filadendron/E+ via Getty Images

Investment Thesis

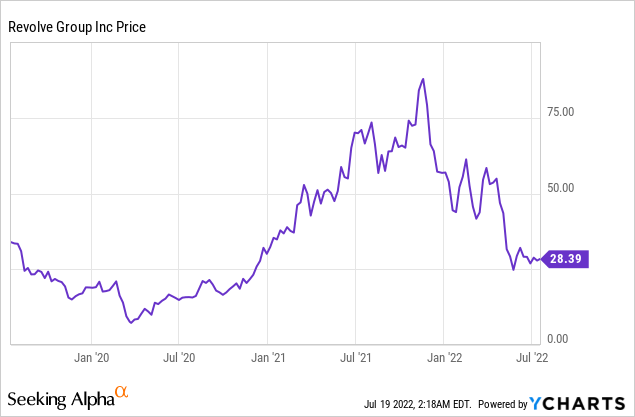

Revolve (NYSE:RVLV) is a next-generation online fashion retailer that focuses on Millennial and Generation Z customers. It offers over 70,000 items including apparel, footwear, accessories, and beauty styles. Revolve was one of the best performing companies during COVID. The online fashion retailer saw its share price rising from $7.7 in March 2020 to $86 in November 2021, up over 1,000% in less than two years. It was heavily benefited from the pandemic as the worldwide lockdown forced people to start shopping online. The stimulus checks also significantly increased consumer spending on discretionary items.

However, Revolve was taken down sharply amid the broad market sell-off as the inflation rate persists at a high level and the economy starts to weaken. The share price is down almost 70% from its all-time high, now trading at $27.2. After the huge drawdown in share price, Revolve is a buy in my opinion. The market opportunity for the company remains huge as the shift from physical retail to e-commerce continues to accelerate. It is still posting very impressive financial results despite facing strong turbulence in the macro environment. It is also profitable with meaningful cash flow and a solid balance sheet. Macro headwinds are likely to stay for a while but I believe the company will be able to navigate them as they did for the past quarter. Therefore, I rate the company as a buy at the current price.

Huge Market Opportunity

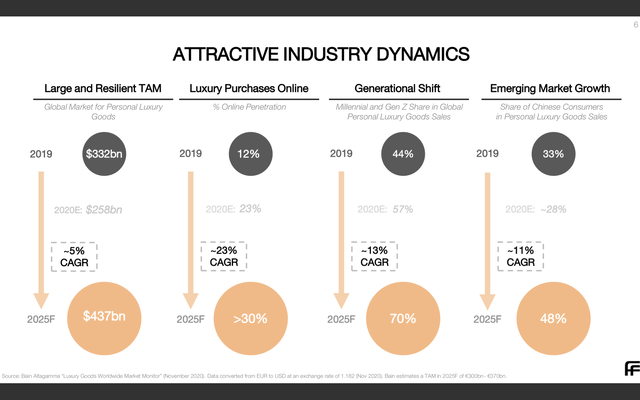

The online luxury fashion market presents a huge opportunity for Revolve. This is due to the consumer purchasing habit shifting from physical retail to digital retail. The pandemic further accelerated the shift as the nationwide lockdown forced everyone to purchase goods online. According to Statista, the current e-commerce share of personal luxury goods sales worldwide is 10% and is forecasted to increase to 25% in 2025, representing a 2.5 times growth over the period. The TAM for the industry is also huge. According to the online fashion marketplace Farfetch (FTCH), the global market for personal luxury goods is expected to increase from $322 billion in 2019 to $437 billion in 2025, representing a 5% CAGR (compound annual growth rate). I believe the international market presents a strong growth avenue as well. Currently, US revenue makes up 84% of Revolve’s total revenue with International revenue accounting for only 16%.

Mike Karanikolas, CEO, on market opportunity:

These exceptional results reinforce the path forward in the very large market opportunity we are pursuing, where purchasing power has continued to shift in our direction. Even with the recent growth acceleration, we still serve only two million active customers, representing what we believe to be just 3% penetration of our target demographic in the U.S. market.

It is worthy to note that the competition in the industry is also very fierce. The company is facing competition from both legacy retailers and also emerging e-commerce companies. Some notable competitors include Farfetch, Mytheresa (MYTE), The RealReal (REAL), Selfridges, Lane Crawford, Harvey Nichols, and more. One significant advantage that Revolve has is it operates its own women’s brands, which none of the companies above do. This allows it to create value and brand loyalty rather than being just a brand carrier. However, in the men’s department, the company operates with a marketplace model and doesn’t have its own brand; therefore it is facing much stronger competition.

Farfetch

Strong Financials

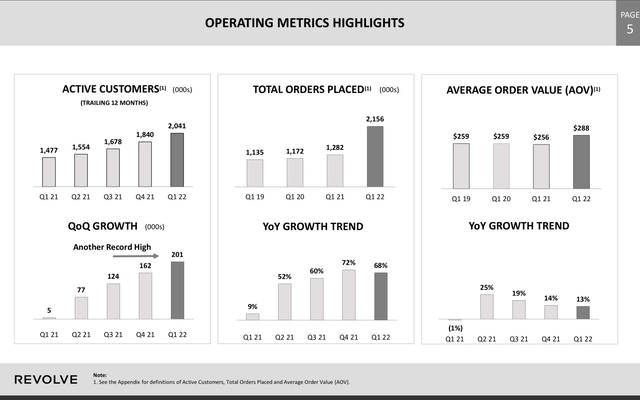

Revolve reported its first-quarter earnings in May and the results are very impressive, especially during highly uncertain times like these. The company reported revenue of $283.5 million, up 58% YoY (year over year) compared to $178.9 million. The gross profit was $154.4 million compared to $96.7 million a year ago, up 60%. The gross profit margin for the quarter was 54.5%. The increase is largely attributed to the accelerated growth in active customers and increasing engagement, driven by product category expansion and improving loyalty programs. The total number of customers at the end of the quarter was 2 million, up 38% YoY. Total orders placed were 2.2 million, up 68% YoY. Customers spend more with an average order value of $288, compared to $256 a year ago. For the quarter, US sales accounted for 84% of total revenue while International sales accounted for 16%.

Unlike most high-growth companies, Revolve is able to balance growth with profitability. The company reported an adjusted EBITDA of $31.5 million, up 35% YoY compared to $23.3 million. Adjusted EBITDA margin was 11.1%. Free cash flow was up a whopping 62% from $32.5 million to $52.7 million, representing a free cash flow margin of 18.6%. Net income was $22.6 million compared to $22.3 million, up 1%. The slower growth in net income was due to the increase in the effective tax rate, which was up 28 points in the quarter. The company also ended the quarter with a very strong balance sheet. Current cash in hand amounts to $270.6 million while debt is only at $16.9 million. It gives the company a lot of flexibility to operate, such as reinvesting in the business or buying back shares if the time is appropriate.

Mike Karanikolas, CEO, on first quarter results:

We’ve had an exceptional start to the year, highlighted by 58% net sales growth year-over-year in the first quarter, record quarterly growth in active customers, and record levels of net income and operating cash flow for any first quarter, these impressive results and our consistent delivery of profitable growth reflect outstanding performance across the REVOLVE and FWRD segments, underscoring our team’s ability to execute and navigate through what continues to be a very challenging macro environment.

Macro Headwinds

One of the biggest risks when investing in Revolve is the uncertainty regarding the macro environment. The company is quite exposed to macro headwinds as it is a consumer discretionary company. As inflation persists at a high level and supply chain blockage continues, the economy is starting to show signs of weaknesses. Retail giant Target (TGT) lowered guidance earlier while tech giants like Microsoft (MSFT), Tesla (TSLA), and Oracle (ORCL), announced plans of laying off employees. Consumer sentiment is also falling off a cliff to levels not seen since the great financial crisis, according to Michigan Consumer Sentiment data. I believe this is going to hurt Revolve as consumer purchasing power is likely to be reduced and they will have to save more for essential items like groceries. Higher fuel prices also mean higher shipping costs for Revolve. This will impact its bottom line if the company can’t pass the cost on to consumers. The ongoing Russia-Ukraine war and lockdown in China are also affecting the company’s international growth, which has been lower compared to US’s revenue. So far Revolve has been doing a good job of navigating the situation, but these are still some risks investors should be aware of as they may still pose meaningful headwinds to the company going forward.

Conclusion

I believe the sell-off in Revolve presents a great buying opportunity for investors. The company has a huge TAM as the shift from physical retail to e-commerce is still in its early innings, especially in overseas countries. This leaves a lot of room for international growth as overseas revenue currently accounts for a tiny fraction of total revenue. Competition within the industry is fierce but Revolve has a significant advantage with its own brand which improves brand loyalty and creates value. Despite meaningful macro headwinds, the company still manages to put out very impressive results. Not to mention it is already profitable with a strong balance sheet. The macro environment is likely to stay volatile for a while but I believe Revolve will be able to handle it well as it did in the past few quarters. Therefore I rate the company as a buy at the current price.

Be the first to comment