kupicoo/E+ via Getty Images

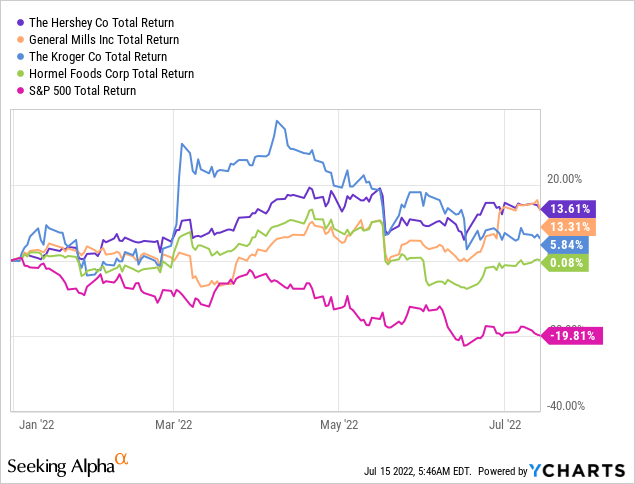

The first half of 2022 has been a difficult period for stocks, with scorching inflation and rising recessionary risks, most companies have delivered negative returns to shareholders. Emphasis on most, there are a few exceptions. Here we highlight four companies that have benefited from recessions in the past, and that have delivered positive returns to shareholders in the first half of the year, comparing very favorably to the ~20% decline in the S&P 500 index during the period.

The four companies that we are about to highlight are not particularly cheap, but they have shown they are a particularly good fit for the current environment, and that is why their share prices have done so well relative to the index. These four companies are The Hershey’s Co (HSY), General Mills (GIS), The Kroger Co (KR), and Hormel Foods Corp (HRL). As we’ll see, they either have shown an ability to grow revenues during a recession, or are showing they can pass inflation to customers, or both.

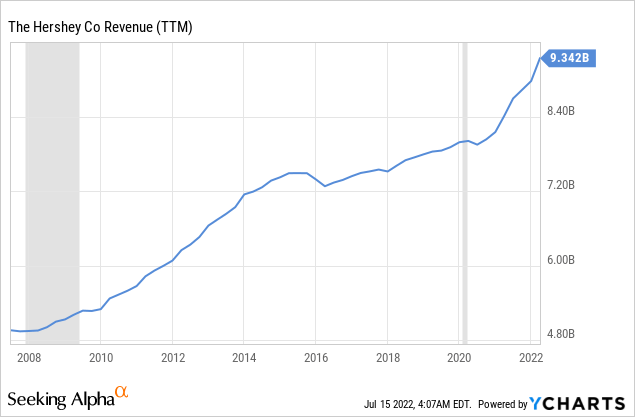

1. Hershey’s

Hershey’s proved it is a recession-resistant stock by growing its sales organically during the great recession of 2007-2009, as can be seen in the shaded region of the graph. The theory is that people not being able to afford a bigger luxury, like maybe going for a fancy restaurant meal, replace it with a cheaper alternative like staying home to watch TV with some candy.

Hershey’s has some incredibly strong brands, such as its namesake, as well as Reese’s, and Skinny POP among others. Having these powerful brands allows the company to raise prices to pass any inflationary pressures to its customers.

Hershey’s Investor Presentation

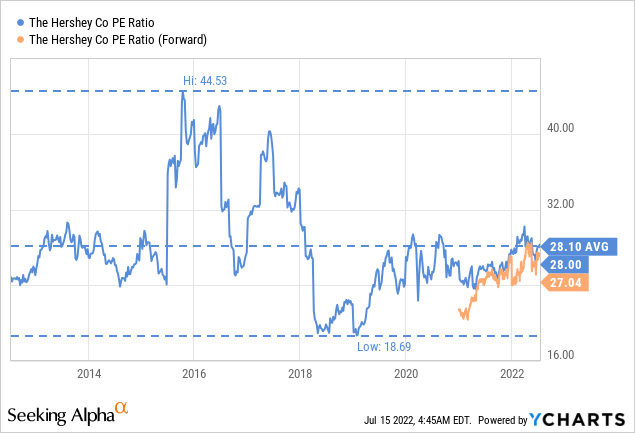

Shares are not exactly a bargain, but they rarely trade at a low multiple. If anything, the P/E ratio is currently very close to the ten-year average.

Hershey’s raised sales and earnings guidance for 2022, and its long-term targets aim for +2-4% net sales growth, and +6-8% adjusted earnings per share growth.

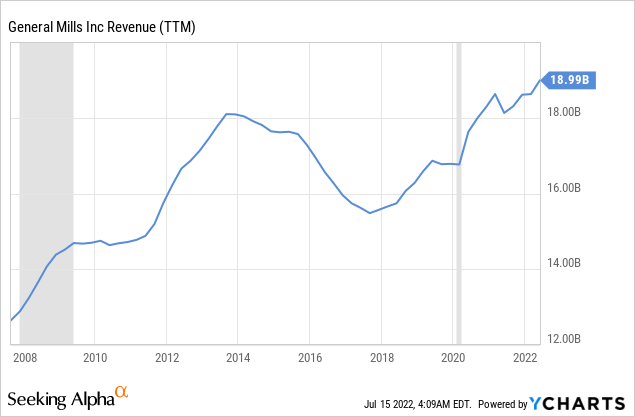

2. General Mills

General Mills is another company that has proven that it can increase revenues during a recession, for similar reasons to what we outlined above for Hershey’s. For instance, instead of going out for that fancy avocado toast brunch, you stay home and have a bowl of Cheerios.

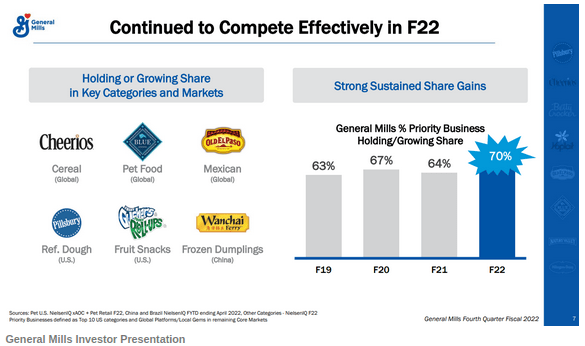

2022 has been a good year for General Mills, with ~70% of its products holding or increasing market share. The slide below shows some of the key categories and markets where General Mills is outperforming.

General Mills Investor Presentation

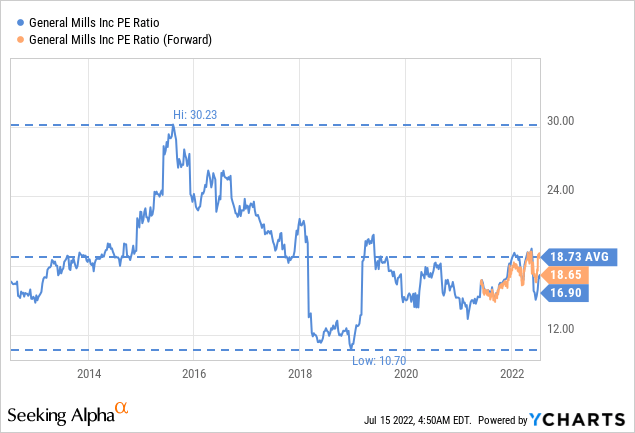

Shares are currently trading with a price/earnings ratio close to its ten-year average, and while they don’t look particularly cheap, shares don’t look overly expensive either.

3. Kroger

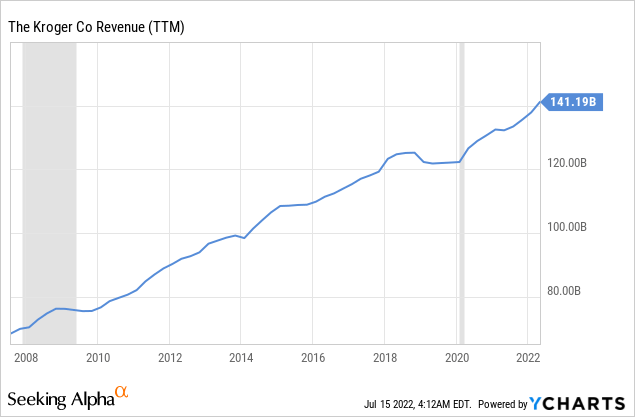

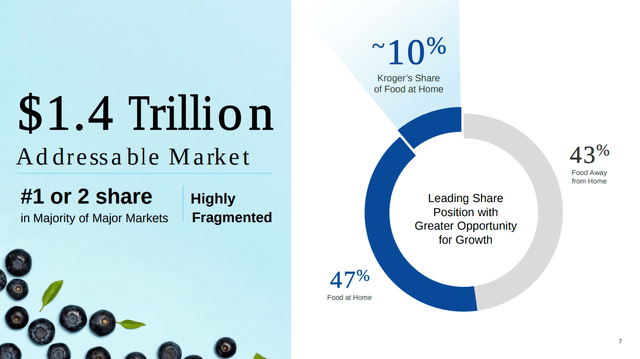

As one of the largest grocery stores, Kroger benefits when consumers have more meals at home and fewer at restaurants. The company has been able to increase sales in good times as well as during recessions.

In the US about 57% of food is consumed at home, and ~43% away from home. Kroger estimates its share of food at home at ~10%. It therefore tends to benefits when people eat more food at home, as they tend to do during recessions.

There is another reason why Kroger tends to benefit during recessions, and that is that consumers are more likely to chose private labels over name brands, to reduce costs. Kroger is well positioned with about a quarter of its sales coming from its own private label brands, such as Kroger, simple truth and HOME CHEF.

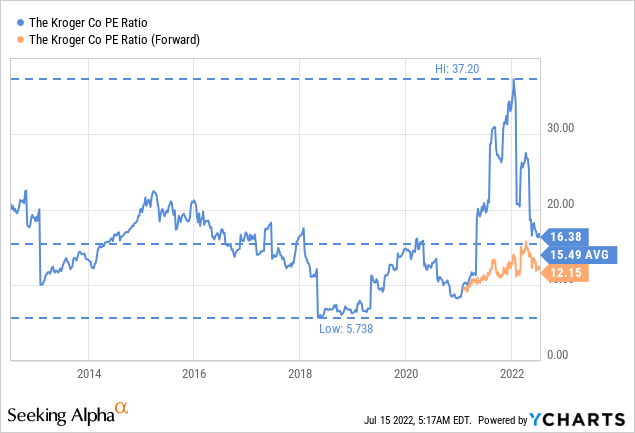

Kroger believes that it can deliver returns of between 8%-11% to its shareholders, with 3%-5% coming from net earnings growth, and 5%-6% from share repurchases and dividends. Shares are trading close to their ten-year average price/earnings ratio of ~15x, with analyst estimating significant growth next year, putting the forward p/e at only ~12x.

4. Hormel Foods

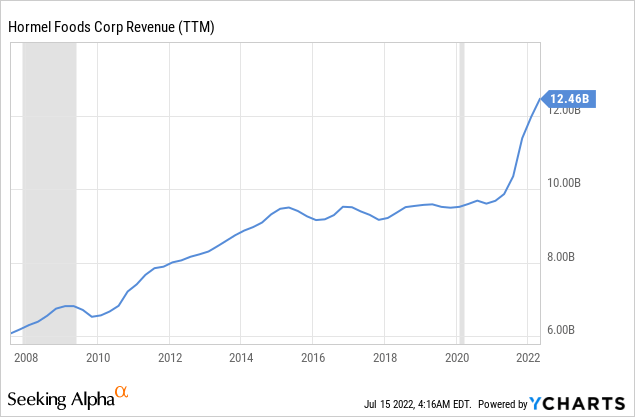

The last company we are highlighting is Hormel Foods, which not only has shown to be able to grow sales during a recession, but has increased its dividend for an impressive 56 consecutive years, including the 2022 declared increase.

The company is another beneficiary of more eating at home, and it has some very well-known brands such as Skippy and SPAM, among others.

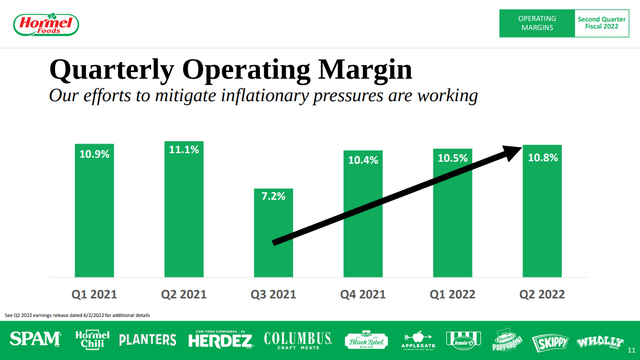

With Hormel we are particularly impressed by its ability to maintain its operating margin by passing increased costs to consumers, as its brands have responded well to pricing actions.

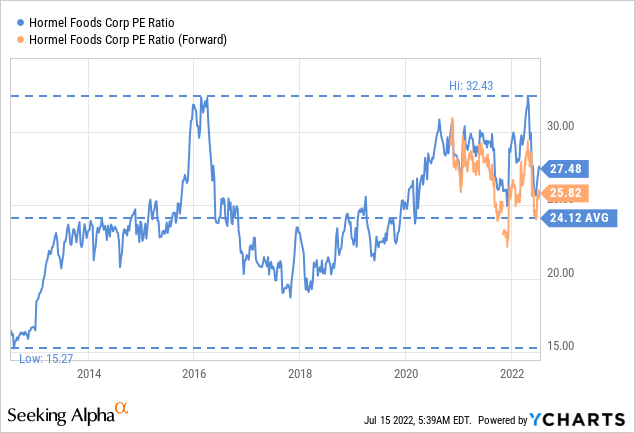

Hormel has reaffirmed full-year sales guidance and narrowed full-year diluted EPS guidance range. Shares look a little expensive with a price/earnings ratio in the high 20’s, and above the ten-year average. Still, given the dividend track record and recession resistant properties of the business, they are worth consideration.

Conclusion

As difficult as the first half of 2022 has been for most businesses, there are a few that have managed to deliver positive returns to their shareholders. We highlighted four of them in this article, that tend to be recession resistant, and have powerful brands that allow them to pass increased costs to customers. They are not particularly cheap, but some of them still appear reasonably valued, and given the current environment we believe the four of them are worthy of consideration by investors. These are companies that we believe will continue to outperform the market should we enter a recession soon.

Be the first to comment