Smederevac/iStock via Getty Images

The Thesis

Rio Tinto’s been falling of late, with some negative headlines hitting the news:

China’s been building like crazy for a couple of decades now, and it’s had a big effect on the price of iron, as we’ll see later. So is this the time to get out of Rio Tinto? We think the answer is no. At a normalized PE of 12, the cyclicality of earnings is already priced in. In the decade ahead, we estimate returns of 13% per annum.

Takeaways From The 2021 Investor Seminar

Rio Tinto’s management is focused on the green energy revolution. The company is positioning itself to capitalize on the metals of the future, with a fairly long-term view. Management discussed how metals like copper and lithium will power the world’s economy and transportation in the future; while old school metals like iron will be used in wind turbines as the world continues its transition away from fossil fuels.

Management is also focusing on “going green” in its own operations, with net-zero goals. Of course, net-zero goals involve additional Capex spending, but its paying off right now with very high oil prices globally. The world is also projected to run out of oil by 2052.

A Bet On Iron

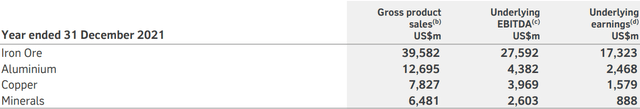

Rio Tinto makes most of its money from the mining of iron ore, which accounted for about 78% of its earnings in 2021:

Rio Tinto’s Earnings Breakdown (2021 Annual Report)

Iron is a good old-fashioned metal. On iron ore, Rio Tinto’s advised:

“We are one of the world’s leading producers of iron ore, the primary raw material in steelmaking. In the Pilbara region of Western Australia (WA), we operate a network of 17 iron ore mines, four port terminals, and a rail network spanning nearly 2,000 kilometres. Steel remains essential for ongoing urbanization and will support the global shift to decarbonize.”

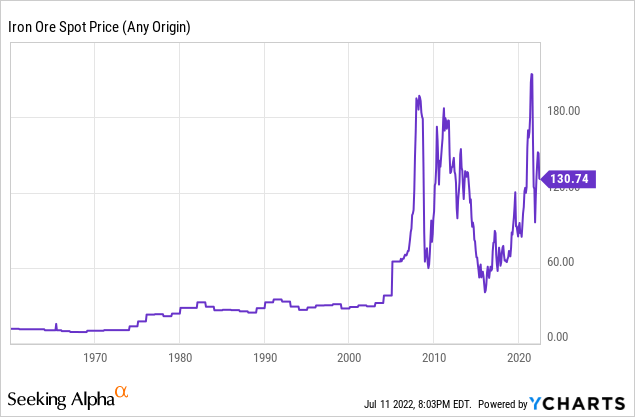

Rio Tinto’s proven it can be profitable in adverse price conditions. Over the past decade, the price of iron has been extremely volatile:

Over the very long-term, the price of iron has grown around 4% per annum, basically in-line with inflation.

| Iron | Copper | Aluminum | |

| Annualized Price Growth Since 1960 | 4.2% | 4.5% | 2.8% |

Rio Tinto will grow along-side inflation, but the company can improve returns by improving operational efficiency, making prudent acquisitions, and buying-back shares.

Normalized Earnings

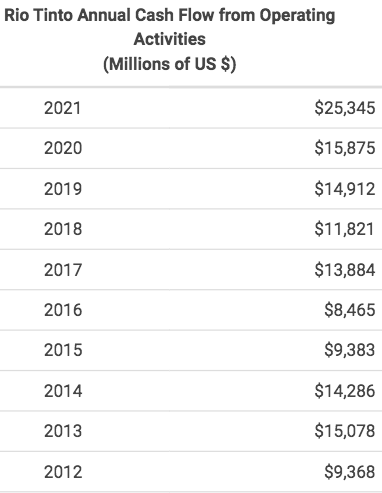

(Rio’s Cash From Operating Activities (Macrotrends))

Rio’s a cyclical commodity business. When commodity prices are high, Rio rakes in the profits. But when commodity prices are low, Rio breaks even. Notice we didn’t say, “Rio loses money.” The company appears to enjoy industry leading break-even prices on its mining operations.

Rio’s averaged $13.8 billion of operating cash flow and $7.3 billion of capital expenditures over the past decade. That’s $6.5 billion of free cash flow. With $7.2 billion of average net income over that time, Rio Tinto has a CAPE ratio of 13, an 8% earnings yield. Not bad.

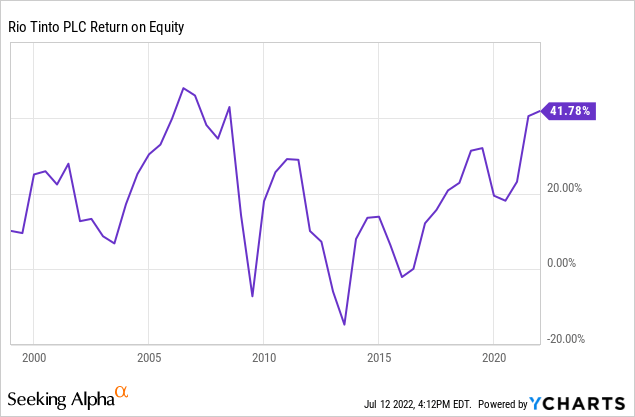

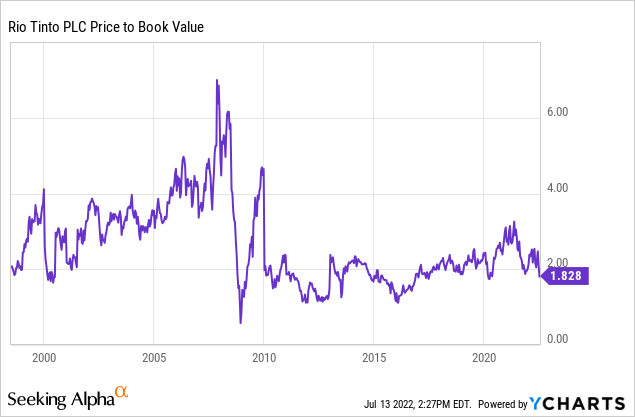

Another way to smooth out Rio’s earnings is to take a look at its historical return on equity.

The company’s averaged around 20% returns on equity over time, very impressive. If we apply a 20% ROE to the company’s 2021 common equity ($51.4 billion), we get $10.3 billion.

Rio Tinto is guiding towards $9 billion of capital expenditures in 2023, and says that $3 billion will go towards growth Capex. That’s $6 billion of maintenance Capex.

All things considered, we think Rio’s normalized earnings are around $8 billion ($4.94 per share). Keep in mind, this is just an estimate.

Rio Tinto’s Still Cheap

| Rio Tinto (NYSE:RIO) | BHP (BHP) | Vale SA (VALE) | |

| Forward P/E | 5.2 | 7.2 | 3.4 |

| P/B | 1.8 | 3.6 | 1.7 |

| FCF Yield | 19% | 13% | 24% |

Against its peers, Rio Tinto has an attractive valuation. Of course, Vale offers a Brazilian discount, but that comes with other issues. Rio Tinto is an Anglo-Australian business.

The Dividend Yield

As profits soar, Rio’s been paying out enormous dividends. We like this strategy. The company’s balance sheet is already strong, and it makes more sense to buyback shares at the bottom of the cycle. Going forward, dividends will decrease. Rio Tinto reports:

“The board expects total cash returns to shareholders over the longer term to be in a range of 40 to 60 percent of underlying earnings.“

This pay-out ratio seems quite conservative, but if Rio follows through with a 50% pay-out ratio, on normalized earnings, it would represent a dividend yield of 4.2%. This would leave the company with ample cash for acquisitions and buy-backs.

A Market Beating Return

Our 2032 price target for Rio Tinto is $130 per share, implying a return of 13% per annum with dividends reinvested.

- Combining the effects of inflation, buy-backs, and acquisitions, we think Rio Tinto can grow its normalized earnings ($4.94 per share) at 6.5% per annum, resulting in 2032 earnings per share of $9.30. We’ve applied a terminal multiple of 14.

- If Rio pays a higher dividend yield, you could get less growth, but your total return should be about the same.

Risks To Consider

As we mentioned in the intro, China’s been buying an abnormal amount of iron over the past two decades. This could fall off in the years to come. Despite this, we think areas like India, Africa, and South America will spend more on infrastructure over time.

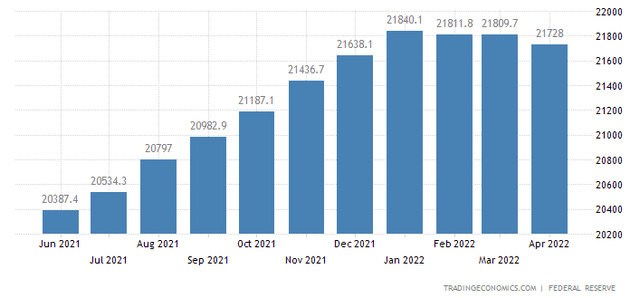

Quantitative tightening is a short-term risk for commodities like iron, copper, and aluminum. After a steep run-up, the M2 money supply is declining for the first time since 2018:

U.S. M2 Money Supply (Trading Economics)

Then, of course, you have commodity price swings, which can lead to dividend cuts and volatile earnings. Investors must be prepared for volatility, but this can also be an opportunity to double down. Management will need to keep the balance sheet strong to weather inevitable downturns.

Conclusion

Don’t get too cute with timing the commodity cycle. If Rio falls further, you can always double your position. Rio’s CAPE ratio and historical returns on equity show the company is still cheap; it trades at 12x our estimate of normalized earnings. China could consume less iron in the future, but the likes of India, Africa, and South America should make up for that. Rio’s management appears to be focused on the long-term, positioning Rio to capitalize on the energy transition. Rio Tinto benefits from inflation over time. With 13% prospective returns, we have a “strong buy” rating on the shares.

Be the first to comment