Mikolette/E+ via Getty Images

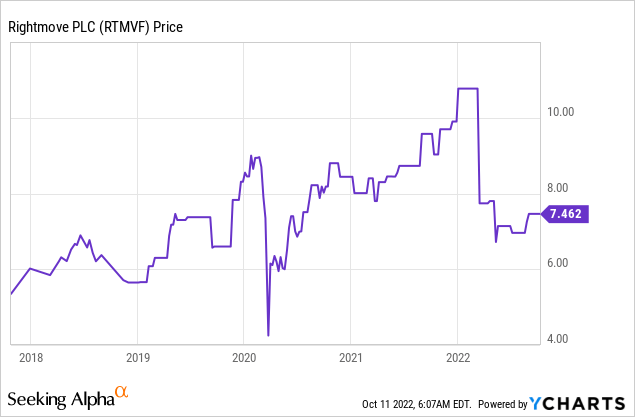

House prices in the UK are forecasted to fall by at least 10% in 2023. This is forecasted to be driven by the high inflation and rising interest rate environment which have impacted the affordability of houses in the UK. The average mortgage rate was approximately 1.6% in 2018, and this has risen to over 6% by October 2022. To put things into perspective an average mortgage with the Halifax bank had a monthly repayment rate of ~£360 in 2018, but by 2022 this had shot up to over £600/month. This affordability crisis and pending recession are forecasted to decimate the housing market. Therefore it is not a surprise to see that the market consensus right now is to not invest in property stocks due to the high mortgage rates and slowing down of buyer transactions. For example, Rightmove (LSE:RMV)(OTCPK:RTMVF) which is the largest online property portal in the UK has seen its stock price get butchered by over 40% from its all-time high in December 2021. Despite these issues, I believe the housing market is extremely robust in the UK due to the supply/demand situation and it will rebound, as it has done cyclically in the past. Therefore an investment into a company such as Rightmove is a solid contrarian play, which I expect to pay off long term.

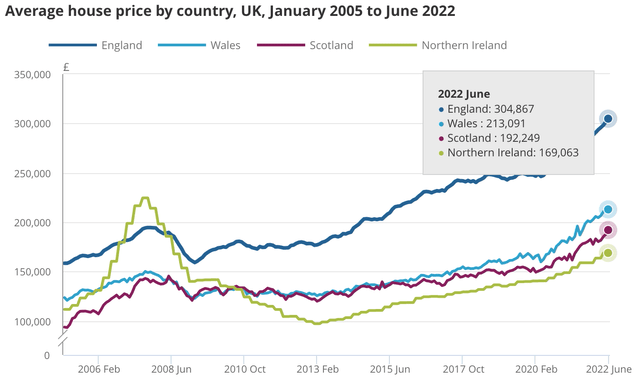

The UK has one of the strongest and most robust housing markets in the world. The average house price in England has risen steadily over the past number of years from ~£158,000 ($175k) in 2005 to ~£305,000 ($340k) by 2022, up 93% over the period.

Average UK House Price (‘ONS’)

The UK is often seen as a safe haven country for real estate investment, especially with investors from China, more volatile parts of Europe, and even Russia, with areas of London being popular with Ogligarch Billionaires. The high demand for UK housing both from internal citizens and external investors, has led to an ongoing housing shortage in the country. The UK government reported 216,000 new housing starts in the year 2020/2021 which fell below its target of 300,000. Thus in this post, I’m going to breakdown the business model, financials, and valuation of Rightmove, as the business is starting to look tasty at these levels, let’s dive in.

Business Model

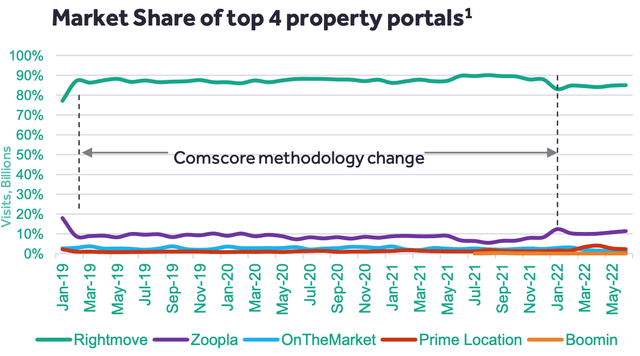

Rightmove dominates the UK housing market with an 84% market share of the UK online property sale/rental industry. Its market share has slid down slightly from 88% in 2021, but this was mainly due to a calculation methodology change by the data provider (Comscore), thus not an issue to worry about.

Rightmove (Market share data )

As you can see from the image below, visitors looking for a property to rent or buy, search through the vast collection of properties before reaching out to an agent. The website generates over 112 million visits per month with the average visitor viewing 18 pages of content, as they hunt for property. A staggering 1.5 billion hours per month were spent on the platform in first half of 2022. This was down 11% from the 1.7 billion hours, but still up a substantial 36% from the 1.1 billion hours generated in 2019. The pandemic highlighted the importance of a good home, as often it is not just a place to live but also work for many people.

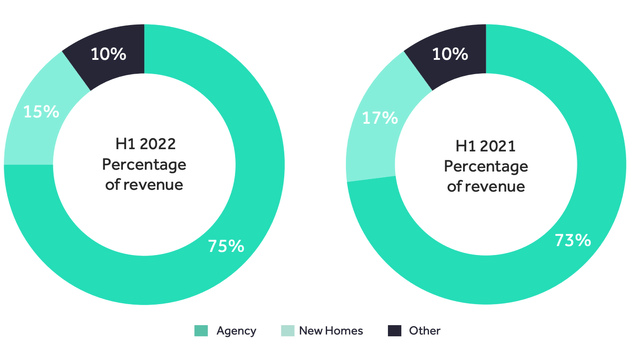

The company makes its money by charging estate agents or realtors a listing fee to list properties on the platform. 75% of the platform’s revenue comes from these agents while 15% comes from new home sales.

Revenue Split (Investor Presentation 2022)

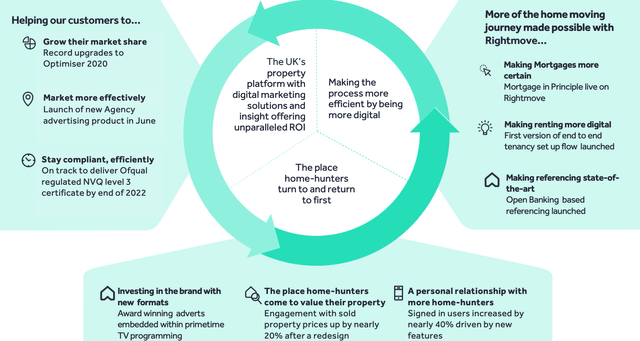

In my previous post on Rightmove, I highlighted the fact that the company has plenty of opportunities to innovate and capture a greater share of the real estate market. For example, Zillow in the US is planning to build out its Zillow 2.0 platform which aims to capture a fee for mortgages, legal work, and much more. I believe Rightmove can learn from Zillow in terms of what to do, but also what not to do such as getting into the house flipping business. It looks as though Rightmove’s management has now seen the light (maybe they read my post) and is now starting to innovate again. In 2022, the company launched its first digital platform for end-to-end tenancies. This basically enables a customer to view a property and then book it to rent directly through a mobile device. The company is also offering a “mortgage in principle” live in Rightmove which reduces friction in the process. Although this is a great start, I would like to see the business move a lot faster learning from businesses such as Zillow.

Rightmove (Investor presentation)

Growing Financials

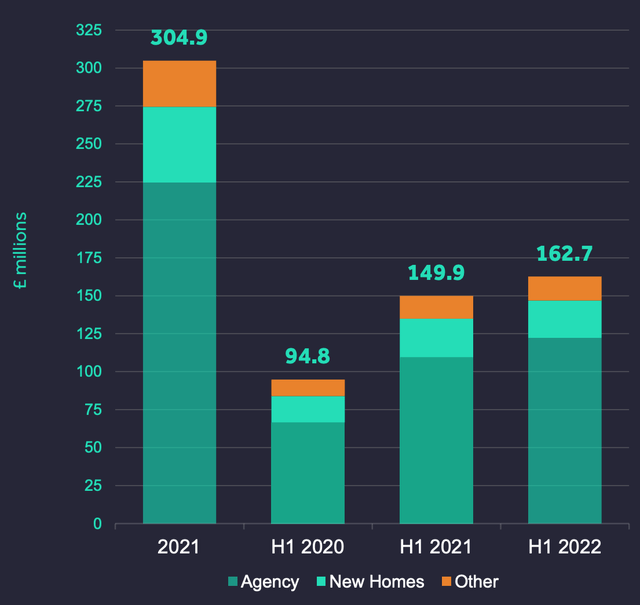

Rightmove generated revenue of £162.7 million ($185m) in the first half of 2022, which popped by 9% year over year.

Revenue (H1,22 Earning report)

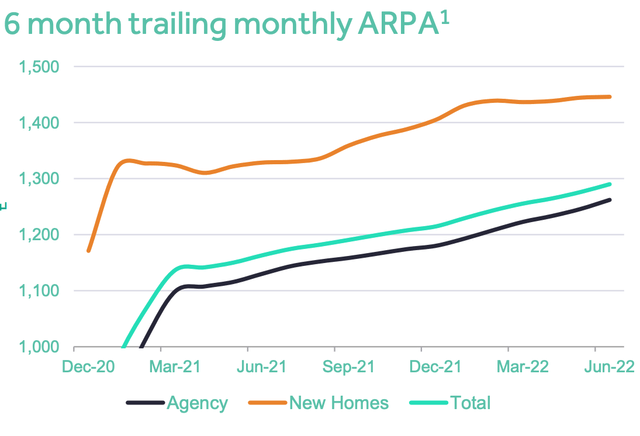

Its Revenue growth was driven by strong Average Revenue per Agent (ARPA) growth of 11% to £1,290. This was further driven by strong product adoption and new package upgrades to the Optimiser 2020 product.

ARPA (H1,22 Earnings Report)

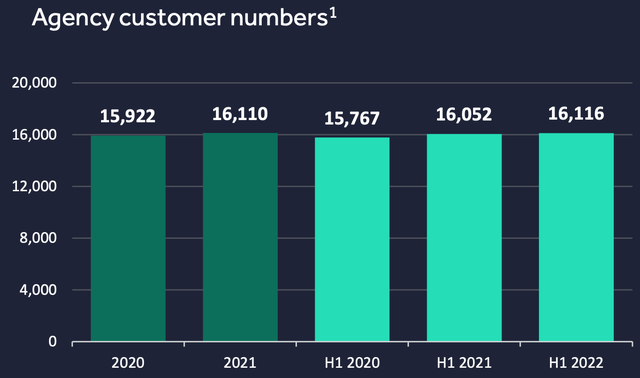

Rightmove had 16,116 Agency customers as of the first half of 2022. This was up slightly from the 16,052 agents in the prior year. Previously there was talk of an agent backlash due to rising costs, but Rightmove has a solid 95% agency retention rate so I don’t deem this to be a major issue.

Agency Customers (H1,22 Investor Presentation)

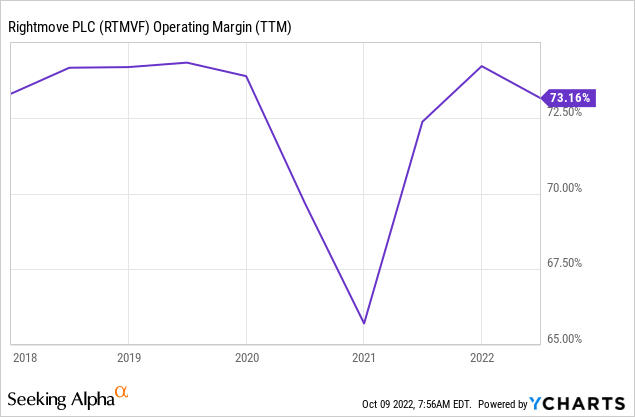

As a software company, Rightmove has an extremely high operating margin of ~73%, which is astonishing given the average operating margin for the software industry is 23%. The company generated solid operating profit of £121.3 million in the first half of 2022, up 6% year over year. Basic earnings per share was 11.7p which increased by 8% year over year.

These earnings are fantastic given the company increased its costs for product development, sales, marketing, and even recruitment in the first half of 2022.

Rightmove generated solid cash from operating activities of £122.1m in the first half of 2022, up from £121.5 in the prior year. As a comparison, Zillow has taken an aggressive approach to growth, investment and are happy to run unprofitably. Whereas, Rightmove has taken a conservative approach to revenue growth and focused more on profitability and dividends. For instance, Rightmove has a dividend yield of 1.73%, which has increased from 3.0p to 3.3p per share, year over year.

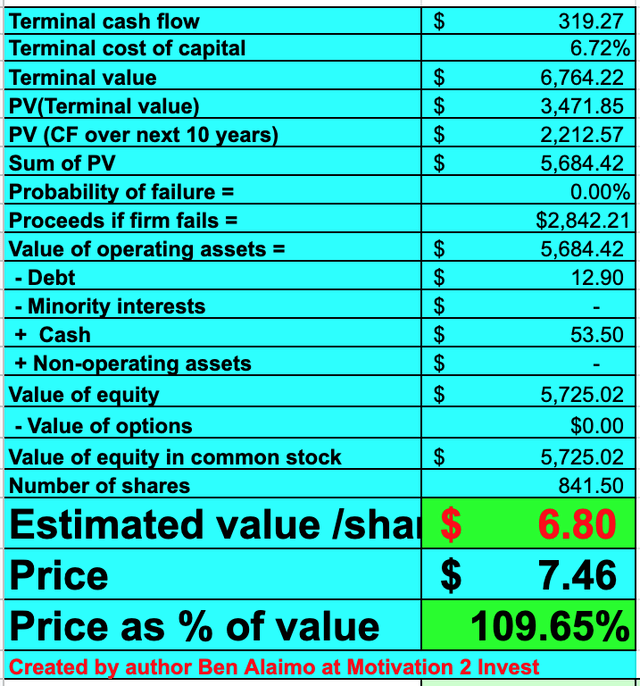

The company has a solid cash position to weather any storm with £43.9 million ($53.5m) in cash and cash equivalents on its balance sheet. In addition, the business has just £12.9 million in total debt which is easily manageable.

Advanced Valuation

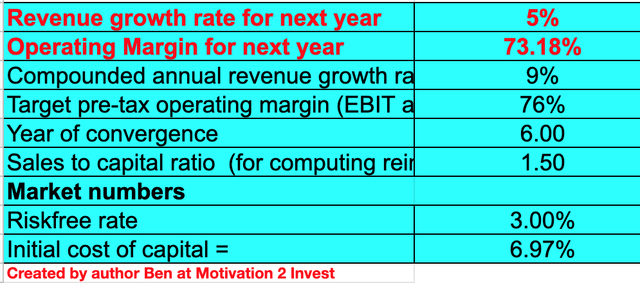

In order to value Rightmove I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a 5% revenue growth rate for next year and 9% growth rate over the next 2 to 5 years. These growth rates align with conservative analyst estimates, which reflect tepid growth initially before a rebound.

Rightmove stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted the business’s operating margin to increase to a spectacular 76% over the next 6 years. I forecast this to be driven by increased product adoption and a great transaction share captured from the online property market.

Rightmove stock valuation (Created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $6.8 per share, the stock is trading at $7.46 per share at the time of writing and thus is ~10% overvalued. However, if I increase revenue growth rates to 10% per year over the next 2 to 5 years which is slightly more realistic, the stock is “fairly valued”.

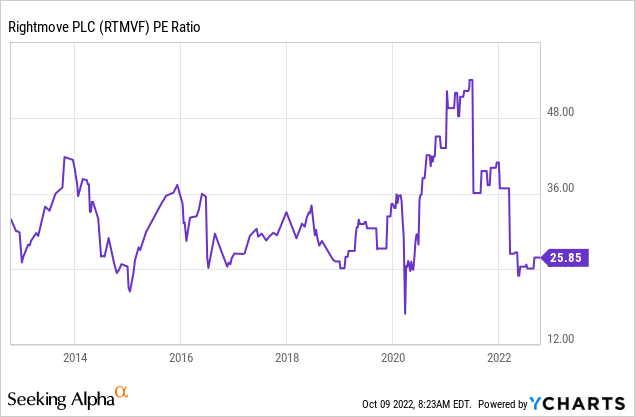

Rightmove trades at a PE ratio = 19.15 which is cheaper than historic levels of over 50 but is still not the cheapest it is has ever traded.

Risks

Recession/Housing Market Volatility

As mentioned in the introduction the high inflation and rising interest rate environment is squeezing the real estate customer. Landlords have higher debt servicing and input costs, while tenants are fighting back at rent rises due to cost of living issues. Therefore it is likely we are entering a cyclical downturn in the property market. I believe tenants will be less likely to move and property buyers will be more hesitant. Thus as property transactions slowdown, agent revenue and thus Rightmove’s revenue will also be hit.

Final Thoughts

Rightmove dominates the UK housing market and the company is poised to continue to benefit from the solid real estate market which is currently going through a cyclical decline. I believe these macroeconomic headwinds are only temporary and thus I forecast a rebound in the future. Great companies with high profitability and a dominant market share are rarely cheap. Therefore the fact the stock is close to fairly valued, given the bleak outlook is no surprise. Thus I believe it makes sense to dollar cost average into the stock, but do expect further declines over the next 3 to 6 months, before the long-term secular up trend resumes.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment