scaliger

This article was co-produced with Nicholas Ward.

I have published more than a dozen bullish reports on Prologis, Inc. (PLD) in recent months.

PLD shares have a “Strong Buy” rating attached to them right now within the iREIT ratings system.

Prologis is one of just 3 stocks that receive a perfect 100/100 iREIT IQ quality rating (Realty Income Corporation (O) and Alexandria Real Estate Equities, Inc. (ARE) are the other two), and ever since the stock dipped below the $120/share mark earlier in the year, I’ve been pounding the table about PLD because of my high conviction bullish outlook here.

Why have I been so adamantly bullish on Prologis recently?

Because this stock rarely trades with an attractive valuation attached.

No one questions PLD’s quality.

It has a $100 billion+ market cap for a reason… this company has some of the most attractive global assets in the industrial space, as well as an urban land bank that provides the company with a very attractive growth pipeline.

But over the years, it has been extremely difficult to accumulate PLD shares because of its high valuation multiples.

Looking back at PLD’s historical valuation, the stock has been overvalued for the vast majority of the time since mid-2009.

From July 2014 through February 2015, Prologis shares traded with a P/AFFO multiple that I felt comfortable paying.

These shares fell down into “Buy” territory for a brief moment in late 2018 when the market had a flash crash of sorts due to a temper tantrum.

And of course, like just about every blue chip stock in the market which stubbornly trades with a premium valuation, during March 2020 shares were cheap during the COVID-19 crash.

But, other than that, PLD shares have been in “Hold” and even “Trim” territory, with regard to iREIT ratings, for the last decade because of the high premium that investors have been willing to pay.

Believe me, I continue to love Prologis here in the $110 area. I believe shares offer strong double-digit upside potential, alongside an extremely safe 2.7% yield with dividend growth prospects that remain above today’s high inflation levels.

But, instead of writing another bullish piece on PLD, I wanted to mix things up a bit, highlighting another blue chip industrial REIT (real estate investment trust) that has a very similar story…

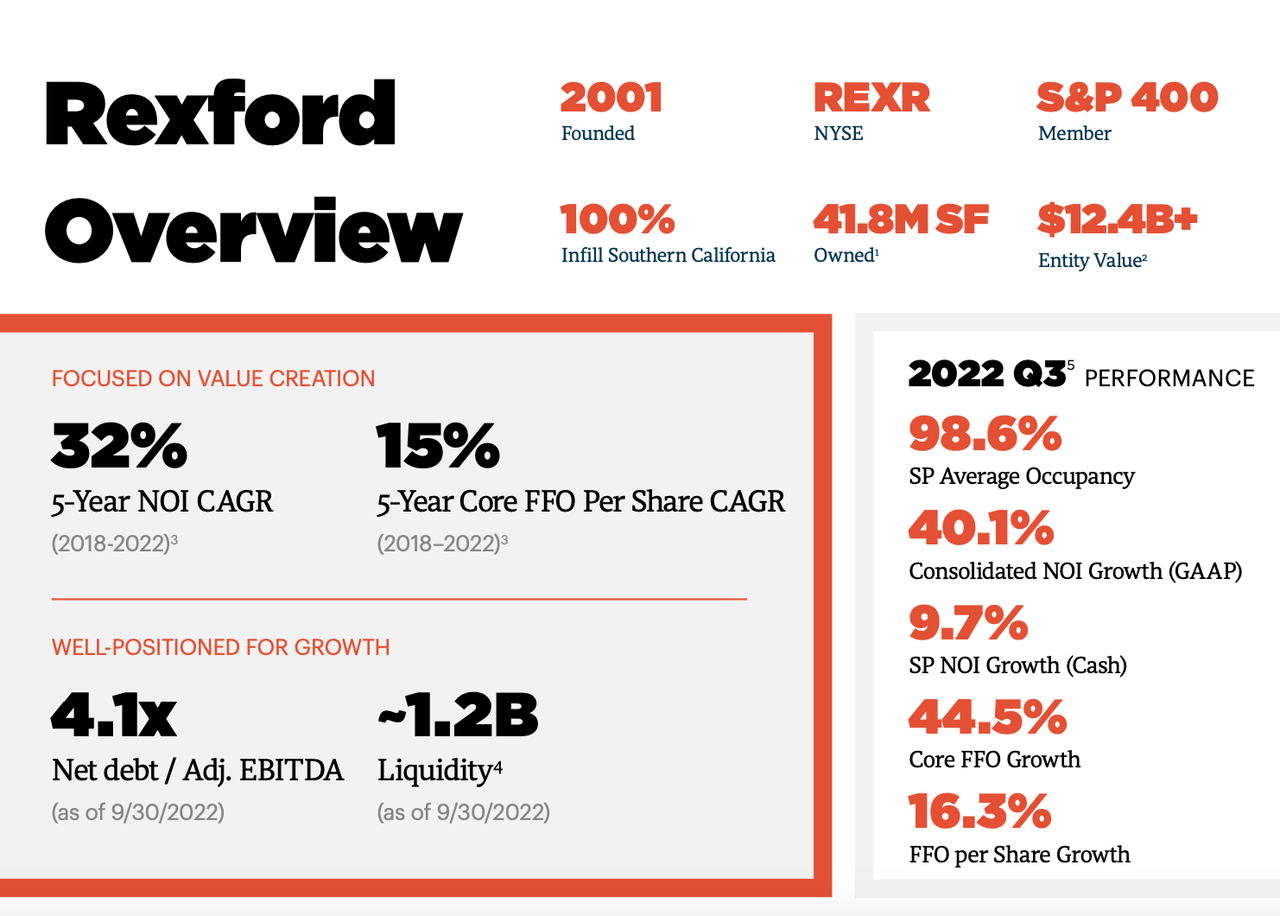

I’m talking about Rexford Industrial Realty, Inc. (NYSE:REXR), the dominant player in the Southern California warehouse and logistics space.

As I’ve said before, diversification is the only free lunch that I’m familiar with on Wall Street, and I continue to believe that it’s prudent to spread risk amongst blue chip equities.

Prologis remains my favorite industrial REIT, but in terms of quality, Rexford isn’t far behind.

Rexford is also one of the highest quality REITs that we track at iREIT with a 99/100 iREIT IQ quality score.

Like Prologis, Rexford has a history of sky-high valuations.

This shouldn’t be surprising with such a high-quality operation in mind.

However, unlike PLD shares, REXR is still in “Hold” territory at iREIT.

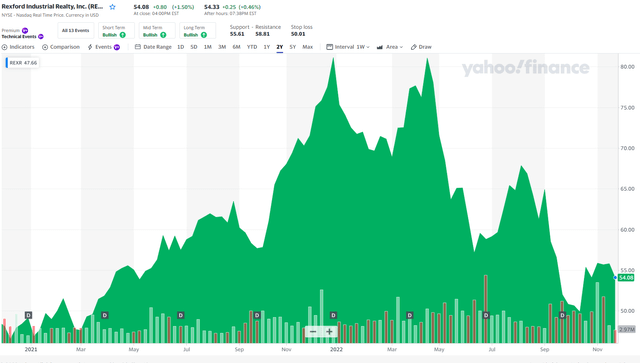

Rexford shares are down 33.5% on the year (shares are down by 3.7% this week alone). This negative performance is in-line with Prologis’s -33% year-to-date returns. However, coming into 2022, REXR shares were trading with a P/AFFO multiple in the 62x area and regardless of quality, that was entirely too high.

Yet, recent weakness in the stock has pushed its share price down towards our $50.00 “Buy Below” threshold and, therefore, I wanted to take the time to write up a report on REXR so investors looking to diversify their industrial REIT holdings are prepared to make a move if the recent selloff persists.

REXR: Best In Class Operational Performance

Before we get into the valuation breakdown here, let’s analyze Rexford’s real estate and operations.

Rexford is pretty unique because its assets are all located in southern California.

The company’s properties are 100% infill industrial assets, largely located in and/ or around Los Angeles.

REXR Investor Presentation November 2022

This concentration may turn certain investors off (especially when compared to a company like Prologis, which has assets in just about every major coastal urban area in the Americas, Europe, and parts of Asia).

However, REXR’s very focused strategy has worked out well for management. They are able to use their expertise to accumulate the best deals in close proximity to the Port of Los Angeles and the Port of Long Beach (which are the two busiest ports in the U.S.), meaning that REXR is the dominant player in the most attractive region of the country for industrial/logistics companies.

Rexford recently noted that:

“SoCal ports are largest in U.S., linking the U.S. to Pacific Rim representing 40% of all U.S. containerized imports, with 40%-50% of imports distributed locally.”

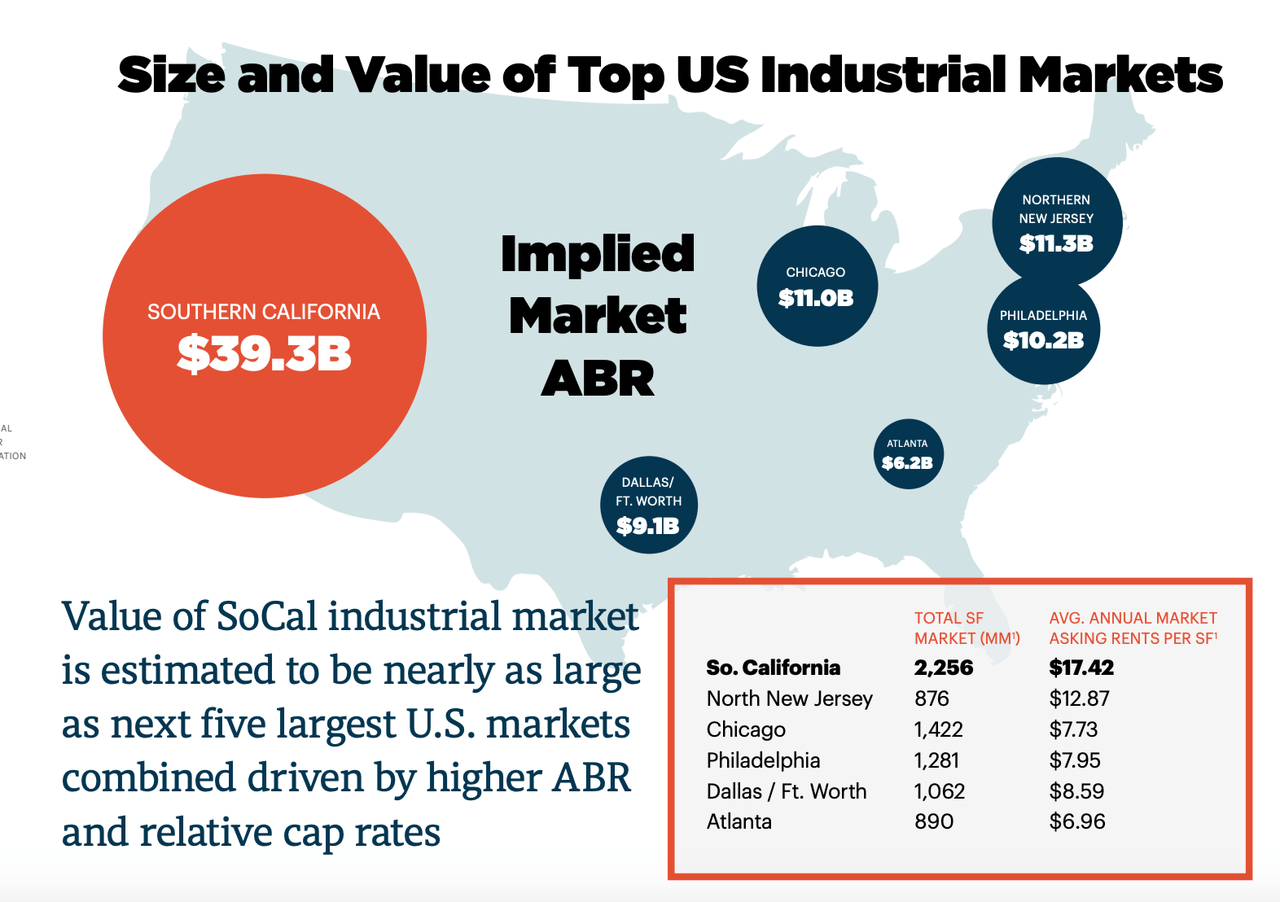

Rexford says that southern California is the largest U.S. industrial market and the 4th largest industrial market in the world. And, this strong demand has resulted in average rent that its competitors simply can’t match.

The company says that rents are:

“More than 95% higher in SoCal than the average of the next five largest U.S. markets.”

In a recent shareholder presentation, REXR management noted that their average ABR per SF was $12.97, which is roughly 65% higher than its peer average of $7.76.

With that being said, while we realize that it’s a bit ironic mentioning diversification and Rexford in the same sentence due to its southern California focus, the fact is, there’s no better place to invest in industrial properties in the United States and, therefore, we see no reason for this company to look outside of their infill focus.

REXR Investor Presentation November 2022

And, this isn’t just our opinion…

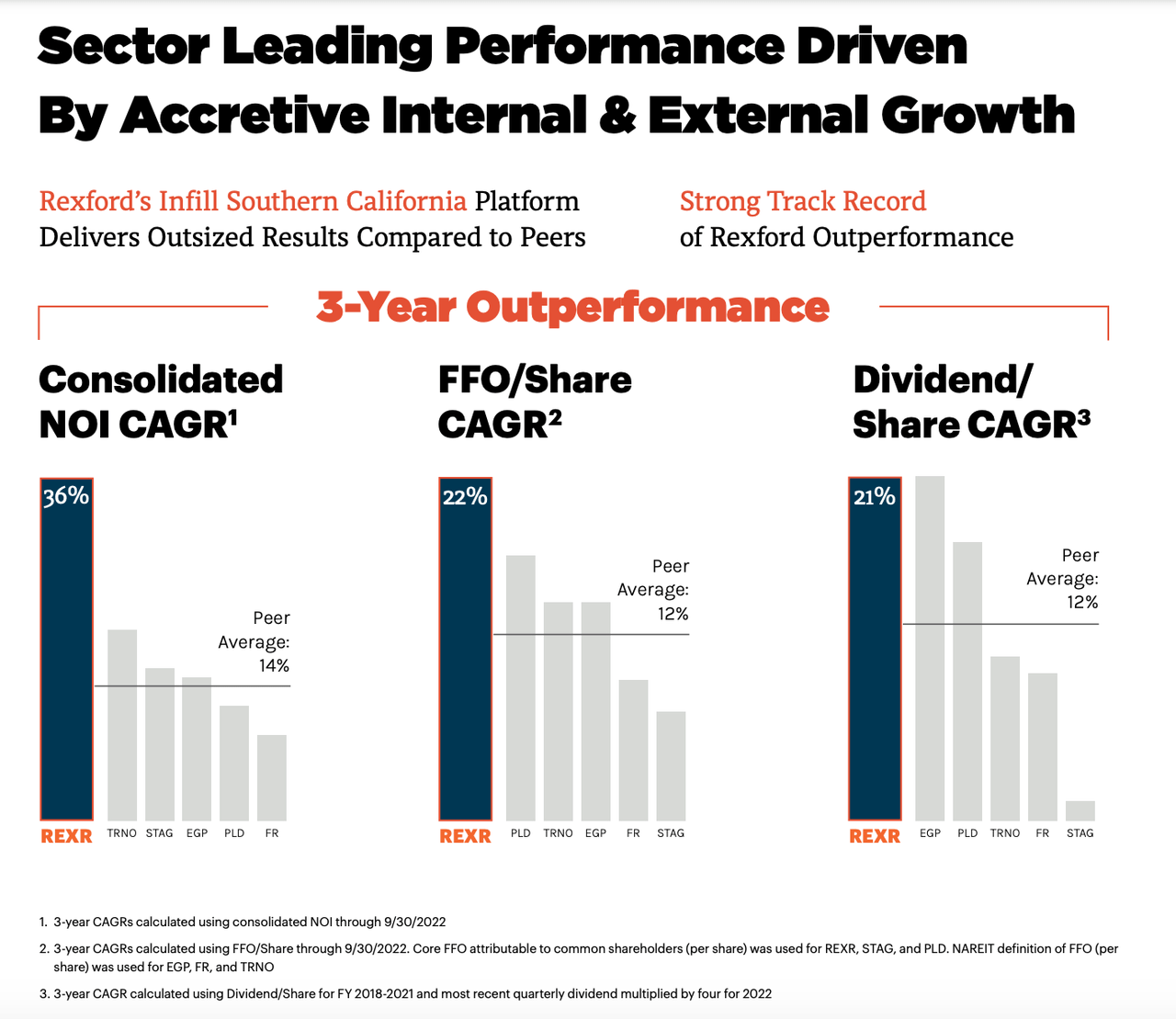

The data clearly supports this stance, as Rexford’s local expertise and high local demand have allowed it to produce industry-leading results throughout the pandemic period.

REXR Investor Presentation November 2022

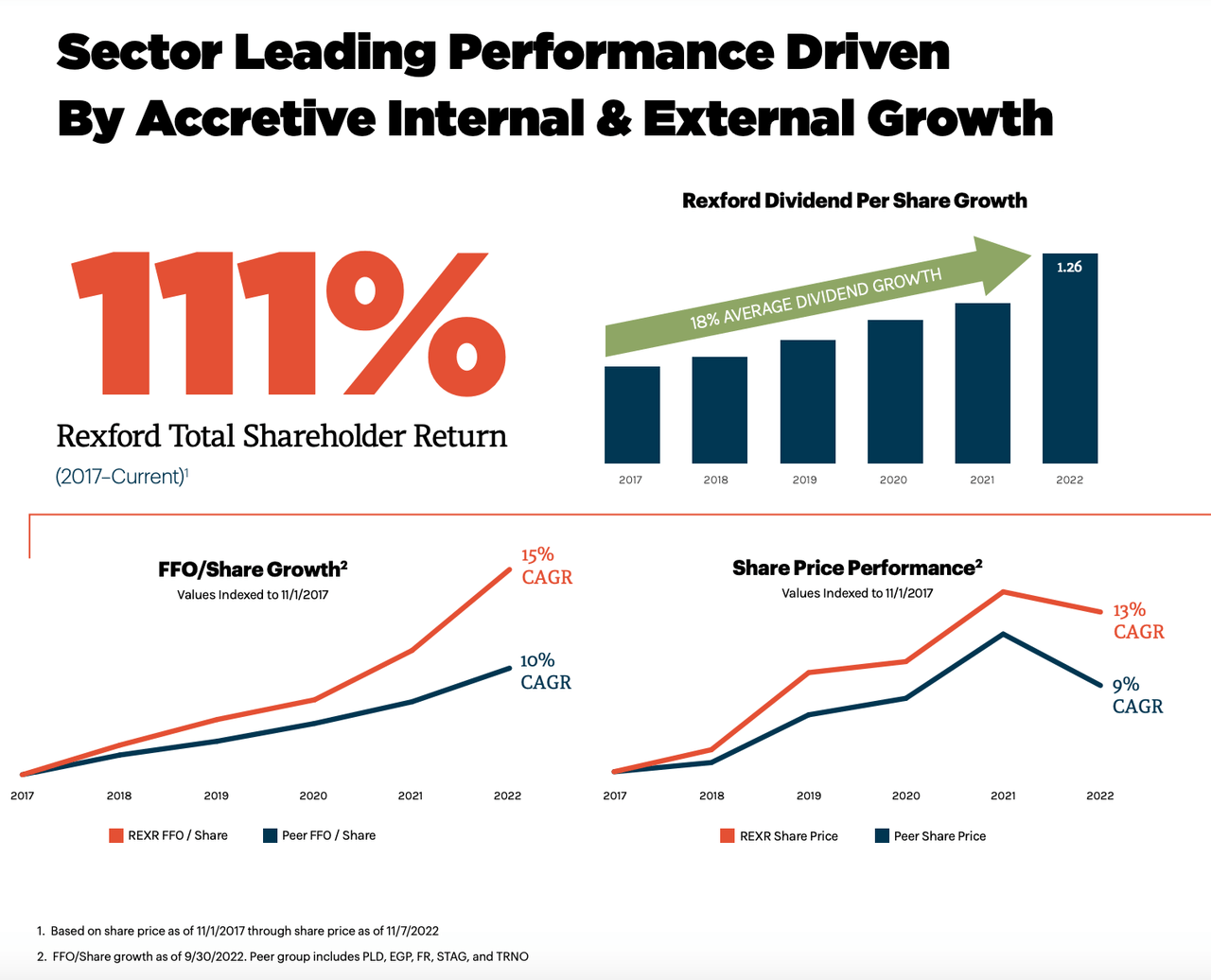

And, as you might expect, REXR’s strong fundamental growth has translated directly to outperformance from a total return standpoint as well.

REXR Investor Presentation November 2022

Lastly, on top of all of this growth, I want to mention that REXR is a BBB+ rated company with a solid balance sheet and a well-laddered debt maturity schedule, leading me to believe that the company has the financial wherewithal to continue to grow (during 2022 thus far, REXR has invested $2.1 billion into its portfolio).

This is exactly why Rexford is a name that we believe REIT investors should have on their radars as its share price falls.

Valuation

As great as REXR’s operations are, the stock can only be a good investment if it’s trading at fair value (or better yet, with an attractive margin of safety).

As I said, coming into the year, REXR was trading with a P/AFFO multiple north of 60x.

But, the combination of the stock’s -33.5% selloff and continued strong double-digit AFFO growth during 2022 thus far has resulted in that 60x premium being cut nearly in half.

Right now, REXR shares trade with a 33.9x multiple when looking at 2022 AFFO expectations.

Furthermore, shares are even cheaper on a forward basis, currently trading for 29.7x 2023 AFFO estimates.

Sure, 30x premiums are hefty, but there’s a solid argument to be made that REXR has the growth to justify that sort of premium.

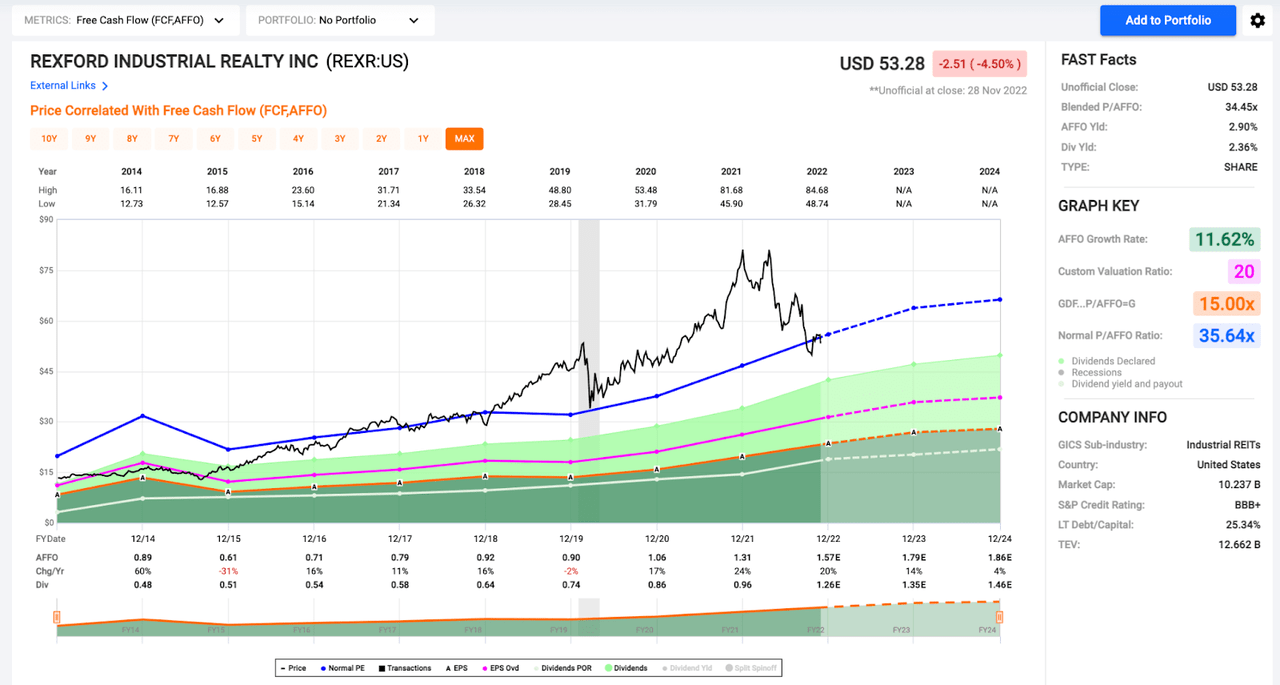

FAST Graphs

This company has posted double-digit AFFO growth during 5 out of the last 6 years (during 2022, REXR’s AFFO fell by 2% during the COVID-19 crash). And, once the company finishes its fiscal year, it looks like that streak will improve with expectations of full-year AFFO growth in the 20% range for 2022.

Since its IPO in 2013, REXR’s average P/AFFO multiple is 35.6x.

During the last 5 years, REXR’s average P/AFFO multiple has been 44.7x.

During the last 3 years (COVID-19 period), REXR’s average P/AFFO multiple is 53.07x.

Therefore, as high as the current premium may seem to REIT investors who are used to paying 10-15x for companies in other areas of REITdom, REXR’s current multiple is below historical averages.

I still believe that shares are slightly overvalued (currently, REXR is trading with a 7% premium to my $50.00 fair value estimate); however, the stock was down 4.5% yesterday, and if the REIT selloff continues in the coming days, we could place that elusive “Buy” rating on REXR shares.

Without a doubt, this is a company that I’d love to add to iREIT portfolios.

The flow of goods coming into the U.S. from Asian countries isn’t going to slow anytime soon.

Yes, we’re seeing manufacturing leave China; however, most of it is headed towards other countries in the region.

A resurgence of American manufacturing isn’t going to stem the tide of Asian imports. Therefore, I really like the Los Angeles/Long Beach industrial markets.

Overall, Rexford is neck and neck for best-in-breed status with Prologis within the industrial space. And, while this company’s dividend yield remains relatively low at 2.26%, it’s important to note that Rexford raised its dividend by 31% earlier this year.

In the graphic above, you may have noticed that since 2017, REXR’s dividend growth rate is 18%.

That means that REXR has established itself as one of the top dividend growth stocks in all of the market (not just the real estate sector).

And, looking ahead, I believe that the company has what it takes to continue providing double-digit dividend growth to shareholders.

All in all, industrial real estate continues to be one of my highest conviction bullish ideas over the next 5-10 years. I’ll be watching REXR shares closely in the coming days to see if they dip below my $50.00 price target, because exposure here would pair nicely with our existing stakes in names like Prologis and STAG Industrial, Inc. (STAG).

Be the first to comment