Justin Sullivan

Based on a statement by Judge Jones at the very end of Friday’s DIP financing hearing for bankrupt Revlon (NYSE:REV) it looks like the critical November milestone to file a restructuring support agreement – RSA will not be extended. This is a major blow, in my opinion, to Revlon investors because, as I covered in a prior article, a filing of a RSA after the holiday selling period most likely would reflect an improved Revlon. A final decision by Judge Jones was made during Monday’s hearing not to require any extensions. Various parties also had a meeting with Revlon’s management earlier on Monday morning. This article is an update to previous articles.

DIP Hearing

I “attended” the DIP financing (amended DIP agreement docket 299) hearings on Thursday, Friday, and Monday via Zoom. While the hearings never got intense, a number of participants seemed frustrated during the process. (See below for my opinion of Judge Jones.) Before the lunch break on Friday, Judge Jones urged the various parties to reach settlements on the outstanding issues and at that time also indicated that he was leaning towards an extension of the November 1 DIP milestone to file a RSA and November 30 to file an “acceptable” plan. After lunch, the lawyer representing the BrandCo DIP lenders offered to extend those dates to November 15 and December 14. The lawyer representing the Official Unsecured Creditors Committee stated that various new proposed changes (There were also other proposed changes.) were “insulting”. I agree. They are almost meaningless and are just a way to imply to the court that BrandCo lenders are in control here.

After additional testimonies and statements ended late on Friday, Judge Jones stated he would not make a decision until Monday August 1. He again urged the various parties to reach settlements on various issues over the weekend. At the very end, he stated that he would agree to the “business judgement” of Revlon’s management that they would be able to file a RSA by November 1, which is a change from before lunch.

Originally, the BrandCo DIP lenders wanted a RSA filed by the end of July and plan by the end of August. Revlon originally wanted to have until the end of December to create a business plan that would be used as a basis in negotiating a RSA. Those parties eventually agreed to creating a business plan by September 30 and filing a RSA by November 1. During the hearings, Revlon had to defend their “business judgement” that they could complete a reasonable business plan by September 30. The Official Unsecured Creditors Committee strongly disagreed with that “business judgement”. They thought much more time was needed to create a business plan that reflected an improved supply chain/vendor operation. In a very unusual move, Revlon’s lawyers filed a short “Closing Argument” (docket 311) near the end of the day that further asserted that the court must follow management’s “business judgement”.

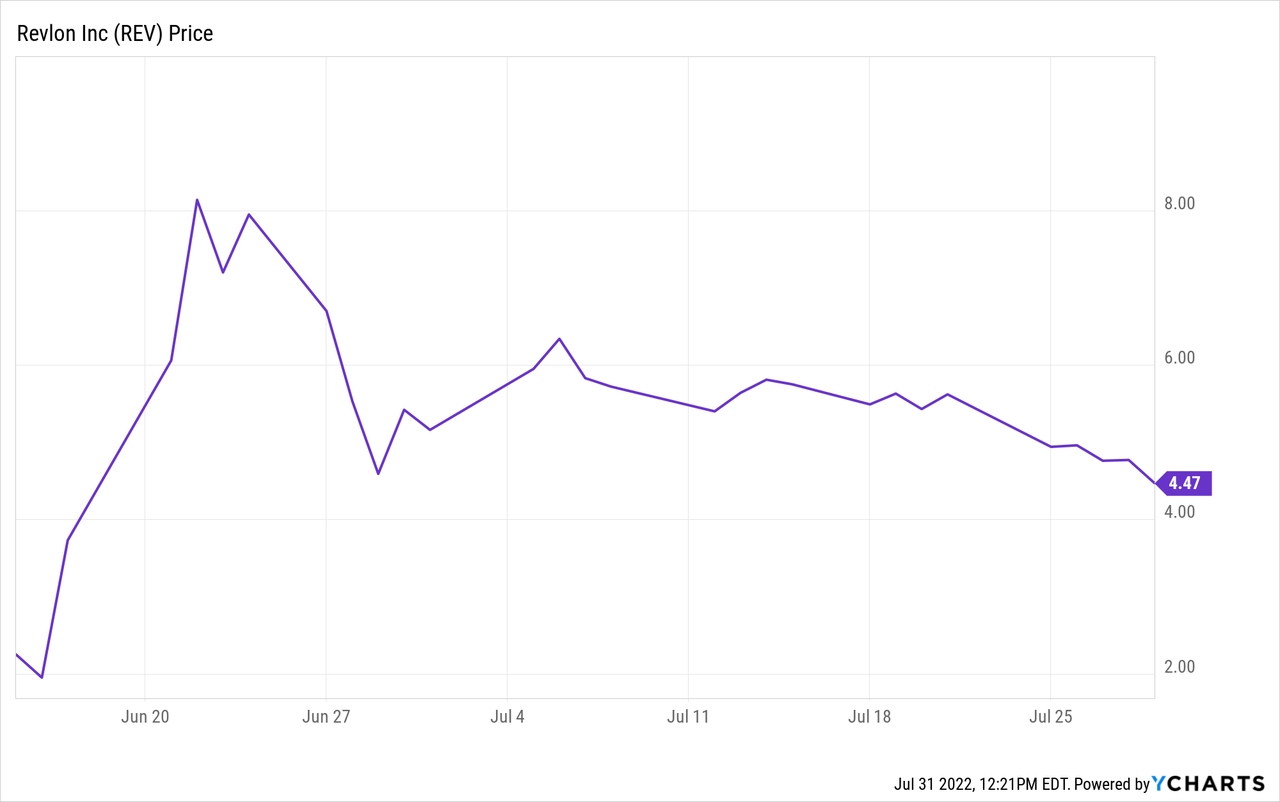

Revlon’s Stock Price Since June 15 Bankruptcy Filing

Impact of Judge David Jones

Judge Jones is a new bankruptcy judge and was a major disappointment, in my opinion. He did not have control over the process and seemed too reluctant to make needed decisions. I have been in many bankruptcy courts over the years and have watched great judges and poor ones. At this point. he seems unwilling to defend the various priority classes that are being “rolled over” by the BrandCo lenders. He is not a Judge Berstein who was always cognizant of all the stakeholders.

The lawyer for the OUC even stated that he (Judge Jones) could assert that if the parties could not agree on certain issues that he would file in these issues himself, which the other Judge David Jones in Texas has done. This lawyer seemed to be implying that the extremely well-respected other Judge Jones “knows what to do and that you don’t”.

I was shocked that Judge Jones told the various parties to be “available” for the rest of late Friday in case he again changes his mind and decides to make an oral ruling late Friday. This was right after he said he would make an oral decision on Monday. “Available”? What? On a late Friday during the summer? Can all these lawyers bill for being “available”?

I think that the two page “Closing Argument” that was filed late on Friday by Revlon’s lawyers may also indicate that these lawyers also do not have the highest opinion of Judge Jones. The content was at a level for an audience that was just in first year law school – not a sitting federal judge. I do not recall ever seeing a similar type of filing during an actual hearing, but it seemed to have worked. He was leaning towards an extension of the time to file a RSA before lunch and switched to indicating he would follow Revlon’s “business judgement”, which would not require extending the time.

He read his decision during a hearing on Monday that only had some modest changes that were already agreed to last week, including raise the budget to bring litigation from $50,000 to $350,000 and lengthening that challenging period to 90 days from 75 days. The milestone dates will now be November 15 for the RSA filing and December 15 for filing the plan.

As I often remind investors, the bankruptcy judge is a very important variable in estimating the recoveries for various claim classes. Often the desktop results are completely different than actual results because of the decisions by the judge. Most investors understand the differences in SCOTUS justices. The same often applies to bankruptcy judges. What I heard during the recent hearings could indicate that Revlon shareholders need to worry that this judge might not be “shareholder friendly” and is not decisive enough to avoid being controlled by the BrandCo lenders. (He definitely is not a “Judge Judy”.)

Current Business Status

Revlon filed for bankruptcy because of liquidity/high leverage and severe supply chain problems. It did not file because of a severely flawed business model that forced Sears into Ch.11. If they can reduce their debt and increase liquidity under a Ch.11 reorganization plan along with a hoped for a much-improved supply chain, they could become a very viable company. With new more creative marketing/advertising campaigns Revlon could again be a leader in their industry.

Currently, it is the supply chain issues that are impacting Revlon. According to management, they were only able to fulfil about 70% of their orders at the time they filed for bankruptcy. They are paying $40.4 million on an interim basis and $79.4 million on a final basis of the $130 million accounts payable to pre-petition trade creditors. They absolutely must get needed raw materials to make their products immediately to avoid lower supplies of their 8000 different “stock keeping units”. If they don’t, it could negatively impact the annual retail “shelf-space allocation” in September.

I find it unlikely that these supply chain issues will change enough before the September 30 deadline for filing their business plan. It looks like, in my opinion, that the BrandCo lenders want a business plan and thus a RSA, that reflects these current problems and not one that would reflect an improved operation. They want a lower enterprise valuation number so they can justify getting a larger percentage of the ownership of the new Revlon. (I am assuming that BrandCo lenders are going to attempt to get most of the new equity for their secured claims.)

I expect the first indication of Revlon’s current financial results will be their monthly operating report – MOR that they should be filing at the end of August for the period from their June bankruptcy filing date thru July 31. This could be a horrible report. Investors need to also remember these MORs do not follow GAAP accounting, so they need to try to make appropriate adjustments.

Other Updates

At this point, it looks like Mittleman is going to be using an Ad Hoc Group of Non-Insider Shareholders to advocate for Revlon shareholders because an official equity committee has not been appointed. They filed their verified statement (docket 306) that lists members Kevin Barnes owning 20,000 Revlon shares, Adam Gui owning 1,000 shares, and Christopher Mittleman owning 989,525 shares.

The meaning of an “acceptable plan” was clarified during the hearings. It does not mean that the BrandCo lenders are requiring as a DIP milestone that they accept the entire plan. It means that the “acceptable” plan must include full cash payment of the DIP financing and the $939 million 1lien BrandCo financing, unless 2/3 of the holders agree to “other treatment”. (I am thinking that they will try to get equity in the new Revlon as partial payment, especially since “credit bidding” was mentioned a few times during the recent hearings.)

BrandCo lenders still were insisting that any proceeds from avoidance litigation be included in their collateral package. As I pointed out in my prior article, this could mean that they might be just getting any cash they have to pay to Revlon for prior bad acts paid right back to themselves. The lawyer for the OUC wanted this potential cash to be part of a shared recovery by various claim holders that would include unsecured creditors (and unsecured noteholders). At this point, it is just theoretical because there may never be any successful litigation against BrandCo lenders, but it would be beneficial to have that potential recovery for unsecured noteholders. During Monday’s hearing, he stated that he was not making any changes.

Since irrational meme trading in Revlon stock has been reduced from a few weeks ago, investors must make rational decisions regarding owning Revlon securities. If shareholders receive a recovery under a Ch.11 reorganization plan greater than the current stock price of $4.47, it would be fairly likely that noteholders of the 6.25% 8/1/24 unsecured notes (CUSIP 761519BF3) would receive a recovery much greater than their current price of 10 cents on the dollar. The notes might be a more rational trade, but both have a very high risk of getting no recovery.

Conclusion

I am writing this update because most of the media has lost interest in Revlon’s bankruptcy case. The stock price on Friday dropped about 6% at the same time the market was rising, which might indicate that investors who were following the hearing were concerned, based on various statements, that the milestone dates to file a RSA and plan would not be extended.

I had a neutral/hold rating for REV shares, but since Judge Jones decided not to require an extension, I am changing my rating to sell REV stock. I am, however, maintaining a hold rating on the unsecured notes.

Be the first to comment