nigelcarse

Thesis

Upstart Holdings, Inc.’s (NASDAQ:UPST) Q2 earnings release reinforced the recalibration of how investors should consider UPST as part of a technology-focused portfolio.

As an AI-focused lending technology solution provider that mainly derives its revenue from transaction fees based on the volume of loans, it’s inevitable that Upstart will be impacted by macroeconomic cycles. Coupled with the higher-risk underlying customer profile addressed by its solution, the pain will be felt even more during downturns, as external financing starts to taper off significantly, leading to a marked fall in loan volume.

What we heard from Upstart’s Q2 earnings call suggested that the worst in its underlying metrics may not be seen yet, as the macro environment continues to worsen. Furthermore, investors also need to consider the potential impact on Upstart’s P&L, as management leveraged its balance sheet once more to provide a crucial source of liquidity to stabilize its loan volume. As a result, we believe it’s getting increasingly challenging for investors to assess UPST’s fair valuation, given the current dynamics.

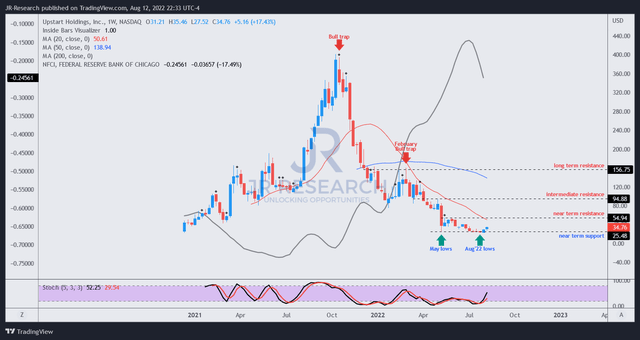

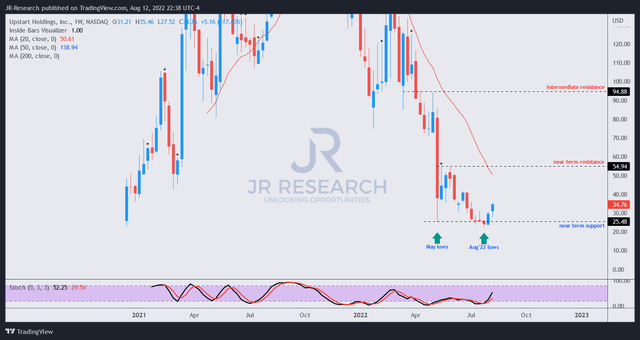

Notwithstanding, it’s also critical for investors to note that UPST has already been battered since its October 2021 highs. Also, we note that UPST’s post-Q2 selloff didn’t break its May lows and was resiliently supported. Coupled with our confidence in a market bottom, we are confident that if Q2 didn’t break UPST, then it has likely staged its medium-term bottom.

Accordingly, we revise our rating from Buy to Speculative Buy, with a medium-term price target (PT) of $48 (implying a potential upside of 38%).

Upstart’s Q2 Helps Reset Expectations

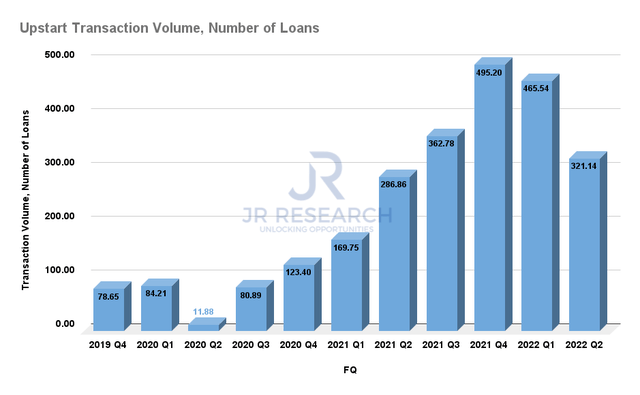

Upstart transaction volume, number of loans (Company filings)

Upstart reported a transaction volume of 321.14K loans in Q2, down markedly from Q1’s 465.54K. The company attributed the fall in volume to a significant pullback in funding by third-party capital, as institutional investors were increasingly concerned about the worsening macro environment. Furthermore, investors were also concerned with the deteriorating credit performances of its higher-risk borrowers, further crimping demand for Upstart’s loans. Management articulated:

Industry data shows a general rise in delinquencies across all segments of unsecured credit, disproportionately impacting the higher risk tiers that is comprised a significant component of our borrower base. The macro uncertainty and the impact of economic stress on consumer delinquencies have led to a decrease in available funding for loans on our platform, which has become the operating constraints of the business. Do we really think we’re at past the bottom of the cycle? I think in a short word, no. So I think we’re expecting further degradation in loss trends. We are now projecting it and prepared for it. (Upstart FQ2’22 earnings call)

But, Things Should Get Better From FY23

It’s important to note that Upstart highlighted that it’s planning for worsening macros that could impact its business through FY23. Therefore, we believe the company’s planning norms have considered that normal business conditions may not resume until the end of 2023. The company also pulled its full-year guidance, which we believe is sensible. We think too many variables are at play now that could significantly impact its revenue and credit performance visibility through H2’22.

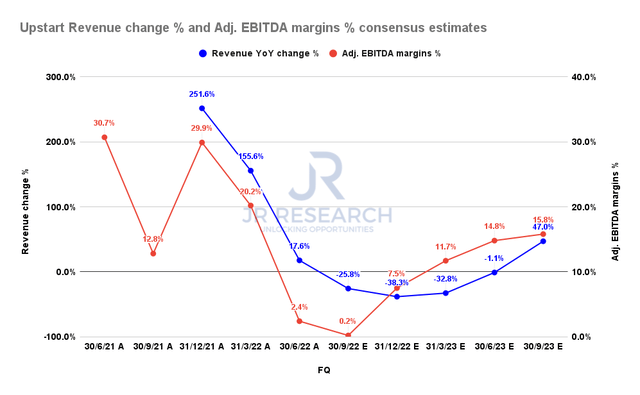

Upstart revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

Notwithstanding, the consensus estimates (neutral) have already been revised markedly downward. It projects that Upstart’s revenue growth could continue to decline through FQ3 (in line with management’s Q3 guidance). Upstart’s adjusted EBITDA margins are estimated to reach a nadir in Q3 before reversing through FY23.

UPST price chart (weekly) (TradingView)

We believe the Street has modeled the company’s malaise as transitory, even as management highlighted that it had used conservative planning norms. Is it reasonable?

As seen above, the National Financial Conditions Index (NFCI) has loosened in recent weeks, despite the Fed’s still-hawkish stance. We believe the market has been adjusting for less “nasty” surprises from the Fed as the recent CPI and PPI print came in less ominous than previously anticipated. Therefore, if the NFCI can continue to loosen up further, it could help Upstart to regain the support of its third-party capital providers and reduce the need to leverage its balance sheet to a large extent.

Is UPST Stock A Buy, Sell, Or Hold?

UPST price chart (weekly) (TradingView)

We observed that UPST’s May lows had held firmly even though it released an abysmal Q2 card. Furthermore, robust buying momentum also rejected the post-earning selloff, as UPST benefited from the market’s positive sentiments.

Therefore, we are confident that it has staged a medium-term bottom and provides a favorable risk/reward profile. Notwithstanding, we urge investors to be aware that UPST is unlikely to retake its all-time highs anytime soon, as its growth profile has changed dramatically.

As such, we revise our rating from Buy to Speculative Buy, with a medium-term PT of $48.

Be the first to comment