pixelfit

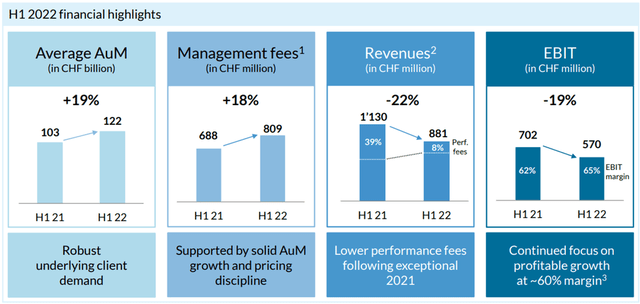

Partners Group (OTCPK:PGPHF), a leading European private capital manager, recently surpassed expectations with an H1 2022 revenue-driven beat on higher management fees and assets under management (AUM) growth. In turn, the company generated EBIT of SFr570m at a ~65% headline operating margin (underlying was closer to the low 60s %), helped by lower operating costs for the quarter.

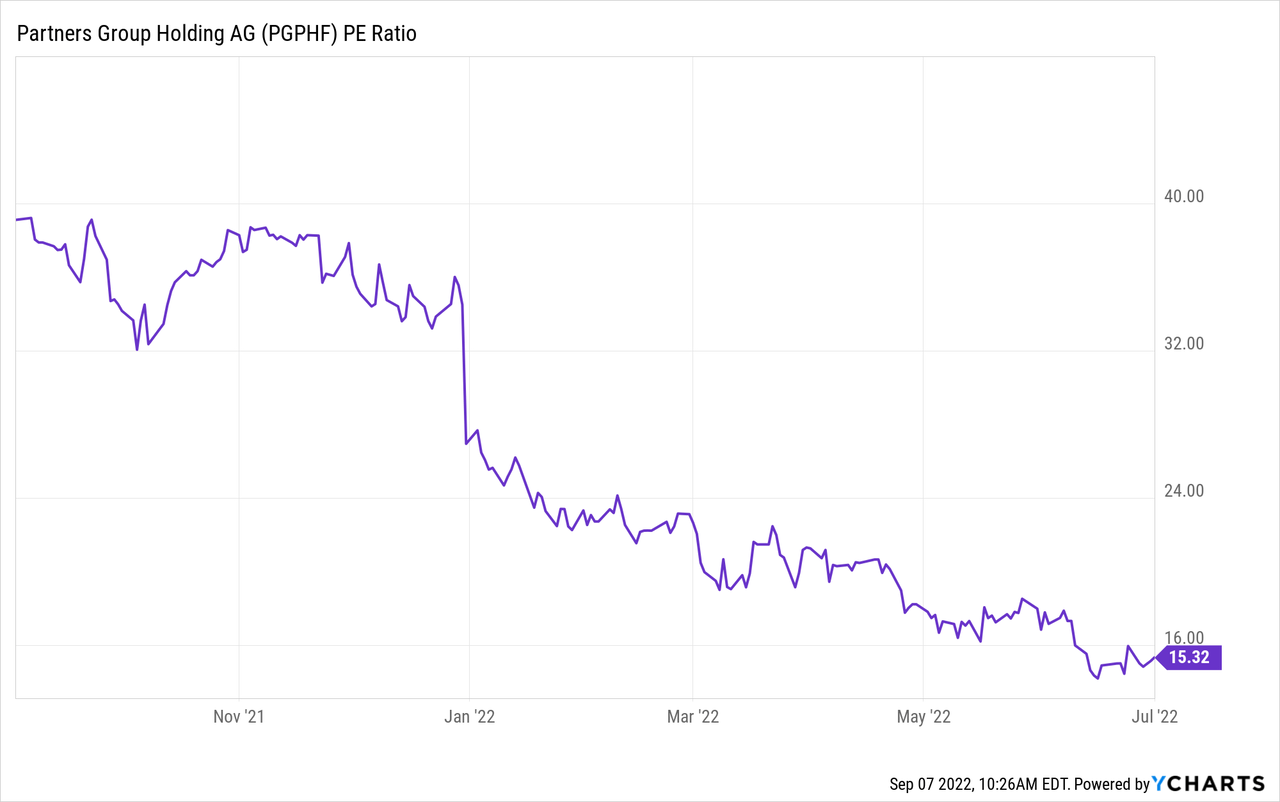

Clearly, there are near-term risks to the Partners Group investment case, given its outsized private equity exposure and a higher rate backdrop. Yet, I would contend that this is one of the structurally best-positioned names to benefit from the secular shift toward alternatives – not only does the company have a fully built-out global distribution, but its high-quality management fee stream (built on closed-end funds with long-dated lock-ups and long-term mandates) adds defensiveness through the cycles. Coupled with its differentiated focus on bespoke client solutions and best-in-class margin profile, the recent Partners Group sell-off to a ~15x P/E seems unwarranted.

H1 2022 Highlights Resilience Through the Challenging Market

Revenues of SFr881m for the first half of the year were down 22% YoY but still above consensus expectations on higher management fees. This was partly due to late management fees, though, stemming from its direct private infrastructure flagship fund (closed in February). Performance fees of SFr72m, or ~8% of total revenues, were largely in line with the 5-10% guidance range. On a YoY basis, performance fees declined due to the postponed realization of select mature assets in H1 2022 (a result of the current market uncertainty), but with the management fee margin holding firm at 1.38% (up from 1.33% in H1 2021), this was a decent result.

For context, returns across Partners’ asset classes have been negative (but broadly in-line with company estimates). Private equity was reported as down 6.7% during the latest quarter (missing prior guidance of low-mid single digits), as lower valuation multiples offset EBITDA growth across the portfolio. Private debt held up well at -0.5% (in-line with guidance), while private infrastructure and private real estate were down -1.8% and -0.1%, largely in line with the prior guide for flattish returns. On the flip side, the low base from the negative Q2 2022 returns could be a boon for QoQ/YoY comps going forward, with an H2 2022 recovery looking more likely, in my view.

Where Partners really shines is on margins – the H1 2022 operating margin of 64.7% was well above consensus, as higher management fees and lower operating expenses boosted the result. A word of caution, though, as the ~65% EBIT margin did benefit from ~SFr50m of late management fees and ~SFr15m of provision release (related to the impact on equity incentive plans from the lower stock price). Excluding these non-recurring gains, pro-forma margins would have been closer to ~61% – still a very decent result, all things considered.

The reiterated margin guidance for a ~60% marginal EBIT margin on new business was also positive, particularly in light of the current market outlook and FX volatility. The 60% level could prove conservative, though, as management seems keen on embedding some buffer to absorb any EBIT margin volatility. Plus, the elevated tax rate of 15.5% in H1 2022 (due to dividend repatriation) should normalize lower in H2 2022, providing an additional earnings tailwind.

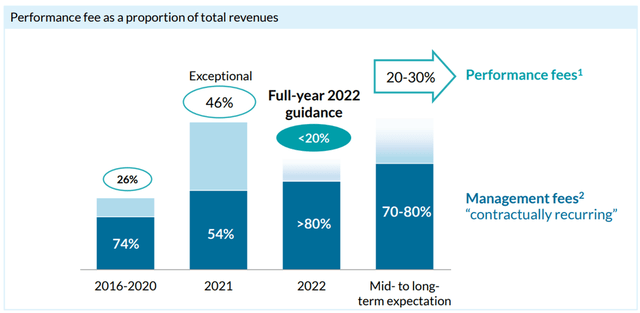

Performance Fee Outlook Intact Despite the Market Headwinds

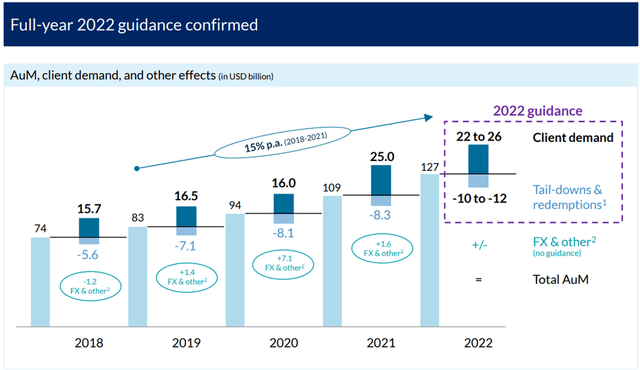

Partners Group remains confident in its fundraising outlook – management reiterated its full-year 2022 gross client demand guidance of $22-26bn for 2022, with $13bn already achieved through H1 2022. Meanwhile, performance fees are set to be <20% of total revenues for the year (albeit subject to uncertainties). Despite the challenging market backdrop, there remains ample upside to guidance, in my view, given that currently signed exits for the second half of 2022 already make up ~12% of the performance fee contribution. That said, any postponements of already signed deals could still weigh on the performance fee result, so getting to the upper end of the guidance range likely requires more exits to be signed and completed in the coming months.

Meanwhile, the intact mid-to-long term performance fee guidance of 20-30% of total revenue emphasizes management’s confidence in the underlying momentum. To achieve this, Partners will continue to hire its targeted ~1.8k full-time employees by year-end to build out capabilities to facilitate this growth. Given the company’s highly diversified client base and differentiated custom solutions focused offering (bespoke mandates and evergreen products) as well, it makes sense that Partners has been less impacted than peers with more traditional offerings (e.g., flagship funds). All in all, I see limited hurdles to reaching the guided $22-26bn of new commitments this year. Furthermore, with its AuM update also pointing to an outcome at the upper end of the guidance range (assuming unchanged market conditions), I feel comfortable underwriting another beat-and-raise quarter ahead.

Well-Positioned to Capitalize on Secular Growth Tailwinds

Another key positive from the H1 2022 results was the company’s commitment to a base case return target in the high-teens to 20%; even in bear case scenarios, management sees an at least break-even or single-digit return outcome as within reach. Assuming management executes according to plan, I see a clear path to rising allocations ahead. While such ambitious targets raise the bar for execution as well, I would point out that Partners’ returns tend to be less dependent on the macro and market conditions. Plus, the company has a historical track record of disciplined allocation and aligned incentives (achieving 5-15% AuM growth is one component of management’s long-term incentive plan), so I feel comfortable underwriting an ~10% mid-term growth outlook.

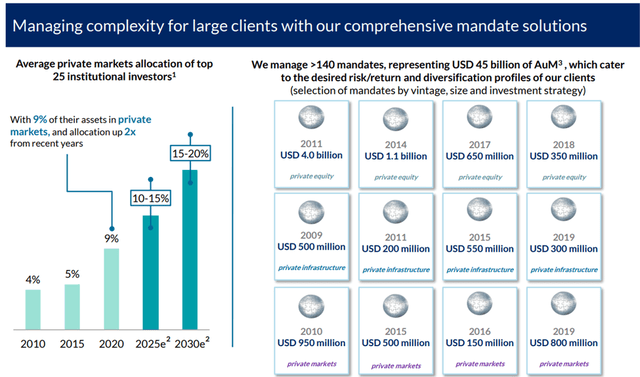

Thinking long term, Partners’ competitive offerings make it particularly well positioned within the asset management space to benefit from strong secular growth within private markets (institutional investor allocations are already up 2x over the last decade and are projected to double in the next decade). Of note, its diversification and customizable offering are key differentiators, with private client demand on the rise and institutional clients also looking for increasingly sophisticated solutions. In tandem, its mid-market focus across themes, the breadth of its global coverage, as well as its emphasis on value-add should support deal origination through the cycles. Finally, the secondary business will be one to watch – while market expectations are low having ceded market share previously, the re-allocation of resources here implies Partners expects to hold share going forward.

Riding Out the Market Downturn with Partners Group

Following a resilient first half, Partners Group has maintained its full-year gross client demand guidance of $22-26bn, having already achieved $13bn (a record half-year performance for Partners). To be clear, there are headwinds ahead – for one, tightening market conditions present a challenging fundraising outlook for the industry. Yet, Partners’ unique focus on bespoke client solutions is a key asset amid the uncertainty, allowing for a faster turnaround relative to single-fund capital raises. In addition, its exposure to smaller funds and financial institutions less impeded by market fluctuations should help fundraising prospects near-term.

Net, I view Partners Group as a best-in-class alternative manager positioned to expand alongside the secular growth in private markets. Coupled with its defensiveness from a diversified client base and resilient margins, the current valuation in the mid-teens P/E (approaching pandemic troughs) strikes me as an attractive entry point.

Be the first to comment