dan_prat

This article was prepared by Eranda Kalhara, CFA and Dilantha De Silva and was published for members of Leads From Gurus on July 01.

Suncor Energy Inc. (NYSE:SU), Canada’s premier integrated energy company operating oil sands mining and offshore oil production facilities, has witnessed a surge in the stock price in 2022 on the back of skyrocketing energy prices. In contrast, back in early 2020, the company took a toll when pandemic-related disruptions wreaked havoc in energy markets. Governments shut down borders and oil prices plunged as lockdowns pushed people to work from home and keep cars in garages and planes at hangers. This situation is reversing today and a host of other geopolitical and macroeconomic developments have aided the recovery of oil prices.

Given all this, the question we are faced with today is whether it is the right time to book the profits of our Suncor investment (model value portfolio) or to remain invested in anticipation of more gains. To answer this, we need to consider the outlook for the global economy, assess the possibility of another oil market shock, and gauge how OPEC’s decision to increase daily production will impact oil prices, thereby Suncor’s profitability.

Suncor was a beneficiary of rising oil prices – what does the future hold?

Suncor has been a clear beneficiary of rising oil prices, and shareholders have so far enjoyed a nice run ever since oil prices started heading higher last year.

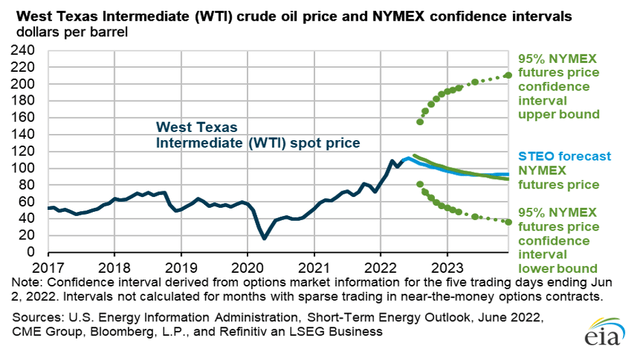

The price of oil bottomed in the spring of 2020 during the Covid-19 market crash, but today, a barrel of oil fetches almost $110 in the U.S. while the average price of a gallon of gasoline recently hit an all-time high of $5.016 compared to $2.77 a year ago. The Russia-Ukraine war has been one of the main reasons behind the surge in oil prices this year as energy giants including Shell, BP and Exxon had to pull out of Russian energy deals while the U.S. and most of its western allies announced bans on importing Russian oil and other petroleum products (the U.S. acquire 8% of crude shipments from Russia).

According to the International Energy Agency, Russia is producing about 15% less than its target of 10.8 million barrels a day for July. This number is expected to decline further due to western sanctions. This situation has challenged the projected supply of oil leading to a supply-demand imbalance coupled with the resurgence of geopolitical risks the market has been highly sensitive to. The challenging situation is expected to continue for a while as we are yet to see any progress on peace discussions. In other words, unusually high oil prices are likely to persist in the foreseeable future.

Exhibit 1: WTI spot prices

Energy Information Administration

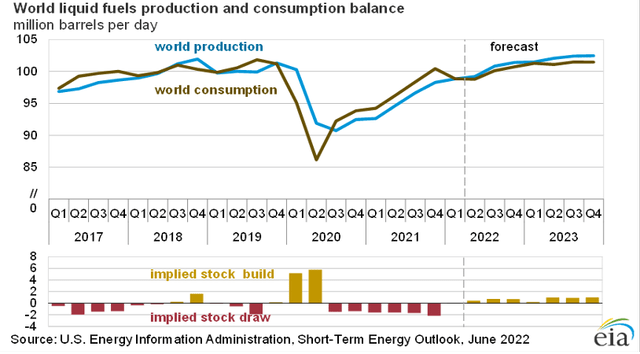

OPEC’s production was slowed down with the pandemic and production has not caught up with the post-pandemic demand either. Energy markets will witness upward pressure on prices until OPEC maintains or exceeds its commitment to the laid-out plan. Despite the OPEC+ announcing plans to increase oil production at the request of Washington to offset the supply from Russia, prices have continued to rise amid the inability of OPEC to fully offset the lost supply from Russia, which does not come as a surprise. The oil cartel has agreed to raise production by 648,000 barrels a day (7% of global demand) in July. However, only a few countries in the group such as Saudi Arabia and the UAE have the required capacity to hike production to the desired levels. Many Wall Street analysts are divided on the proposed production increase as Riyadh does not seem to want to break its five-year alliance on oil matters with Moscow, which is a co-leader of OPEC+.

Exhibit 2: Liquid fuel production vs consumption

Energy Information Administration

American oil producers, on the other hand, are taking a slow approach to expand production as they do not want to see a sudden supply increase leading to a price decline and also a build-up of a massive inventory that would eat into their profits. Large-scale investors are pressurizing these companies to commit to ESG goals as well, which makes it even harder for oil giants to funnel investments into oil production. Commenting on this dilemma, Mace McCain, chief investment officer at Texas-based Frost Investment Advisors, said:

The U.S. oil rig count is currently at 520, after hitting a low of 295 a year ago. We are still well below the 2014 high of 1,609 rigs. The oil majors are reluctant to increase exploratory spending, a trend that’s been growing since 2015.

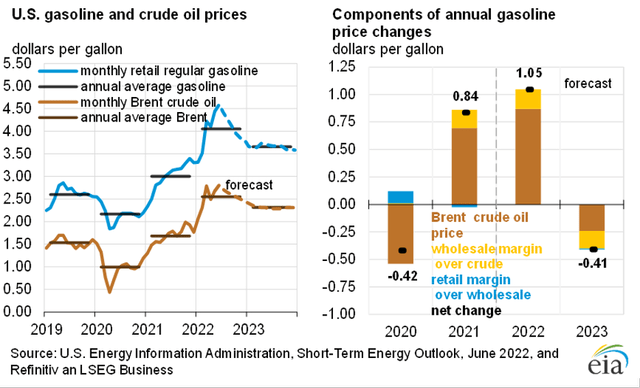

Exhibit 3: Projections for U.S. gasoline prices

Energy Information Administration

Despite the looming recession which will potentially reduce the demand for oil, a significant drop in the price does not seem very likely given all the supply-side issues we are seeing today. The EIA, in its June Short-Term Energy Outlook report, projects WTI averaging $102.47/b in 2022, an increase of more than $4.27/b from its prior estimate in May. The EIA also expects Brent to average $107.37/b in 2022, an increase of $4.02/b from its May projection.

Suncor benefits from its size and integrated operations

Suncor’s business operations can be divided into three main segments: Oil Sands, Exploration and Production, and Refining and Marketing. The Oil Sands segment is focused on the mining and upgrading of oil sands in Canada’s Alberta province to produce refinery-ready synthetic crude oil which includes Suncor’s 54% and 59% stakes in Fort Hills and Syncrude projects, respectively, and contributed to around 42% of 2021 revenue. The company’s base operations include Millennium and North Steepbank facilities and in-situ oil sands operations are at MacKay River and Firebag. Suncor has benefited from its operation capacity of 766,000 barrels of oil equivalent per day and refinery throughput of 436,500 barrels per day in Q1 2022 which is at the higher end compared to some of its peers in the same region. The combined SCO production was 515,000 barrels per day at a 96% upgrader utilization and was supported by In-Situ production of 249,000 barrels per day at 98% utilization. We must appreciate the management on improved reliability, asset optimization, and also the decision to focus on operations in Fort Hills which delivered 88,000 barrels per day of oil production supporting growth momentum in Q1.

Because of its size and scale, Suncor Energy has the luxury of carrying out regular maintenance without severely impacting its daily production. In addition, Suncor benefits from the long life and low-declining oil sands assets. Nonetheless, Canada’s focus on maintaining climate targets on lowering carbon emissions per barrel may pose a challenge to expanding bitumen mining to feed its key oil sands operations in the future. A high geographical concentration of oil-producing assets and focus on the production of crude from the Alberta oil sands (additional costs are associated with the extraction of oil from oil sands compared to production from conventional oil wells) poses a threat to the overall business of Suncor.

The Refining and Marketing business of Suncor – or downstream operations – is carried out with refineries in seven locations and products are marketed through Sunoco and Petro-Canada branded retail outlets (a network of more than 1,500 Petro-Canada retail and wholesale outlets) and this business contributed to around 53% of 2021 revenue. Suncor’s refinery production is heavily weighted towards distillate products. Suncor has continued to strategically expand its logistics network and added 4 kbpd of nameplate capacity to its Edmonton refinery in early 2021. Prevailing macroeconomic conditions helped the LIFO margins of Suncor to show an improvement of 20% in the downstream segment and the contribution from this segment to the revenue of the company can only be expected to increase in the coming quarters, which is good news for investors.

The integrated business model supports the company’s efforts to capture value from both ends while providing the company and its shareholders with downside protection.

Strong Balance sheet driving shareholder value

Suncor Energy has always been able to maintain a strong liquidity position to manage through the commodity price cycle. Currently, the company holds more than C$4 billion worth of liquid assets (cash and cash equivalents of C$2.1 billion). Given the favorable market conditions, the company was able to accelerate debt retirements in recent quarters as well. The company reduced the debt burden by nearly C$730 million in the first quarter to roughly C$15 billion of net debt and expects to achieve a net debt position of C$12 billion by the second half of the year.

On the recent investor call, the management emphasized that the plan is to direct 75% of free funds flow to buying back shares and 25% to debt reduction once the net debt reaches C$12 billion levels and direct 100% of free funds flow to shareholder distributions once the net debt level reaches C$9 billion. In the first quarter of the year, Suncor returned $600 million in dividends and $830 million in share buybacks, which equates to an 11% annualized cash return yield using the Q1 average share price. Suncor’s strong liquidity position will allow the company to sustain its dividend even if oil prices decline from these levels but remain above $50. The company recently hiked the dividend by 12% to 47 Canadian cents per share (after doubling it previously) and increased the buyback authorization to roughly 10% of its public float as well.

Suncor Energy has commenced the sales process of its wind and solar assets (non-core operations) and expects a sale to close within the next 12 months. Proceeds from the liquidation of assets will be used in line with the company’s stated capital allocation policy, meaning that shareholders can expect a pleasant surprise in the form of dividends and/or buybacks in 2023 as well.

External pressures

In 2021, Suncor management rolled out a plan to reduce operational costs by C$1.7 billion over a multi-year period. Suncor has been continuously upgrading its systems and facilities to maintain operational reliability and workplace safety performance at its oil sands operations. The company regularly consults with third-party experts including mining brokers and global safety experts to find new ways to ensure workplace safety, and these do come at a cost to the company. With the changing dynamics in the energy industry, we believe Suncor and its peers will come under a lot of pressure in the future to both reduce its carbon footprint and maintain safety protocols, which could deteriorate the company’s margin profile.

With the new business process and new systems in place, the management expects to incur more costs during the second half of the year but is on track to achieve the mentioned C$1.7 billion cost-saving target. We believe it is too early to predict whether the company will be in a position to achieve permanent cost efficiencies from the current level given the uncertainty in energy markets.

Increasing environmental regulations is also a factor to be considered. As mentioned earlier in the article, Canada’s ever-increasing environmental regulations are targeting the reduction of GHG emissions which will likely limit the growth potential of the company in the medium term. In addition, due to the prevailing political and legal hurdles, Canada’s exploration and production sector has remained out of favor among policymakers, which is not a good sign for Suncor either.

Takeaway

We do not want to make investment decisions on the assumption that oil prices will remain elevated for a prolonged period. This is because we believe geopolitical conditions can change very fast. With a focus on the long term, it makes little sense to make investment decisions based on temporary geopolitical tensions anyways. For this reason, we believe now is not the time to add to our Suncor stake although we believe Suncor will continue to reap the rewards of uncertainty in oil markets for the foreseeable future. We do not want to book our profits at this point either because Suncor seems to be on the right track to reward long-term shareholders handsomely in the years to come. For now, we will hold SU stock and monitor new developments.

Be the first to comment