FG Trade/E+ via Getty Images

Call me crazy, but shares of the beaten-down retail drug store chain Rite Aid Corp. (NYSE:RAD) might be worth a shot here. The stock is down 97%-plus from its all-time high more than five years ago, but I see improving technical features while fundamentals look quite weak.

For background, the Pennsylvania-based retailer engages in the ownership and management of retail drug stores. It operates through the following segments: Retail Pharmacy and Pharmacy Services, according to the Wall Street Journal. The stock is just a $340 market cap firm, but employs 53,000 people, per the WSJ. Something traders should note is the whopping 26% short float on RAD. That could play a crucial role in price action next week.

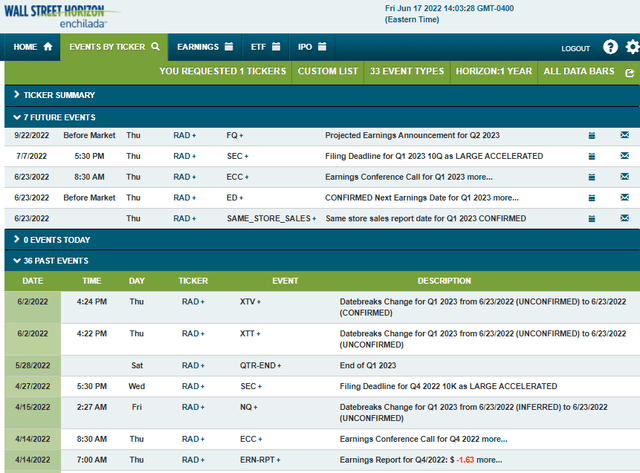

According to Wall Street Horizon, Rite Aid has a confirmed earnings date of June 23 BMO with a conference call to follow. As we head into that announcement, I like to gander at the at-the-money straddle for clues on how much the market expects shares to move post-earnings.

Corporate Event Calendar: Confirmed Earnings and Conference Call on Thursday

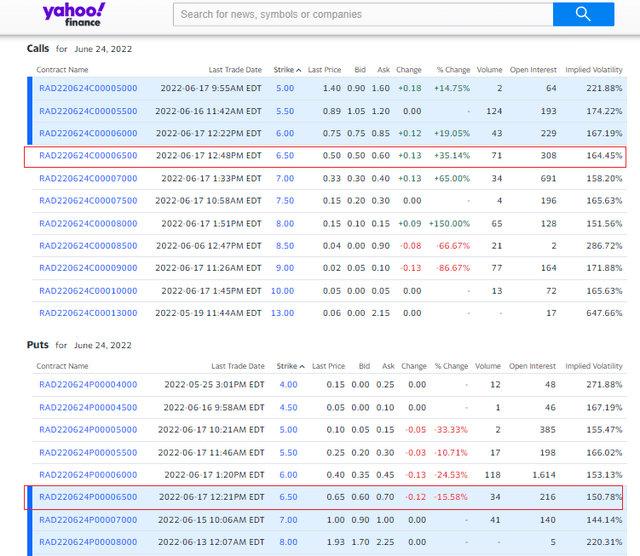

The straddle, which is a buy of both a put and a call, costs $1.20, according to Yahoo Finance data. That implies a percentage stock price change between now and the June 24 options expiration of 19%. The market sees a monster move, up or down, in RAD shares over the next week.

Options Action: Expensive Straddle Portends A Big Earnings Move

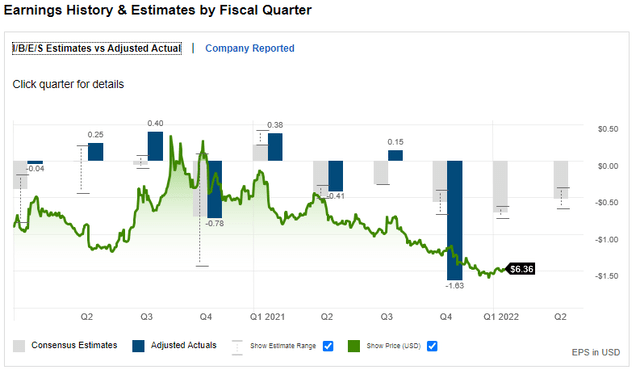

Unfortunately, recent earnings reports have been poor to cataclysmic. The most recent report featured a massive loss, per Fidelity stock research. Perhaps that was a kitchen-sink moment for this Consumer Staples stock. Why even touch this hot mess? There are technical signs of a bottom.

Kitchen Sink Quarter? Unstable and Negative Earnings Picture

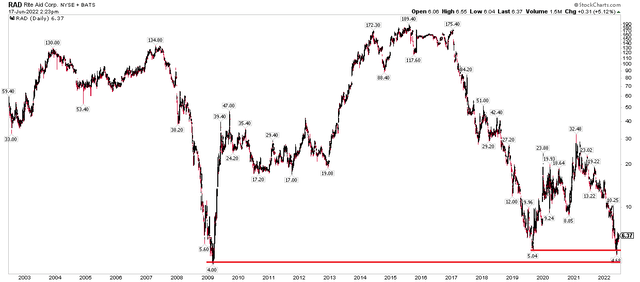

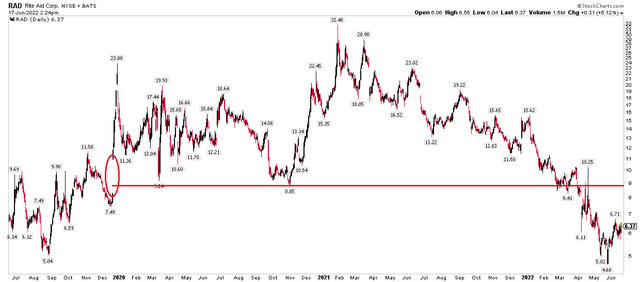

Zooming way out to the past 20 years, the stock has found a floor a few times in the $4 to $5 range. Right now, RAD shares are bouncing off $4.68 hit a month ago. So, buyers seem to take a chance in this price area.

Here We Are Again. Long-Term Chart: Historical Support $4-$5

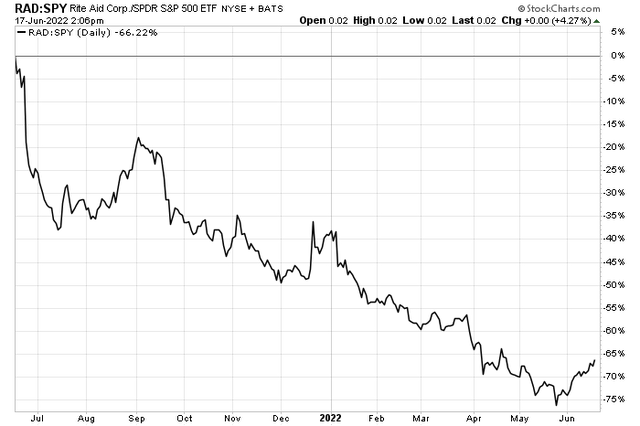

Moreover, the relative chart vs the S&P 500 SDPR Trust ETF (SPY) shows a potential trend reversal. The relative chart below still has some work to do, admittedly. But it’s up 42% vs SPY since May 24.

RAD Relative Bounce Off the May Low – Still Work To Do Here

To be clear, this is not an investment. It’s a trade. I think shares can approach $9 on this bounce. Recall the March 2020 low and the November nadir later that year – near the $9 figure. There was a key late-2019 gap that was partially filled which remains significant.

Upside Resistance Marked at $9

The Bottom Line

Rite Aid shares could be shaping up for a continued significant bounce. While anything can happen after an earnings report, traders price in a 19% change as RAD shares sport good recent relative strength after bouncing off long-term support. Longs should take profits should the stock hit $9.

Be the first to comment