simoncarter/E+ via Getty Images

“Most of the time, the end of the world does not happen. “

— Howard Marks, Co-Founder of Oaktree Capital Management

|

Portfolio Returns1 |

Q1 2021 |

FY 2021 |

FY2020 |

FY2019 |

|

RCG Long Only |

(-8.4%) |

2.5% |

40.3% |

28.7% |

|

RCG Long Short |

(-7.9%) |

(-14.3%) |

10.0% |

8.1% |

|

RCG Top 10 |

(-6.9%) |

18.6% |

16.4% |

37.6% |

|

Benchmark Returns |

||||

|

Russell 2000 Index |

(-7.5%) |

14.9% |

20.0% |

25.5% |

|

Equity Long/Short Index2 |

(-1.2%) |

10.7% |

9.4% |

6.9% |

|

S&P 500 (large cap) |

(-5.0%) |

28.7% |

18.4% |

31.5% |

Dear Partner,

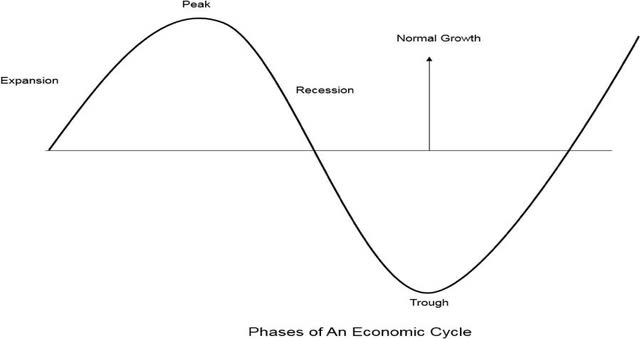

As we close the first quarter of 2022, all signs point to our economy moving into a new stage of the business cycle. We are past the peak and rolling into the earliest stages of contraction. After laying the groundwork for months, the Federal Reserve Bank officially began raising interest rates earlier this year. Their goal is to dampen inflation which has now increased to alarming levels and is affecting businesses and families across the socioeconomic spectrum. The Fed has most likely taken too long to act, and they are removing stimulus that was too excessive and lasted for too long. While the Fed’s quick action likely saved our economy from the worst possible outcomes during the pandemic, we are now surrounded by inflation that is having real world impact.

Consumers face double digit price increases on groceries, gas, electricity, and rent. This will likely continue as global supply chain challenges promise more shortages and higher prices well into the second half of the year. Housing markets are heated, and an entirely new market distraction entered the chat with Russia’s invasion of Ukraine. Wars are generally the harbinger of… more inflation:

- The military’s demand for goods is piled upon civilian demands causing prices to rise further.

- Sanctions and embargoes disrupt supply chains.

- Governments finance wars by printing more money.

Russia’s invasion will keep inflation higher than it would have been and will directly impact the price of aluminum, oil, wheat, corn, and the entire food economy.

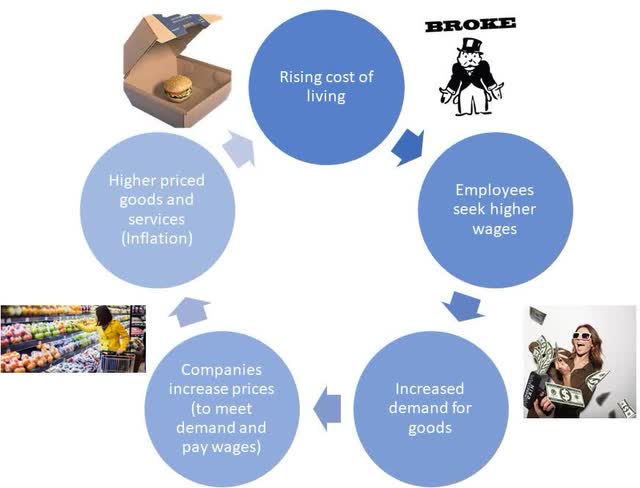

The Federal Reserve was created to provide price stability for the U.S. by improving the flow of money and credit through the economy. Managing inflation is one of the Fed’s primary goals. Given the pervasiveness of inflationary impact, they are already behind, and we may be witnessing the beginning of a wage price spiral. A wage price spiral occurs when consumer prices rise and workers demand pay raises to keep up, or switch jobs to seek better pay. Employers then raise prices on goods and services to match rising costs. Eventually wages and prices become trapped in a circular dance. We last saw this in the 1970s.

Beyond wages and inflation, there are telltale signs indicating that we in the middle of an economic bubble that has yet to be deflated. The excesses are there:

- Meme stock trading is back.

- Americans are quitting their jobs at the highest rate since….2000.

- Job quitters are highly confident they will find a safe landing spot or just content to do contract work that will earn them an easy 6 figure income.

- It’s easier to feel wealthier when you don’t have a monthly student loan payment.

- Worker shortages are abundant.

- Jobless claims are the lowest in 50 years.

- And the Federal Reserve Bank of Dallas is confident that the current housing market is a bubble.

It’s not 1999, but the radio is playing a familiar tune.

The Fed is attempting to address the problem. My concern is that they are too focused on navigating a “soft landing,” the proverbial sweet spot where the Fed raises rates just enough to slow the economy without tipping the economy into a recession.

But what if a recession is “the cure”?

Curing an ailment typically requires treatment. And the treatment isn’t always pleasant. Medicine tastes like… medicine. Surgery involves discomfort, dislocation, and potentially extensive rehabilitation. But if all goes well, our bodies are better off than when we started. The problem with the soft-landing approach is that once inflation grows and begins to impact consumer thinking (consumers expect prices to rise), it can burn out of control and lead to far worse outcomes in the form of hyperinflation seen in Germany, Zimbabwe, and Venezuela. The effects can linger for decades.

The Federal reserve is already behind. If they consistently raise interest rates at a 50bps pace at each successive meeting, the Fed won’t reach their target rate until well into 2023. Instead of trying to slow inflation and potentially missing the mark, the answer may be for the Fed to hold a fire hose against it and stomp it out. And then the Fed can focus on reigniting the economy through various stimulus efforts.

A recession is defined as two or more consecutive quarters of negative economic growth, typically measured using GDP—the value of all goods and services a country produces. When we think of a recession, we typically associate it with falling prices, extremely tight credit, bankruptcies, and high unemployment. But that is not always the case.

Recessions do not happen frequently. Each recession is unique, but they usually have a few traits in common:

- They typically last about a year

- There is a fall in consumption

- International trade drops

- The unemployment rate almost always jumps

If you consider these basic characteristics, a recession sounds uncomfortable but not ominous. And in the case of unemployment, we need a tightening of the job market which has been artificially propped up by government support through unemployment insurance and economic stimulus. A recession may not be that bad. Some economists think we may already be in a recession that started late last year.

Recessions are a normal part of the economic cycle:

Recessions don’t always lead to significant job losses and typically the drop in hiring is much steeper than the number of actual layoffs. Some companies and sectors thrive during recessions. And, on the positive side, companies are forced to become more efficient. Money isn’t free flowing and so companies tighten their belts and find ways to do more with less. They implement technology to reduce costs. During a recession, prices regain their balance through a reverse of the spiral described earlier: employment slows, consumers cut back on spending leading to companies cutting prices to become more competitive. As prices fall, consumers start to spend again. We then start our ascent out of the recession and flowers begin to bloom after the rain. The risks of the current bubble reaching larger proportions and inflation growing out of control could be much more severe than a simple recession.

The downside of proactively providing this medicine is the potential political blowback. No one wants to be responsible for removing the punchbowl and ending the party.

For equity markets, the process described above acts as a cleanser for stocks. (A good thing!) Questionable business models start to get questioned, valuations become more rational, and stock pickers place more focus on cash flows and profits.

Wait, don’t stock pickers always focus on cash flows and profits?

“Your vision gets blurry when it’s raining money.” – Professor Scott Galloway, NYU Stern

Selected portfolio discussion

For the first quarter of 2022, the RCG Long Only strategy declined 8.4% and the RCG Long Short strategy declined 7.9% while their respective benchmarks the Russell 2000 and Equity Long Short Index declined 7.5% and 1.2%.

As we move into this next cycle of the economy, three forces are simultaneously impacting stocks:

- A repricing of assets as inflation rises and the Fed begins a tightening cycle,

- The war in Ukraine and the associated impact on global supply chains, and

- The lingering residual impacts from the pandemic

In the next phase of the cycle, value stocks will receive the most attention. And while there are many definitions of value, from our perspective, the companies/stocks that will differentiate themselves and thrive aren’t just “cheap”. They will have profitable business models with operating leverage and cash generating characteristics. They will be focused on niche markets which they exploit and dominate. They will have astute management teams who are nimble and can adjust to the new rules of the economic cycle. Their management will be forward thinking and prepared for not just today but what is coming around the corner.

With our portfolios, we have taken a bifurcated strategy to position portfolios to perform in the new environment. We have exited a few companies that we are still very positive on. But because they have risen to valuations that the current market is unlikely to bear regardless of their growth prospects, we have moved to the sideline. For others, we consider the valuation to be reasonable and we will remain invested through the cycle. For new additions to portfolios, we will continue to cast a keen eye on the impacts of rising rates and valuation while remaining disciplined in identifying the key characteristics that will allow them to thrive.

Our biggest detractors for the quarter

We had numerous detractors during Q1. There were several including Par Technology (PAR down 21.57%), Adobe (ADBE down 19.7%), MSCI (MSCI down 16.34%), and Amphenol (APH down 13.7%) which all declined with seemingly limited or no news. In Q1, the market rejected almost anything tech or tech related. We view these names as babies getting thrown out with the bath water.

CoreCard (CCRD – down 29.2%)

Shares of the credit card processing software company declined some 20% after the release of a news article indicating that Apple (their largest customer) is looking to bring more financial services capabilities in-house. Anytime a small company relies on a single customer for 30% or more of revenue, it can be of concern. This is especially warranted for a customer such as Apple which has a history of developing technologies in-house to replace outside vendors. What is notable in the report is that it does not mention credit cards, which is the service that CCRD provides. And subsequent versions of the article clarified that Apple uses CCRD as their core processor and that CCRD is likely to remain on board for current products. Finally, we contacted management to get clarification on the situation. I won’t detail the specifics (they did not provide any information that was inappropriate) of the communication. But what gave us confidence that the report was innocuous is that their attitude was not defensive. Their demeanor contrasted from management teams I have observed making best efforts to keep a key client they know is preparing to leave. Finally, we are focused on the future prospects for CCRD as they build a platform to support numerous large customers similar to Apple. CCRD continues to have more inbound interest than they can currently service.

Our biggest contributors for the quarter

Nexstar Media Group (NXST up 24.8%)

The television broadcasting and digital media company surged during the quarter after presenting at an investor conference where management pointed to a strong 2022 for both political advertising and retransmission. They have exposure to more than 80% of markets with competitive mid-term political races. NXST is developing new ad categories such as sports betting and they are focused on expanding digital ad revenue and providing digital solutions to local advertisers. Auto advertising will return in the fall as auto dealerships re-enter the market to sell their replenished inventory.

SolarEdge (SEDG up 14.66%)

SolarEdge has benefitted from a market focus on alternative energy sources. The war in Ukraine and subsequent increase in oil prices have encouraged countries around the world to look to a future less reliant on oil. We recently published a write-up on our investment thesis for the company. You can read it here.

Business Updates

As planned, we made our first hire in Q1. John McHugh joined our team as a Senior Investment Analyst. John has over 30 years of experience as an investor in the capital markets. He brings with him market expertise in the Healthcare space as well as skills identifying and researching unique opportunities among smaller companies. He is a perfect fit for Richie Capital Group, and he hit the ground running. His presence is already allowing us to cover much more ground and go deeper with our investment research. Welcome aboard, John!

We are still interviewing for our Director of Operations position and expect to have an announcement in our next letter.

Despite our performance over the last few quarters, I remain very excited about the companies we have in our portfolio. There are so many that I look at and say, I wish we owned ALL of the company and not just a few shares. These are truly exceptional businesses with outstanding management teams. On occasion, the market can get overly negative (or overly enthusiastic) about a company. Our job is to focus on the underlying value of the business along with its future prospects and not be too distracted by the blinking red and green lights on the screen. Time is on our side.

Thank you for your continued trust with your valuable assets.

Khadir Richie

Principal, Richie Capital Group (Richie Capital Group)

“It is a privilege to manage money for others.”

Footnotes

- All portfolio and index returns mentioned are presented net of expenses and maximum management fees paid by any account within the composite. All performance is estimated pending year-end performance audit. Completed audit numbers available upon request. Numbers are

- Barclay Hedge Equity L/S Index

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment