ArtistGNDphotography/E+ via Getty Images

Background

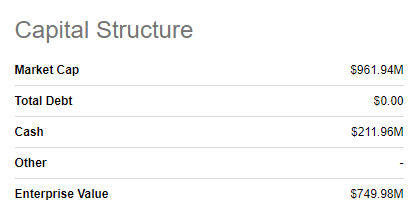

Relmada Therapeutics (NASDAQ:NASDAQ:RLMD) is a US-based, pre-commercial stage biotech developing therapies for depressive disorders. The company is trading at a 700M enterprise value and holds 200M cash, which is a highly robust cash runway for a clinical-stage company. Accordingly, we initiate RLMD with a strong BUY rating.

RLMD IR deck (RLMD IR deck)

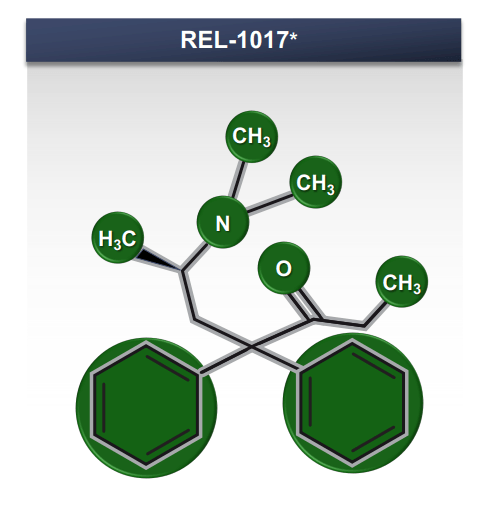

The unique mechanism of action of REL-1017 is key for best-in-class efficacy and safety

REL-1017 is a novel first-in-class compound formulation of oral dextromethadone currently being studied to target depressive disease. We highlight that REL-1017 is the only compound that uniquely targets NMDA receptors to treat depression. The drug’s key compositions are dextromethadone, the purified “d” enantiomer of methadone. We note that this is important for the drug’s exceptional safety, a racemic mixture of “d” and “l” methadone is currently used to treat patients with opioid addiction problems; however, the “d” form lacks substantial opioid receptor activity and instead works as an NMDA receptor antagonist and channel blocker, similar to ketamine.

Phase 2 efficacy and safety data points were effective and clean, we are optimistic about the success of the drug in phase 3

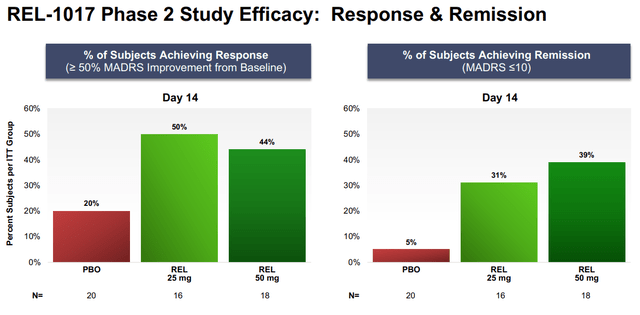

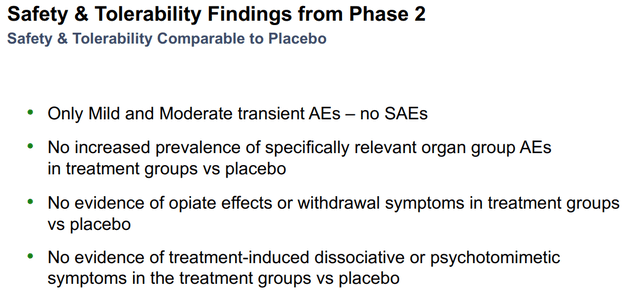

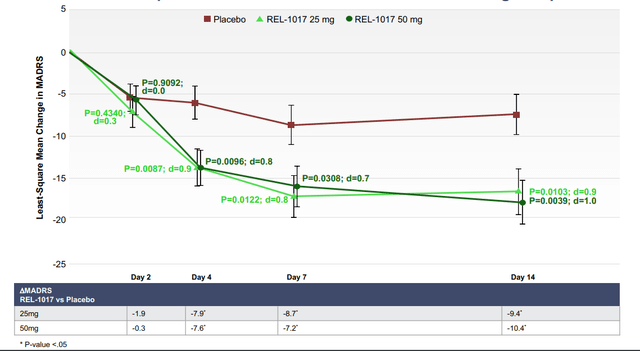

We highlight the key takeaways from phase 2 trials i) effective and durable anti-depressant effects on all tested scales, ii) rapid onset of action, with detected efficacy by day 4, iii) robust safety without opioid-related adverse events, psychotomimetic adverse events, and metabolic side-effects were shown, and iv) convenience – the drug is orally administered with a QD tablet formulation.

Key findings are:

- Subjects in both the REL-1017 25 mg and 50 mg treatment groups experienced statistically significant improvement of their depression compared to subjects in the placebo group on all efficacy measures, including: the MADRS; the Clinical Global Impression – Severity (CGI-S) scale; the Clinical Global Impression – Improvement (CGI-I) scale; and the Symptoms of Depression Questionnaire (SDQ).

- The improvement on the MADRS appeared on Day 4 in both REL-1017 dose groups and continued through Day 7 and Day 14, seven days after treatment discontinuation, with p-values <0.03 and large effect sizes (a measure of quantifying the difference between two groups), ranging from 0.7 to 1.0. Similar findings emerged from the CGI-S and CGI-I scales. Source: company IR deck

We believe REL-1017’s remarkable potency combined with the drug’s rapid and sustained effects make it the best-in-class agent currently being developed. We highlight that REL-1017 demonstrated impressive separation from placebo on the MADRS endpoint on Day 14. In comparison to SOCs, the ~9.4–10.4 reduction compared to placebo is more than double the reduction seen with approved anti-depressants. This level of efficacy was achieved in a more challenging, treatment-refractory patient population, which is highly promising moving forward in terms of commercial potential. Keeping the difference in study design in mind, if we compare REL-1017 to fellow NMDA receptor antagonists, Spravato, Spravato only demonstrated a 4.0 reduction in MADRS score over placebo at day 28 in its pivotal TRANSFORM-2 trial.

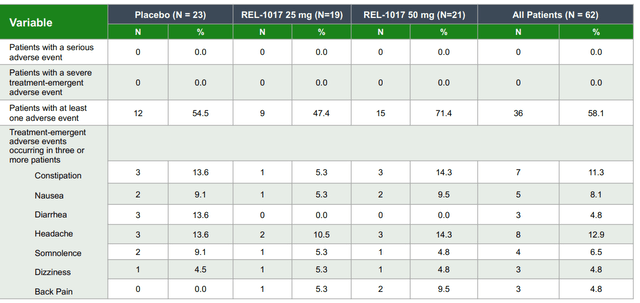

RLMD IR deck (RLMD IR deck) RLMD IR deck (RLMD IR deck) as shown above (REL-1017 phase 2 study safety data (Company IR)

No serious treatment-emergent adverse events were shown. In terms of safety, the global safety profile seems superior to Spravato as there were no reported dissociative/psychomimetic effects. Furthermore, there were no signs of opioid withdrawal upon treatment discontinuation. The most common adverse events included mild to moderate headache, nausea, and sedation, which were evenly distributed across the treatment arms, which does not concern us, and we believe the drug has a robust profile with a favorable risk/benefit as an MDD therapeutic candidate. Furthermore, we believe REL-1017’s oral formulation to be more convenient for patients than Spravato’s intranasal administration as it is less discrete.

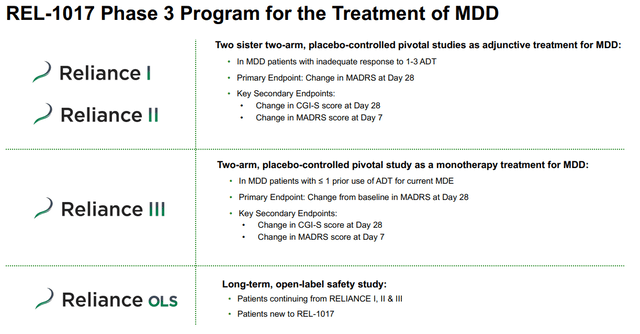

We believe the phase 3 trial design is robust and the endpoints are achievable for the drug based on their robust phase 2 performance

Key points of the Phase III program agreed upon in discussions with the FDA include:

- The Phase III program will consist of two sister, two-arm, placebo-controlled clinical trials. Each trial will be conducted in 55 clinical sites in the United States and will include approximately 400 MDD patients with inadequate response to standard antidepressants in their current depression episode. Patients will add either a 25 mg oral dose of REL-1017 once per day or placebo to their ongoing antidepressant treatment.

- The primary endpoint to be evaluated will be the change from baseline on the Montgomery and Asberg Depression Rating Scale (MADRS) score at day-28 for REL-1017 compared to placebo. Success on this endpoint with the collection of sufficient safety data would support the use of REL-1017 for chronic treatment, if approved.

- The change from baseline and the 7-day MADRS score will serve as a key secondary endpoint and will provide data on the rapid onset of treatment effect; statistically significant separation between REL-1017 and the control group was achieved by day 4 in the Phase II proof-of-principle trial completed in 2019.

- The Company expects to initiate the second Phase III trial, RELIANCE II, in the first half of 2021. Patients who complete RELIANCE I and RELIANCE II will be eligible to rollover into the long-term, open-label study, which is also expected to include subjects who had not previously participated in a REL-1017 clinical trial.

- Source: Company announcement

Valuation makes sense

Seeking Alpha Financials tracker (Seeking Alpha Financials tracker)

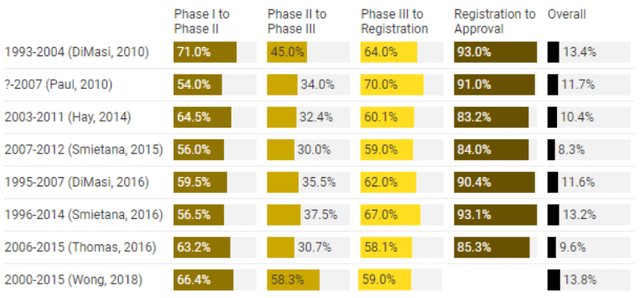

We see the peak sale of REL-1017 easily USD>1Bn for TRD considering the 19.5M in the US (2019 data) more than 280M population (globally) with treatment resistance depression (WHO Depression Fact Sheet). With a conservative penetration rate of 10% and drug price of USD5,000 per pt per year, even within the US, the peak sales should go beyond 1Bn. Considering the drug is in phase 3, using a conservative 60% probability-of-success adjustment (to adjust for clinical risk in phase 3) we get around 600M risk-adjusted peak sales. When valuing a pharmaceutical company’s pipeline asset, probability of success (PoS) percentages are usually multiplied by the unapproved drug’s projected cash flow or peak sales in order to discount the potential risk of the drug failing. Key statistics can be found below.

Alacrita Consulting POS (Alacrita Consulting POS)

Using a peak sales multiple of 2.5 (lower than what I have used previously considering current macro trends), we get a 1.5Bn valuation. Even with my conservative valuation, the stock has another 100% upside from the current valuation.

Key risks to our thesis

Key risks for Relmada are i) clinical risk where the company could fail phase 3, ii) commercial risk – due to unproven marketing capacity, iii) capital risk – the company is not cashflow positive yet and may need to raise more capital to finance its operation in ~2 years’ timeframe. Usually, for biotech investors, < 1-year cash runway is a red flag. If the company fails phase 3, the company may have a hard time raising capital at the market value and may have to give huge discounts or issue messy warrants diluting the share price.

Catalysts

Relmada Therapeutics announced that they expect data from the RELIANCE III monotherapy MDD trial of REL-1017 in mid-2022 during the FT 21 conference call. We believe the data can be announced any day. We believe the topline phase III data of the RELIANCE trial to be the key catalyst that we are planning to trade around. After positive data, we are planning to sell 70% of the position into the rally and keep 30% as a long-term investment. If the drug fails in phase 3, we are planning to liquidate 100% of the position to manage risk.

Conclusion

We are initiating with a BUY rating. We find REL-1017 a highly compelling best-in-class clinical candidate, and we are a big fan of the company’s robust financial position of having more than USD200M cash. We are positive about the company’s upcoming key catalyst, REL-1017 data readout during Q4 22, and if phase 3 is positive similar to phase 2, we believe there is a further ~100% upside to the current valuation.

Be the first to comment