VioletaStoimenova

The Industrials sector has not been weathering volatility well lately. FedEx recently had a bearish earnings preannouncement, and the overall transports space portends bearish moves in the overall market. Professional services, tied to the labor market, might hold up a bit better given surprising strength with employment. One firm within that industry reports quarterly results this week, and I see upside risks.

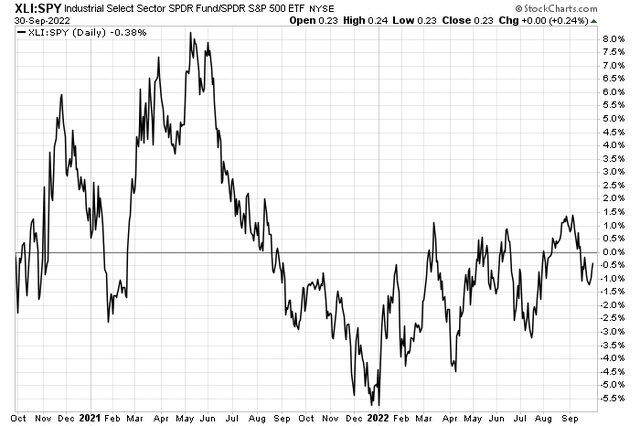

Industrials Struggle vs SPX in September

StockCharts

According to CFRA Research, Resources Connection, Inc. (NASDAQ:RGP) provides consulting services to business customers under the Resources Global Professionals name in North America, Europe, and the Asia Pacific.

The company offers services in the areas of transactions, including integration and divestitures, bankruptcy/restructuring, going public readiness and support, financial process optimization, and system implementation; and regulations, such as accounting regulations, internal audit and compliance, data privacy and security, healthcare compliance, and regulatory compliance.

The California-based $610 million market cap Professional Services industry stock trades at a low 9.0 trailing 12-month price-to-earnings ratio and pays an above-market 3.1% dividend yield, according to The Wall Street Journal.

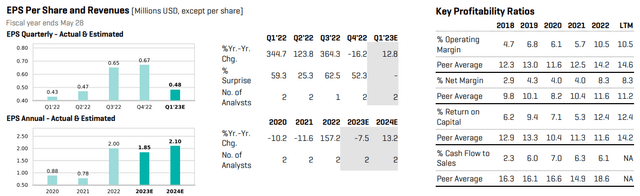

On earnings and valuation, RGP is expected to see a decent year of EPS growth in 2024 while 2023 earnings may dip. This coming quarter’s per-share earnings would be a significant increase from the same period a year ago, though. Seeking Alpha rates Resources Connection’s valuation with a solid B rating, but growth could be limited – it garners a D rating. Still, profitability and momentum are positive for RGP. With a forward P/E of under 10 and a forward price to free cash flow multiple of under 9, shares are a good value.

RGP: Earnings Outlook & Key Profitability Ratios

CFRA Research

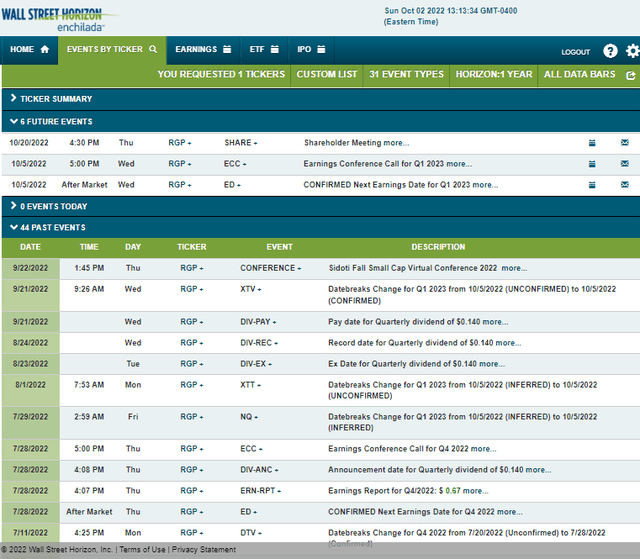

Looking ahead, corporate event data provider Wall Street Horizon shows a confirmed Q1 2023 earnings date of Wednesday, Oct. 5 AMC with a conference call immediately following. You can listen live here. The action does not end Wednesday evening; Resources Connection has a shareholder meeting on Thursday, Oct. 20 that could bring about some stock price volatility.

Corporate Event Calendar

Wall Street Horizon

The Options Angle

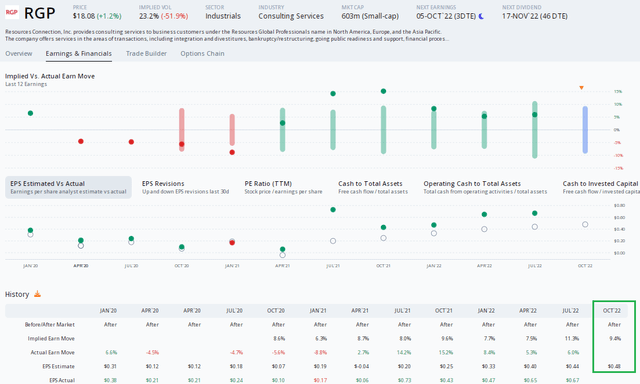

Digging into the upcoming Q1 profit report, data from Options Research & Technology Services (ORATS) show a consensus EPS estimate of $0.48. That would be a 10% increase from the per-share profit figure reported in the same quarter a year ago.

In terms of the expected stock price reaction, the nearest-expiring at-the-money straddle implies a 9.4% move. That would be the biggest post-earnings share price change in a year, but it is not out of the ordinary in terms of historical swings. What’s bullish, though, is that RGP has traded higher in each of the past six earnings reactions – and every one of those moves corresponded to a bottom-line beat.

Going long calls here could make sense based on the trend and favorable valuation. But do the technicals agree?

A Strong EPS Beat Rate & Stock Price Reaction History

ORATS

The Technical Take

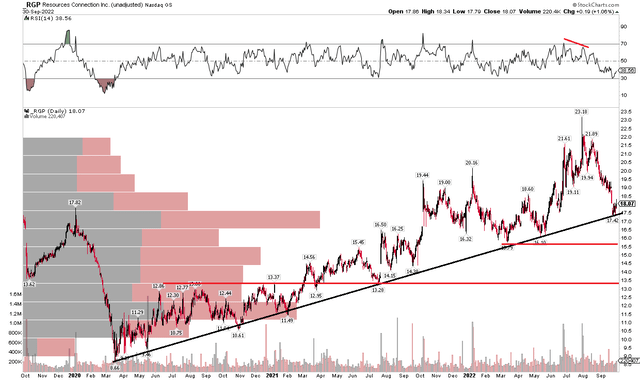

Now could be a great time to pick up RGP shares. The stock has pulled back to trendline support and there is significant support via high volume at the current range, as measured by the volume-by-price metric (left side of the chart).

Notice that RGP had bearish negative divergence when it notched a new rebound high in early August. That indicator proved correct, and a swift decline back to its trendline came in short order.

If the stock breaks support, however, expect next support to come into play near $16. More significant support appears to be near $13. Buying here with an initial target back to the high of $23 looks like a favorable risk/reward play.

RGP: Shares Retreat to Trendline Support

StockCharts

The Bottom Line

RGP is an inexpensive Industrials stock ahead of its earnings report Wednesday. It has a bullish earnings stock price reaction history and options are not overly pricey. Short-term traders can go long calls or longer-term investors can simply buy shares as the stock is at support and the company is attractively valued.

Be the first to comment