Diego Thomazini

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on December 14th, 2022.

RiverNorth Specialty Finance Corporation had a very recent change in its name. The fund now is RiverNorth Capital and Income Fund (NYSE:RSF), effective as of December 7th, 2022. They’ve retained the ticker, and the fund’s strategy and objective remain the same. As one of the only interval funds traded publicly, this is one that I continue to watch from time to time.

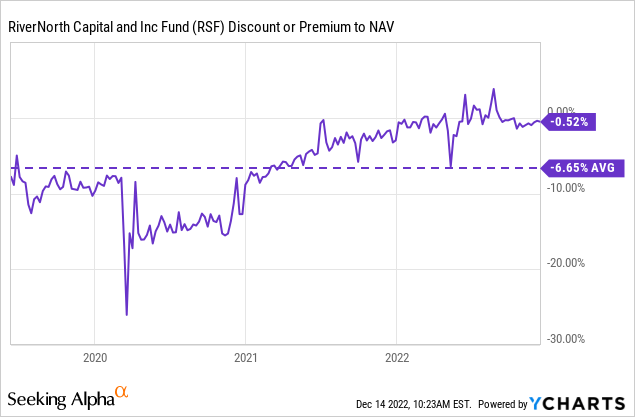

The discount shouldn’t get too wide as an interval fund. Shortly after it launched, it traded at some deep discounts, and through 2020, that was also true. The interval structure means they are repurchasing shares every quarter. Basically, there is a guaranteed tender offer each quarter for this fund. Generally, it is going to be a 5% repurchase at NAV each quarter.

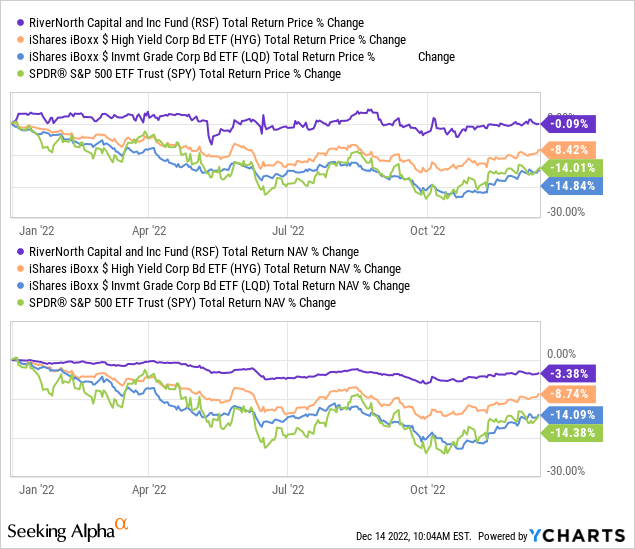

For the most part, RSF has held up relatively well on a YTD basis. They’ve topped the performance of other major investment classes as represented by the iShares iBoxx $ High Yield Corporate Bond (HYG), iShares iBoxx $ Investment Grade Corporate Bond (LQD), and the SPDR S&P 500 (SPY).

Ycharts

The Basics

- 1-Year Z-score: 0.10

- Discount: 0.52% (Recent NAV $17.45)

- Distribution Yield: 11.49%

- Expense Ratio: 1.95%

- Leverage: 42%

- Managed Assets: $100.97 million

- Structure: Interval

RSF’s investment objective is “a high level of current income.” They attempt to achieve this through “investing in credit instruments, including a portfolio of securities of specialty finance and other Financial companies that the Fund’s Advisor, RiverNorth Capital Management, LLC believes offer attractive opportunities for income.” They have no restrictions on maturity or credit quality.

The fund is small and will continue to get smaller due to the interval structure, plus the fund’s distribution policy is also conducive to a slow liquidation. They could grow by issuing new shares in an at-the-market offering or through their dividend reinvestment program. ATMs and DRIPs can be done at a premium, which would benefit as it would be accretive.

They could also utilize a rights offering. I mention this because they recently filed an N-2. In fact, several of the RiverNorth funds just filed an N-2. In this way, they leave their options open for conducting ATMs and/or rights offerings.

The fund is also leveraged, and while they’ve been holding up relatively better, this leverage ratio is rising. They offer leverage via their 5.875% Series A Term Preferred Stock Due 2024 (RMPL.P) holding. They have a credit facility but had no outstanding balance at the end of the last fiscal year. Through the preferred, they raised $41.4 million. The benefit here is that the leverage costs are fixed, so as rates rise, they won’t be hit with any higher leverage costs.

On the other hand, it is fairly more difficult to deleverage if they need to. With having publicly traded preferred, they are limited to a leverage limit of 50%, or they would have to suspend their distribution. We are quite far away from that level, just something to consider.

When looking at the expenses of RSF, they can be quite shocking at first. The 1.95% expense ratio is when excluding the Loan Servicing Fee. The fund’s management fee is 1.25%. That’s higher than usual, but their investments can require more attention. It is the Loan Servicing Fee that can get to a shocking level. With that, it comes up to an expense ratio of 6.87%. The leverage and loan service fees were 4.69% of that.

Performance – Patiently Waiting For Discount

As shown above, the fund’s performance this year has been relatively strong. Their unusual investment style makes the fund a true diversifier in one’s portfolio. They benchmark themselves against the Bloomberg U.S. Aggregate Bond Index.

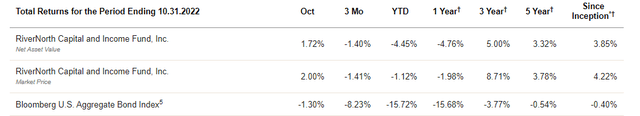

RSF Annualized Returns (RiverNorth)

Over the long and short term, the fund has outperformed. While 3.32% annualized over the last five years might not sound impressive, it was better than the index that generated losses. This is a true testament to how much bonds have fallen this year, bringing down any positive performance they’ve put up in the last several years.

The primary benefit here is not the total returns, though, or how it performed against a benchmark that really isn’t applicable. What I would focus on is the fund’s discount. In particular, I would focus on the fund’s lack of a discount.

If a fund is going to repurchase shares every quarter at NAV, I want to be able to buy at a 5 to 10% discount to turn around to collect NAV. That’s guaranteed alpha. Of course, the overruling factor here is if you want exposure to the type of underlying portfolio this fund brings. Ultimately, I believe one has to be comfortable with the portfolio.

Ycharts

The fund at first traded at a fairly wide discount. That represented quite the opportunity in hindsight. Investors seem to be more aware of the opportunity in the interval fund structure. For the last couple of years now, the fund has traded much closer to its NAV. That’s why we should continue to be patient if one wants a position in this fund.

Also worth noting here is that the fund transitioned in 2020. This latest name change also wasn’t their first name change. They had gone by RiverNorth Marketplace Lending. With that change, they did implement a strategy change as well. That went into effect on May 22nd, 2020. That transition made them a more flexible fund overall. It would seem that the latest fund name change further reinforces that flexibility.

Distribution – Managed 10% Policy

The distribution policy for RSF is like other RiverNorth funds. It is based on a NAV target that resets annually.

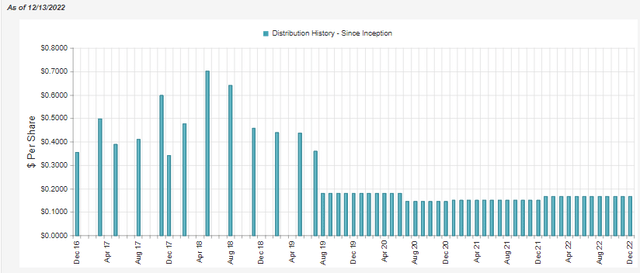

RSF Distribution History (CEFConnect)

With that policy, the latest NAV at $17.45 could see the new annualized distribution come to $1.745 or $0.1454 monthly. A relatively small trim from the $0.1662 it’s paying now. And by relatively small, I mean that several other funds with managed distributions will have their payouts gutted and slashed next year. It’s been a tough year, but this is another benefit where RSF’s portfolio holding up relatively well can pay off.

Due to the distribution policy, the distribution coverage might not be as important as it otherwise would be. For example, it won’t tell us if they will likely cut their distribution or not. It is based on the percentage of NAV to set the rate the following year.

However, if it is being covered, that should show in a higher NAV; if not, then that should result in a lower NAV. In the case of RSF, the distribution coverage is lacking. Meaning that all else being equal, it is also providing a slow liquidation of the fund. Therefore, it will continue to pressure NAV as they erode a bit of it away every year.

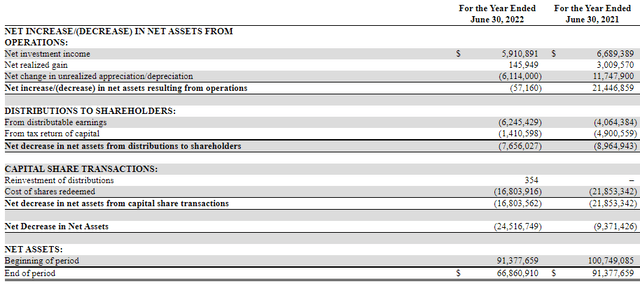

RSF Annual Report (RiverNorth)

On a more optimistic note, the NII coverage did come up from ~74% coverage previously to 77.2% now. They should even see this rise further in NII coverage when the distribution cut comes in for next year. Of course, that’s also assuming they can generate a similar relative NII in the next 12 months.

We also see that the fund was able to take advantage of the DRIP. After this period, the fund has traded at a premium on more occasions. That could mean more shares were issued in an accretive manner for the fund.

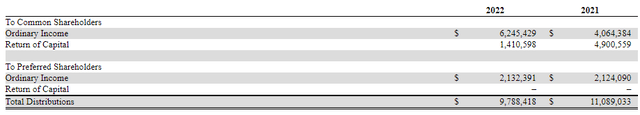

Perhaps unsurprisingly, the fund’s distribution does show classifications of return of capital. Not all ROC is negative for CEFs, but for RSF, it would be considered destructive.

RSF Tax Character (RiverNorth)

RSF’s Portfolio

The fund has shown some very elevated turnover, so looking at the portfolio today means it could have already changed drastically from its last reports. Turnover in the last year was 130%, and in fiscal 2021 it was 138%. I wondered if the turnover would slow this year after 2020 was their transition year. However, it appears as if it is remaining elevated.

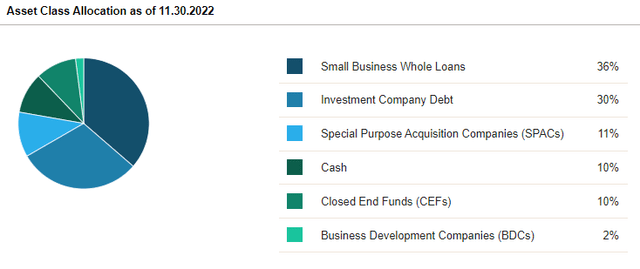

The fund still carries a significant exposure to small business whole loans. This is what they were invested in almost entirely before 2020. Since then, they’ve been incorporating more BDC debt, CEFs, and SPACs.

RSF Asset Allocation (RiverNorth)

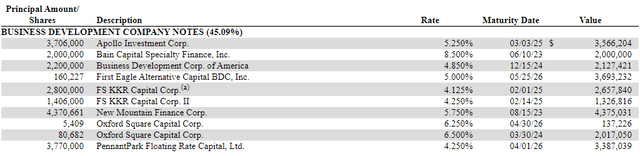

Finding a fund investing in BDCs isn’t too unique. VanEck Vectors BDC Income ETF (BIZD) is an ETF that offers this, and First Trust Specialty Finance & Financial Opportunities Fund (FGB) is a CEF that offers this. However, for RSF, it is a bit more unique as they invest in the debt of these BDCs.

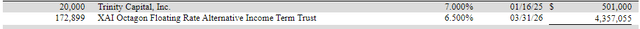

RSF BDC Debt Holdings (RiverNorth) RSF BDC Debt Holdings (RiverNorth)

I see this as both a unique and also a potential downside of the fund. The reason being is that these BDCs are paying fixed rates on their debt. As interest rates are rising, this is of no benefit to RSF. They don’t get to participate in the upside or have a hedge against higher interest rates here.

The other largest exposure here remains the whole loans they have invested in. This accounted for $55,263,009 in principal invested. It carried a value of $47,697,567 at the end of June 30th, 2022. They listed the interest rate as 4.21%, with maturities between 4/4/2018 and 12/26/2023. This entire whole loan exposure is through the alternative credit platform Square Capital.

Square Capital is an invitation-only advance on the sales that retailers make through Square’s point of sales system. It’s essentially a merchant cash advance, meaning that you pay a fixed fee rather than interest and repay the funds with a percentage of your daily sales.

We also have SPAC exposure. These are before they de-SPAC, meaning they are incredibly safe investments. There is even the benefit as they generally sit in T-Bills. With higher interest rates, the U.S. debt is starting to pay something these days.

Overall, the fund’s positioning has made it hold up rather well on a YTD basis. The SPACs tend to hold around NAV until a deal is announced. Then the fund can opt to cash out before it merges if it comes to that. The BDC debt should also be fairly safer but has some credit risks. The whole loans will also carry credit risks. If the economy slows down, people could find it difficult to repay these debts. The risks here are mitigated a bit due to diversification. These are also short-duration assets with short maturities.

Conclusion

RSF is a unique closed-end fund in several ways. A notable feature is that it is a publicly traded interval fund. It also carries a unique portfolio with access to whole loans and BDC debt. They mix in some SPAC exposure and CEFs as well. That makes it one flexible fund in the way it invests. It recently changed its name, but that has no fundamental change in the fund’s investment strategy.

Despite these unique qualities that make this fund interesting, I would still be looking to get the fund at a minimum of a 5% discount. I think that a 10% discount would be even more ideal. Although the benefit I’d look to exploit at a 10% discount with the quarterly tender offers is the very reason why a 10% discount may never happen. For this one, patience could truly pay off if a black swan event pushes it to such a discount.

Be the first to comment