Daria Nipot

Amazon.com, Inc. (NASDAQ:AMZN), the world’s largest e-commerce company, has lost nearly half of its market value this year, with the company exiting the trillion-dollar club last week. It is the first time Amazon’s market capitalization has fallen below the $1 trillion mark since April 2020. The pandemic surge is waning, and the current challenging economic situation is weighing down the company’s profitability. Amazon missed earnings estimates for the third quarter and provided a bleak outlook for the current quarter as well. The e-commerce industry is generally experiencing slow demand and revenue declines, primarily due to supply chain issues. As the challenges are far from over, and the Fed continues to raise rates, investors are concerned that Amazon’s growth will come to an abrupt halt in the coming quarters. On November 2, the Fed announced its fourth consecutive interest rate hike of 75 basis points. Although the Fed has indicated that it may reduce the size of its rate hikes beginning in December, many Wall Street analysts expect the economy to enter a shallow recession in the first quarter of 2023.

Amazon has been the fastest-growing big tech company for over a decade, which makes now a good time to revisit the company to evaluate whether we are nearing an inflection point in Amazon’s growth story.

Third Quarter Business Highlights and Outlook

E-commerce is Amazon’s largest revenue generator, explaining why the company has been hit hard this year by high inflation and rising interest rates, which are limiting consumers’ spending power and increasing costs. Despite this, the company managed to deliver 15% top-line growth in Q3, with total revenue of $127 billion. Amazon’s international revenue growth has slowed because of the volatile exchange rates. The worsening economic environment in Europe because of the Ukraine war and the energy crisis is also having an impact on international demand. Consequently, international sales fell 5% YoY to $27.7 billion, while North American sales increased 20% YoY to $78.8 billion in Q3. Excluding volatile foreign exchange, international sales increased by 12%. However, the company is still investing in expanding its footprint. During the quarter, Amazon officially launched Amazon.com.be in Belgium, with an initial inventory of 180 million products.

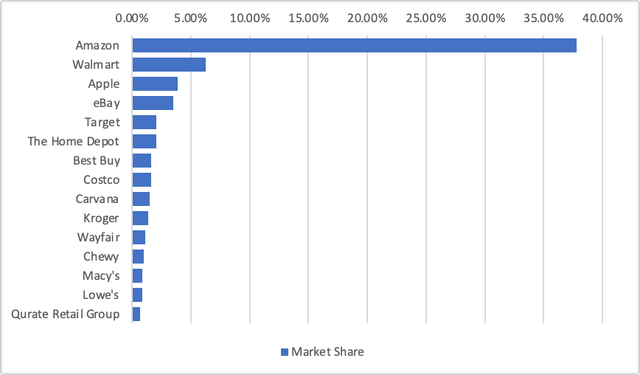

E-commerce companies enjoyed favorable macroeconomic conditions in the last two years as people increasingly relied on online stores for the convenience they provided during the public health crisis. However, e-commerce growth has since declined as consumers have returned to shopping in person. This does not mean that the best days for e-commerce companies are over; in fact, there are numerous opportunities for long-term gains. And, Amazon continues to dominate the e-commerce market, despite rising competition.

Exhibit 1: U.S. e-commerce market share as of June 2022

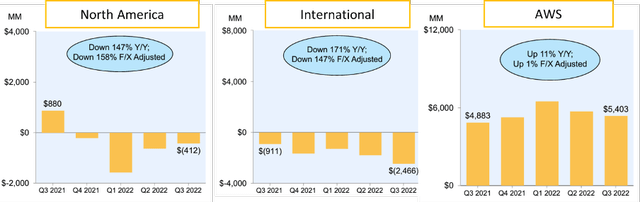

Apart from the company’s e-commerce business, Amazon’s cloud business also fell short of expectations as customers cut back on spending. Amazon Web Services (AWS) sales increased 27% YoY to $20.5 billion but fell short of analyst expectations. AWS accounts for less than 20% of Amazon’s total revenue but has been the company’s growth engine in recent years. The slowdown in AWS is a concern for investors because the segment has been responsible for the company’s growing operating income so far in 2022, while other segments have reported losses. This means that if this slowdown continues, Amazon’s profitability will suffer in the coming quarters. AWS is also dealing with high energy bills cutting into its operating income.

Exhibit 2: Operating income by segment

As cloud growth slows, the company has slowed its hiring in AWS. Amazon, however, continues to invest in its expansion. AWS launched its second cloud data center region in the Middle East (UAE) during the quarter. The company released three serverless services in July to help customers deploy data-analytics tools without having to configure, scale, or manage the underlying infrastructure. AWS also announced a new partnership and investment with Harvard University to advance fundamental research and innovation in quantum networking, with a focus on applications to combat privacy and security threats. At the Harvard Quantum Initiative, AWS also announced the AWS Generation Q Fund to train the next generation of quantum scientists and engineers.

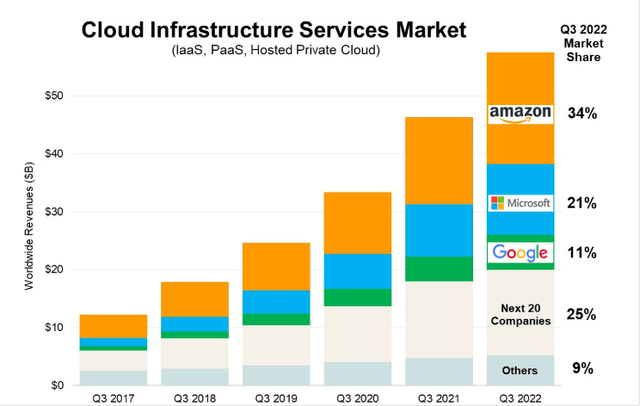

The overall cloud infrastructure market remains strong, with Synergy Research Group data showing that enterprise spending on cloud infrastructure services exceeded $57 billion in Q3, up 24% YoY. Amazon controls 34% of the market, followed by Microsoft Corporation (MSFT) (21%), and Google (GOOG) (GOOGL) (11%).

Exhibit 3: Q3 market share of top 3 cloud infrastructure companies (2017-2022)

Although Google is the only one of the top three companies to report higher-than-expected cloud revenue in the most recent quarter, AWS remains the market leader and has been named a leader in the Gartner Cloud Infrastructure & Platform Services (CIPS) Magic Quadrant for the 12th consecutive year. Despite the difficult environment, cloud migration will continue, and spending will eventually increase, propelling the cloud computing industry to a trillion-dollar market by 2030.

With Amazon’s two fastest-growing segments slowing, its advertisement segment outperformed expectations in Q3, while its peers’ ad revenue remains under pressure. Every tech company depending on ad revenue has reported reduced spending as businesses cut marketing budgets due to decreased customer demand and purchasing power. However, Amazon’s advertising revenue grew by 25% YoY, generating $9.5 billion. With 2.4 billion combined desktop and mobile visits, Amazon is by far the most visited e-commerce platform in the United States, and more than 50% of visitors are between the ages of 18 and 34, making it an appealing place for the majority of sellers to market their products.

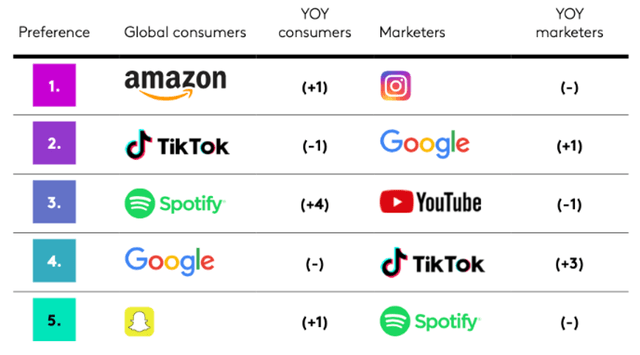

Amazon is also expanding its advertising opportunities through its media assets such as the Prime streaming platform, Twitch streaming, and Fire TV. Product placement in films and television shows provides brands with an excellent opportunity to capture target markets and promote their products. According to Sortlist research, customers are sold an average of 12.61 products per movie. Given the benefit, virtual product placement is now being used by streaming platforms to allow more advertisers to place and monetize content. According to a Wyzowl survey, 73% of people prefer to watch short video ads, 88% say brand video ads convinced them to buy a product or service, and 87% of video marketers say video in general provides a good return on investment. Kantar’s Media Reactions 2022 survey, based on media insights from over 18,000 consumers and 1,000 senior marketers worldwide, reveals that consumers find ads on the Amazon platform more “relevant and useful” than others, making it the most preferred ad platform among consumers.

Exhibit 4: Top-ranking media brands for advertising

Amazon earned $2.9 billion in net income in the third quarter, including a $1.1 billion gain from its equity stake in electric vehicle manufacturer Rivian Automotive (RIVN). The company intends to cut its capital expenditures budget for this year by one-third, including halting hiring in certain businesses and discontinuing products and services that it believes are unprofitable to redirect those resources elsewhere. The company has spent heavily in the last two years expanding its fulfillment and logistics network to meet high demand during the pandemic, and it is now taking steps to keep up with rising costs. As the company’s core business continues to suffer, the company forecasts fourth-quarter revenue of $140 billion to $148 billion, representing 2% to 8% year-over-year growth.

Takeaway

Amazon’s stock price continues to fall as investors expect the company to perform far below expectations during the holiday season. However, Amazon has diversified into several rapidly growing markets such as cloud services, streaming video content, and the advertising market while maintaining its leadership in e-commerce. Amazon is a strong, healthy business with a long runway for growth, although the company might face short-term hurdles that would mask its growth potential in the short run. Amazon is increasingly becoming cheaply valued, presenting a good opportunity for growth investors.

Be the first to comment