bjdlzx

(Note: This article appeared in the newsletter on August 5, 2022, and has been updated as needed.)

Ring Energy (NYSE:REI) like so many others in the industry had a blockbuster conference call and earnings quarter. Like so many others in the industry, those results were largely ignored. That left the stock at a bargain price level.

The reason for this lackluster stock price action is the debt levels. The market is extremely impatient with the pace of debt repayments, no matter how profitable the company is in the current environment. There is a focus on profitability at considerably lower prices that are unlikely to “go away” anytime soon.

Stronghold Acquisition

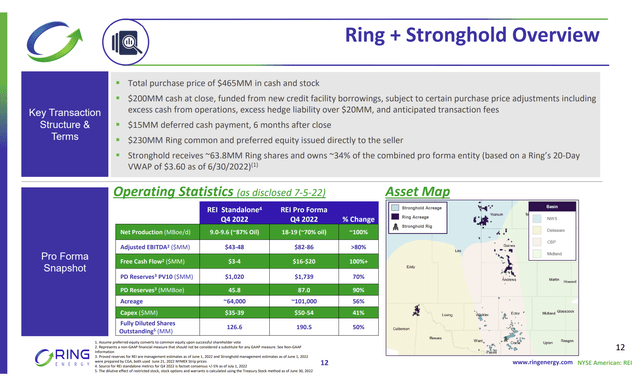

In order to get back to some great operations and growth without all this misplaced concern about debt levels, management has made an accretive acquisition that brings down debt and also places two Putnam representatives on the board.

Ring Energy Stronghold Acquisition Summary (Ring Energy August 2022, Investor Presentation)

The debt levels may approach $500 million (but will not get there, probably). But it is easy to see that the originally forecast debt ratio of 1.5 post-acquisition will likely happen short of another oil price crash. Even then, management is busy hedging with some decent hedges “just in case”.

Along with this acquisition comes a brand-new bank loan that is far more comfortable and allows dividend payments. Meanwhile, the sale of some non-core leases is now far less important because the debt ratio will be lower. Given the current debt fixation of Mr. Stock Market and Mr. Debt Market, this is a very reasonable way forward, despite the fact that the wells drilled are profitable enough to enable the company to dig its way out of debt.

The reasons for this market (and debt) concern would be the years 2008, 2015, and 2020. That is simply too many economic “disasters” (in the eyes of the debt market as well as the stock market) to allow for time to dig out of debt holes by drilling profitable wells. Obviously, the solution had to be “yesterday” and not a moment later.

So now “yesterday” came. Despite more shares issued, this is considered accretive and the combined company should do better than the parts. Far more importantly, Putnam should be able to add value in a number of ways now that it has representations on the board. Ranger Oil (ROCC) used a similar strategy that brought experience to the board and is now doing far better than it was before the deal.

Second Quarter Results

Now, after all of that, the market can finally turn its attention to what should have mattered in the first place.

Had the fiscal year 2020 not happened, then Ring Energy was going to drill wells until production attained an amount that allowed for positive cash flow to comfortably pay off the debt. This was a “tried and true” strategy used by a lot of low debt and no debt companies to convert to operations from the initial lease acquisition or startup stage.

The fiscal year 2020 changed all of that to put the emphasis on operational results no matter the situation combined with the ability of those operations to service debts. That put a lot of pressure on companies like this one.

The fact that EBITDA doubled in the current quarter was met with a collective yawn by the market along with another fact that these wells break even at a received oil price in the $20’s area. Wells like that have a real fast payback in the current environment so that two or even three can be drilled with the same money in one fiscal year. Had the lending market allowed the company to return to the original strategy, things would have been “righted” in short-order. This is a conventional business with long-lived wells. So, it is an exceptionally profitable opportunity with or without the acquisition.

But as the saying goes, “here we go again” with the hope that there are no more years like some in the past. Management does have 1 rig operating and may not need another until the acquisition has been fully reviewed after closing. Any acquisition tends to come with deferred maintenance that needs to be dealt with first before there is any discussion about drilling new wells (and growing production).

The debt repayments have accelerated to $10 million a month in the current fiscal year. In times, past that would have been more than sufficient. The acquisition should allow at least $20 million a quarter (for debt payments) as long as the current robust pricing environment holds up. There is also a process to sell some non-core acreage that would accelerate debt repayment. In the current environment, that process should succeed this time.

Risks

There is a deferred payment that I am including for conservative purposes as part of long-term debt in this discussion.

There is a risk for common shareholders that at some point Putnam will “want out”. If that happens, then there are a lot of shares that would hit the market. But usually, a situation like the current one with two board members is a long-term affair. But that cannot be guaranteed.

Lastly, the current war in Ukraine does make for an unpredictable future. It still looks like demand will exceed supplies for a while. But politics can change things overnight in this very low visibility industry.

The Future

This company has a good, if not somewhat speculative, future compared to many in the industry. The wells are unusually profitable, even compared to the best offshore projects (which usually have low breakeven points to justify the huge upfront costs).

Despite all the new shares issued to overcome the challenges of the last few years, the recovery potential of REI stock remains excellent. What has changed is the “strategy to get there”. The fact that these acquisitions are still happening means that a lot of professionals still believe that the industry overall remains undervalued. Those professionals are using considerably lower prices for the long-term than is the case right now (though assumptions do vary).

As long as the professionals are buying, then it is probably reasonably safe for investors to continue to consider investments in the industry. The thing to watch for is when people that have successfully begun and built companies before now actually begin to sell the company they are currently running. Clearly, that is not the case right now.

While traders may want a price goal to get out, long term buy and hold investors are far better served by waiting for insiders to sell their companies in significant numbers and reviewing the value obtained at that time. Having a price goal to sell when insiders are buying, as is the case now, is an excellent way to miss out on significant long-term gains. That is especially true with cyclical companies (even volatile ones like this one).

Be the first to comment