AntonioSolano/iStock via Getty Images

Riskified Ltd. (NYSE:RSKD) has had some tough times since trading at a little over $40.00 per share on September 6, 2021, eventually falling to its 52-week low of $3.43 on October 6, 2022.

After climbing from the low, it rebounded to around $4.00 per share and traded a little above that until its recent earnings report, which afterwards the share price took off to just under $6.00 per share, although I haven’t seen anything in the report to justify that level of a move.

I understand there was a decent growth in revenue and an upwardly revised outlook for full-year 2022, but the headwinds it’s facing in the fourth quarter will slow down its momentum, and with the economic environment expected to worsen in 2023, I see significant headwinds going forward.

In this article, we’ll look at its recent earnings, performance of segments, and how 2023 will probably play out for RSKD.

Latest earnings

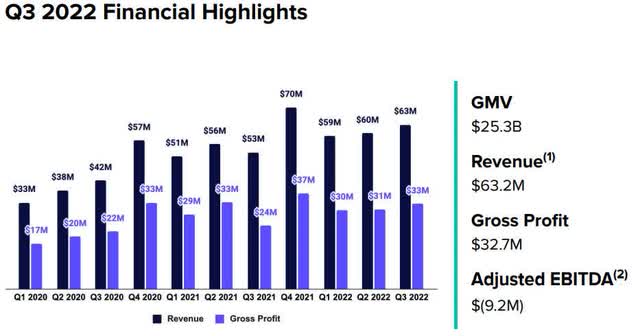

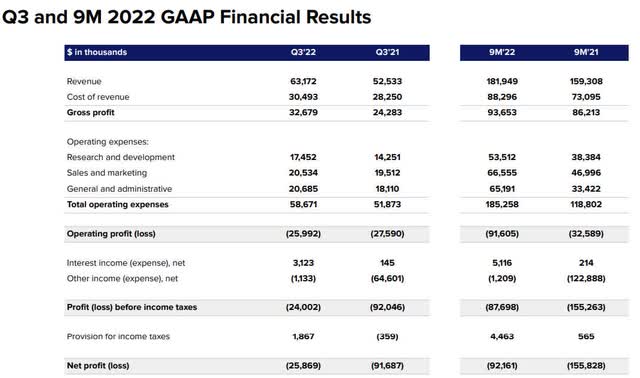

Revenue in the third quarter was $63.17 million, up 20 .3 percent year-over-year, beating by $4.19 million. GAAP revenue for the first nine months of 2022 was $186 million. Cost of revenue in the quarter was $30.4 million.

RSKD slightly upwardly revised its full-year revenue outlook from a range of $255 million and $258 million to $257 million to $261 million.

Non-GAAP EPS in the reporting period was ($0.05), beating by $0.11.

Expenses remain an issue for the company, with R&D costs of $17.4 million, sales and marketing costs of $20.5 million, and general and administrative costs of $20.7 million, for a total of $58.7 million. With a gross profit of $32.7 million, that resulted in an operating loss of $26 million.

Adjusted EBITDA in the quarter was a loss of $9 million, a 30 percent improvement year-over-year. Cash flow in the quarter improved by 75 percent over the same quarter of 2021, but it still was a negative $4 million in Q3.

As for its balance sheet, the company had about $484 million in cash and deposits, with no debt. That is a bright spot for the company as it continues to navigate difficult economic conditions that likely aren’t going to abate any time soon. In that regard, it should be able to continue to invest in initiatives that may eventually bring it to profitability.

For the fourth quarter 2022, the company guided for growth to slow down sequentially. My main concern here is the loss of momentum from the projected weaker performance as it heads into historically slower demand in the early part of the year.

Strengths in the quarter

Tickets & Travel

The best performance among its segments was Tickets & Travel, which accounts for a little 30 percent of the company’s revenue. RSKD landed “the world’s largest secondary ticket marketplaces for live sports, concerts, theater, and events,” in the third quarter, and that should be a nice catalyst for 2023, depending on whether or not consumers continue to prioritize experiences in events in their spending decisions.

For now, the momentum in this market continues to show strength, as companies competing in live events have shown significant growth from pent-up demand to get out after being locked down during the pandemic remains in play. That could come under pressure if the recession goes deeper for longer in 2023.

The rest of the company’s business is diversified across a variety of industries and geographies, and consequently, the company has yet to build a “bottoms up model” that will help it to understand how that mix will perform in 2023. For that reason, management stated that will have to be accomplished “before really understanding the path to profitability.”

Upsell

Upsell business in the third quarter experienced strong growth in comparison to the third quarter of 2021. The top contributions came from companies with e-commerce sales of over $3 billion on an annual basis.

Increased upsell business, along with new logos, was able to offset the drop in organic growth from some of its existing merchant client base. The decline in organic growth at many of its merchants was from the macroeconomic headwinds they face. That suggests the larger merchants are carrying the heavy weight.

While this business is probably going to be a driver in the fourth quarter, once again, consumer spending will determine how strong it’ll be.

If economic conditions get worse before they get better, like many believe, this could make it harder to continue to grow its upsell business in the next two to three quarters.

If the company can continue to maintain momentum in Tickets and Sales, along with Upsell, it could surprise to the upside if it can find ways to improve organic growth.

Conclusion

RSKD had a solid third quarter and is growing its top line while improving its bottom line. It also has plenty of available capital at this time to invest in initiatives that give it a chance to continue growing.

That said, I do think a lot of its short-term potential is already priced in, and even if it is able to maintain its recent share price momentum, I don’t think there is enough strength in its overall portfolio to generate a lot of revenue growth in the near term.

The fourth quarter will be challenging, assuming a live event spending slowdown in the holiday season, and with uncertainty surrounding how well e-commerce is going to do in the calendar fourth quarter, there is a lack of clarity in my opinion as to whether or not the third quarter will be one of the best it has for a while.

Assuming the second half of 2023 starts to rebound economically, RSKD could return to some of its recent momentum. Until then, I’m thinking the recent boost in its share price is probably not going to be sustainable.

For investors interested in the company, I would think waiting for its share price to pull back for a better entry point is the best strategy to employ.

Once the market digests the entirety of its performance and path forward, I think shareholders that enter at this price could end up underwater for a prolonged period of time.

On the other hand, as mentioned earlier, if the company is able to surprise to the upside with organic growth and upsells, and demand for live events continues, RSKD could outperform in 2023.

All that said, it isn’t out of the woods yet and has a way to go to sustainably generate a profit over the long term.

Be the first to comment