Justin Sullivan

After a 70% retracement in Rivian Automotive, Inc. (NASDAQ:RIVN) stock price this year, I believe RIVN offers investors significant long-term upside potential.

In addition, the EV company recently reaffirmed its production forecast of 25K electric-vehicles, and the stock, in my opinion, remains very appealing to investors on a cash-corrected basis.

Rivian Automotive’s sales are expected to double in 2023, and the stock trades at a low sales multiple. With the holidays only a few weeks away, RIVN stock appears to be an excellent Christmas present.

Rivian Automotive Is Set To Become A Major Player In The EV Industry

Rivian had 114K pre-orders on its books as of November 7, 2022, a 16% increase from the end of June, when the electric-vehicle company reported 98K pre-orders. Rivian Automotive reaffirmed its 25K production target for 2022 in its 3Q-22 earnings report.

Due to frustrating supply-chain challenges and shortages that affected many more companies in the industry than just Rivian Automotive, the EV company previously reduced its target production level from 50K. But things are looking up for Rivian Automotive, and they are looking up quickly.

The EV company is beginning to see significant production and delivery growth, which has resulted in new records in the third quarter. Rivian Automotive delivered 6,584 electric-vehicles to customers in 3Q-22, up from 4,467 in the second quarter, representing a 47% QoQ increase.

Rivian Automotive also informed shareholders that it implemented a second production shift in the third quarter to meet the high demand for its electric-vehicles.

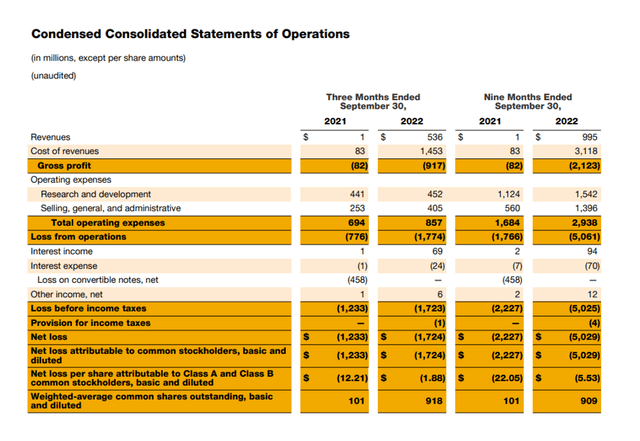

Importantly, Rivian Automotive is beginning to generate real sales, which investors have been anticipating for some time. Rivian Automotive generated $536 million in sales in the third quarter, a commendable achievement given that total sales in the previous year were only $1 million.

Even though Rivian Automotive is still losing money, I believe the EV company is on the right track and will become a major player in the EV industry if current production growth continues.

Condensed Consolidated Statements Of Operations (Rivian Automotive, Inc.)

Possible Production Volume In 2023

Investors can expect a significant increase in production and sales in 2023 as the company scales its R1T and R1S production and works to meet its delivery obligations to early reservation holders.

Rivian Automotive expected to produce 50K electric-vehicles this year, a target that proved unrealistic as the EV sector struggled with supply-chain issues. Having said that, I believe Rivian Automotive will be able to produce up to 50,000 electric-vehicles next year.

Rivian Automotive recently added a new shift to its production (which will increase the number of EVs produced and deliveries), and the EV company saw robust demand for its R1T and R1S models in the third quarter.

Rivian Automotive’s (Cash-Corrected) Valuation Is Very, Very Reasonable

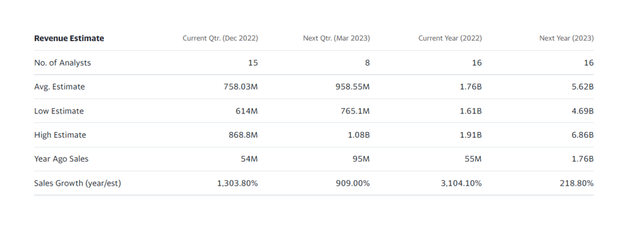

The market anticipates about 220% annual sales growth for Rivian in 2023, which I believe is very achievable given how quickly deliveries are increasing.

Rivian Automotive’s annualized 3Q-22 sales are already around $2.1 billion, and the company plans to ramp up production in the fourth quarter as well as in 2023.

Revenue Estimate (Yahoo Finance)

Rivian Automotive has a cash-correct market value of $14.5 billion after deducting $13.3 billion in cash and cash equivalents from its balance sheet as of September 30, 2022.

The EV company’s stock is valued at 2.6x the cash-corrected market value of Rivian Automotive’s auto operations (using the consensus average sales estimate of $5.62 billion shown in the chart above).

I believe the sales multiple is extremely compelling, given Rivian Automotive’s potential to become one of the major EV players in the auto industry in the future.

Why Rivian Automotive Might See A Lower Valuation

A decline in EV company reservation growth could be a catalyst for a lower sales multiple. Customers are clearly interested in purchasing an R1T or R1S, as Rivian Automotive reported a significant increase in reservations since its last update based on June figures.

Rivian Automotive’s supply chain could also be a problem, especially if new supply-chain restrictions delay the recognition of sales and income in 2023.

My Conclusion

The holiday season is quickly approaching, and if you’re looking for a unique Christmas present for yourself or your children, consider purchasing Rivian Automotive stock. The EV company is making great strides in production scaling, and Rivian Automotive is beginning to produce actual sales.

Furthermore, unless new supply-chain restrictions are imposed in 2023, I believe Rivian Automotive will be able to double its production next year.

Now that the company is actually scaling production and making sales, I believe Rivian Automotive has reached a tipping point, and the stock, given its low sales multiple, could trade higher in 2023.

Be the first to comment