Sundry Photography

Introduction

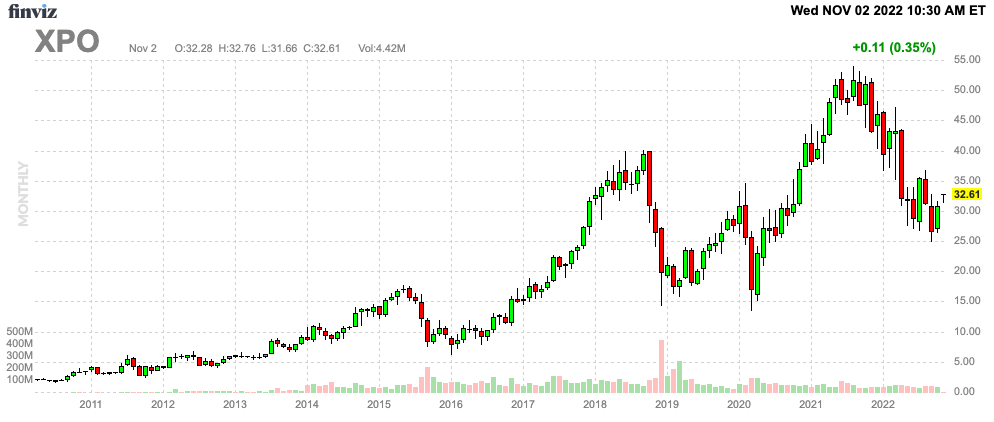

It’s time to talk about one of the most fascinating transportation companies in North America. Connecticut-based XPO Logistics (NYSE:XPO) is a relatively young company, which was incorporated in the year 2000. I have frequently covered the company over the past few years as it went from a company expanding through aggressive M&A and its own capabilities to a company focused on making its core business as efficient as possible. After the recent RXO spin-off, XPO is now a pure-play less-than-truckload (“LTL”) operator.

Reading through its earnings results and business opportunities, I continue to believe in the company as a terrific long-term investment – despite ongoing macroeconomic challenges.

In this article, I will give you the details!

Pure-Play LTL

Less-than-truckload transportation is different from truckload. LTL shippers ship goods that are not as large as full truckload loads and too large for parcel shippers. Most goods are on pallets with shipments weighing between 150 and 15,000 pounds.

While there are a lot of reasons why LTL services are needed, one of them is to keep supply chains flexible:

Often, a company will not wait until a wholesaler is running low on product inventory to ship a full truckload of replenished goods. Instead, it will more frequently ship less-than-truckload to mitigate the risk of the potential loss of sales from lack of inventory for its distant customers. The shipping costs of its goods may be incrementally higher, and the delivery time may be longer than for a dedicated full truckload, but the trade-off is more dependable inventory availability.

With that said, XPO became a pure-play LTL company on November 1, after spinning off its truck brokerage business RXO, which we will discuss at some point as well.

I’m also mentioning this because of the spin-off, a lot of financial numbers you will find on the internet do not make sense anymore. For example, the XPO stock price has been adjusted for the spin-off, which means that some websites have valuations and other information that is wrong. It will take a few weeks until that has been adjusted on most mainstream finance websites. So, please be careful when doing your own research.

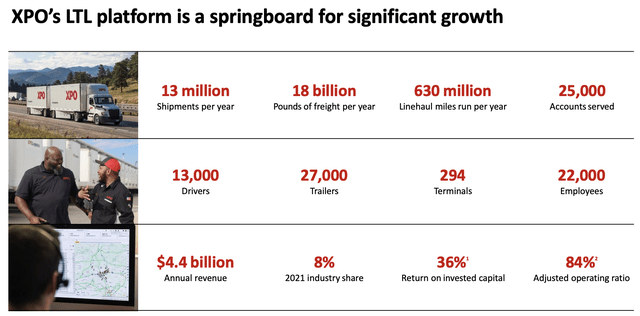

The company is now running a platform with 13,000 drivers, 27,000 drivers, close to 300 terminals, and more than 25,000 accounts.

An LTL Company With Great Financials

As of October, the company has an 8% market share and an 84% operating ratio. The operating ratio measures how expensive it is to run operations as a percentage of total revenues. The lower, the better. Most competitors have operating ratios higher than 90%. Weaker companies are currently struggling to generate a positive operating results.

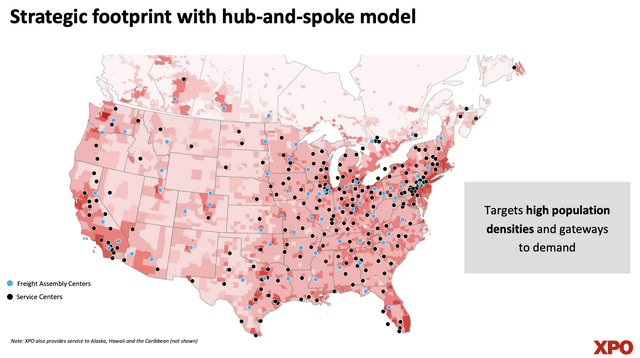

An 8% market share may not sound like a lot, but that’s a big deal. While I am not a big fan of companies in industries with low entry barriers, XPO offers opportunities because companies with the right business model can achieve outperforming growth and market share gains.

XPO has a rather low operating ratio, which means it has an edge over most competitors. The more XPO ships, the more it can accelerate investments in its business. Hence, it has now close to 300 terminals allowing it to quickly service customers in all parts of the country.

What’s interesting is that industry terminals dropped by 3% between 2012 and 2022E, meaning that the competition (in general) isn’t investing as much in these capabilities.

When adding pricing power, the company is expected to further lower the OR. This is what the company said in the third quarter:

Our operating ratio in the quarter was 85% and our adjusted operating ratio was 82.8%, that’s a year-over-year improvement of 160 basis points. The full year target we put out with our preliminary third quarter results is for 50 to 100 basis points of adjusted operating ratio improvement year-over-year. We expect at least 120 basis points of year-over-year improvement in Q4. In the third quarter, we improved yield by 7%. And we continue to see rational industry pricing.

Speaking of pricing, the company shipped 2.9% less weight in 3Q22. Total shipments were down 1.8%. However, gross revenue per hundredweight was up 7.0% excluding fuel surcharges. Including fuel, it was up 16.4%.

Hence, the company could turn 12.4% into 22.1% operating income growth, which is not easy to do in this environment.

The company also produces its own trailers (4,700 in 2022). That’s 12.9 per day. That’s a very high number for a company whose core business isn’t producing and selling trailers.

XPO also trains its own drivers. This helps new drivers to deal with costs (no tuition) and it makes hiring easier. I also need to mention that hiring LTL drivers is easier than hiring truckload drivers as routes are usually shorter – better working conditions.

Moreover, going forward, we can expect XPO to work on aggressive growth. After all, it’s not a dividend stock. In 2022, the company is expected to spend up to 10% of its revenue on CapEx. Prior to 2022, that number was consistently close to 5.0%. Again, this is giving the company an increasing advantage over most of its less profitable competitors.

It also helps that the company has a healthy balance sheet. Going into this year, net leverage (net debt/EBITDA) was at 2.7x. That’s down from 3.3x in 2020 and expected to end in a net leverage ratio of just 2.0x at the end of this year. This is also achieved by using the cash proceeds from the RXO spin-off.

So to sum up, the company aims to achieve the following long-term (2021-2027) growth targets:

- 6-8% annual compounding revenue growth.

- Adjusted EBITDA growth of at least 11% per year.

- An operating ratio improvement of at least 600 basis points to 82.0%.

Valuation

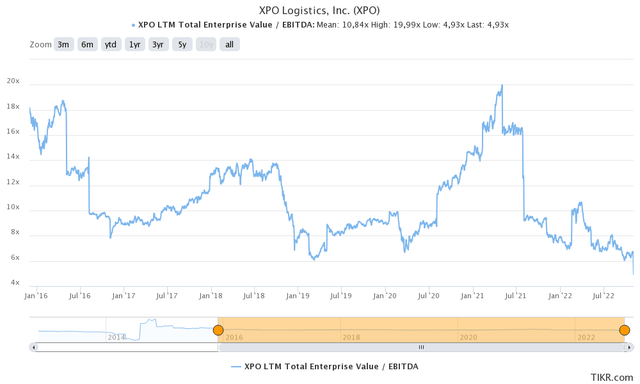

XPO shares are down 37% from their all-time high, falling 30% since the start of the year. That’s adjusted for the RXO spin-off. This puts the market cap value at $3.74 billion. Net debt is roughly $2.4 billion based on $2.9 billion in gross debt and $544 million. This puts the enterprise value at $6.1 billion.

This is 6.1x 2022E EBITDA, according to the latest guidance.

Looking at the full year, XPO Logistics reaffirmed guidance for the North American LTL business to generated at least $1B of full-year adjusted EBITDA, including gains on sales of real estate of up to $50M in Q4 and year-over-year improvement of 50 to 100 basis points in adjusted operating ratio for the full year, including at least 120 basis points of improvement in Q4.

That valuation is extremely attractive as it is right at the bottom of the longer-term valuation range. It’s also way too low given the company’s expected long-term targets – which I believe are reasonable.

The reasons for this valuation are economic headwinds like the ones discussed in this article.

While my rating will remain bullish, I believe that XPO shares will remain in a volatile sideways trend until I expect the Fed to pivot next year. At that point, I believe XPO shares will rally far beyond their prior all-time high.

FINVIZ

Takeaway

In this article, we discussed one of my favorite trucking companies. After spinning off RXO, XPO is now a pure-play LTL trucking company, which is good news for investors. The company is efficient, it aggressively invests in growth, and it is getting an increasing advantage over smaller, less efficient, operators.

Its long-term targets are ambitious but realistic.

Moreover, the valuation has become extremely attractive as a result of macro headwinds, which the company is dealing with quite efficiently.

Hence, while I believe that XPO will remain volatile, my rating is still bullish as I have little doubt that XPO will generate outperforming capital gains for its investors in the years ahead – and beyond.

(Dis)agree? Let me know in the comments!

Be the first to comment