Michael Warren/E+ via Getty Images

Real Estate Earnings Preview

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on July 17th.

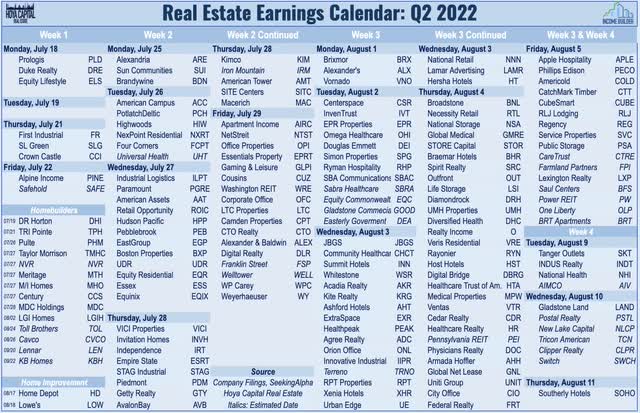

Real estate earnings season kicks off this week, and over the next month, we’ll hear results from more than 175 equity REITs, 40 mortgage REITs, and dozens of housing industry companies which will provide the first look into how the real estate industry is adapting to the shifting macro environment. This report discusses the major themes and metrics we’ll be watching across each of the real estate property sectors this earnings season. Below, we compiled the earnings calendar for equity REITs and homebuilders. (Note: Companies that have not yet confirmed an earnings date are in italics)

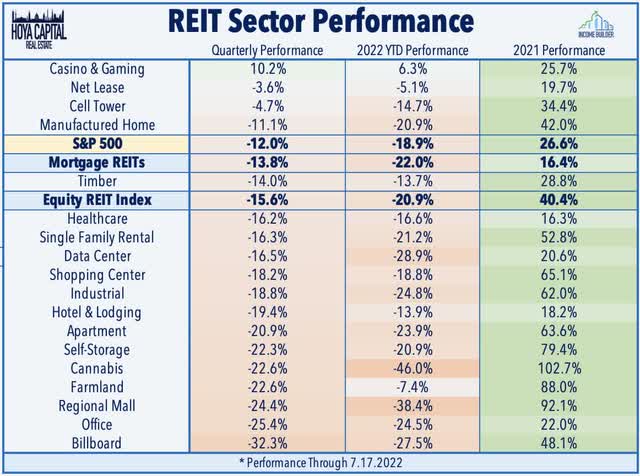

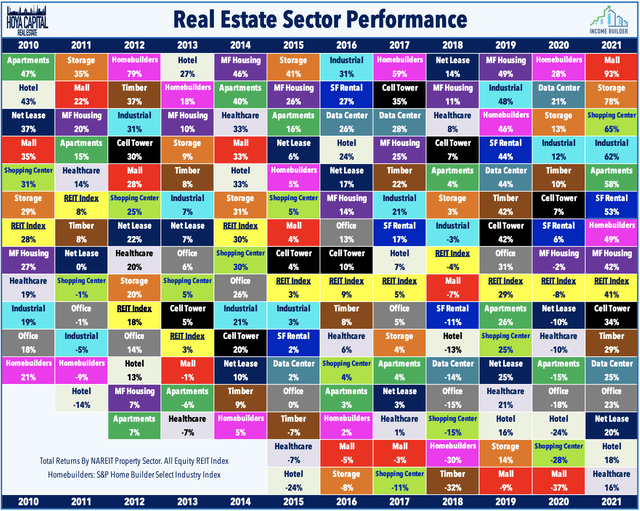

Over the past quarter – the 13-week period beginning April 17th – the Equity REIT Index is lower by roughly 16% – slightly lagging the 12% decline in the S&P 500 during this time. The benchmark 10-Year Treasury Yield is almost exactly flat during this time – beginning the period at 2.86% and ending at 2.92% – despite a brief spike up to 3.50% in June. Interest rate-sensitive sectors – net lease, manufactured housing, and healthcare – have benefited from the recent retreat in long-term rates while recession concerns have dragged on the more economically-sensitive sectors – billboard, office, and regional mall REITs. Notably, casino REITs are the lone property sector in positive territory over the past quarter – and the only positive sector for YTD 2022 as well – benefiting from an upward “re-rating” of the sector.

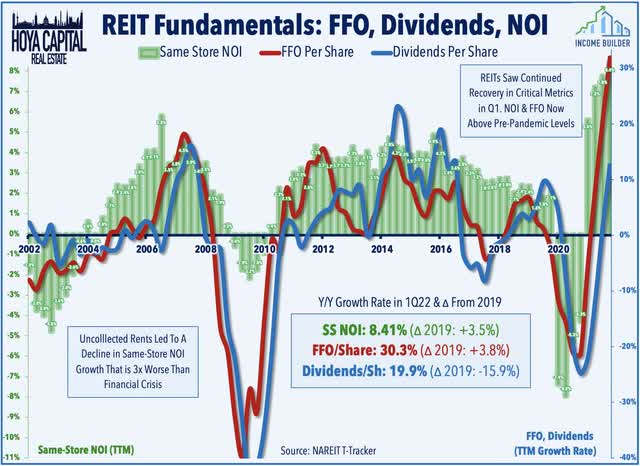

As discussed in our Real Estate Earnings Recap, the REIT sector is coming off a solid first-quarter earnings season in which roughly 80% of equity REITs beat consensus FFO estimates while more than 70% of the REITs that provide forward guidance raised their full-year outlook. Dividend hikes have been among the prevailing themes throughout 2022 with over 85 REITs already raising their payouts so far in 2022, outpacing the record-setting pace seen last year. In the equity REIT space, we’ve seen one dividend cut while in the mortgage REIT space, we’ve seen four dividend cuts.

While performance patterns have been seemingly uncorrelated with fundamentals in recent months, results from residential and shopping center REITs were most impressive last quarter, followed closely behind by industrial and storage REITs. The sell-off combined with upward earnings revisions and dividend hikes has pulled valuations to the “cheapest” level since 2020 and swelled the average dividend yield to the highest since 2018. Driven by a 8.4% rise in same-store Net Operating Income (“NOI”) – the strongest quarter of property-level growth on record – REIT Funds From Operations (“FFO”) was nearly 10% above its 4Q19 pre-pandemic level on an absolute basis, and 3% above pre-pandemic levels on a per-share basis.

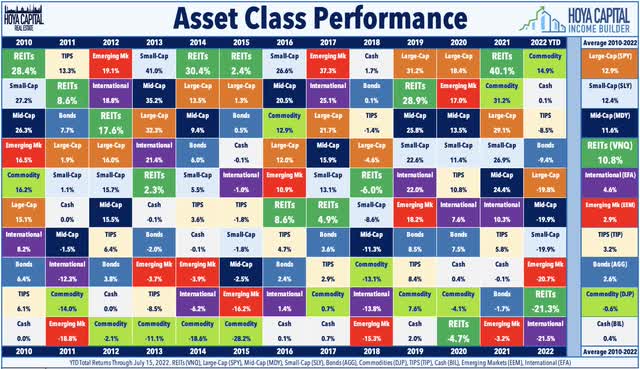

Despite the strong slate of earnings reports across most property sectors, performance trends have been dominated by macroeconomic factors and the broader sell-off across essentially all asset classes. Our recent “Best Ideas in Real Estate” report discussed our view that ‘quality is cheap’ as unusually elevated correlations between REITs this year has resulted in the relative undervaluation of ultra-high-quality names in recession-resistant sectors. More broadly, with REITs being one of the most domestic-focused and rate-sensitive sectors, we believe that earnings season will be a catalyst to drive an upward re-pricing of the sector with a particularly strong rebound from high-quality REITs in the “essential” sectors – residential, technology, and industrial.

Industrial & Tech REITs Earnings Preview

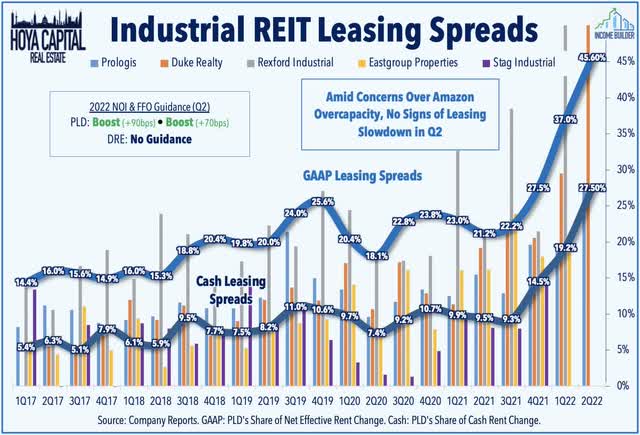

Industrial: REIT earnings season kicked off on Monday with very strong results from Prologis (PLD) – one of the most closely-watched reports of the entire month. Industrial REITs – a perennial performance leader in recent years – have been slammed over the past month with declines of 20-30% after Amazon announced plans to cut costs in its logistics network, pumping the breaks on its aggressive pandemic-fueled footprint expansion amid rising costs and slowing consumer spending, seeking to reduce overcapacity through sublets and renegotiated leases. Results from PLD showed few signs of slowing demand as the logistics giant boosted its full-year NOI and FFO outlook while recording an acceleration in renewal rates. PLD recorded a record-high 45.6% increase in effective rents and a record 27.5% increase in cash rents. In addition to updated NOI and FFO guidance, we’re focused on commentary around any changes in leasing demand given the pullback from Amazon.

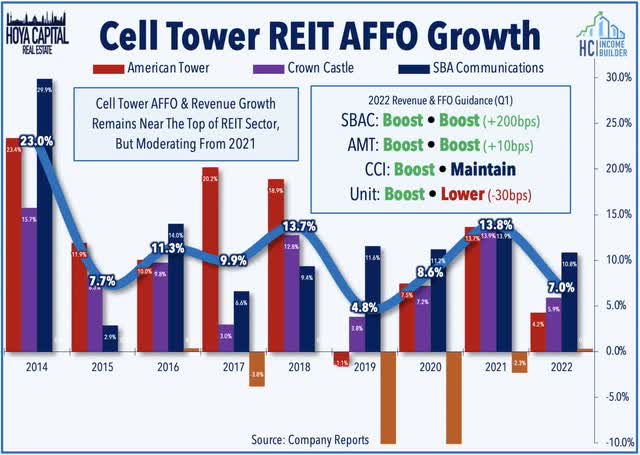

Cell Towers: After uncharacteristically lagging for most of the year, Cell Tower REITs have been one of the best-performing property sectors over the past quarter, benefiting from favorable macro shifts and positive industry-specific catalysts. Strong earnings results in Q1 highlighted the underappreciated inflation-hedging characteristics of cell tower REITs as international lease escalators are typically linked with local CPI. DISH Network (DISH) commercially launched its 5G network, becoming the fourth national wireless carrier alongside AT&T, Verizon, and T-Mobile. Tower leasing demand suggests that DISH intends to be a viable player, and we believe that any level of success is incremental for tower REITs. We’re focused on updated AFFO guidance and the outlook for U.S. organic growth as well as any commentary around the pace of 5G deployment specifically related to DISH.

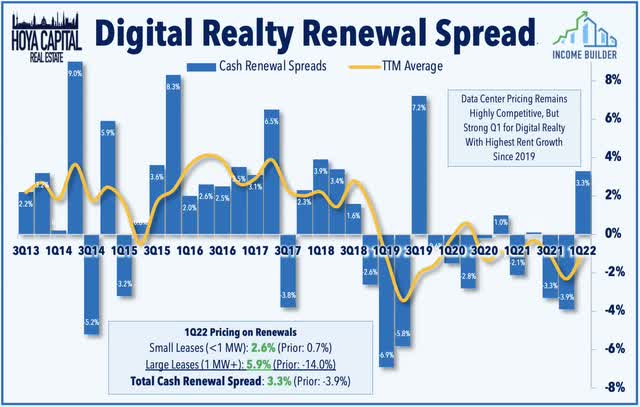

Data Center: Data center REITs have become “battleground” stocks in recent months after short-selling firm Chanos & Company launched a $200m fund that will bet against US-listed REITs with a particular focus on data centers. In a Financial Times interview, Jim Chanos described the position as the firm’s “big short” based on the thesis that “value is accruing to cloud companies, not the bricks and mortar legacy data centers.” While growth has indeed slowed from the mid-2010s, we’re quite a bit more bullish on the sector than Chanos, noting that the data center operators, too, have aggressively consolidated and believe that there’s more than enough value to be shared in the cloud for data center REITs and hyperscalers to coexist. We see a significant underestimation of the pricing power of the network-dense data centers, in particular, the major focus of Equinix (EQIX). Pricing trends and leasing demand will be closely watched this quarter, as will commentary around M&A given the acquisition of Switch (SWCH) this past quarter by DigitalBridge (DBRG).

Residential Real Estate Earnings Preview

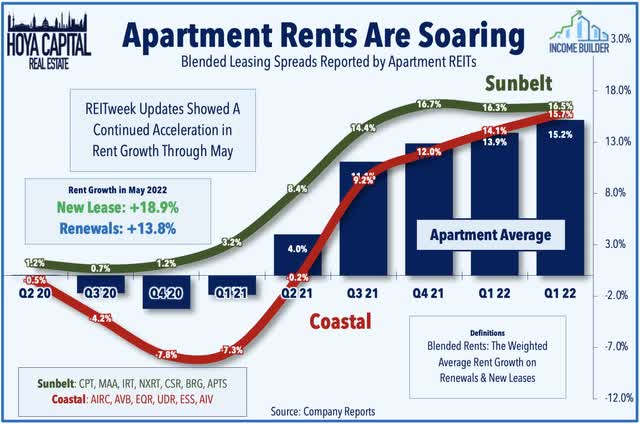

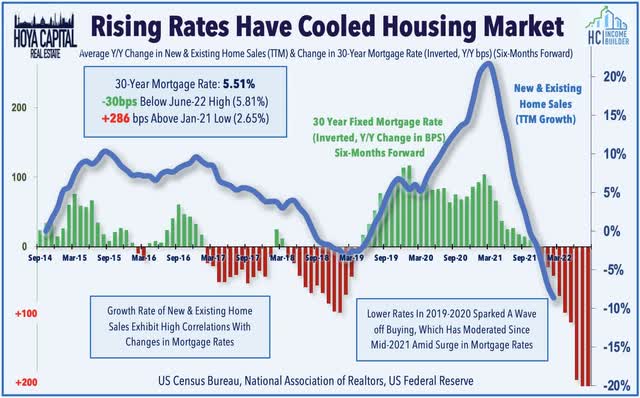

Apartments: The state of the U.S. housing market will be a critical focus throughout earnings season as the historic surge in mortgage rates prompted a sharp cooldown in home buying demand and pushed many potential buyers back into the rental markets. Cooling home prices will eventually filter into rental markets, but rents still have quite a bit of “catching-up” to do to equalize the Buy vs. Rent economics which favor renting by the most in over a decade. The latest report from Apartment List found that rents increased by 5.4% in the first half of 2022 – a cooldown from the record pace of 8.8% in 2021 – but still faster than the rent growth in the pre-pandemic years. We’re focused on rent growth metrics on new and renewal leases and on commentary about any potential changes in demand observed in the past month since the encouraging updates provided in early June during REITweek.

Homebuilders: With the pace of home sales moderating considerably amid the surge in mortgage rates, and with home price appreciation showing significant cooling over the past month – and even turning negative on a month-over-month basis in several of the hottest markets – results from homebuilders will be a major focus this earnings season. Supply chain and land constraints prevented the type of overbuilding that we observed in the mid-2000s, and even with elevated cancellation rates, homebuilders still have a historically large demand backlog to work through while overall housing inventory levels remain far below average. With P/E valuations in single digits, homebuilders have a relatively low hurdle to beat, and investors will be looking for confirmation that the resilience seen in results from KB Home (KBH) and Lennar (LEN) weren’t stymied by the latest surge in mortgage rates, which peaked in late June near 6% before retreating in recent weeks.

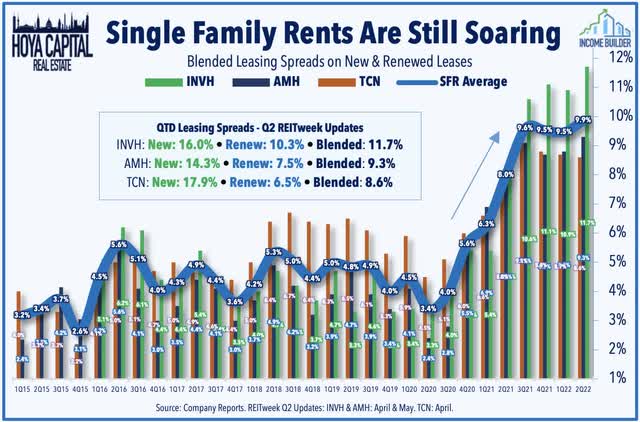

Single-Family Rentals: Single-Family Rental REITs were born from the last economic crisis when a cascade of foreclosures enabled a new class of institutional rental operators to emerge by buying distressed properties en-masse. Similar distress in the U.S. housing market is highly unlikely given the underlying supply constraints resulting from a decade of underbuilding, and ironically, due to the presence of these well-capitalized institutional investors. REITweek updates in June showed notable strength with blended leasing spreads actually accelerating in the quarter while several REITs acknowledged that lease rates on existing units remain far below market, which should serve as a tailwind for sustained NOI growth. We’re focused on leasing spreads and if these REITs are viewing the recent cool down as an opportunity to accelerate the expansion of institutional ownership across the single-family space and the maturation of “built-for-rent” single-family development.

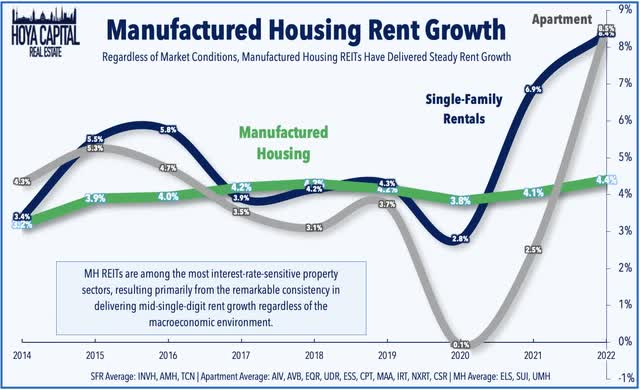

Manufactured Housing: Manufactured Housing REITs – one of the most “recession-resistant” property sectors given their countercyclical demand profile- have rebounded over the past month following uncharacteristic underperformance in early 2022. While MH REITs have historically been among the most rate-sensitive sectors due to their remarkable consistency in delivering steady 3-4% rent growth, we believe their inflation-hedging potential is underappreciated. MH rents are more closely linked with the CPI Index than any other residential sector. This CPI-linkage comes in two forms – indirectly through the Social Security Cost of Living Adjustments, and directly through the direct CPI-linkage on longer-term MH site leases. We’ll be focused on rent growth guidance and on commentary about recent demand trends in the more pro-cyclical business segments – marinas and RV parks.

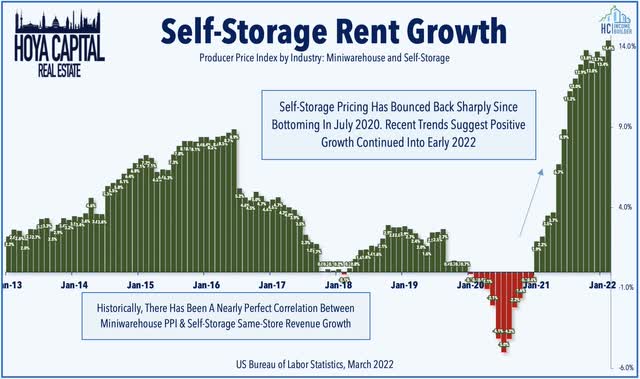

Self-Storage: Storage REITs appear to be caught up in the bearish sentiment surrounding industrial REITs – a rather distant “cousin” to the storage sector – and the unusually-high recent correlations are fundamentally unwarranted. Few REIT sectors have defied expectations as comprehensively as storage REITs since the start of the pandemic, and while several pandemic-fueled tailwinds are waning, the long-term outlook remains quite compelling. The Producer Price Index for self-storage facilities – which has historically exhibited a near-perfect correlation with rent growth – showed that pricing power remained robust in the second quarter with rents rising at 20% annualized rates. We’re interested to see if the streak of “beat and raises” can continue and whether the likely moderation in record occupancy rates towards pre-pandemic norms can continue to be offset by rent growth.

Office & Hotel REITs Earnings Preview

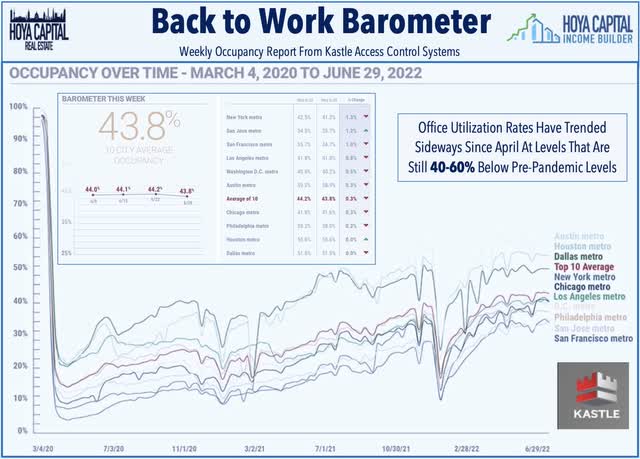

Office: The “Return to the Office” has been slow, to say the least. More than two years into the pandemic, data from Kastle Systems still shows that office utilization rates remain 40-60% below pre-pandemic levels and have trended sideways since the post-Easter acceleration. Office leasing demand – and earnings results from these office REITs – have been surprisingly resilient, however, particularly for REITs focused on business-friendly Sunbelt regions and specialty lab space. Investors remain skeptical over how long companies will continue to pay full price for half-empty office space. Utilization rates remain far higher in Sunbelt markets with shorter commutes, and so long as labor markets remain tight and employees have the negotiating power, it’ll be tough to pull reluctant workers back into the commuting grind in coastal markets. Leasing velocity will be closely watched this quarter.

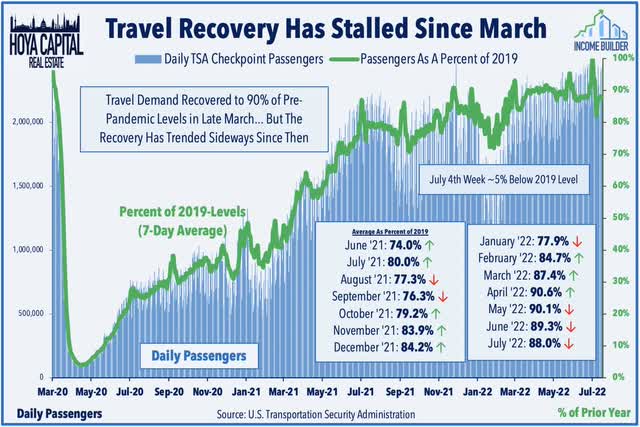

Hotels: Dubbed the ‘Summer of Revenge Travel’, several years of pent-up demand from COVID delays have helped to offset mounting economic headwinds with hard-hit urban hotels enjoying a particularly strong recovery. Skepticism over the sustainability of this momentum, however, has dragged hotel REITs lower by roughly 20% over the past quarter after being the top-performing property sector for much of 2022. Concerns over a “demand bubble” appear warranted given recent high-frequency data and the complexion of the recent boom, driven almost entirely by domestic leisure travel and surging urban room rates while business and international travel remain severely depressed. We remain cautious on full-service coastal hotel REITs, but see long-term value in select limited-service hotel REITs. We’re interested in updated expectations from hotel REITs and whether these REITs have seen any material demand shifts in the past several weeks.

Retail REIT Earnings Preview

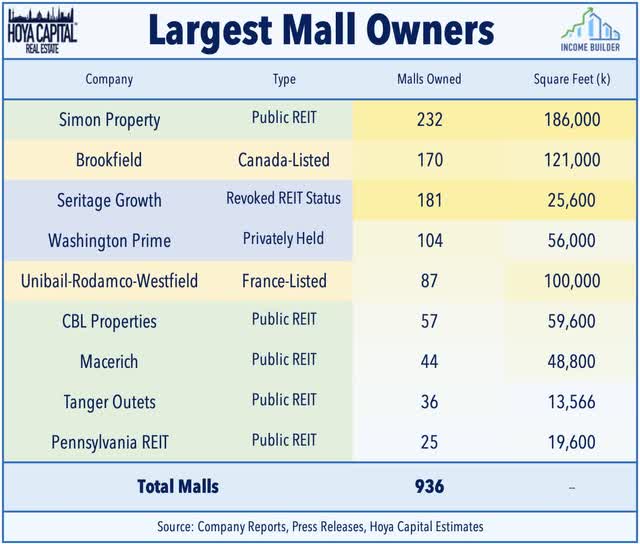

Malls: Mall REITs are back at the bottom of the REIT sector in the performance tables this year as surging gas prices and broader recession concerns have led to a cool down in brick-and-mortar retail spending. The slowdown comes as mall REITs were just beginning to see a return to pre-pandemic traffic and sales levels in early 2022 and we reiterate that a recession could be a final death blow to lower-tier malls. Seritage Growth Properties (SRG) approved a plan earlier this month to sell all of the company’s assets and then dissolve. France-based Unibail-Rodamco-Westfield – also announced earlier this year that it wants to sell most of its two-dozen U.S. properties by the end of 2023. We’re interested to hear whether Simon Property (SPG) and Macerich (MAC) are potential buyers. We’re also focused on leasing spread this earnings season – which remained weak last quarter despite improving NOI and FFO trends.

Shopping Centers: Unlike their mall REIT peers, shopping center fundamentals are now as strong – if not stronger than before the pandemic. In the first quarter, occupancy rates climbed to the highest level since early 2015 while rental rates continue to accelerate, benefiting from the versatility and larger footprint of the strip center format, which has been a winning formula as retailers increasingly utilize their brick-and-mortar properties as hybrid “distribution centers” in last-mile delivery networks. Like their mall REIT peers, however, worries over slowing consumer spending have tempered the optimism. We’ll be focused again on leasing spreads and occupancy rates and whether the signs of pricing power on display in Q1 can be sustained.

Net Lease & Casino REIT Earnings Preview

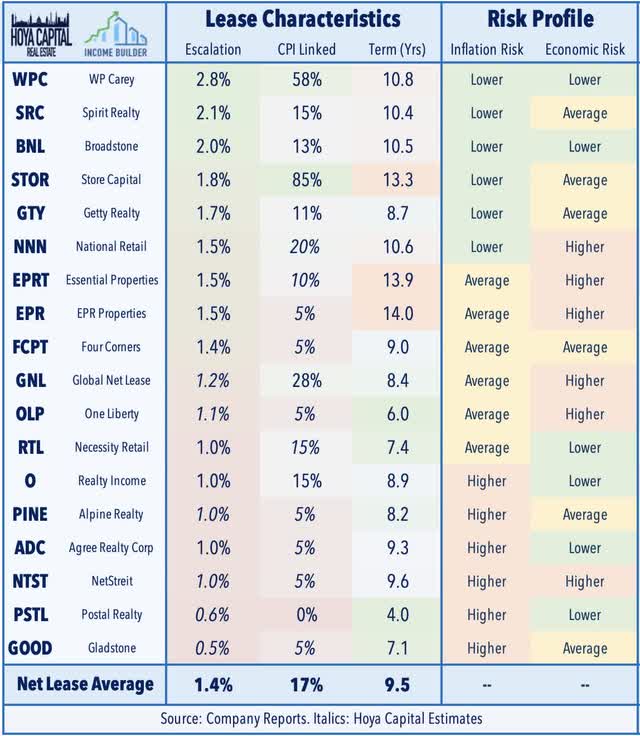

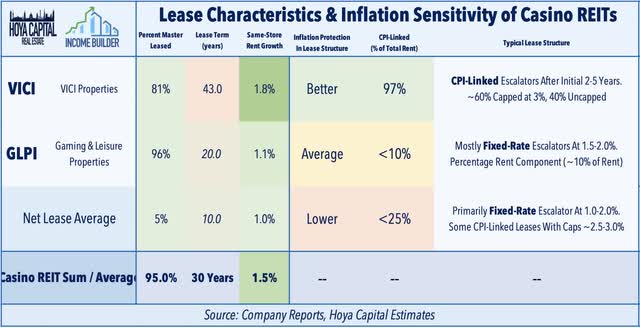

Net Lease: The counterintuitive outperformance from net lease REITs over the past quarter is consistent with the phenomenon discussed earlier this year in which net lease REITs actually outperformed the REIT sector during the prior Fed rate hike cycle from 2015-2019. Critically, net lease valuations respond to long-term interest rate and inflation expectations – not short-term rates or realized inflation – and market participants aren’t buying the “new normal” of permanently elevated inflation. Within the net lease sector, inflation risk isn’t always efficiently-priced, and some REITs are poised to report accelerating rent growth related to rising inflation while others are stuck with fixed escalators that won’t budge much beyond 1%. We expect that commentary around the inflation protection and we’re also focused on indications of how the interest rate environment is impacting acquisition activity, which has been the primary driver of earnings growth over the past decade.

Casinos: Las Vegas is one of the hotel markets that continue to see relatively strong demand as resilient leisure demand has offset the continued slump in group and convention demand. Despite their ultra-long term triple net lease structures, casino REITs provide excellent inflation hedging characteristics. VICI Properties, in particular, has one of the most inflation-hedged lease structures of any REIT. The sector has benefited from an upward re-rating over the past quarter following VICI Properties’ (VICI) completed acquisition of MGM Growth (MGP), which gives the firm a dominant competitive position in the critical Las Vegas market. We’re interested to hear commentary regarding the impact of rising interest rates on the M&A environment and how the macro environment may alter plans related to future growth opportunities given that these REITs have explored potential international expansion or a push into related property sectors.

Key Takeaways: Real Estate Earnings Preview

Performance trends across the REIT sector have been recently dominated by macroeconomic factors rather than underlying fundamentals, a theme discussed in our recent “Best Ideas in Real Estate” report. “Quality” appears to be unusually cheap within the REIT sector, particularly given the backdrop of mounting recession concerns. More broadly, with REITs being one of the most domestic-focused and rate-sensitive sectors, we believe that earnings season will be a catalyst to drive an upward re-pricing of the sector with a particularly strong rebound from high-quality REITs in the “essential” sectors – residential, technology, and industrial. As always, we’ll provide real-time commentary throughout earnings season for Income Builder members.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment