marrio31/iStock via Getty Images

Investing away from home base always brings up some nervousness, even if the foreign company that you are interested in trades on the NASDAQ. The point is that other countries have different laws and ways of operating that can have unanticipated consequences. Many US citizens also probably think that the US economy is the engine of the world so why look elsewhere? Coming from a small country (Australia) at the other end of the world gives me a different perspective. I’m interested in investments anywhere that will provide outstanding returns for my investment portfolio. But moving out of the comfort of the US must provide upside to counteract potential risks of the unknown. Those who follow me will be aware of my interest in the wind industry (especially offshore) and this means investment in European companies which lead the world. Elsewhere I’ve covered Vestas Wind Systems (OTCPK:VWDRY) as a contrarian opportunity with big potential upside. But what about an investment in a foreign company in an industry that isn’t as unloved as is the wind industry?

The world’s energy system is being turned upside down as climate emergencies bite just about everywhere, leading to consensus that we must exit fossil fuel use for power generation. However a universal theme from the fossil fuel industry is that, notwithstanding what Europe and the US do, India and China will continue with fossil fuel consumption for decades. My reading suggests that this misunderstands what is happening in these two huge countries. Here I look at the growing Indian grid (and hence the renewables market) through the lens of ReNew Energy Global (NASDAQ:RNW), a major Indian renewables player. I suggest that the picture is different to what a lot of investors consider to be the case in India. ReNew Energy Global is NASDAQ-listed, with major project skills and strong international partners. Investors looking to participate in the biggest emerging markets might keep ReNew Energy Global on their radar. This company has to be of interest if you want an outstanding foreign investment opportunity.

India is undergoing a dramatic power system restructure

This decade there is a massive effort underway to change the way power is generated in India, even as dramatic expansion of the power system happens.

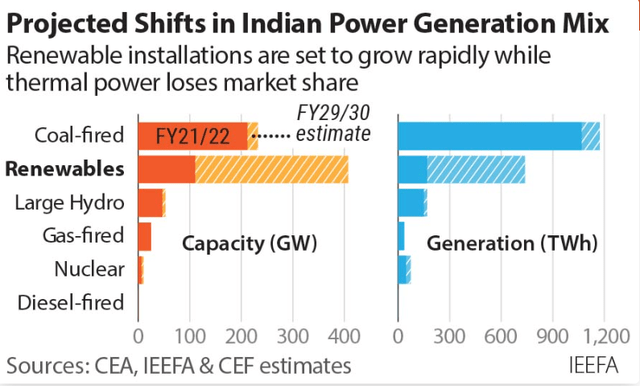

A recent report from IEEFA gives a visual snapshot of what is predicted as India rapidly builds out its power system.

India’s changing grid (IEEFA)

Source : IEEFA

While coal dominates Indian power supply currently, the period between now and 2030 will dramatically change the situation, with the increase in power generation coming largely from renewables. There is moreover no reason to expect that the momentum for the renewable transition will cease in 2030. Even quite recently India was expected by the coal industry to take up the slack as China moves towards a renewables transition. However, Prime Minister Modi has been clear that India will not modernize its economy through fossil fuel expansion.

The most amazing feature of this power transition is that 24/7 power involving renewables and batteries is now established both at the village level as well as in big power projects (see below). Denigrating renewables as of no use, because they are intermittent, is losing currency as 24/7 renewables projects proliferate.

Oil & gas spend versus renewables investment

The crisis in Russia, which has resulted in dramatic increases in the price of coal and natural gas, is having another unexpected outcome in relation to payback time for renewable energy projects. A report just out from Rystad Energy indicates that elevated prices for fossil fuels has led to elevated prices for power. This in turn has meant payback times for major renewables projects of less than a year in some cases in Europe! Perhaps it is no coincidence that 2022 is projected to be the year when renewable investment ($494 billion) will exceed oil and gas investment ($446 billion).

ReNew Energy Global’s position in the Indian power scene

Six months ago The Green Edge provided an excellent overview of ReNew Energy Global’s business. Readers might find his article useful for background information. Like me The Green Edge was clear about the opportunity as India embraces a future based on renewable energy and ReNew was regarded as emerging as a major player, even as the Indian energy scene began to clarify its future direction.

Q1 2023 earnings call transcript : management views make a lot of sense

Readers who follow me are aware that I’m a fan of earnings call transcripts because they give an investor a good sense of management’s views and how they position the business. While a little dated now (August 19 call), the Q1 2023 transcript helped me to reflect on comments made by The Green Edge in his report of March. A concern was high financing costs hindering profitability. This was not seen as a problem in the earnings presentation and earnings call transcript.

The earnings call was very upbeat, but justifiably because it is based on pretty impressive results. Revenues and adjusted EBITDA are up ~50% year-on-year and distributable cash flow more than doubled compared with the same quarter last year. ReNew’s portfolio grew 33% compared with the prior year and now stands at 13.2 GW. Forecasts for the coming year are based almost entirely on currently operating assets, giving the company confidence about their forecasts. The company has a really good balance of renewable assets (7.0 GW solar, 6.1 GW wind and 0.1 GW hydro) and also a good balance between commissioned and committed projects (solar PV: 3.7 GW commissioned, 3.3 GW committed; wind: 3.8 GW commissioned, 2.2 GW committed). A key development is customers seeking 24/7 renewable power solutions. This not only involves a balance of renewable power offerings, but also digitization and proprietary AI technology. There is a lot of interest in intelligent energy solutions. Most of the ReNew leadership team has grown with the Indian renewables sector, so they are familiar with the ups and downs of the sector. The team has a lot of operational expertise.

Corporate PPA (Power Purchase Agreements) opportunities are gaining momentum, today comprising 10% of the ReNew portfolio (against 4% a year ago). Corporate PPAs give superior returns and they account for 30% of portfolio additions in the past 12 months. The company thinks the growth of corporate PPAs will accelerate in the near term and eventually get to 25% of all portfolio growth over the next several years. This is a 25 GW addressable market growing at double digits annually and a 100 GW opportunity by 2030! Note that 1 MW of Renewable Power Capacity requires 3 MW of renewable energy power.

Another favourable feature of ReNew is that it is a NASDAQ-listed company. Corporate governance is critical to the highest quality corporate customers; ReNew’s largest competitors in the Indian corporate PPA market are all private companies.

A further differentiator is that corporate PPA customers are in a hurry and ReNew has the ability to pre-prepare projects. This is mostly about preparation for project commencement, which is time consuming but not particularly costly. The company targets projects early so that it can be in a position to move quickly when a customer is ready to commit. ReNew makes the point that corporate India is growing rapidly and this means that once new customers are engaged, further business often follows. Power is critical for running a business.

ReNew can supply power to corporate customers at ~3.5 INR per kWh. ReNew says corporate customers say they pay 6-10 INR per kWh to buy power from the grid. This makes ReNew’s product attractive. Added to that, corporates are seeking to source net-zero power to assist their emissions reduction goals and there are various attractive features about sourcing renewable power (eg transmission cost waiver from renewable energy to corporates). ReNew sees good cross-selling opportunities with corporate PPA customers.

The company has $850 million cash currently and expects to have $900 million cash after completing spend on the 13.2 GW portfolio. The debt level is comfortable and the lending environment favourable. Even if the refinancing market were to close suddenly, the company is well positioned for debt servicing, with 80% of debt maturing in the next two years already pre-funded. The company regards its shares as being underpriced and a share purchase program has repurchased 12 million shares since a buyback was implemented, leaving $150 million still available for further repurchases. Management acknowledged some overhang from the SPAC NASDAQ listing, but it argues that ReNew was not a typical SPAC listing. Some issues hindering the stock’s attractiveness are being addressed.

The company has strong ESG policies which are detailed and impactful. An example is the water savings (216,533 KL in 2022) resulting from deploying robotic cleaning of solar panels. It is among the first in its industry to disclose Scope 3 GHG emissions.

JV with Fluence (FLNC)

A missing element in the Q1 2023 earnings transcript was mention of a JV with Fluence, which is a major energy storage and management company formed by Siemens Aktiengesellschaft (OTCPK:SIEGY) and AES Corporation (AES). I suspect that this was an oversight, because it seems likely to me that Fluence’s technology is a core part of ReNew’s smart 24/7 power systems. Fluence provided India’s first battery storage project (10 MW/10 MWh) in 2019 (early days for Fluence), so there is history for Fluence with India, including the recent formation of Fluence India Technology Centre which will support the ReNew/Fluence JV.

ReNew and Fluence entered into the JV at the start of 2022. This JV was positioned to be about energy storage solutions for India, but my take is that it has a bigger significance because it is also about providing 24/7 power based on renewables plus batteries as discussed below. The JV brings together ReNew’s deep knowledge of Indian customers with Fluence’s wide experience of making renewable power reliable and dispatchable 24/7. Fluence is developing a strong track record in doing more than providing battery storage, although it is a market leader in this area. More importantly Fluence’s renewable energy management skills is changing grid structure to minimise the need for fossil fuel power backup.

An example of a recent international Fluence project is a major project to improve the German grid by managing major new renewable additions. The project is described as the world’s largest battery-based storage-as-transmission project. Called the “Grid Booster” it is a 250 MW battery system to be located at a major German grid hub. The expected outcome of the project, which will be completed in 2025, is reduced German grid operating costs by increased efficiency of utilisation of the existing assets. This will reduce the need for traditional (fossil fuel-based) network reinforcement and ease bottlenecks in moving wind-generated power from Northern Germany to Southern Germany. It will also provide millisecond response backup to the overall grid.

Fluence is also a key partner in strengthening California’s grid with battery storage projects and smart energy management.

A big focus in India is how to provide electricity 24/7 based on solar PV and battery technology (and in some cases including wind power in the mix). This is becoming a reality both on a small scale for communities with unreliable power supply and also for bigger projects involving PPA (Power Purchase Agreements). ReNew has the contract for the first renewables hybrid project, which when announced in August 2021 was to involve 400 MW solar PV, probably 900 MW wind and an undisclosed big battery to pull the project together and provide 400 MW of 24/7 power to the client, the Solar Energy Corporation of India (SECI) which is a central Government owned entity. Prime Minister Modi mentioned the ReNew project at an opening last week of a small scale community energy network which provide 24/7 power (based on 6MW solar PV and BESS (Battery Energy Storage System) for a small town).

The SECI PPA is the first project of the JV between ReNew and Fluence, although this project was described as a 150 MW BESS and 300 MW peak power project in the JV Press Release. Presumably this 24/7 renewables project has become more ambitious as the project development proceeded.

An interesting perspective from Fluence VP Growth & Head of Commercial, Kiran Kumaraswamy, on how the company thinks about battery business and making grids more efficient is provided in this link. In particular this involves not only providing 24/7 power but also integrating long duration storage.

Hydrogen

ReNew is a green hydrogen enthusiast but they are cautious, which is good because I think there is too much hype and not enough reality in hydrogen. Management sees green hydrogen as a multibillion dollar opportunity, but not needing capital or investment in the near term. The plan is to only proceed with green hydrogen developments “if the opportunity clears a very stringent set of requirements, including returns over our cost of capital and payment security.”

Hydrogen is not an energy source. It is a means of storing energy (like batteries). The point is that massive production of renewable energy is required to power the manufacture of green hydrogen. I’ve described above that projects both at village level as well as industrially are being implemented now in India to provide 24/7 power based on renewables, batteries and smart energy management. Why waste ~70% of the renewable power generated to make hydrogen and convert it back to electricity, when you can use the electricity directly and store it in batteries with much less energy loss? The interesting thing about the front end of hydrogen projects is that they involve major renewables projects to generate the electricity. Should (as I suspect) hydrogen prove to be a wasteful cycle, the renewables projects would still be useful to integrate with a 24/7 renewables/battery/smart energy management project. The point is that ReNew management is saying they will only go down the green hydrogen path when/if there is reality. There is too much hype currently.

What SA writers and Seeking Alpha think

As happens a lot with companies whose business is not US-centric, RNW is essentially absent from SA writer coverage, with no SA authors covering the stock in the last 30 days. However, Wall Street has some coverage with seven analysts in the last 90 days covering the stock. The sentiment from Wall Street is positive, with four strong buy and three buy ratings. RNW is NASDAQ listed and it is a major player in a huge emerging market. I’m with Wall Street in paying attention to this company. However the stock is down 50% since its NASDAQ listing in early 2021, and down 31.6% year on year. This has earned it a “sell” rating from Seeking Alpha’s Quant rating system and a red flag from Seeking Alpha as at “high risk of performing badly”. It has five “F” and one “D-“ on profitability gradings and three “D-“ ratings on momentum. I don’t see that these gradings reflect where the company is headed, but I acknowledge that my analysis is heavily biased towards qualitative analysis. The point is that ReNew is a company in an emerging market with novel technology, while the Seeking Alpha analysis compares it with established companies in the Utilities sector. I think this is a “chalk and cheese” comparison.

Conclusion

We live in a global village and, just as is the case of holidays no longer being restricted to being close to home, today it makes sense to have an expanded investment horizon. I indicated in the introduction to this article that foreign investment has additional risks so investors look for better upside.

I’ve made the case here for considering investment in ReNew Energy Global as this company is well placed to benefit from massive increases as the Indian power system grows up. The company has a best of breed team, the opportunity is massive, and the company is listed on the NASDAQ. Investors not familiar with what is happening as the world begins to exit fossil fuel use and electrify everything might need to do some homework to get comfortable, but my take is that this company is well worth considering as a potentially lucrative addition to the energy sector of an investment portfolio. At the least it is worth having on your watchlist to see how it performs.

I am not a financial advisor, but I look broadly at the massive changes happening as we begin to exit the fossil fuel industry. I hope that my comments on the opportunity in India and specifically concerning ReNew Energy Global are of interest to you and your financial advisor.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment