Wachiwit/iStock via Getty Images

Thesis

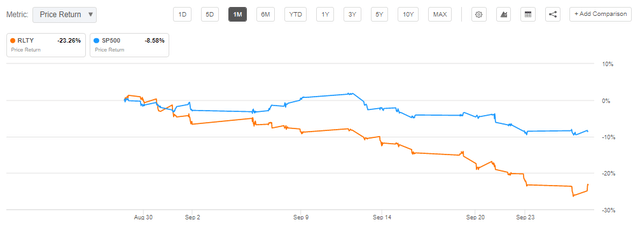

We wrote an article on the new Cohen & Steers CEF back at the end of August. The fund just IPO-ed this year and it is going through a significant amount of tribulations in its first months. We had rated it a Sell, with expectations for further losses in the high duration asset class as yields rise. We were not disappointed:

Sell Rating (Seeking Alpha)

Down almost -20% since our rating the fund has given up a significant amount of value in 2022 (the vehicle is down almost -30% year to date). A retail investor who would have heeded our advice would have saved almost 3 years of dividends by trimming the position.

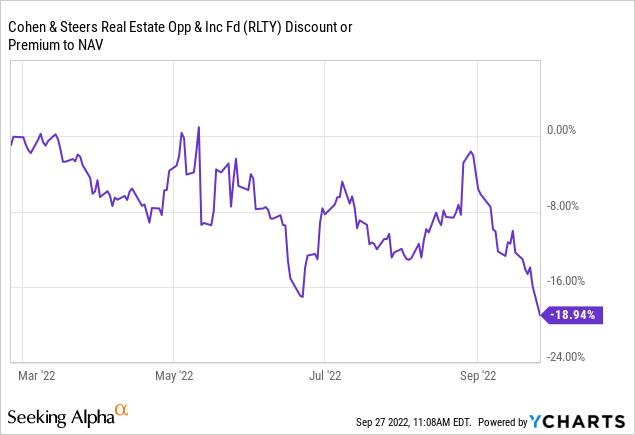

What is surprising in the fund’s performance since our article though is the fact that the vectors for the negative mark-to-market come 50% from the widening of the discount to NAV and 50% from market moves. The fund has lost around -10% from the market price widening further versus the value of the underlying assets. This is surprising because the fund now trades at a historic discount to NAV of -18%, which is unheard of for Cohen & Steers funds. We attribute this set-up to the fact that the fund is new, with no track record and market participants are avoiding un-seasoned risk in today’s environment.

It is true that the underlying assets have a significant duration component which has been negatively affected by the rising yields environment, but there is nothing in the collateral that is “toxic” or about to default even in a recessionary environment. We correctly anticipated the move lower in RLTY but we are a bit surprised by the velocity of the move and the composition. Even if the fund is new, the Cohen management team is very seasoned and we do not believe this fund should be trading at a -18% discount. We are therefore moving from Sell to Hold on the name, undertaking a neutral stance because the discount to NAV has gotten extremely wide for this fund.

Performance

The fund is down more than -20% in the past month:

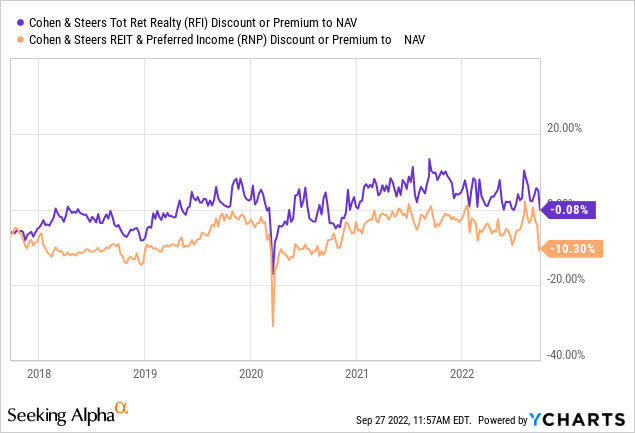

The performance has been driven both by underlying assets depreciation as well as the discount to NAV widening:

We can see the discount to NAV is at a historically wide level of -18.9%. This is a bit much. RLTY is indeed a new fund and it is leveraged but the fund family does not see these sort of levels for the other CEFs. We believe the current discount is a combination of market risk-off mood, new fund discount and hesitancy to enter risk. Either way we find this sort of discount on the very wide side. The underlying assets are not toxic and there will probably be no defaults. Duration is indeed high but we feel this is an overdone move.

Holdings

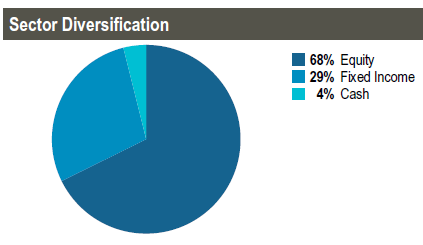

The fund is overweight REIT equities:

Sector Allocation (Fund Fact Sheet)

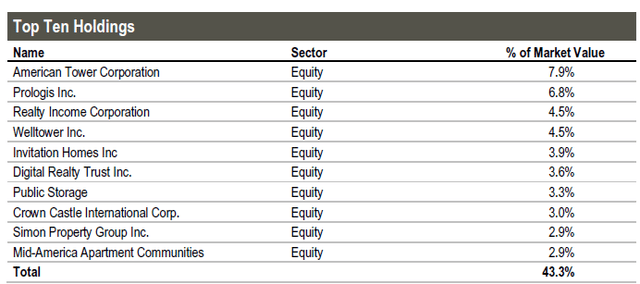

We can see that two-thirds of the fund is invested in common equity issued by REIT structures. The top holdings in the fund are reflective of that allocation:

Top Holdings (Fund fact sheet)

We can see from the top ten holdings that the fund is fairly concentrated, with a very large position in American Tower Corporation (AMT). In fact, the top ten holdings account for almost 50% of the holdings. In our book this is a very concentrated CEF, especially on the equity side.

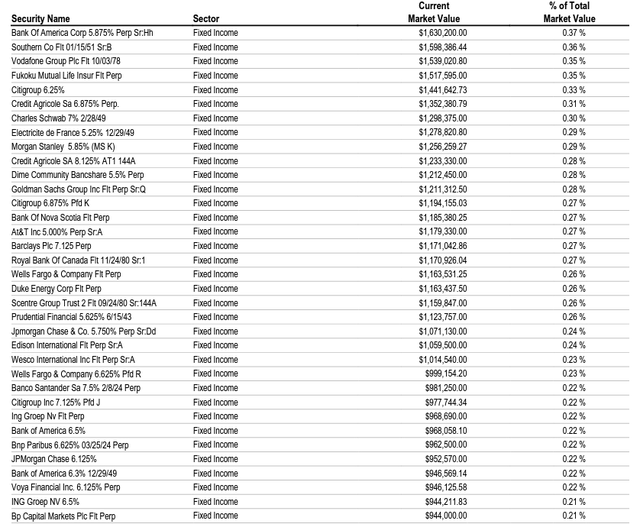

In terms of the bucket labeled as “Fixed Income”, the fund mainly invests in financials’ preferred equities:

Granular Holdings (Fund Website)

We can see that the exposures on the preferred securities are much more granular versus the equity side.

Other Cohen & Steers CEFs

Let us have a quick look at other CEFs from Cohen & Steers:

We have plotted above the discounts to NAV for RFI and RNP in the past five years. We can see that RFI is consistently trading at a premium while RNP, while at a discount, has exhibited very low figures nonetheless. The discount to NAV is very much driven by the asset manager and asset class. If the asset class is well proven and not in a down macro cycle then a good asset manager should always command a premium. We feel that is the case with Cohen and the performance of the other funds in the manager’s umbrella illustrate this point.

Conclusion

RLTY is a new CEF from Cohen and Steers. The fund focuses on REIT equity and financials preferred equities. The CEF has been pummeled this year, being down almost -30%. Since our Sell rating the fund has lost almost -20%. Both the velocity of the move and the vectors have been a bit surprising. Half of the recent losses have come from the widening of the discount to NAV to historic wide levels (-18% now). While we understand investors’ hesitance to enter unproven risk during market sell-off environments we feel the discount is extremely large for a CEF in the Cohen and Steers family. While the tremors of higher yields are not over yet, we feel the vertical move down in RLTY has traced most of the down move for the fund, and the discount to NAV has now gotten too large for the vehicle given its collateral and manager. We are therefore moving to neutral via the Hold rating.

Be the first to comment