courtneyk

Co-produced with “Hidden Opportunities”

Bear markets can be depressing. The unrealized capital gains you were proud of tend to disappear, your portfolio value shrinks, and all you see is news forecasting the worst. Investor forums are filled with comparisons with the Dot-com bubble and the Great Financial Crisis. In this case, dealing with 40-year high inflation levels, we see parallels with the financial crisis in the 1970s.

A year ago, Wall Street was closely watching and reporting COVID-19 case counts from around the world daily. Today, we see a wide range of commentary about the CPI, PCE, and other inflation reports, data that we hardly paid any attention to 2 years ago. Soon, mainstream media will shift to the next bad news. If you keep adjusting your portfolio in reaction to these coverages, you are just giving away your money.

Wall Street makes money, one way or another, catching the crumbs that fall off the table of capitalism. They don’t make money unless people do things, and they get a piece of them. They make a lot more money when people are gambling than when they are investing. – Warren Buffett

Wall Street wants you to make poor decisions by letting you believe that the world is ending. If you are in the market looking for passive income, there is no better time to be a buyer than at present. This bear market, due to surging interest rates, is a gift. Don’t get depressed thinking about your declining portfolio value. Remember, markets go up in the long term, and your portfolio values will recover eventually. But if you are a buyer now, you can set up a more significant income stream by spending less.

Pessimism is the friend of the long term investor, euphoria the enemy – Warren Buffett

There is a more fantastic opportunity to invest in higher yields today than you could at the beginning of the year. What makes things better is that many leading companies have raised dividends this year, so you are getting a raise for staying invested. In the spirit of growing your passive income, we discuss two picks with a solid value proposition, proven dividend stewardship, with inelastic demand for their goods and services.

Pick #1: VZ, Yield 6.9%

Telecom is almost as critical as any other utility in today’s digital world. You may have heard of the Rogers Communications (RCI) outage in Canada earlier this year which impacted everything from banking and commerce, emergency services, healthcare, border protection, and other government agencies. This is how crucial wireless connectivity is in today’s economy. This industry is a very defensive sector that will experience inelastic demand with economic fluctuations. In the event of a recession, we can expect consumers to cut costs, but cell phone bills will not be the first to get slashed.

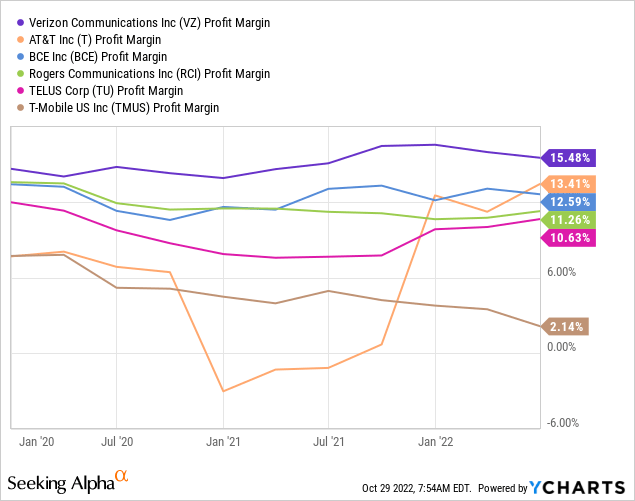

Verizon Communications Inc. (NYSE:VZ) is the largest U.S. wireless telecom company by subscriber count. The U.S. wireless market is highly consolidated, with the big three having ~95% market share. The network of assets owned by these corporations is designed to provide reliable coverage and connectivity to millions of Americans across a wide range of geographic diversity. VZ has consistently maintained the highest profit margins among North American telecom companies.

Verizon isn’t the cheapest wireless service provider out there, and subscribers rarely praise the company for budget-friendly pricing. However, the company is consistently rated well for its coverage quality and high speeds. It must be noted that VZ is still catching up to its peers to provide the same level of coverage quality with 5G as it does today with 4G.

Verizon’s strength lies in its partnerships with businesses to unlock the best that wireless technology offers. Recent developments in this include:

-

VZ’s partnership with Visionable is to build a digital healthcare collaboration platform that enables healthcare professionals to access data, collaborate and share resources within the APAC and EMEA regions.

-

VZ was recently awarded a $158 billion contract to modernize U.S. embassies. The 10-year contract is to modernize global communications infrastructure and provide IT services for the Department of State’s (DOS) U.S. embassies, consular, and other key locations around the globe.

-

VZ’s public sector won a $400 million contract from the Federal Bureau of Investigation (FBI) to increase 4G/5G speeds, network availability, and service continuity to help the agency meet increasing demands for data bandwidth around the globe.

-

VZ’s recent collaboration with Lockheed Martin (LMT) on 5 G-powered drone projects establishes ultra-secure and reliable connections for transferring high-speed, real-time intelligence, surveillance, and reconnaissance data. This is being designed to aid the U.S. Army in detecting and geolocating military targets.

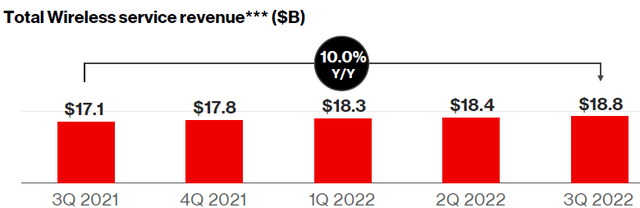

Q3 marks the 5th consecutive quarter that VZ Business reported more than 150,000 postpaid phone net additions. Driven by strength in its business segment, the company reported a 10% YoY revenue growth in total wireless service. (Source: 3rd Qtr Earnings – Oct. 21)

Verizon 3Q Results

The best dividend is one that has been raised. VZ recently announced a 2% raise to its dividend, making it the 16th consecutive annual increase. 9-month Adj EPS of $3.65 adequately covers its YTD dividend of $1.9725 with an excellent 54% payout ratio. The telecom giant’s balance sheet carries an A- credit rating from Fitch, and its unsecured debt to adj. EBITDA stood at a healthy 2.7x at the end of Q3 2022. The company projects 8.5-9.5% growth in its wireless business for FY2022, and its full-year EPS guidance indicates a healthy 50% payout ratio.

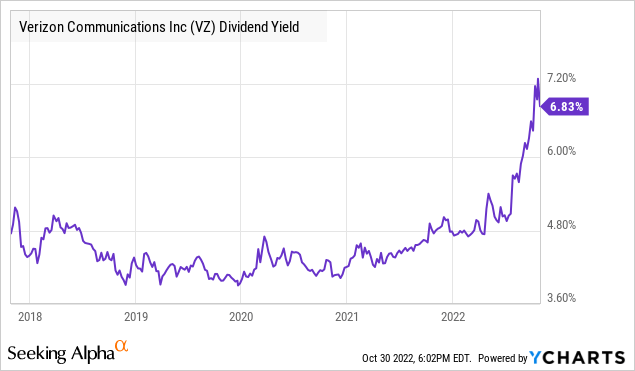

VZ’s current $0.6525 quarterly dividend calculates to a 6.9% annualized yield. This is the highest yield from the company in over ten years, presenting a very attractive opportunity for income investors.

Verizon is providing services that form the backbone of digital transformation in America.

Wireless connectivity is the heartbeat of the digital economy, and VZ is a 6.9% yielding wide-moat entity with solid operating fundamentals. High yields from this quasi-utility company won’t last long.

Pick #2: BTI, Yield 6.3%

If we are staring down the barrel at an upcoming recession, there is no better place to invest than good old tobacco. Studies tell us that smokers continued to smoke and increased their cigarette intake during recessions and associated periods of economic difficulty.

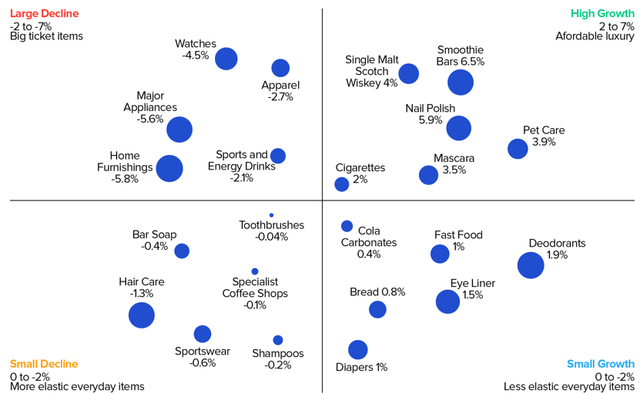

Recession-proof industries either provide an absolute necessity that consumers will always keep purchasing or have characteristics that are conducive to experiencing increased demand in downturns. In the eyes of a consumer, tobacco products represent both and experience inelastic demand. The chart below shows consumer goods during the Great Financial Crisis, and it is not surprising to see cigarettes included in the list of High Growth names. (Source)

Toptal

Here is an early 2010 article about British American Tobacco p.l.c. (NYSE:BTI), the largest global tobacco company.

The Guardian – 2010

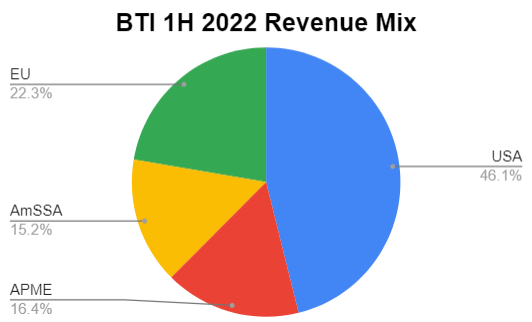

Unlike other big tobacco companies, BTI’s business is well diversified, with a healthy geographic distribution of revenues. Source

British American Tobacco 1H 2022 Report

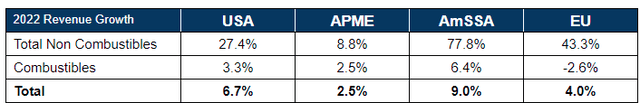

The company’s new product category, including e-cigarettes and nicotine products, continues to see explosive growth in every market and is well-positioned to be a leader in this space with very few big players. For example, BTI’s nicotine pouch brand Velo maintains market leadership in 15 out of 17 European markets. Source

British American Tobacco 1H 2022 Report

While Main Street continues to think cigarettes are a dying industry, I am here to tell you that BTI’s combustible segment saw 2.3% revenue growth. This is primarily due to their dominance in Pakistan, Brazil, and Bangladesh, where traditional smoking is still considered cool.

Double-digit growth in new category revenues is evidence that this tobacco giant is successfully pivoting its product category. BTI is on track to deliver £5 billion in New Category revenue and achieve segment profitability by 2025. The company can use its predictable cash flow from its combustible business to fuel the growth into these new and attractive categories. Additionally, BTI has been growing its footprint in the cannabis world. The company recently took a non-controlling minority stake in a German cannabis company. This is the second major venture in this space after the strategic collaboration with Canadian marijuana producer Organigram in 2021.

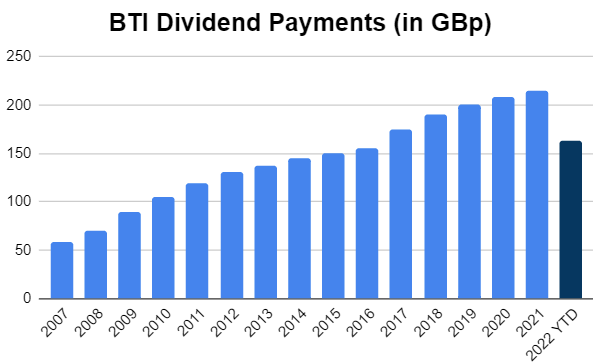

BTI is a solid dividend steward, with growing distributions since 2007.

Author’s calculation

The company is pursuing an attractive share buyback program of up to £2 billion. As of 30 June 2022, the company has repurchased 37,657,945 ordinary shares for £1.3 billion. The company’s 54.45p quarterly dividend calculates to a 6.3% annualized yield (US$0.6311/qtr – Oct. 26, 2022).

Note: BTI pays dividends in GBP. The GBP is currently weak against the U.S. Dollar and can result in lower distributions due to unfavorable conversion rates.

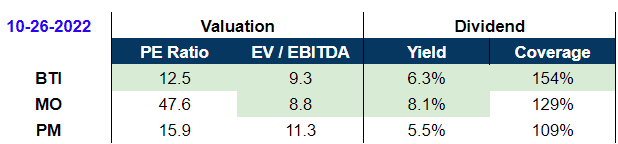

BTI is the cheapest valued and has the best dividend coverage compared to other big tobacco peers.

Author’s calculation

BTI has proven pricing strength in challenging economic conditions. The company is successfully pivoting to new product categories that are more appealing to the younger population and increasingly being accepted by regulators across the globe. It is time to buy this 6.3% yield cash cow for its recession-resistant and favorably transforming business.

Dreamstime

Conclusion

There will be bull and bear markets. Irrespective of market movements, you always win as long as you have regular cash flow. Passive income is critical to controlling your financial freedom, including your retirement.

With passive income, you can rely less on your paycheck, stay less stressed and anxious about the future, and learn to enjoy life in the moment. It provides tremendous potential for personal growth and well-being and gives you more time to spend with your loved ones.

Money may not bring happiness by itself, but passive income has the potential to take you one step closer to it. Want to retire early? This bear market is the perfect opportunity to enable that. Two significantly discounted picks with high yields and growing annual dividends to fuel your rocket ship to early retirement.

Be the first to comment