Justin Sullivan

After the bell on Thursday, we received second quarter results from electric vehicle maker Rivian (NASDAQ:RIVN), which can be seen in this shareholder letter. The company has been working to scale production as fast as possible, but its low volumes currently have resulted in large losses. The Q2 report showed things are coming along mostly as expected, with investors eventually cheering the results after an initial after-hours pullback.

For the second quarter, Rivian announced revenues of $364 million, handily beating street estimates for $338 million. There is no year over year growth rate to be calculated here, since the company was in its pre-revenue stage in Q2 2021. On a sequential basis, revenues rose from $95 million, as the company was able to deliver almost 4,470 vehicles in Q2, a strong increase from less than 1,230 seen in Q1 of this year. Demand will not be a problem anytime soon, as the company boasted roughly 98,000 R1 net pre-orders as of June 30th, up from more than 90,000 as of May 9th. Don’t forget that the company also has an order from Amazon (AMZN) for 100,000 delivery vans.

The main problem for Rivian currently is that its expense base is just too high. The company reported a gross loss of $704 million for the June period, which was nearly twice the amount of revenues that were recorded, although that was a dramatic improvement from gross margins of more than negative 528% in Q1. While operating expenses declined by about 7% on a sequential basis, the company still ended up losing over $1.7 billion for Q2, or about $116 million more than Q1. Investments in future growth as well as inflationary pressures continue to hurt the company.

The company’s GAAP net loss ended up being about $4.70 for every dollar of revenue that was recorded, so Rivian is still a long way away from being profitable. However, the negative net margin was almost $16.77 per revenue dollar in Q1, so things are getting better. On a non-GAAP basis, the company reported a $1.62 per share loss, which beat street estimates by a penny. Even with revenues projected to top more than $2 billion a quarter late next year, analysts still see Rivian losing well over $1 per share even on a non-GAAP basis for several quarters moving forward.

When looking at the yearly forecast, three main items were detailed. First, and perhaps most importantly, is that the production forecast for 25,000 vehicles for this year was maintained. Unfortunately, due to inflation, supply chain issues, and other larger than expected expenses, management cut its adjusted EBITDA guidance by $700 million. That means that adjusted EBITDA will now be negative $5.45 billion for the year. On the flip side, capital expenditures are now going to be $2 billion, down from previous guidance of $2.6 billion, so management expects its year end cash position to be in-line with its initial expectation.

In terms of free cash flow, Rivian burned through more than $1.56 billion in the quarter, up about $110 million from Q1. The good news here is that unlike many other electric vehicle startups, Rivian ended up with a huge cash position after its IPO, as it was one of the largest IPOs of the last decade. The company ended Q2 2022 with nearly $15.5 billion in cash, and that excludes additional borrowing capacity available under its revolving credit facility. With a strong financial position, the company remains confident in its ability to launch its R2 platform at its new Georgia factory in 2025.

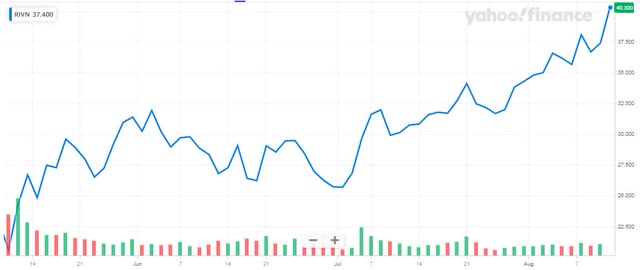

Rivian shares initially sold off a couple of dollars after the headline numbers came out. I didn’t think that was a terrible reaction at first, because as the chart below shows, the stock had basically doubled over the last 3 months. A pullback on mostly decent news would have just been seen as a “buy the rumor, sell the news” type of event. However, shares quickly reversed in the after-hours session, topping $40 for the first time in about four months. The street still really likes this name, as the average price target on the stock was more than $53 going into Thursday’s report. Those targets might come down a couple of dollars based on the adjusted EBITDA forecast reduction, but even at say a $50 average the street would still see decent upside from here.

Rivian Last 3 Months (Yahoo! Finance)

In the end, Rivian announced a solid set of Q2 results on Thursday, helping to sustain the recent surge we’ve seen in shares. Revenues came in well ahead of analyst estimates, and even though expenses are the biggest headwind here, the adjusted bottom line still beat the street by a penny. Even though losses might be more than previously expected, Rivian maintained its production forecast, which is key in this tough supply chain environment. With a solid balance sheet able to sustain a lot of cash burn in the near term and plenty of potential orders to fill, Rivian’s growth story is definitely one I’m excited to watch.

Be the first to comment