FatCamera

Shares of Repare Therapeutics (NASDAQ:RPTX) have lost roughly a quarter of their value since IPO was priced at $20 in June of 2020. Over the past year, the stock has lost roughly half its value.

Opportunistic licensing deal inked with Roche at the beginning of June for lead oncology candidate camonsertib drew my attention here, as the influx of cash allows the smaller company to aggressively pursue additional high-value synthetic lethality targets in its pipeline with operational runway into 2026.

As this is a theme I’ve wanted to gain exposure to for some time, I believe Repare is worth learning more about due to its derisking data for lead asset, multiple big pharma partnerships and accelerating clinical momentum as novel targets move forward in phase 1 and late pre-clinical stage development.

Chart

Figure 1: RPTX weekly chart

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see shares hit a high of $45 before gradually declining to a low of $8. The stock rebounded significantly on news of Roche partnership at the beginning of June, but even there we can see share price remains substantially depressed versus levels it touched previously. My initial take is that investors interested in this name would do well to initiate a pilot purchase and from there accumulate dips 2H 22 ahead of initial data readout for second drug candidate RP-6306. To manage risk appropriately, I suggest holding off on amassing a full-size position until after that data set comes out due to early-stage nature of the asset.

Roche Collaboration Call

Camonsertib is an oral ATR inhibitor with potential to address several cancers as monotherapy and in combination with other agents. Camonsertib is designed to treat cancers with DNA damage response or DDR defects and high replication stress. This drug candidate is their first clinical stage asset and entered human studies in July 2020.

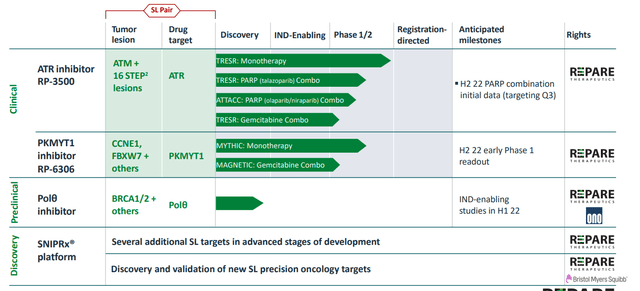

Figure 2: Pipeline

ATR is a critical damage response protein and plays a central role in regulation of cell replication stress. Data from phase 1/2 monotherapy trial demonstrated promising signs of activity including early proof of concept in ovarian cancer.

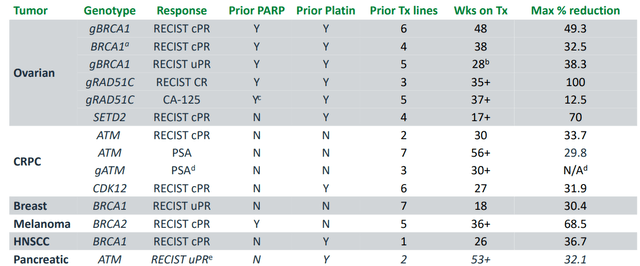

Figure 3: Monotherapy results in median duration of treatment of ~8 months

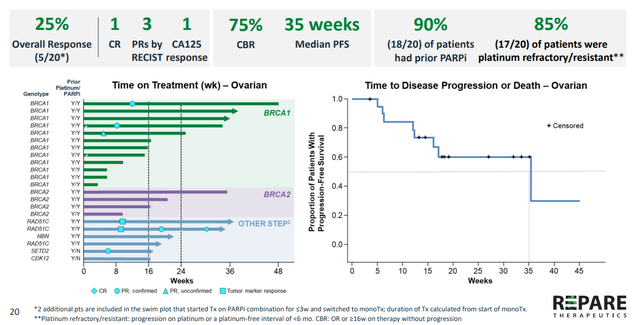

Figure 4: Proof of concept achieved in ovarian cancer with clinical benefit demonstrated in heavily pretreated patients including those who received prior platinum & PARP

In addition to ongoing monotherapy trials, they also have multiple combination studies underway with PARP inhibitors and chemotherapy (strong rationale for additional combos such as radiotherapy, immunotherapy and other DDR agents such as in-house PKMYT1 inhibitor RP-6306).

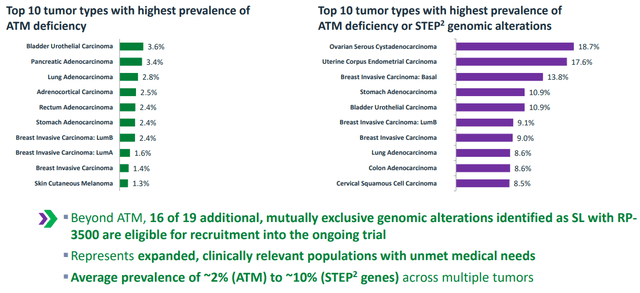

Management believes camonsertib is favorably differentiated versus competitor ATR inhibitors further ahead in development (best-in-class safety, potency and selectivity). Proprietary patient selection insights allow them to expand addressable patient population beyond original gene of interest.

Figure 5: Camonsertib opportunity expanded via STEP2 selection tools

Scale and scope of monotherapy and combination opportunities for camonsertib and especially the resources needed to move forward efficiently would be quite a challenge for any small oncology firm. Management thus believed that the optimal strategy was to partner with best-in-class precision oncology leader Roche.

As for financial terms, deal provided upfront cash of $125M with additional $1.2B in potential milestones including $55M in potential near term payments. As for potential royalties on sales, in US they would be low double digit to high teens and ex-US high single digit to high teen. Additionally, Repare retains the ability to opt-in 50/50 US co-development and profit share arrangement. Cash runway for Repare would be extended all the way to 2026 (including near term milestones).

Management seems more excited about the assets in pipeline behind camonsertib, including RP-6306 currently in clinic, Polθ inhibitor and other late preclinical-stage assets. Phase 1 data for RP-6306 is coming later this year and updates on progress for Polθ inhibitor are expected 2H 22 as well. Additionally, they have an asset against an undisclosed target they are bringing forward and hope the timeline closely resembles their Polθ inhibitor (unveil more on this program 2H 22).

Roche deal validates their SNIPRx platform for synthetic lethal drug discovery (utilizes CRISPR screening campaign to identify and validate targets) as well as STEP2 screens which allow for expanding the addressable patient population. Adding two years of cash runway to balance sheet in very uncertain times for biotech is clearly a positive development, allowing Repare to focus on execution with remaining clinical and preclinical assets.

Moving onto Q&A, keep in mind Bristol Myers Squibb development partnership was inked in May of 2020 ($65M upfront payment, up to $3B in milestones ($300M/program) and focuses on targets that Repare has no plans to pursue internally. BMS will do the preclinical chemistry and discovery work (the “heavy lifting”), as here the idea is that Repare simply identifies the targets and hands them off. Overlap with more recent Roche deal is virtually non-existent.

With the data management saw in camonsertib, they clearly wanted to aggressively move the asset forward into mid-stage development. On the other hand, they wished to “keep the pedal to the metal” with early-stage and preclinical assets. The company had a strong balance sheet pre-deal, but without it they likely would have had to make a choice of which of the above actions needed to be prioritized, so again in that light the Roche deal is logical in allowing them to achieve both. In other words, deal allows Repare to “have their cake and eat it too” in the sense of high degree of certainty for camonsertib global development (yet retaining some upside) while focusing time & energy on the rest of the portfolio.

Going Back a Step

As for other presentation nuggets, let’s take a step back to the October 2021 webcast for initial data of camonsertib (then called RP-3500):

- Expanded patient opportunity for camonsertib goes beyond 2% prevalence of ATM alterations to 10% prevalence when the additional 16 STEP2 genes are included (Figure 4 above).

- Speed of clinical execution bodes well for this management team also in regard to how they could move forward with other programs. Camonsertib phase 1/2 trial started in July of 2020 and as of August 2021 cutoff the company had enrolled over 100 monotherapy patients (achieving objective of identifying recommended phase 2 dose & schedule).

- Lead Investigator Dr. Timothy Yap notes that patients recruited to the trial were highly refractory/resistant or intolerant to standard therapies. Every tumor was centrally reviewed to confirm deleterious STEP2 alteration. Half of these patients had 4 or more lines of therapy. Tumor types included ovarian, prostate, breast, sarcoma and others. Most common genotypes included were ATM, BRCA1, BRCA2, CDK12 and other STEP2 alterations.

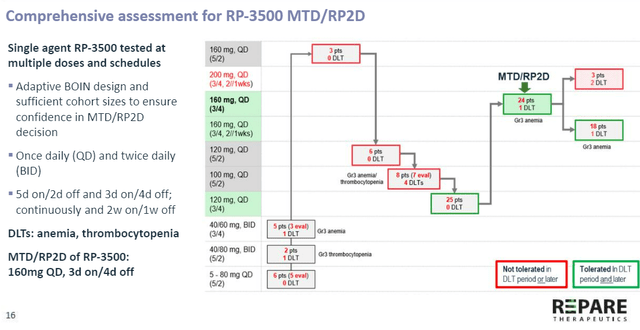

Figure 6: Camonsertib RP2D established at 160mg QD, 3 day on 4 day off schedule

- Of note is how the company used larger number of patients to drive decisions such as determining maximum tolerated dose (some small cap companies use lower N but there’s always the question of how much confidence you can have in resulting decisions). In 24 patients at the RP2D they only had 1 DLT (dose limiting toxicity) of anemia. They also looked at alternative dose schedules (Plan B if they require dose or schedule reduction) and explored 160mg QD (once daily) 3 days on 4 days off for 2 weeks on, 1 week off (18 patients, only 1 DLT). Lower dose of 120mg QD 3 days on 4 days off continuously was explored in 25 patients without DLT issues.

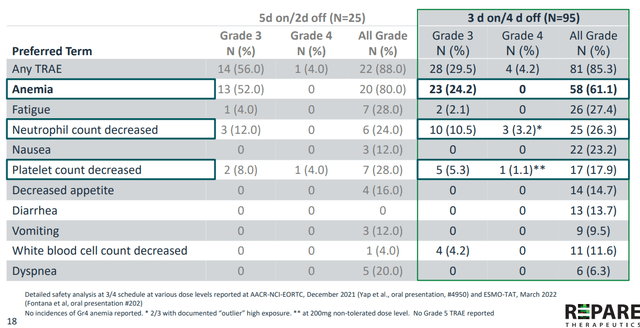

- Adverse events were similar to what’s been observed with other ATR inhibitors (anemia), but to their advantage there was a void of other toxicities. On 3/4 schedule Grade 3 anemia was down to 14.5% (this increased to 24.2% in the latest data cutoff as seen below, from 76 patients to 95 total). There were no Grade 4 anemia cases observed at both data cuts. Beyond neutropenia, they did not see increased platelet counts as a major issue. Grade 3 decreased neutrophil count increased from 5.3% in the first data cut to 10.5% in the second, while 3.9% decreased platelet count fell to 1.1%. Other toxicities that may be due to off target effects we see very low rates of Grade 3 fatigue, anorexia and other GI side effects. These toxicities (improved AE profile versus competitors) are especially important when considering combination potential as well.

Figure 7: Camonsertib safety profile

- As for PK profile, they showed half-life is 6 hours. Cmax and AUC (area under the curve) were linear and consistent across all doses. QD and BID dosing schedules were compared but there wasn’t major difference in target coverage. Food effect study showed camonsertib can be given with and without food.

- As for efficacy, clinical activity was observed across different cancer types and STEP2 alterations. There were four ovarian cancer patients with BRCA1 mutations and one with RAD51C mutation who had failed prior PARP inhibitors and responded to treatment. Meaningful clinical benefit was observed in 49% of patients on the trial (CBR or clinical benefit rate then rose to 75% in the latest data cutoff). Some responses occurred later (as late as week 16) and that is something observed with other ATR inhibitor companies as well.

- Case studies are always interesting to read into (with the usual caveats). An ovarian cancer patient who was post PARP inhibitor and platinum treated, harbored gBRCA1 mutation and achieved confirmed partial response on camonsertib (also as ongoing GCIG CA125 response). Very deep decrease in ctDNA is observed as well (as early as week 3 in treatment). Another patient with aggressive prostate cancer who harbored CDK12 mutation had nice PSA response that came early on at week 3 (correlated with ctDNA decreasing). This patient had 6 prior lines of treatment including ipilimumab/nivolumab combo. A different castration resistant prostate cancer patient had ATM mutation and achieved rapid PSA response (as early as 6 weeks)- this man had bony metastases, lymph node disease and other markers of poor prognosis. His main issue was intractable pain (on opiates) and on treatment was able to come off pain killers (no more pain).

- To be fair, overall response rates then and in updated data cut were a bit underwhelming (at least to my eyes). 25% ORR in heavily pretreated ovarian cancer was more promising- they also saw 14% ORR in BRCA1/2 mutated tumors and 12% ORR in patients with ATM LOF tumors.

Flash Forward to Goldman Sachs in June

- This webcast was quite helpful, especially after listening to the prior two to gain better insight and context for the company’s current prospects. CEO Lloyd Segal states that one of the biggest differentiators is Repare’s platform, including SNIPRx (CRISPR screening to find novel targets including ones that no one else is finding) and STEP2 (allows them to systemically find other genetic alterations in that synthetic lethal network of genes that predispose the patient to respond to those compounds). Those things together were proved in camonsertib phase 1/2 trial (differentiate the way they develop drugs). CEO states that their secret sauce is in their ability to take those insights and drive them with great medicinal chemistry (validated by the Roche deal).

- Company has a bespoke approach to how to constantly partner and exploit its assets. ONO Pharmaceutical deal in 2018 was the first collaboration the company entered into (inbound interest, ONO believed in Polθ and Repare gave up just Japan & nearby country rights). Flash forward to 2020, and the company was discovering more synthetic lethal targets than it could ever exploit. BMS deal was about asset mobility (Repare management did not want stuff just sitting on the shelf because competitors would make the connection eventually). BMS deal assured that nothing was going unexploited, and company always has more compounds to put into its pipeline.

- Roche deal resulted from 2021 conclusion that the way to win in ATR inhibition was with a global partner that had the same vision (probability of success is far higher with this caliber of a partner). Substantial resources are now needed for the large size trials needed for camonsertib and Roche has unique capabilities within the precision medicine space (Foundation Medicine which they acquired a while ago). Roche also has opportunity with Flatiron to do studies of real-world comparisons for rare populations. Roche has capability to run very complex and large trial designs, such as focusing on bi-tumor or bi-alteration. Roche had real-time access to clinical data to make the deal decision. CEO states they like the opt-in feature, in the future when Roche indicates they are going ahead at that time management can look at the model at that time, probability of success and decide whether NPV merits participating or alternatively staying focused on internal pipeline (simply ride on milestones and royalties that can be achieved in the deal). He calls it “heads we win, tails they lose”.

- AACR camonsertib update analyst highlights 25% response rate in ovarian cancer patients (predominantly PARP and platinum failures). Management states the pro of pursuing these indications is they are fast path to regulatory approval, but the con is indications are smaller. Very solid proof of concept and proof of safety in phase 1, 120 patients in 14 months (aligns well with FDA’s Project Optimus) is what helped convince Roche. Combination with RP-6306 has been initiated recently and that will be quite interesting as well (in addition to irinotecan and gemcitabine combos).

- Management reiterates company now has runway into 2026 and can prosecute other parts of the portfolio at full speed. RP-6306 has 4 ongoing trials alone, then have Pol Theta inhibitor hope to share news very near term and finally another compound (undisclosed target). Stated goal is a new IND every 12 to 18 months.

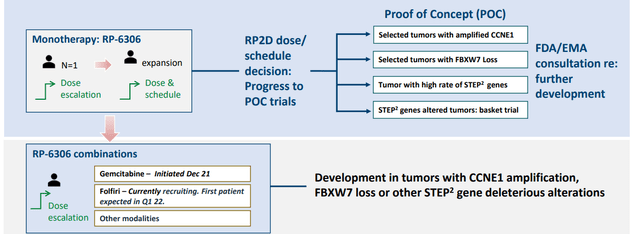

- For RP-6306, initial data this year will include just monotherapy (analyst got it wrong and thinks combo data is coming as well, but management states that it doesn’t look likely until next year). They were able to enroll patients so fast for camonsertib due to deep understanding of ATR, whereas 6306 is a novel target so clinical trial progress is moving for carefully and slowly (seems like they are talking down the importance of initial data, as it’s just a phase 1 and not a phase 1/2). Initial endpoints are safety, tolerability, PK, PD and any vectors they can find for recommended phase 2 dose and schedule. Later on, they would like to focus on gynecological malignancies for CCNE, upper GI for CCNE and FBXW7 and definitely colorectal cancer for FBXW7 mutations.

Figure 8: Innovative trial design for RP-6306

- From there, they could do a basket study for all possible tumors but again initially that is too much risk to take on for a novel agent. Recent Nature paper backs up this exciting target.

- 3rd asset Pol Theta is a long sought-after target. ONO is a great partner, they obtained rights to commercialize any eventual product in Japan, Taiwan, South Korea, Singapore, Malaysia and Hong Kong (what Repare gave up). It’s a wonderful deal given 2.5 years ago the company was at very early stages for this project. Pol Theta is an incredibly exciting target with more and more rationale for development but is notoriously tough to target. 1H 23 the compound could enter IND enabling studies, they will share where they’re at in 10Q filing in August.

- Management obviously excited about the undisclosed target but keeping it under wraps (extremely competitive field and wish to retain edge until they are filing IND). This is another novel target that’s never been studied in the clinic before.

- Bottom line, the company wants to build the best pipeline of drugs in DDR and synthetic lethality space, and management feels they have not missed a step yet execution-wise.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $282M (excludes the $125M received from Roche) and management guided for operational runway into 2026. I’m a big fan of biotech companies with strong balance sheets, especially in the current climate of pessimism where financings can be difficult. Net loss totaled $38M, while R&D expenses came in at $31.5M. G&A expenses came in at a reasonable $7.9M.

As for competition in ATR inhibition, keep in mind due to the validation of this target there are a lot of clinical trials ongoing. Results for German pharmaceutical powerhouse Bayer’s phase Ib trial of ATR inhibitor elimusertib (BAY1895344) in advanced tumors with DDR defects achieved partial responses in 4 of 21 evaluable patients across various tumor types including a patient with liver metastasis and 11 prior lines of therapy. However, dose dependent neutropenia and thrombocytopenia were observed as well as 81% Grade 3 anemia. AstraZeneca’s ceralasertib (AZD6738) is being evaluated in gynecological cancers among other indications. Phase 1 data (paclitaxel combo) showed 33% ORR in melanoma patients who were resistant to prior anti-PD1 therapy (most common toxicities being neutropenia at 68%, anemia at 44% and thrombocytopenia at 37%). Overall response rate across tumor types was 22.6%. Unfortunately, there were 2 cases of Grade 3 febrile neutropenia. Additional papers and articles on competition in this space can be found at the bottom of this article.

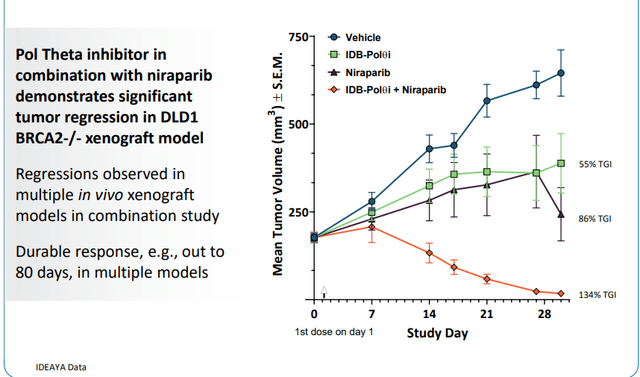

As for competition in Pol Theta, I note that IDEAYA Biosciences (IDYA) recently announced its development candidate as part of GSK collaboration.

Figure 9: IDEAYA’s in vivo activity for its pol theta ATPase inhibitor

As for institutional investors of note, Biotechnology Value Fund has been aggressively accumulating shares and owns a 19.4% stake in the company. Orbimed Advisors owns a 7.7% stake.

As for management team, EVP Chief Financial Officer Steve Forte served prior as Chief Financial Officer at Clementia Pharmaceuticals (acquired by Ipsen for $1.04 billion). EVP Commercial and New Product Development Philip Herman served prior as Chief Commercial Officer at Y-mABs Therapeutics (led launch of Danyelza). Chief Medical Officer Maria Koehler has prior experience at Pfizer as VP of Oncology Research & Development. Chief Business Officer Kim Seth held the position of Executive Director Worldwide R&D at Pfizer.

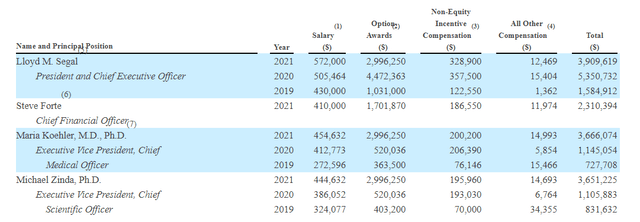

As for executive compensation, a look at the table below reveals reasonable numbers for a company at this point in its early stage of development (ATR moving into mid-stage trials, 2nd asset with initial data readout coming up). I wish the cash component were a bit lower given the current environment in biotech, but on the other hand I can’t argue that management has prudently managed the balance sheet including Roche deal extending runway to 2026.

Figure 10: Executive compensation table

As for intellectual property, patent portfolio consists of nine pending US provisional applications covering camonsertib salts, crystalline forms, uses as well as method of use for additional pipeline candidates. Two of 3 solely owned PCT applications cover composition of matter and method of treatment for camonsertib (expiration 2040 if issued). Additional mentioned patents such as covering are expected to expire between 2039 and 2042 (the latter for RP-6306).

As for devil’s advocate case, I’m glad the company wisely chose to put its differentiated ATR inhibitor in the hands of a competent big pharma partner with the resources required to run large-scale & complex trials. This space has high amount of competition and while it looks like camonsertib has an edge in terms of safety, at this stage of the game it’s anyone’s guess which competitor comes out on top. Synthetic lethality field on the whole is in very early innings and there’s no telling what obstacles or hiccups will be encountered along the way. One could also argue as I mentioned above that management is guiding very conservatively for initial readout for RP-6306 and perhaps meaningful results won’t come until 2023 with combo data.

Final Thoughts

To conclude, Roche partnership provided a substantial degree of validation to this budding synthetic lethality player, showcasing the worth inherent in its SNIPRx and STEP2 platform technologies (identify first or best-in-class targets and expand the molecularly driven patient population). Camonsertib’s data update revealed a superior safety profile to Bayer’s BAY1895344 which in turn likely led the Roche team to step up to the plate with attractive economic participation retained for Repare, including US opt-in. From here, the company can apply learnings from its initial asset to other programs in the pipeline, using unique screening capabilities to find other genetic alterations in that synthetic lethal net of genes that predispose patients to respond to the compound in question and thus increase probability of success. The company is aggressively moving forward with RP-6306 (mono, gemicitabine, FOLFIRI and camonsertib combos) and it’ll be exciting to see where the story goes in the next few years.

For readers who are interested in the story and have done their due diligence, RPTX is a Buy and I suggest establishing a small pilot position in the near term.

From there, a conservative strategy could be to add on dips up to perhaps half of one’s desired total and await initial data for RP-6306. That way, in the event of a “sell the news” reaction (management guiding for mainly monotherapy data), investors would still have the capacity to further add exposure ahead of 2023 combo data sets.

One key risk is disappointing initial data for RP-6306, as management is clearly utilizing conservative language when discussing this event (mainly monotherapy data, combo results would likely wait until 2023 unless “the stars align”). The company relies on third-party contract manufacturing organizations, so without in-house capabilities there could always be unexpected delays or obstacles encountered that they have less control over. As for camonsertib’s place in the increasingly crowded ATR field, it’s fair to say that updated efficacy data looked quite similar to initial results (not much in way of incremental improvement and incidence of anemia adverse event did inch up).

On the other hand, the 25% response rate touched on above for post-platinum/PARP ovarian cancer was a clear signal that needs to be prosecuted in mid to late-stage studies. The company is going up against big pharma muscle including AstraZeneca (AZD6738), Bayer (BAY1895344), Merck Serono (M4344, M6620, M1774) and most recently, Artios Pharma (ATR0380) and Atrin Pharmaceuticals (ATRN-119).

Corporate filings note that the intensity of trials with ATR inhibitors combined with chemotherapy and radiation, as well as other DDR inhibitors, has substantially increased over the past few months (could lead to intense competition for patients in trials as well, leading to slower enrollment and delayed timelines). For the Pol Theta target, the company is going up against Artios Pharma’s ART-4215 and IDEAYA Biosciences with recently nominated development candidate. Near term dilution is not a risk to my eyes, as the company has operational runway to 2026 after the Roche deal upfront payment (and accounting for near term milestones).

OTHER LINKS OF INTEREST

CCNE1 amplification is synthetic lethal with PKMYT1 kinase inhibition

Therapies targeting DNA damage response show promising antitumor activity

DNA damage response drugs for cancer yield continued synthetic lethality learnings

Be the first to comment