DisobeyArt/iStock via Getty Images

Decentralized exchanges are one of the proven use cases of blockchain technology. A decentralized exchange enables investors to swap digital assets without an intermediary, such as a broker, in the middle of the transaction. Eliminating the middleman was the founding principle of Bitcoin (BTC-USD) and the decentralized finance (DeFi) movement that followed. Today, numerous decentralized exchanges exist across blockchain-software platforms. Decentralized exchange trading volumes sometimes rival centralized exchanges, such as Coinbase or Binance. Osmosis (OSMO-USD) is the leading-decentralized exchange on the Cosmos (ATOM-USD) blockchain ecosystem, which is designed to become the Internet of Blockchains.

Disrupting Market Makers

In traditional finance, market making is done by professionals working at banks, brokerages, and proprietary trading desks. These middlemen provide liquidity and execute trades on behalf of investors in exchange for earning the difference or “spread” between the bid and ask (i.e., buy and sell) price of an asset. Market makers ensure liquidity and thus a smooth flow of trades on the buy and sell sides of the market, facilitating the experience for investors.

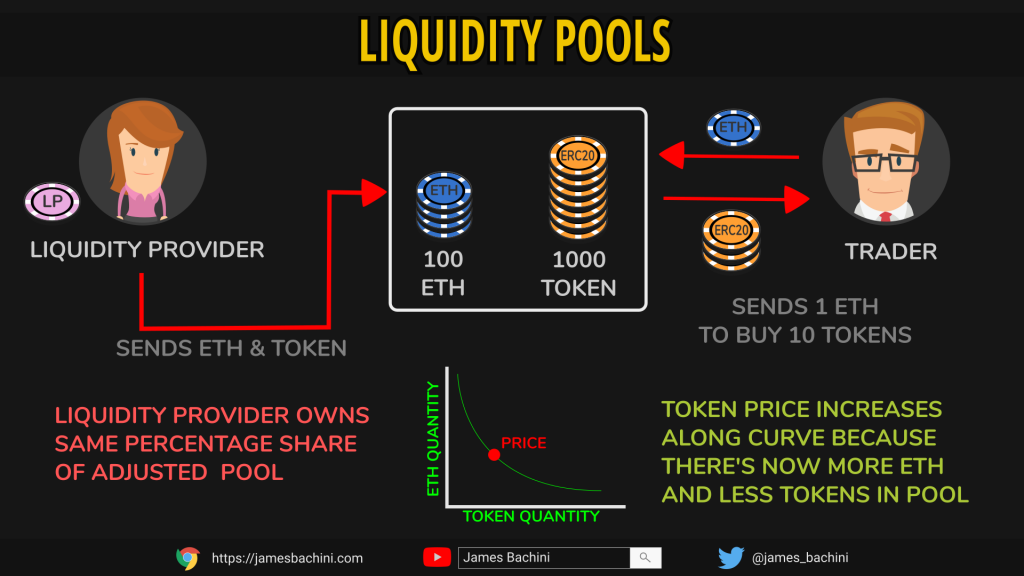

The open, permissionless nature of blockchain has revolutionized market making for crypto assets. Automated Market Makers (AMM), including Osmosis, use open-access liquidity pools instead of traditional, permissioned-access order books to provide liquidity and execute trades for investors. Users who provide liquidity receive the trading fees generated by the liquidity pool (LP), which is represented by an LP token (i.e., a receipt for providing liquidity into the pool). Below is a visual depiction of how these liquidity pools work, using Ethereum (ETH-USD) and a generic Ethereum-based (ERC-20) token as the trading pair:

James Bachini

A permissionless group of users can deposit digital assets and provide liquidity into Osmosis pools, such as the Osmosis-Cosmos two-sided liquidity pair. These decentralized, user-generated pools are the source of liquidity for executing trades programmatically on Osmosis, which is connected to other Cosmos-based chains through the Inter-Blockchain Communication (IBC) Protocol. Eventually, Cosmos seeks to connect all major blockchains through the IBC Protocol, making Cosmos into the Internet of Blockchains.

A Closer Look at Osmosis

Osmosis is a layer one (i.e., base layer) blockchain with its own validator set that secures the chain through Proof-of-Stake consensus. Proof-of-Stake is environmentally friendly compared to the Proof-of-Work system used by Bitcoin and Ethereum. The Osmosis asset is used for staking to secure the network, on-chain governance, and transaction fees. Osmosis offers interoperability with other blockchains using IBC and Axelar. Osmosis seeks to compete directly with the user experience of centralized exchanges, such as Coinbase (COIN) or Binance (BNB-USD).

Osmosis was created by Singapore-based Osmosis Labs, founded in 2021. Both co-founders, Sunny Aggarwal and Josh Lee, helped develop Tendermint, which is the core technology of Cosmos. Tendermint is one of the most widely used consensus engines in blockchain software. Mr. Aggarwal previously created a validator company, named Sikka, in Berkeley, Calif. Mr. Lee developed Keplr, which is the leading Cosmos-based, self-custodial wallet. Today, Osmosis Labs develops and supports Keplr in addition to Osmosis.

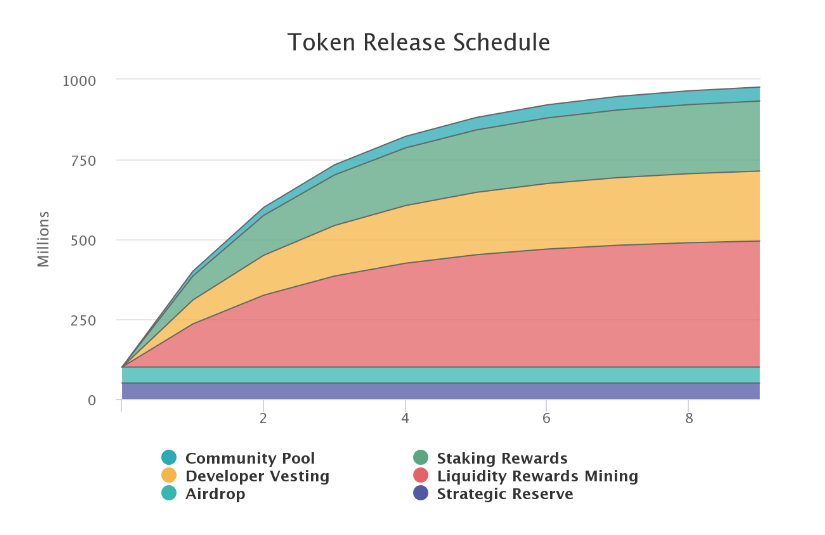

Starting in June 2021, OSMO token emissions are allocated over nine years under a “thirdening” schedule like Bitcoin’s “halvening,” whereby the rate of new coins created is cut in half every four years. New OSMO issuance is cut by one-third every year, and the supply gradually reaches a fixed total of one billion tokens, as shown below:

Osmosis Labs

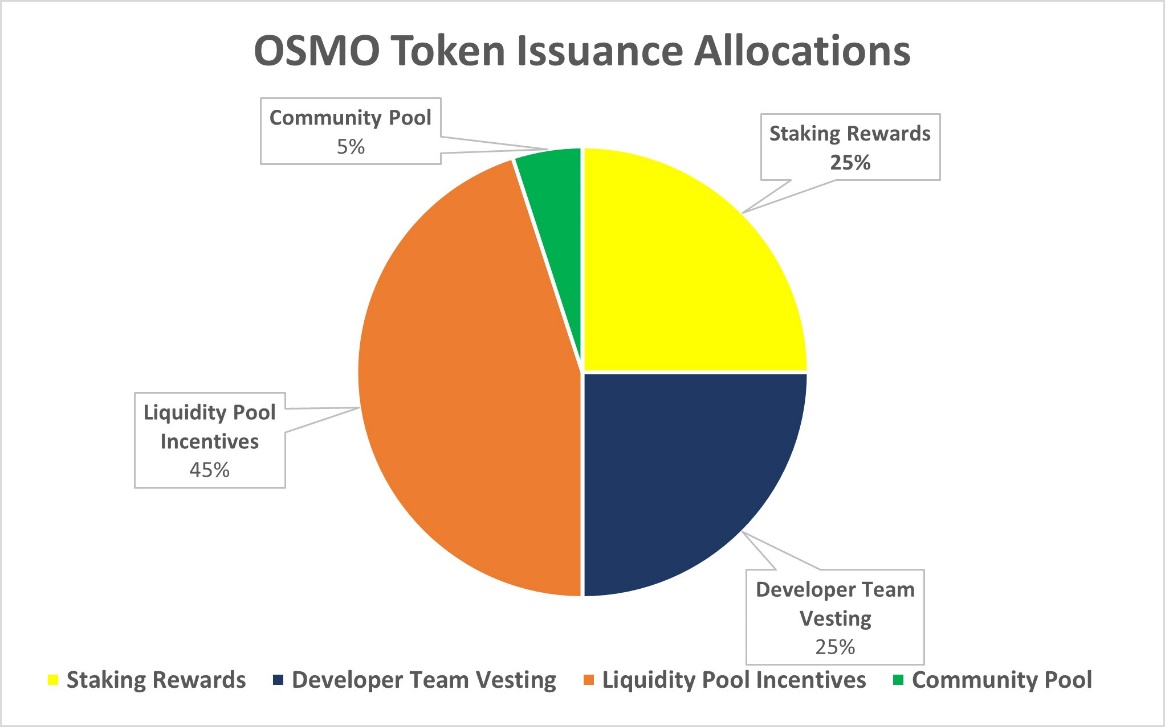

New token emissions are allocated as follows:

Data from Osmosis Labs

(Further detail on token distribution is available in this Osmosis blog post)

The team deliberately chose to avoid listing OSMO on any centralized exchanges, since the project seeks to compete directly against these services. Accordingly, new OSMO buyers must know how to use a self-custodial crypto wallet like Keplr. One common route for new buyers is to acquire Cosmos on Coinbase or Crypto.com, send ATOM to a self-custodial Keplr wallet, then deposit and swap ATOM for OSMO on the Osmosis app. OSMO can also be obtained as a reward for providing liquidity and staking to secure the network. Variable staking rewards are about 30 percent annual percentage yield, as of this writing.

Despite not being listed on any centralized exchanges, OSMO is ranked in the top 150 coins by market capitalization, according to Coin Gecko. In addition, the Osmosis exchange is ranked in the top 20 percent of 240 decentralized exchanges currently tracked by Coin Gecko, based on daily trading volume across all blockchains. Osmosis is number one in terms of dollar volume transferred across Cosmos chains using the IBC interoperability protocol, ahead of the Cosmos Hub itself, according to Map of Zones.

Osmosis is open-source software built using the Cosmos Software Development Kit (SDK) under the Apache 2.0 License. Unlike Bitcoin and Ethereum, Cosmos-based chains offer fast, environmentally friendly, low-cost transactions through Proof-of-Stake consensus. All OSMO holders may delegate their tokens to Osmosis network validators, who stake the tokens on a holder’s behalf. Staking secures the network.

Delegation is required to participate in on-chain governance and earn staking rewards, less a validator commission. If OSMO holders who delegate do not vote, they inherit the vote of their validator. Staking rewards can be claimed at the end of each daily epoch. OSMO stakers receive daily staking rewards from token emissions over the nine-year schedule and transaction fees indefinitely.

Looking Ahead: A Long And Winding Road

Initially, Osmosis has its own validator set securing the network and operates as a sovereign, base-layer chain within the Cosmos ecosystem. When the Cosmos Hub launches its shared security feature, which is expected in late summer or early fall 2022, Osmosis plans to pivot to become a shared-security client of the Cosmos Hub. This means that Osmosis would no longer be its own chain with its own validator set. Rather, Osmosis would become a client chain of the Cosmos Hub that uses the hub’s validator set for security. This plan is subject to approval by on-chain governance, where one token equals one vote.

After main net deployment and the initial OSMO distribution, the Osmosis Foundation treasury raised $21 million from a private token sale in October 2021. The participants were six accredited and/or institutional investors, including Robot Ventures, Nascent, Do Kwon, Figment, Paradigm, and Ethereal Ventures. Paradigm was the lead investor.

Osmosis plans to introduce blockchain front-running protection by the end of 2022 through an encrypted transaction-memory pool. Osmosis would be the first decentralized exchange to implement this feature, according to co-founder Sunny Aggarwal. A secondary Osmosis-based token named ION (ION) has utility to be determined in the future. At network launch, ION was airdropped to ATOM holders who had voted in on-chain Cosmos governance or delegated ATOM to the Sikka validator.

Security Incidents And Risk Considerations

On June 7, 2022, Osmosis experienced an exploit of around $5 million from a bug in the latest software upgrade. The Osmosis blockchain was temporarily frozen through an emergency action taken by the network validators to stop further losses and provide time for remediation. The software code was fixed, and the chain is up and running without further incidents. Most actors involved in the exploit are cooperating to return misappropriated funds. The team plans to absorb any unrecoverable losses through the developer-team fund. Thus, no user funds will be lost.

The Osmosis software code has not been audited, as of this writing. However, the first round of audits is under way. While there have been no regulatory actions taken against Osmosis Labs, the U.S. Securities and Exchange Commission is investigating a similar entity behind a decentralized-exchange platform named Uniswap.

Osmosis has 135 validators, as of this writing. Out of 135, the top 10 validators control about 42% of OSMO delegated, based on data from the Keplr wallet web app. Thus, the network validator set is not as decentralized, based on voting power, as it could be given the availability of 135 validators. Greater decentralization would ensure that the network is more secure against attacks by a cartel of malicious validators.

Conclusion

Traditional market making is a lucrative business for banks, brokerages, and proprietary trading desks. Until blockchain, it was infeasible for individuals to participate in market making. A decentralized exchange like Osmosis cuts out the middleman and gives the value of crypto market making to users and investors. Osmosis is not only the leading decentralized exchange, but also the leading application-specific chain on Cosmos by interchain transaction value.

The product roadmap includes compelling developments, such as front-running protection through a private, encrypted transaction queue. Osmosis is supported by a talented developer team, and it has secured venture funding and support services from highly regarded investment funds. Crypto investors seeking exposure to decentralized finance may want to take a position in Osmosis and also try using the protocol directly to learn more about this innovative application of blockchain technology.

Be the first to comment