

2. Also, Robinhood’s revenue per user dropped: to $63, versus $65 in the same period last year and $102 in Q3 2020.

Assets Under Custody (AUC) increased by about 1% in Q3 vs Q2 to $64.6 billion – this is a surprisingly strong performance. But investors should consider that as compared to the same period in 2021, UC decreased by about one third (loss of $30 billion)

Another issue I see with Robinhood is related to the company’s decreasing level of “popularity.” Personally, I doubt that Robinhood’s loss of user base is only due to the macroeconomic environment. Investors should consider that ever since Robinhood restricted trading of GameStop (GME) in early 2021, retail investors increasingly started to turn their back on Robinhood and doubt their claim of “democratizing finance for all.”

Without the platform of trust, that Robinhood enjoyed pre-GameStop, I doubt that the company will be able to maintain attractive growth rates even in a bull market.

Still Priced For Growth

Robinhood is clearly aiming to improve business fundamentals to “shrinking down the business” and “cost reduction,” as the company cut almost 25% of its headcount in Q3, and another 9% in Q2.

But the market is arguably still pricing HOOD stock for growth – given that the stock is trading at proud growth multiples of x7.3 P/S and x1.5 P/B. Although, the comparison might be aggressive, HOOD should – in my opinion – be trading closer to a non-profitable financial services firm in “restructuring,” which is about x0.2 to x0.5 P/B.

As I have highlighted in my previous article, I continue to see HOOD’s fair value not higher than x0.7 P/B. And accordingly, my base-case target price anchors on a valuation of max. $5.1/share.

Investor Takeaway

Robinhood stock is priced for growth. But the company’s business metrics, including headcount, point to business contraction. And investors should consider that although the company’s September quarter was better than expected, Robinhood is still not profitable.

Personally, I see no indication that Robinhood’s Q3 quarter should change the “Sell” thesis and/or provoke a material adjustment to my $5.1/share price target.

Be the first to comment