simonkr/E+ via Getty Images

When people think about REITs, they think offices and when they think about offices, they think REITs. This association is ubiquitous throughout media and colloquial discourse. It is deleterious to overall REIT performance resulting in the entire REIT index collapsing due to isolated weakness in a tiny property sector.

A report came out about office vacancy being high and CNBC covered the story in the video below. If you click through to watch it, I think the perception problem to which I am referring will become obvious: Office is treated as synonymous with commercial real estate, REITs or Real estate funds.

I largely agree with the expressed views that office vacancies are high and will remain high which is troubling for the office market. The perception problem I want to correct today is the notion that struggling office somehow means REITs will struggle.

NAREIT, the organization that provides governance of REITs, is supposed to be an advocate for the sector but even they are not doing REITs any favors. If you go to their sector list even NAREIT lists offices first.

This notion is grounded in historical reality, but has become antiquated.

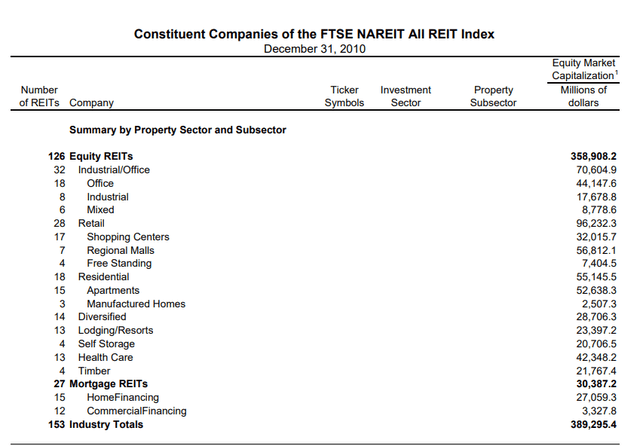

Historical office dominance within REITs

Back in 2010, the office subsector was 12.3% of REITs. It had a market cap of $44.147 billion compared to the overall equity REIT market cap of $358.9 billion.

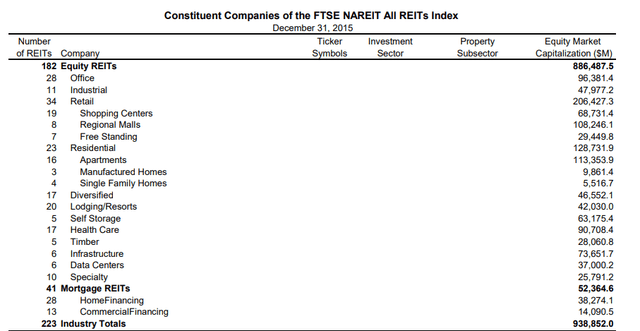

This largely remained the case in 2015 with office having a $96.3B market cap compared to equity REITs at $886.5B for a roughly 11% weighting.

Times have changed

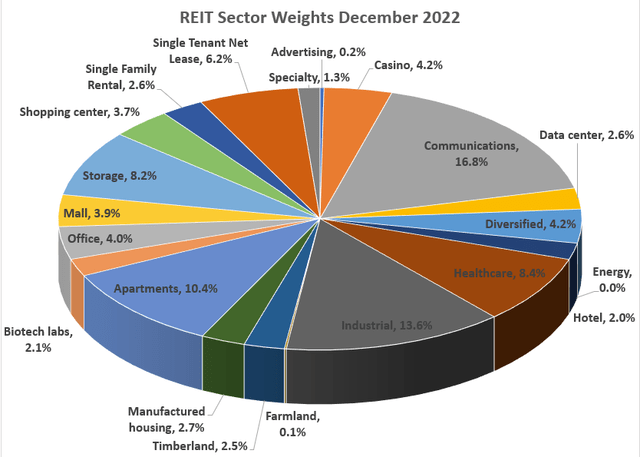

In the last decade, office has shriveled, and other areas of commercial real estate have flourished.

The office REIT sector is now just $44.5B against an overall REIT market cap of $1.1 trillion. It is 4% of the market.

Single REIT stocks dwarf the office REIT sector. Prologis (PLD), an industrial REIT, is single handedly more than twice the size of the entire office subsector. Casinos are a bigger REIT sector than office and there are only 2 casino REITs, Vici Properties (VICI) and Gaming and Leisure Properties (GLPI).

Cell Towers are now the dominant force in REITs with giants like American Tower (AMT), Crown Castle (CCI) and SBA Communications (SBAC) collectively making up 16.8% of the REIT market.

Why this matters

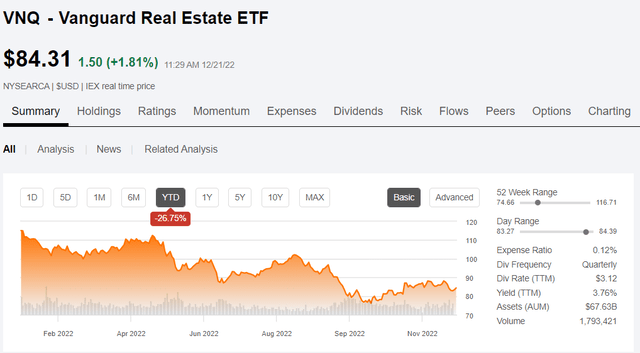

In observing the way market participants discuss REITs and real estate in general it is not surprising that the REIT index is down nearly 27% this year.

- Office is struggling

- Malls are struggling

These sectors are the stereotypical REIT sectors and are perceived as the biggest weights. So when people see that kind of struggle they sell the Vanguard Real Estate ETF (VNQ) and this happens.

The office and mall struggles are only 8% of the index and even the mall sector of REITs is doing well. While malls broadly are indeed hurting, almost all of the REIT weight in malls is Simon Properties (SPG) which consists of the top 25% of malls which are doing fairly well. It is experiencing positive bottom line growth. So really it is just 4% of the index dragging down perception of the entire REIT sector.

It is the dissonance between the perception and the reality that has created the unusually favorable opportunity available today.

The actual bulk of the index is growing nicely.

- Towers are growing secularly

- Industrial is still growing at 30%+ rent bumps

- Apartments had explosive growth in 2022 that will likely slow to moderate growth in 2023

- Healthcare REITs bottomed fundamentally in 2022 and are poised for an earnings rebound in 2023

- Single tenant net lease has steady contractual earnings growth

These sectors are 55% of the REIT index. Most of the smaller sectors are doing well too. In fact, 92 REITs have raised their dividends in 2022.

The main areas in which to be cautious are self-storage and office which are collectively 12.2% of the index.

The opportunity

Isolated weakness amplified by a perception of office being the flagship of REITs has caused widespread price declines.

As of today, the median REIT trades at 76.5% of Net Asset Value (NAV). I think most market participants are smart enough to see this as opportunity if they are looking at individual stocks. However, passive share has now surpassed 50% and price discovery is arguably not working properly.

ETFs necessarily trade groups of stocks rather than individual stocks and it is this passive component that has translated weak sentiment on office into weak pricing on REITs broadly.

I am thankful for the opportunity to buy high quality, growing real estate at 75% of NAV.

Be the first to comment