VioletaStoimenova

RLI Corp. (NYSE: RLI) has been through a challenging third quarter. Inflationary headwinds and Hurricane Ian caused operational disruptions. Yet, it has remained unfazed with its prudent portfolio diversification and disposition. Today, the company is coping with the recent challenges with its operational stability. Revenues and margins remain stable, which helps it maintain a stellar Balance Sheet. Cash reserves and investments remain adequate with manageable yields. They can cover insurance liabilities, borrowings, and dividends.

Moreover, dividends are enticing, given the sustained growth. Special payouts are massive that they can compensate for low regular dividend yields. Indeed, it is a viable and secure dividend stock. Meanwhile, the stock price shows a slight decrease after the sharp uptrend. But it appears expensive using the various price metrics.

Company Performance

RLI Corp. is at the forefront of financial literacy and climate resilience. As a P&C insurance provider, it remains a staple for many households. It is even more essential in places with high exposure to natural calamities. And we can see the vital role it plays during the hurricane season. Despite this, the market still has a low capacity. This aspect allows the company to enjoy policyholder inflows. Yet, it also means higher claims, especially during summer.

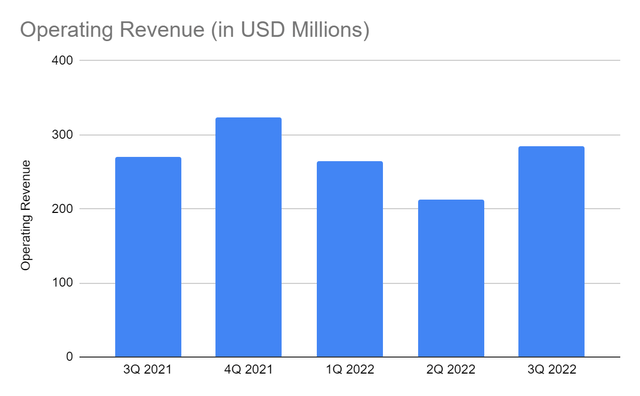

The company’s operating revenue amounts to $285 million, a 5% year-over-year growth. Although growth seems underwhelming, it conveys stability in its core operations. Also, it is a massive improvement from the continued revenue decline in the last three quarters. It sees a mixed market impact on its performance. We will focus on the two primary components.

Operating Revenue (MarketWatch)

First, net premiums earned remain the primary revenue growth driver. RLI recorded nearly $9 million in underwriting income this quarter. We can attribute it to the strategic premium pricing of the company. Adjusting the price helps RLI offset lower purchases and renewals amidst inflation. It is even more visible in the property and construction segment. As property prices increase, having P&C insurance is essential. Most of the segment is composed of commercial properties, so pricing is more flexible. Since the market capacity remains low, RLI sees expansion opportunities for its property segment.

Second, inflation has a mixed impact on RLI’s investment securities. Net investment income is 24% higher than the comparative quarter. Government-backed securities comprise a substantial portion of AFS fixed-income securities. These are more inflation-linked and interest-sensitive, leading to lower risks and stable yields. Meanwhile, unrealized losses on equity securities are ten times higher than in 3Q 2021. These are more vulnerable to inflation. Inflation reduces their valuation, leading to lower fair value and yields.

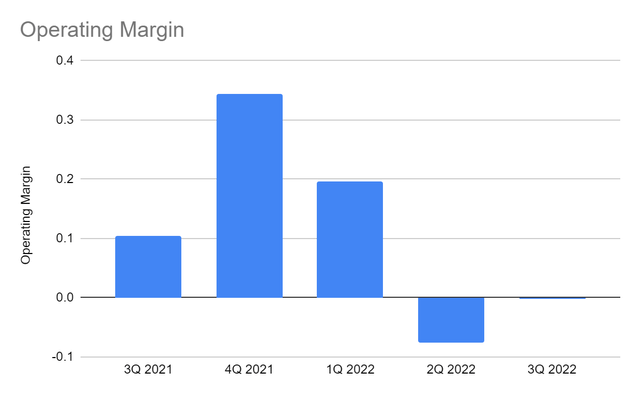

Meanwhile, the combined ratio is higher at 97% versus 95% in 3Q 2021, which lowers viability. But it remains reasonable due to inflation and Hurricane Ian. It has various locations in Georgia and Florida. As such, there was a massive increase in claims losses. Claims were higher on a year-over-year and quarterly basis by 17% and 35%, respectively. Operating expenses are also higher, driven by policy acquisitions. Thankfully, RLI’s strategic pricing worked to its advantage. It partially offset the massive increase in claims and expenses. The operating margin remains low at -0.14%, but it is an improvement from -7.6% in 2Q 2022. Without Hurricane Ian, the operating margin can reach 10-14%, better than in 3Q 2021 and 2Q 2022.

Operating Margin (MarketWatch)

Market Risks And Core Competencies

Inflation, interest, and mortgage rates have stretched further than expected. While they can be troublesome, risks and opportunities are present. RLI’s casualty segment is more vulnerable to inflation. Aside from its exit in some businesses, contracts are long-term. So, its pricing has less flexibility to market volatility.

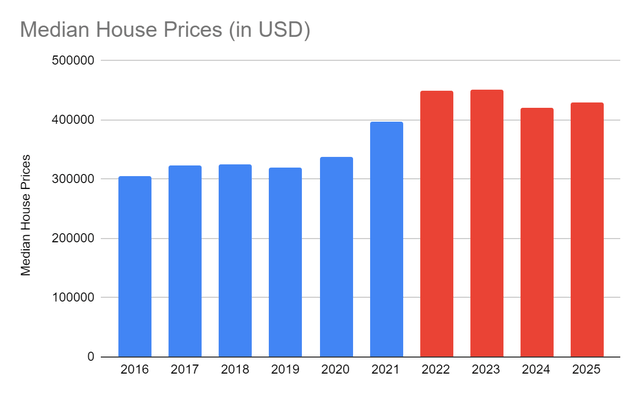

In addition, inflation is most visible in the property market. Its construction segment comprises about 30% of the total business. So it directly relates to housing prices. This year, the median housing price is approximately $450,000. It is already 47% higher than pre-pandemic levels. With that, higher house prices raise the prices of house durables. In turn, it makes P&C insurance more valuable. But as house prices approach their limit, sales have started cooling down.

Median House Prices (ST. LOUIS FED)

This factor affects policy purchases and renewals aside from lower purchasing power. It must prepare for potential price decreases in the next twelve months. Hence, policy pricing may become lower, leading to lower premiums. But it may also mean higher policy purchases and renewals. The impact depends on how RLI sets prices, which should be flexible to market changes.

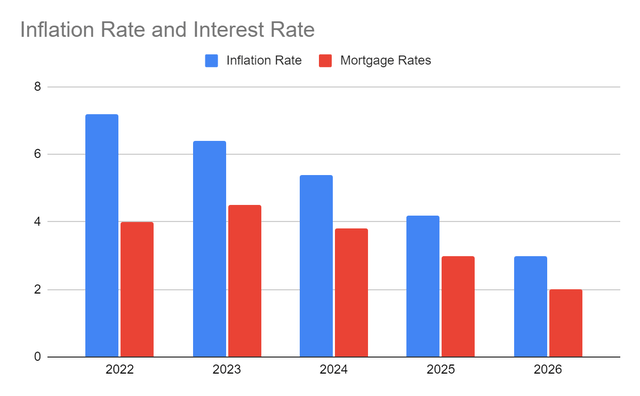

Amidst all these, RLI Corp. may remain a household staple in various locations. I expect a more stable market as inflation slows down to 7.1%. It may still increase but stay within 7-8% this month. Inflation may keep decreasing for the next few years, landing on pre-pandemic levels. The same pattern applies to interest and mortgage rates. Also, Illinois, Georgia, Florida, Texas, and Kansas are some of the most disaster-exposed states. With that, RLI may continue to have a vital role in climate resilience and financial security.

Inflation Rate And Interest Rate (Author Estimation)

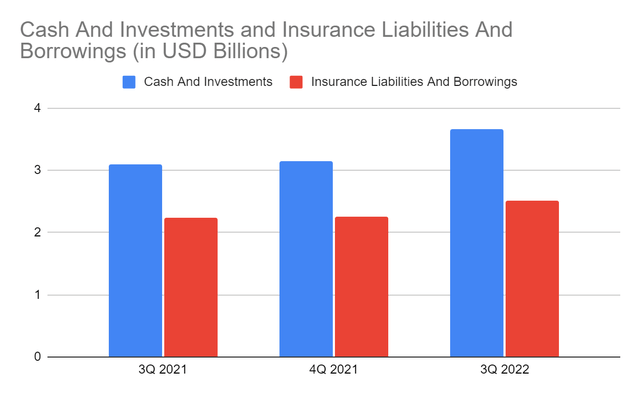

Moreover, RLI maintains a stellar Balance Sheet. This attribute may allow RLI to sustain its operations and cover expansion without borrowing. Cash reserves are adequate and stable at over $700,000. Aside from actual cash transactions, the sale of its minority interest derived cash proceeds. It is about eight times higher than cash levels in 3Q 2021. It comprises 14% of the total assets, making it liquid. RLI can cover all its borrowings and other liabilities using cash. Likewise, investments have stable yields. Thanks to its government-backed securities. Their combined value comprises 71% of the total assets and about twice the value of borrowings and liabilities insurance. It shows adequacy despite the massive increase in claims. Indeed, RLI stays liquid and sustainable, helping it cover its operations even if it incurs net losses. Also, it can continue paying ordinary and special dividends.

Cash And Investments And Insurance Liabilities And Borrowings (MarketWatch)

Stock Price Assessment

The stock price has been in a slight downtrend in the last month. But it’s nothing compared to the sharp increase before. At $125.57, it is already 20% higher than the starting price. The current price-earnings multiple of 9.9x shows that the stock price is reasonable relative to earnings. However, the 3Q EPS is primarily driven by the disposal of its minority interest ownership. The stock price is adherent to the income trend. If we multiply the current PE multiple by my estimated EPS of $5-8, the maximum target price will be lower at $79.2. So, the price may not reflect the intrinsic value of the stock. Meanwhile, the TBV of 29.54x is way better than the average of 22.2x in recent years. It shows the improving fundamentals of the company, raising shareholder value. But the stock price seems high, given the PTBV of 4.25x. It is also higher than the average of 3.98x. If we multiply the average PTBV by the current TBV, the target price will also be lower at $117.57.

Despite the skepticism, it is still a secure dividend stock with sustained growth. The dividend yield is only 0.82% compared to the S&P 400 average of 1.24%. If we include its special dividends, the yield will reach 7%. The good thing about it is that special dividends are continuous. Values are not consistent, but payments are generous. Even better, it has adequate financial capacity, with a dividend payout ratio of 64%. The ratio appears quite high but is way lower than the 88% 2017-2021 average. To assess the stock price better, we will use the DCF Model.

FCFF $124,000,000

Cash $720,000,000

Borrowings $214,000,000

Perpetual Growth Rate 4.8%

WACC 9.2%

Common Shares Outstanding 45,378,171

Stock Price $125.57

Derived Value $108.90

The derived value agrees with our supposition of overvaluation. There may be a 12% downside in the next 12-18 months. Investors may have to wait for a better entry point before making a position.

Bottomline

RLI Corp. operates in a challenging market environment. But it maintains viability and adequacy despite the surge in prices and claims. It remains sustainable with its solid fundamentals while covering enticing dividends. However, the stock price is not that low yet. The recommendation, for now, is that RLI Corp. is a hold.

Be the first to comment