ipopba

Investment Thesis

Digital Turbine, Inc. (NASDAQ:APPS) jumped +25% as investors welcomed its fiscal Q2 2023 GAAP EPS results.

Six weeks ago, I wrote a bullish article on Digital Turbine that had as two of its bullet points:

- It’s very easy to be bearish on a stock that has been nothing but a disappointment for most. But the market doesn’t care about the past, it’s all about the future.

- Digital Turbine has seen its multiple compress. Perhaps justifiably. But even though APPS stock is down, it isn’t out.

And this is exactly where I continue my bull case.

What’s Happening Right Now?

The adtech space has been brutalized and left on its knees. Across the board, investors in adtech have experienced a horrendous 2022.

The main companies in advertising that have so far reported have provided disappointing guidance for Q4. From Alphabet (GOOG, GOOGL) to Meta Platforms (META) to Snap (SNAP) – even reports from coming out of TikTok (PRIVATE) appear to echo that sentiment.

It’s not about losing market share as much as it’s about the advertising market going into a tailspin as we head into the upcoming quarters.

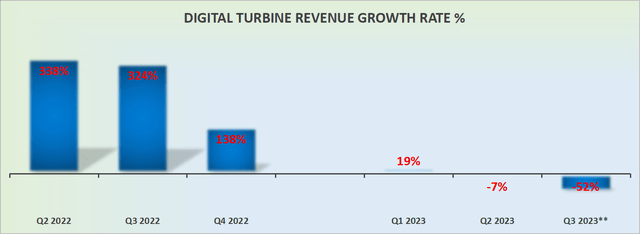

Revenue Growth Rates Turn Negative

As you can see above, on an ”as-reported” GAAP revenues basis, Digital Turbine is guiding for negative 52% y/y revenue growth into fiscal Q3 2023.

Digital Turbine looks set to lose half its revenue base headed into fiscal Q3 2023.

On a positive note, this is what Digital Turbine stated on the call about its flagship product, SingleTap,

Google will be selling our SingleTap licensing product in its Google Cloud Marketplace. This is a yet another benefit of the strategic partnership we announced with Google and our joint press release last year. We also anticipate launching with the other two higher profile partners during this current quarter.

For investors that were concerned that Alphabet would seek to disrupt Digital Turbine’s business model, to see this partnership gaining traction is clearly welcome.

Profitability Profile Set to Improve

As a reminder, Digital Turbine has maintained for some time that after its 3 acquisitions last year, Digital Turbine would be able to carve out a path to robust profitability. And very few investors were willing to give any credence to these proclamations.

But in fiscal Q2 2023, Digital Turbine saw its bottom line report a ”clean” GAAP EPS figure of $0.11. For companies in tech, a GAAP profit is virtually unheard of.

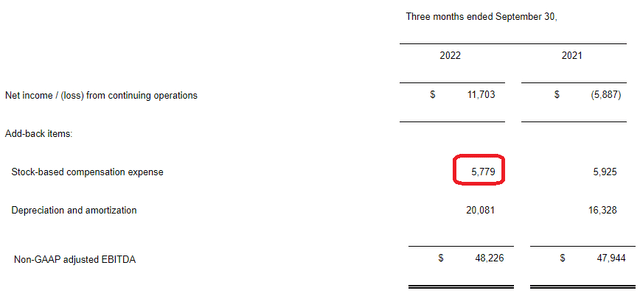

Along these lines, consider the following table, showing Digital Turbine’s share-based compensation (“SBC”) expense.

Digital Turbine saw its SBC expense come down YOY!

I simply don’t know what to make of this. On the one hand, that’s great. But on the other hand, how does one go about retaining key executives, if your stock is down so much, and you are paying them less in SBC?

Consequently, I question the sustainability of this practice.

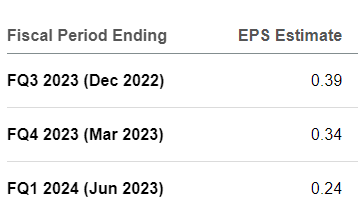

Moving on, looking ahead, Digital Turbine guides for $0.39 of EPS at the high end over the all-important holiday season. This is not pointing to anything that The Street wasn’t also expecting.

APPS consensus estimates

As you can see here, analysts were expecting to see $0.39 of non-GAAP EPS, and that’s exactly what Digital Turbine guided for too.

APPS Stock Valuation — Priced at 8x EPS

If yesterday I told you that APPS was cheaply valued, your response would have been, so what? It has been cheaply priced for months. And, for months, nobody cared. We all knew it was cheap.

And we all know that, compared with The Trade Desk (TTD), it has always been cheap. But this had no impact on anyone.

But today, investors appear to be looking to APPS with high enthusiasm, as it prints a clean GAAP EPS figure this quarter.

The Bottom Line

Despite being bullish on this name, I hope you’ll allow me to highlight some bearish considerations to keep in mind.

Perhaps, my biggest consideration is this: can this adtech business thrive when, across the advertising sector, one company after another notes the deteriorating economic environment as we head into 2023?

Is Digital Turbine truly more immune within the advertising sector than the likes of Alphabet? If Alphabet is priced at 16x next year’s EPS, with its robust moat around its Search operation, can we truly be justified in paying for 8x forward EPS for Digital Turbine?

For now, I don’t believe investors need to be unduly concerned about these investment risks. For now, these will simply linger in the background for Digital Turbine.

Be the first to comment