Justin Sullivan

Thesis

Rivian Automotive, Inc. (NASDAQ:RIVN) demonstrated robust momentum in its Q3 earnings release, highlighting that the EV maker’s production ramp is solid, despite ongoing supply disruptions. In addition, its pre-order backlog also offers clear visibility into 2024, as the company started its second shift to meet its full-year guidance.

As such, the company highlighted in its earnings commentary that it was confident in meeting its 25K production guidance while keeping its adjusted EBITDA outlook intact.

The company also showcased its focus on its path to profitability as it outperformed the Street’s profitability projections, leveraging its fixed costs leverage.

We noted in our previous article that Rivian had continued to perform well, lifting its production prowess to meet its backlog. However, the market has remained tentative over its negative profitability, as sellers brutally forced intense selling against buyers at critical resistance zones.

Hence, we deduce that the market remains tentative over the company’s execution, even though management emphasized it was confident that its cash flow runway was sufficient to meet its targets through 2025.

Our analysis suggests that RIVN is unlikely to be re-rated materially in the near term. While the post-earnings buying surge could have taken out some bears, RIVN’s critical resistance zone remains at its August highs.

Hence, we urge investors to wait for a deep pullback for RIVN to consolidate constructively before assessing the opportunity to add exposure.

Revising from Speculative Buy to Hold for now.

RIVN: Production Is On Track For a Strong Q4 Cadence

Management reiterated its FY22 production outlook of 25K, as Rivian updated 15K of production as of Q3. Therefore, its guidance implies 10K of production in Q4, up nearly 36% QoQ.

We believe management’s confidence emanated from the successful start of its second shift on its facility, as it articulated:

So we’re going through that ramp now. It is going well. The first shift continues to make improvements. We’re very much focused not just on the ramp, but also on operational efficiencies and cost efficiencies, many of which come implicitly just through achieving higher output of the plant and leveraging more of our fixed costs more efficiently across more volume. But we’re very much focused on fully ramping the second shift and going into 2023 strong. (Rivian FQ3’22 earnings call)

We believe that management’s attention on ramping production while keeping a close eye on achieving higher efficiencies is critical to its path to profitability.

Hence, that was demonstrated in Rivian outperforming its Q3 profitability estimates, as it benefited from higher volume against its fixed costs base. Accordingly, Rivian delivered an adjusted EBITDA of -$1.31B (Vs. -$1.41B consensus).

As a result, we believe the company’s ability to meet its FY22 adjusted EBITDA guidance of -$5.45B (Vs. -$5.49 consensus) has been bolstered, as the Street was still tentative in its previous projections.

Is RIVN Stock A Buy, Sell, Or Hold?

Management has demonstrated its ability to execute well for the second consecutive quarter while keeping a close eye on achieving its long-term profitability targets.

As such, the post-earnings spike has likely reflected its near-term upside, even though Wall Street has yet to revise its projections (as the market is forward-looking).

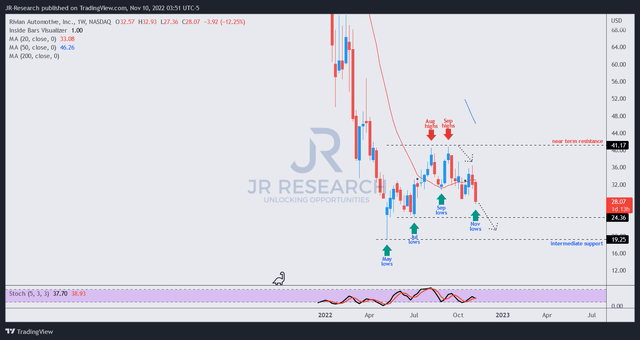

RIVN price chart (weekly) (TradingView)

As seen above, buyers failed to push the stock above its August highs resolutely in its rally from its September lows. Hence, we postulate that its critical resistance level of $40 could continue to attract intense selling pressure, given the decisive rejection of further buying upside from that level.

As such, we believe a deeper pullback is necessary to help provide investors with an improved reward/risk profile to bet on Rivian’s execution risks.

The post-earnings surge could see RIVN open today’s session around the $30 zone. While it proffers more than 30% upside (to $40) from that level, we urge investors to apply a significant buffer as RIVN has seen robust selling pressure recently below its August/September highs.

Hence, we believe a potential re-test of its July lows could offer investors vital clues on the market’s directional bias. Also, a successful re-test should provide a much-improved reward/risk upside from those levels.

Revising from Speculative Buy to Hold for now.

Be the first to comment