Wachiwit

3Q22 Summary

Well, thank God, we’re done with shrinking quarters.” – Reed Hastings on NFLX 3Q22 earning call

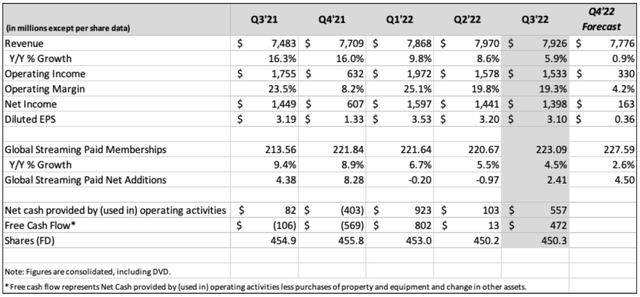

Netflix, Inc. (NASDAQ:NFLX) shares were up 14% post-market as the streaming giant reported better-than-expected Q3 results. Revenue of $7.9 billion (+6% YoY) beat estimates by $90 million and GAAP EPS of $3.10 was materially above $2.13 consensus. Global paid subscribers of 223.1 million was also better than 221.7 million guided as Netflix added 2.41 million net subs vs. 1 million expected. Overall, it was a better-than-feared quarter which told investors the worst may be over.

Digging further, the 6% increase in Q3 top-line growth was driven by a 5% increase in average paid memberships and a 1% increase in ARM (Average Revenue per Membership). A strong dollar also put pressure on results, as revenue and ARM growth would’ve been 13% and 8%, respectively, ex-FX.

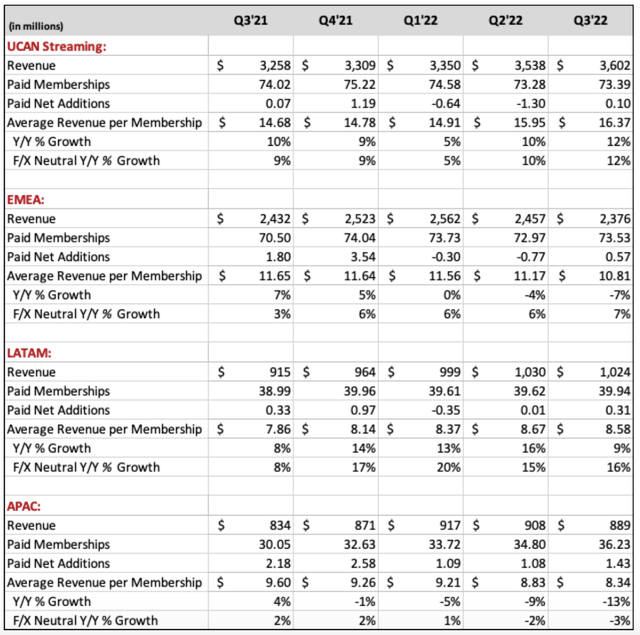

In terms of regional results, APAC was the fast-growing region, with 1.4 million paid subs added during the quarter (vs. 2.2 million in 3Q21). Revenue in APAC grew 19% ex-FX thanks to strong paid membership growth of 23%. This was offset by a 3% decline in ARM driven by India, but balanced out by better performance in Australia and Korea.

Both EMEA and LATAM added 0.6 million and 0.3 million net subs, where revenue growth of 13% and 19% ex-FX were primarily driven by ARM growth of 7% and 16%. In the most-penetrated U.S. and Canadian market, revenue grew 11% ex-FX while ARM was up 12%. Netflix added only 0.1 million net subs in Q3 (vs. 0.1 million in 3Q21).

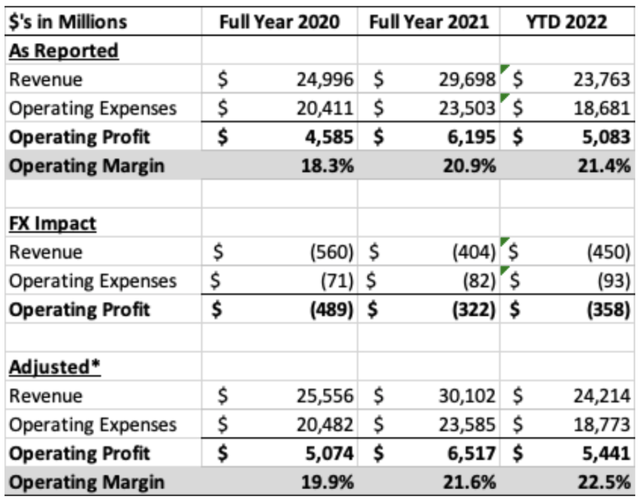

Q3 operating margin was 19.3%, while OPM for the first 9 months of 2022 was 21.4% vs. 20.9% and 18.3% in full year 2021 and 2020. Year-to-date, foreign exchange had an impact of $358 million on operating profit. Adjusted for FX, operating profit would be $5.44 billion for an OPM of 22.5%.

4Q22 outlook

Netflix expects 4Q22 revenue of $7.8 billion (+0.9% YoY/ +9% ex-FX) which represents a sequential decline due to a strong dollar. Management expects to add 4.5 million net paid subs (vs. 8.3 million in 4Q21) to reach a total of 227.6 million paid subs (+2.6% YoY) while ARM is estimated grow 6% ex-FX. Though an ad-supported tier is coming in Q4, there won’t be a material financial impact to the current quarter.

4Q22 operating margin is expected to come in at 4% (10% ex-FX) vs. 8% in 4Q21. As usual, Q4 is a seasonally lower OPM quarter as Netflix ramps up content and marketing spend.

Starting from Q4, Netflix will no longer provide guidance on paid memberships since management believes it’s best for investors to focus on revenues and margins.

Where are we on advertising?

Netflix announced last week that it’d be launching its first ad-supported plan (Basic with Ads) in 12 markets on the following dates:

- November 1: Canada and Mexica

- November 3: the US, UK, Korea, Japan, Italy, Germany, France, Brazil and Australia.

- November 10: Spain.

Per management, these 12 countries generate a total of roughly $140 billion of TV and streaming brand ad spend, making up more than 75% of the global market.

The Basic with Ads plan will be priced at 20%-40% below the full price plan. In the U.S., the ad-supported tier will be $6.99/month vs. the current starting price of $9.99/month. Ad loads will be light at ~5 minutes per hour with frequency capping. The initial response from advertisers are “extremely positive.”

In early 2023, Netflix will start allowing users to transfer their profiles (incl. viewing history and recommendations, etc.) to their own account. This potentially reduces the pain for freeloaders, as Netflix continues its password crackdown efforts which could drive some profile transfers to the ad-supported plan.

What’s my take?

Netflix’s Q3 results and Q4 guidance on paid memberships may indicate that the worst part of subscriber loss is over. However, this also shows that the company is in a relatively mature stage where major markets like the U.S. and Canada may have reached full penetration with minimal room for future net adds. The current macro outlook with high inflation and rising corporate layoffs are also a negative for sub growth going forward.

While advertising may provide some cushion as the more price-sensitive cohorts may switch to the ad-supported tier, whether ads will be a meaningful top and bottom-line driver remains to be seen.

Nevertheless, I believe Netflix is very well-positioned to generate a premium CPM (cost per mile) vs. other AVOD (advertising-based video on demand) providers given its strong content lineup and scaled user base. Additionally, Netflix with ads will only expand the overall CTV advertising total addressable market (“TAM”) as streaming continues to capture an incremental share of traditional pay/broadcast TV ad budgets.

However, intensifying competition in streaming is something to think about. Competitors such as Disney (DIS), Comcast (CMCSA), Paramount (PARA), and Warner Bros. Discovery (WBD) have been ramping up their AVOD offerings (more here), while Google’s (GOOG, GOOGL) YouTube, with over 2 billion monthly users, remains an attractive place for advertisers.

Although Netflix highlighted that its >$30 billion annual sales represent just 5% of the ~$300 billion pay TV/streaming market, increasing competition will likely ensure that no single streaming service will be able to capture a dominant share of the market, in my view.

In the shareholder letter, Netflix also noted that it’s difficult to run a large and profitable streaming business as all other competitors combined are expected to lose over $10 billion in 2022, while Netflix will generate $5-$6 billion in operating profit. This is certainly a respectable feat, but I’m always nervous when a growing industry attracts competitors that just keep throwing money at the problem.

On balance, I’d avoid Netflix as an investment, as the streaming space is expected to become very competitive and consumers simply have too many entertainment choices, whether it’s fully paid or partially free with ads. As a result, it’s difficult to see a scenario where Netflix returns to double-digit revenue growth and investors are willing to pay a premium multiple for the stock as competition heats up and higher interest rates reduce purchasing power.

That said, Netflix’s move into advertising is a positive confirmation that the overall AVOD market continues to grow at the expense of traditional TV. This is where The Trade Desk, Inc. (TTD) will be a major beneficiary as an independent demand-platform that acts as an enabler for advertisers to move dollars into streaming (analysis here). Simply put, I’d avoid the competition and go with a pick-and-shovel play like Trade Desk in the streaming gold rush.

Be the first to comment