Bet_Noire

On Wednesday, November 16, 2022, Virginia-based natural gas utility RGC Resources, Inc. (NASDAQ:RGCO) announced its fourth quarter 2022 earnings results. At first glance, these results appeared to be mixed. The company beat the revenue expectations of its analysts and posted year-over-year growth, but it also posted a net loss. This is not exactly unexpected, though, as the fourth quarter is usually the weakest for a natural gas utility. After all, there tends to be limited demand for natural gas heating in the summer, particularly in Virginia.

We do see the stability that we typically expect a company like this to have, though, which is something that is quite nice to see in today’s challenging market. The fact that we are also seeing some growth here is also nice since it is likely that RGC Resources will be able to continue to produce growth over the long term. Overall, the fact that the company reported a net loss during the quarter should not discourage anyone from investing in the company.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from RGC Resources’ fiscal fourth quarter 2022 earnings results:

- RGC Resources reported total revenue of $14.112560 million in the fourth quarter of 2022. This represents a 5.67% increase over the $13.355254 million that the company reported in the prior-year quarter.

- The company reported an operating income of $454,692 in the most recent quarter. This compares rather unfavorably to the $555,163 that the company reported during the year-ago quarter.

- RGC Resources’ Mountain Valley Pipeline project was granted an extra four years to complete construction by the Federal Energy Regulatory Commission.

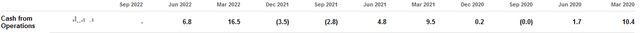

- The company reported an operating cash flow of $6.8 million in the reporting period. This compares quite favorably to the negative $2.8 million that the company reported in the equivalent quarter of last year.

- RGC Resources reported a net loss of $11,415,229 during the fourth quarter of 2022. This compares rather unfavorably to the $481 net income that the company reported in the fourth quarter of 2021.

One of the defining characteristics of natural gas utilities like RGC Resources is that they have relatively stable financial performance over time. We certainly see that reflected in the company’s results to a certain degree. The most obvious indication of that is the fact that the company’s revenues were slightly higher than in the year-ago quarter. This is caused by the fact that the company’s product is generally considered to be a necessity. After all, most people that have natural gas service to their home use it for cooking food or especially space heating. As it is difficult to function without these things, people will normally prioritize paying their utility bills above more discretionary expenses. As the customer base tends to be pretty stable, this makes it quite easy for the company’s management to plan and budget its finances in a way that ensures relative stability.

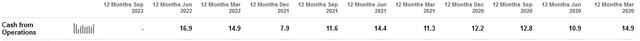

We can see this quite clearly by looking at RGC Resources’ trailing twelve-month operating cash flow over time:

It is important to look at RGC Resources’ trailing twelve-month operating cash flow for a given period as opposed to its quarterly cash flow. This is because the company’s quarterly cash flow shows much greater fluctuation, as we can see here:

The reason for this is that the company is a natural gas utility. As the primary use of utility-supplied natural gas is for space heating, the company’s product will be most heavily consumed during the heating season. This is one of the reasons why RGC Resources uses a fiscal year that runs from October to September. This is because the first two quarters of the company’s accounting year will be its strongest and the last will be the weakest.

The fact that the company reported an enormous net loss during the most recent quarter would seem to run against my statements about general financial stability, however. This may be especially noticeable when we consider that the company reported a net profit, albeit a very small one, in the prior-year quarter. However, once we examine the actual cause of this net loss, we can see that it is not really that big of a deal. This is because the net loss was caused by an $11.3 million impairment charge related to the Mountain Valley Pipeline. In short, this pipeline was originally expected to be active and working during the summer of 2022. That did not happen due to a U.S. Court of Appeals ruling revoking permits required for its construction. That was the result of a case between the company and an environmental group regarding the course of the pipeline.

As the pipeline is not in operation, the company was forced to reevaluate its potential profitability and it determined that the pipeline will not be as profitable as it first assumed. GAAP accounting rules require the company to deduct the loss in value from its earnings as a result of this situation. It is important to note that this was a non-cash charge and it does not actually represent any money leaving the company so we can ignore it when evaluating the company’s financial performance. If we do that, RGC Resources would have reported a net loss of $75,660 during the quarter. This is still worse than the company did last year but it is not nearly as bad as what was actually reported.

Unfortunately, RGC Resources did not actually provide any insight into why its operating income and net income came in worse during the fourth quarter of 2022 than during the year-ago quarter. There were two possible causes, though. The first is that natural gas prices were higher than last year so the company had to pay more money to buy the gas that it needs to have in storage in order to ensure a consistent supply of the compound to its customers during the coming winter months.

In theory, those costs can be passed onto the customers but that is not always possible if it cannot convince regulators to allow a rate hike. In addition to this, customers might decrease their consumption of natural gas in order to save money, which could result in the company essentially buying more natural gas than its customers are actually going to consume. That could certainly be proven to be the case should Virginia end up having a warm winter. There are some signs that this could be the case as current predictions are that Roanoke, Virginia (which is the company’s primary service area) will be somewhat warmer and drier than usual this year. This could have an effect on more than just this quarter as the company may also see lower revenues than normal during at least the first few months of the heating season. That means that there will likely be less money available to cover the company’s expenses and its financial performance may be somewhat worse than we have seen during other winters.

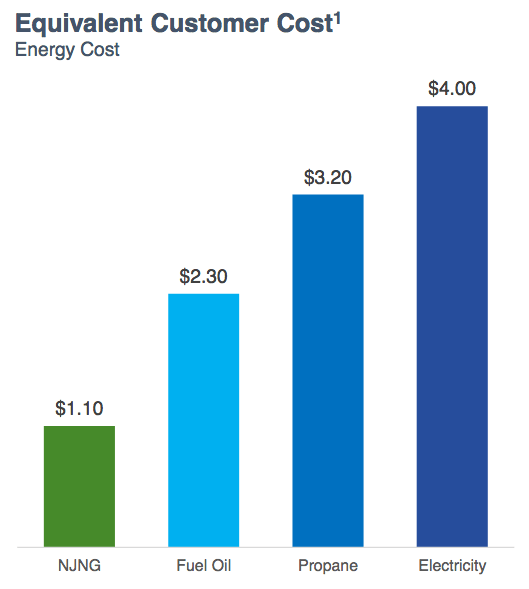

RGC Resources is likely to continue to deliver reasonable results over the long term, though. This is because the need for natural gas utilities is unlikely to go away anytime soon, despite the stated desires of some politicians and activists. We are constantly hearing about the drive to replace natural gas heating with electric heating but this is unlikely to happen in the near future. One of the biggest reasons for this is that natural gas is far more efficient as a source of heat than electricity is so it is much cheaper to use. In fact, the U.S. Energy Information Administration states that it can be four times as expensive to heat a home with electricity as opposed to natural gas:

New Jersey Resources/Data from EIA

This is true despite the huge increase in natural gas prices that we have seen over the past two years. It seems highly unlikely that anyone will be willing to see their heating bills go up to this degree simply to reduce their carbon footprint. As I mentioned in a previous article, consumers realize this and have expressed strong favoritism for a natural gas-heated home over an all-electric one. Thus, we can conclude that RGC Resources will generally prove relatively stable over the long term even if its business is adversely affected by warm weather in a particular year.

Unfortunately, RGC Resources’ leverage has gotten a bit worse compared to the last time that we discussed the company. This is a problem because debt is a riskier way to finance a company than equity. After all, the debt must be repaid at maturity, which is usually accomplished by issuing new debt to repay the existing debt. This can cause a company’s interest expenses to increase following the rollover depending on the conditions in the market. As interest rates have been rising over the past year, we certainly want to bear notice here. In addition to this problem, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flow to decline could push it into financial distress if it has too much debt. Although utilities like RGC Resources tend to have remarkable financial stability, bankruptcies have occurred in the sector so we still want to keep this risk in mind.

One metric that we can use to measure a company’s leverage is its net debt-to-equity ratio. This ratio tells us the degree to which the company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well the company’s equity can cover its debt obligations in the event of bankruptcy or liquidation, which is arguably more important. As of September 30, 2022, RGC Resources had a net debt of $135.7 million compared to $93.1 million of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.46, which is a bit worse than the 1.41 ratio that the company had at the same time last year. Here is how RGC Resources’ leverage compares to its peers:

|

Company |

Net Debt-to-Equity |

|

RGC Resources |

1.46 |

|

New Jersey Resources (NJR) |

1.72 |

|

Northwest Natural Holdings (NWN) |

1.29 |

|

Atmos Energy (ATO) |

0.88 |

|

NiSource Inc. (NI) |

1.44 |

As we can see, RGC Resources is currently more levered than many of its peers, although it is not the most heavily levered company on this list. However, we do still see some signs that the company should probably try and reduce its leverage a bit in order to reduce the overall risks associated with it.

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way of generating a suboptimal return on that asset. In the case of a utility like RGC Resources, one method that we can use to value it is the forward price-to-earnings ratio. This ratio essentially tells us how much money we are paying today for each dollar of earnings the company is expected to generate over the next year.

According to Zacks Investment Research, RGC Resources currently has a forward price-to-earnings ratio of 20.40. This is a bit high for a utility, especially considering that the forward price-to-earnings ratio of the S&P 500 (SPY) is 19.18. This can be seen ever more clearly when we compare RGC Resources against its peers:

|

Company |

Forward P/E Ratio |

|

RGC Resources |

20.40 |

|

New Jersey Resources |

19.84 |

|

Northwest Natural Holdings |

19.38 |

|

Atmos Energy |

19.42 |

|

NiSource Inc. |

18.35 |

We can clearly see that RGC Resources does appear to be a bit expensive here but admittedly not as much as I expected. However, it would still make sense to wait for the stock to come down a bit before buying in. If an investor were to buy in at a better price, they would also receive a higher dividend yield, which is nice.

In conclusion, RGC Resources’ results were not really as bad as they appear at first, although they could certainly be better. The drama surrounding the Mountain Valley Pipeline continues to be a drag on the firm’s performance but it does appear that the pipeline will eventually be completed, just much later than originally planned. The company might also be adversely affected by the likely warm winter in Virginia this year, but a long-term investor may still find some things to like here. It is probably best to wait until RGC Resources, Inc.’s stock price comes down a bit first, though.

Be the first to comment