Albert_Karimov/iStock via Getty Images

Investment Thesis

Coterra Energy (NYSE:CTRA) is very well set up for rapidly increasing natural gas prices.

Meanwhile, in the past month, since I wrote my bullish article on Coterra, much has happened, leading to Coterra’s share price selling off by nearly a quarter of its market cap.

The energy trade had been one of the few spaces in the S&P 500 (SPY) that had been working. But in the past month and half, the energy trade had massively sold off.

For now, Coterra is priced at 6x this year’s free cash flow. This makes it a very attractive multiple for a company that is going to have a very strong 2022 and very likely to have an equally strong 2023.

I rate this stock a buy.

What’s Happened in the Past Month?

There’s been a few forces at play in the past month that led the energy sector to sell off. There are a few rumored activities that several large hedge funds were aggressively shorting energy CFDs in the spot market and crowded into the only area of the market that was deemed to be overbought in 2022.

Another driver had been the perceived overabundance of natural gas in the US, after the Freeport LNG, the second biggest US natural gas exporting facility was suspected to take longer than previously estimated to come back online.

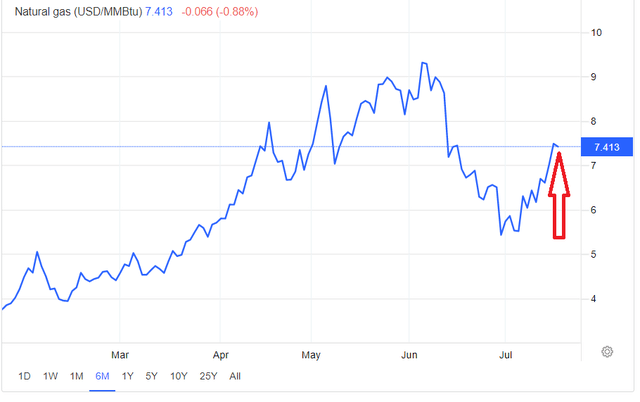

With too much natural gas in the US, there was a perceived overabundance of natural gas that would have led to natural gas prices falling in price. Yet, this consideration appears to now be reversing, see red arrow.

Next, and by no means less meaningful, investors have become increasingly wary that with the US potentially facing a recession, demand for natural gas would diminish.

These are some of the main concerns that investors have been grappling with. Essentially, a lot of fear and uncertainty. However, I believe that this is already heavily factored into Coterra’s 6x free cash flow stock price.

Coterra’s Hedged Book? What Does It Actually Offer?

Coterra is about to report its Q2 2022 earnings in the coming weeks. At that time we’ll have a much better indication of how much of its 2023 book will be hedged.

Part of me is inclined to believe that Coterra will resume hedging its book into 2023 at the absolute minimum by 20%.

Incidentally, Coterra has let investors know that for 2022 it will look to hedge 20% to 30% of its volumes.

Consequently, I’m inclined to believe that Coterra will roll forward this practice into 2023.

Needless to say that if one is highly bullish on natural gas, the least hedged book the better.

However, if one does not want to deal with the high volatility of natural gas prices in the spot market, then perhaps a slightly hedged book, as Coterra offers is a happy medium.

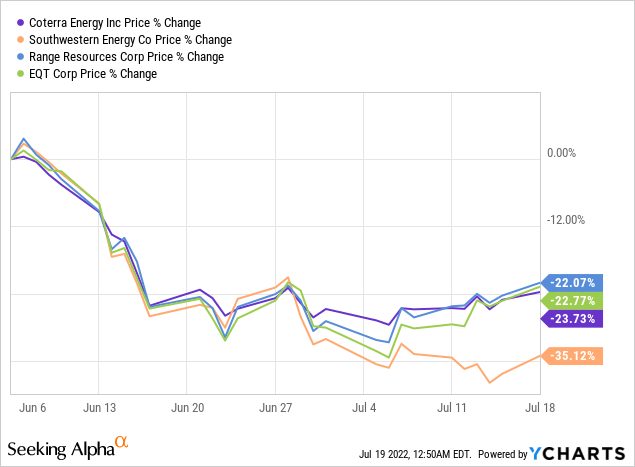

That said, consider the share prices of the natural gas peers below. As you’ll see all these shares have all similarly sold off in the past month.

For instance, this hasn’t stopped Southwestern Energy (SWN) from seeing massive swings in its share price. Even though its books are more than 60% hedged all the way into 2023.

Accordingly, I believe it’s safe to conclude that having a more or less hedged book has not in actuality ”protected” shareholders from the massive swings in share prices.

Hence, one could summarise the situation as such. Investors will see their shares swing massively, causing a lot of pain over short time periods, quite irrespective of the ”safety” of their underlying fundamentals.

Simply put, the market is a voting machine in the short term. The market is simply not that discerning about details.

Coterra’s Capital Allocation?

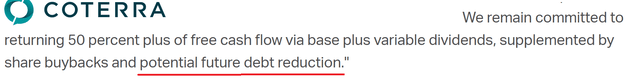

Coterra announced the following together with its Q1 2022 results:

50% of free cash flow going back to shareholders and potential future debt reduction. This statement has caused a lot of ambiguity among the investors that I have communicated with.

In my opinion, this half-hearted, opportunistic, return of capital to shareholders is exactly the reason why commodity companies often trade at such low multiples.

This is an industry that is incredibly cyclical. And investors have a very long history of not getting a commensurate return on their investments.

Therefore, investors want to know precisely how much capital will be returning to them this year and next year. And anything less than a crystal clear plan will see Coterra’s share price sell-off when it reports its Q2 results in the coming few weeks.

The Bottom Line

In summary, there are only two aspects that Coterra’s shareholders should look out for when Coterra reports its Q2 2022 results in the coming few weeks. How hedged its book will be in 2023. What level of capital allocation will be returned to shareholders rather than debt holders.

All other details will be a distraction to the bull case.

Be the first to comment