Hispanolistic

Lyft (NASDAQ:LYFT) is well underway in its recovery, and it is likely that the company will expand its top line growth, but it may be a few years before investors get a semblance of profitability. The reason I call the stock a cheap option is because investors aren’t buying the current business model, they are buying what could potentially be built upon the platform given network effects and further tech innovation. Much like an option, the investment is cheap but may expire worthless given the risks discussed in the analysis. Stocks like Lyft may be appropriate for a “Barbell Portfolio” as a risky addition with a longer investment horizon.

Lyft is a mobility marketplace for ride sharing. The company has developed their marketplace app, where ride seekers can connect to available drivers and get a ride. Lyft makes money by taking a portion of the service fee – a fairly simple business model. It operates in the U.S. & Canada and has been expanding its modes of transportation to networks of bikes, scooters, and rentals. The company’s value proposition is most appealing for short-distance rides, when a personal car is not the best option, such as on weekend nights or in areas with scarce parking.

Mobility companies, including Lyft, got a large boost during 2020 and 2021, but now we will see if these companies have a profitable business. During the analysis, we will discuss some of the risk-factors of building a public company for transportation, which may be more of a regulatory hurdle than a business obstacle. For this reason, I find the company to be high risk, and societal constraints may lead to a strict regulatory environment with the consumers ending up paying an overpriced service to the company that manages to squeeze regulatory backdoors – In other words, there is a reason why one taxi cab company dominated for years in the States, and it isn’t the color yellow.

Business Model Assessment

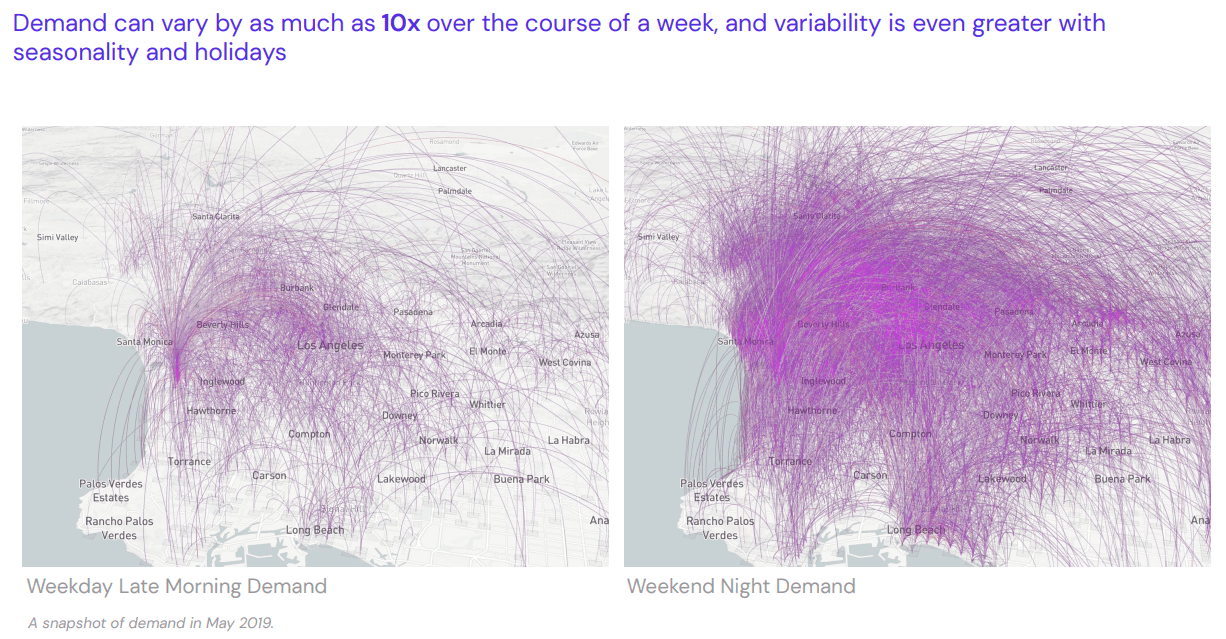

Lyft sees the highest demand for rides on weekend evenings. Although somewhat dated, the picture below illustrates the key business case for Lyft – people take a ride when they shouldn’t drive. Which is a perfectly valid business opportunity.

Map of Lyft’s ride-sharing demand during the week (Investor Presentation)

In order for the business to grow, it must find or create appeal for people to use Lyft on other occasions. This has become more difficult as some people have adapted to a work from home environment, and partly explains why the company has issues recovering to pre-2020 levels.

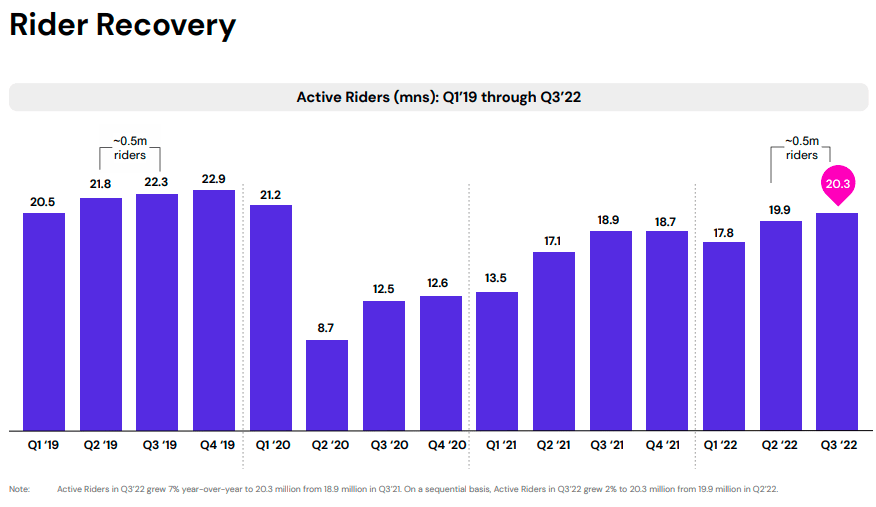

Lyft’s quarterly active riders volume (Investor Presentation)

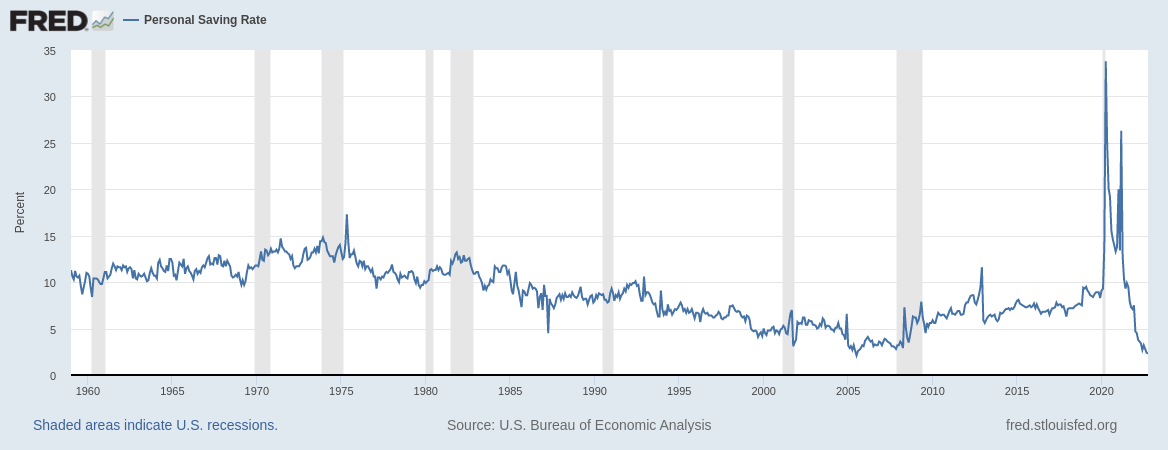

Looking at the active rider numbers may be more informative, as revenue and revenue per active rider can be a function of inflation. This shows the difficulties of expanding the services as a function of competition and consumer spending. As consumer savings reach one of the lowest points (at 2.3%) in recent US history, we can expect large discretionary spending pressures on people, translating into a contraction of the leisure rides for Lyft, and a focus on necessary mobility such as short workplace commutes.

Personal savings rate in the US (FRED – Federal Reserve)

Similar to DiDi (OTCPK:DIDIY), Lyft is shifting investor’s focus on autonomous ride sharing, and we will explore if Lyft has a chance to participate, or if they are hoping to sell investors a new hype bag.

A New Market: Autonomous Vehicles Mobility

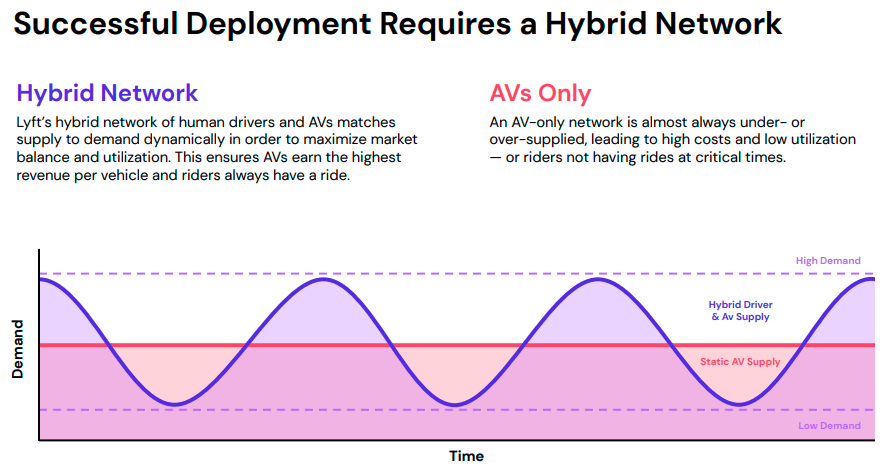

Lyft is targeting the hybrid autonomous vehicle (AV) market with the assumption that AV demand is much better serviced with a variable pool of drivers instead of a static number of available AVs.

Lyft’s hybrid vs autonomous vehicle benefits model (Investor Presentation)

While it seems reasonable that a variable fleet makes much more sense in a changing market, for competitors this isn’t a difficult problem to solve: rental companies and dealers can easily lease the number of vehicles that are currently in-demand and offload the extra to second-hand dealers. In other words, Lyft is attempting to push a problem where there hardly is one.

On the other side, Lyft is in a good position to benefit from full or hybrid autonomous driving, and this can be one of the key verticals that the company may realize by partnering with an AV software provider. The platform is likely in a better position than the AV developers since autonomous driving will likely be available to the public as a standardized solution based on the safest software. It is hard to imagine competing AV software companies in the long-term as the solutions must naturally or by regulatory pressures converge on the safest iteration. I discovered this argument from a conference of Sergio Marchionne from 2016 (5:16 to 8:39), and still find it extremely powerful. This would mean that companies that focus on growing the fleet network will be in a better position than the Mega Caps that are independently developing the algorithms.

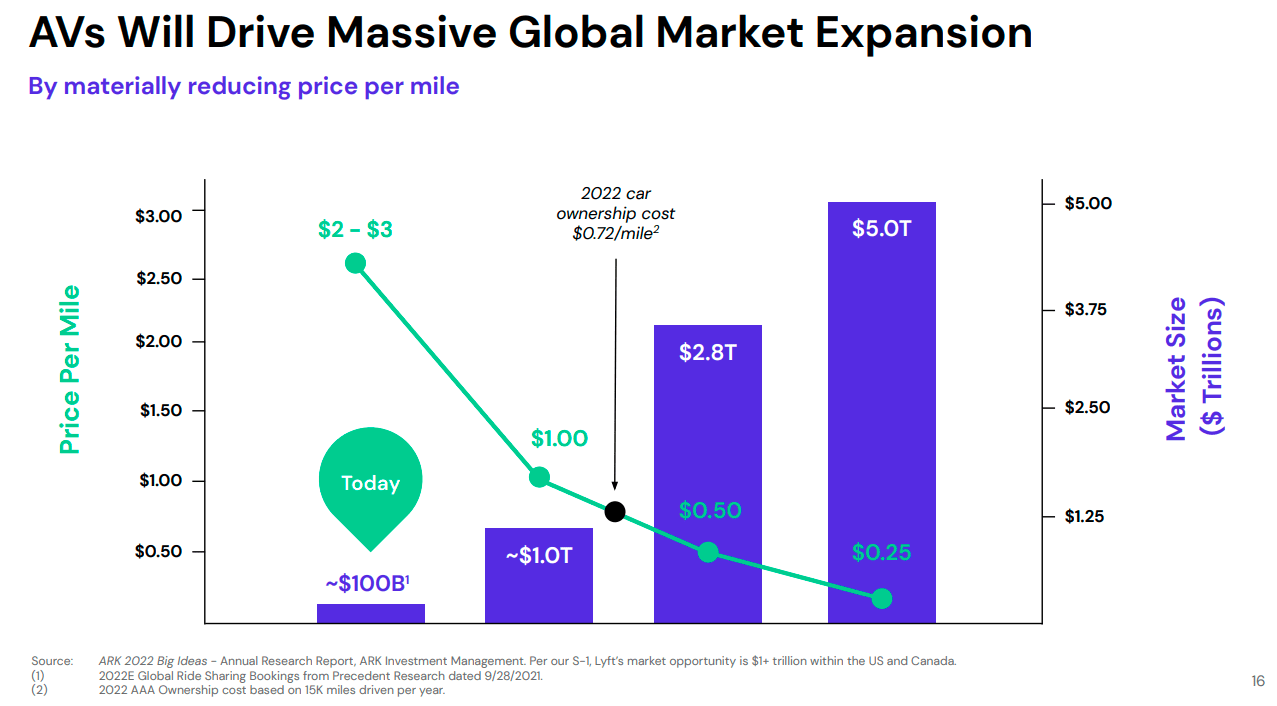

Lyft also likes to present itself in a multi-trillion-dollar market, which may make investors even more distrustful of the actual reach for the business. We can see their high projections in the chart below:

Lyft’s autonomous vehicle estimated market size (Investor presentation)

The market size estimates come from a research report from ARK, and the presentation doesn’t make it clear what is included in this market size estimate.

Estimating Lyft’s Total Addressable Market

Just to illustrate, according to Statista the average price of new vehicles in 2021 was $42,380 for the US, and the US market experienced 161 million new light vehicle sales in the last 12 months. This indicates a potential market of about: 42380*161456000 = $6.8 trillion. This represents the value of the total light auto market in the US, which makes Lyft’s proposed $5 trillion market size somewhat of an optimistic estimate, at least without the needed context.

If we take a step back and look at the current estimated market of about $100 billion, we find a much more reasonable number, and can even consider tripling it to $300 billion in the next 10 years. This would position Lyft as a player in a more reasonable $300b market and we can start thinking about assigning a market share. It seems plausible that Lyft continues to be a market leader at par with Uber (UBER) in the mobility market. We must also consider that there will still be independent competitors and the market will be fragmented as the technology keeps developing. For this reason, I estimate a 6% to 10% market share for Lyft, with a midpoint around 8%, effectively yielding about $23 billion in revenue at year 10. Considering that Lyft made close to $4 billion in the last 12-months, this implies that the company will increase its revenues by about 5x in the next decade – which is still quite an optimistic scenario.

The Option Value of a Mobility Platform

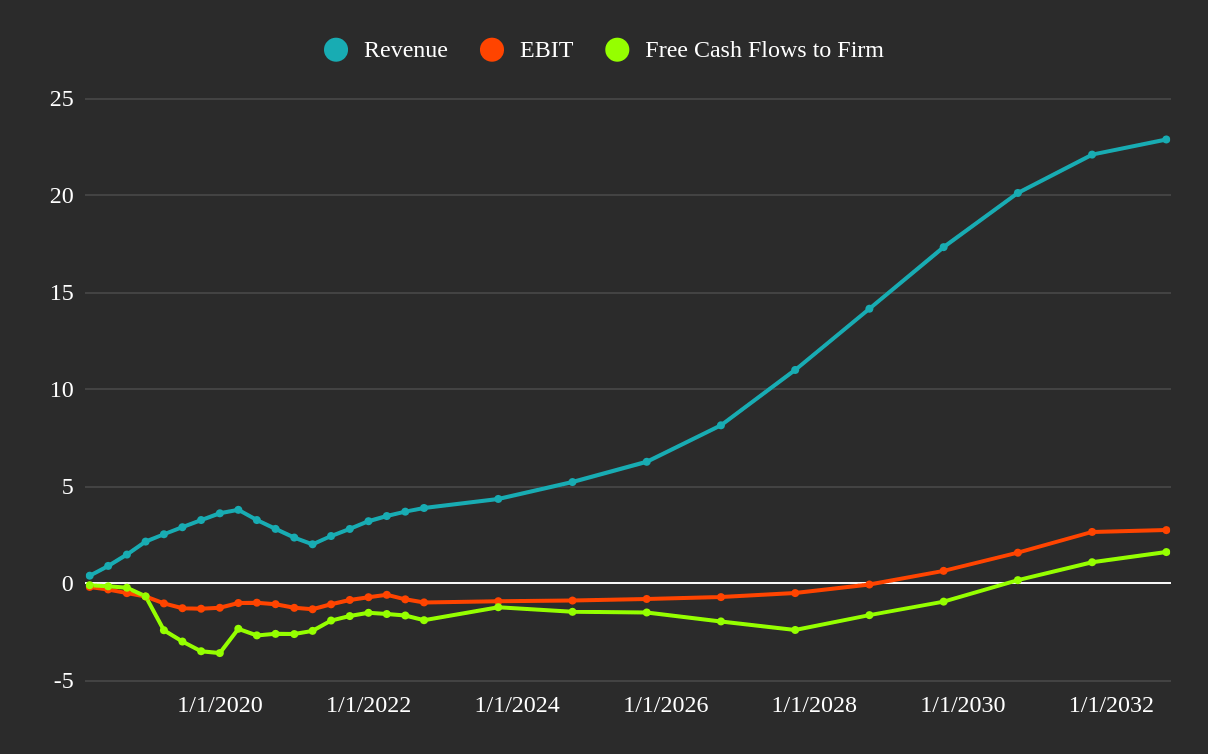

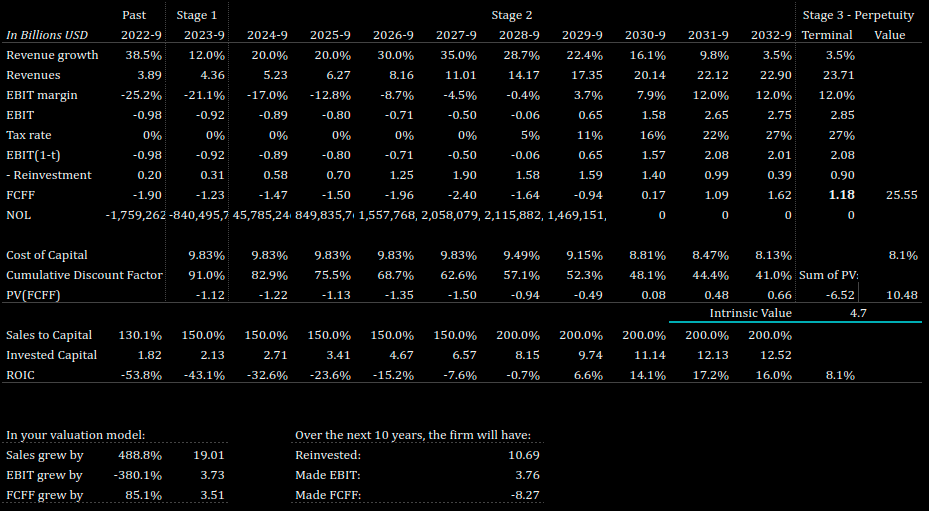

Using our valuation model, we can see that the company may be worth around $25 Billion at maturity. This implies successful execution of the growth avenues during our forecast 10-year period and attaining an EBIT margin of 12%. The chart below shows what needs to happen in order for this to be true:

Future estimates model for Lyft (Author image with data from FMP)

However, Lyft isn’t there yet, and there is no guarantee that it will ever get there. Nonetheless, this partly explains why the price tends to jump around so much for Lyft. Investors swing between valuing the potential of the company in one moment and valuing the actual performance the next.

Another important aspect of Lyft’s optionality properties is the Mobility market, which is gaining on the back of the traditional auto industry as people have access to more ride-sharing opportunities at low cost. As the mobility market shifts to ride-sharing alternatives and possibly self-driving hybrids, companies that were already present and have built up networks will be primed to take advantage of the changing landscape. In other words: companies that capture this market share early may be set up to dominate mobility in the future.

We should also note that a well-organized mobility market makes more sense in periods of high energy prices, as consumers are trying to save on transportation costs and prefer to move as rarely as possible. Should energy prices fall, we will see a resurgence of personal auto use as people can afford to buy and maintain cars as discretionary items rather than a mobility necessity.

For Lyft, this means that the company is positioned to capture the benefits of the move towards ride sharing as it already has the base infrastructure set up, giving it even more value as an option.

Additionally, the company may find technology verticals as well as additional expansion verticals. We can see that Uber is experimenting with an expansion as a food delivery service, and likewise, Lyft may find additional branches or foreign markets where it can expand its offering. We must be mindful that expanding to new and especially emerging markets is high risk, and may not turn profitable in many years, but investors can attach a value to that optionality.

Next, we will look at some of the downside risks to the company before moving to the valuation model.

Constant Struggle With the State and Litigation

In 2021, the U.S. Secretary of Labor expressed his view that in some cases “gig workers should be classified as employees” and that further review is ongoing. This raises the risk of changes in regulation, where the company will have higher obligations towards its drivers and further pressure its ability to capture value. Additionally, some cities are less open to ride-sharing initiatives, which increases the operations risk and implies a prolonged struggle with regulators.

Finally, the company is also subject to bottom-up litigation and is currently (p. 92) involved in “several multi-plaintiff actions and thousands of individual claims”. The number of individual claims (possibly coming from drivers) has the potential to impose significant legal expenses to the business. It may be the case that the future political climate will be leaning more towards the drivers and against the company, which could result in diminished profitability of the overall industry.

Remembering that the auto industry is one of the most regulated fields, we can see what new ride-sharing businesses may have to deal with in the future.

Competition Overview

Lyft entered the ride sharing business after the traditional taxi business was disrupted by Uber. Since then the field has developed, and there are multiple companies seeking to capture the ride-sharing market share. Most of these businesses have localized benefits that have been negotiated separately with domestic authorities. This makes breaking ground into a competitor’s “territory” harder for companies.

Some of the key competitors in this space include:

-

Ride-sharing: Uber and Via in the US and Canada.

-

Bike and Scooter sharing: Lime, Bird, Fifteen and Tier.

-

Car Rentals: Enterprise and Avis Budget Group.

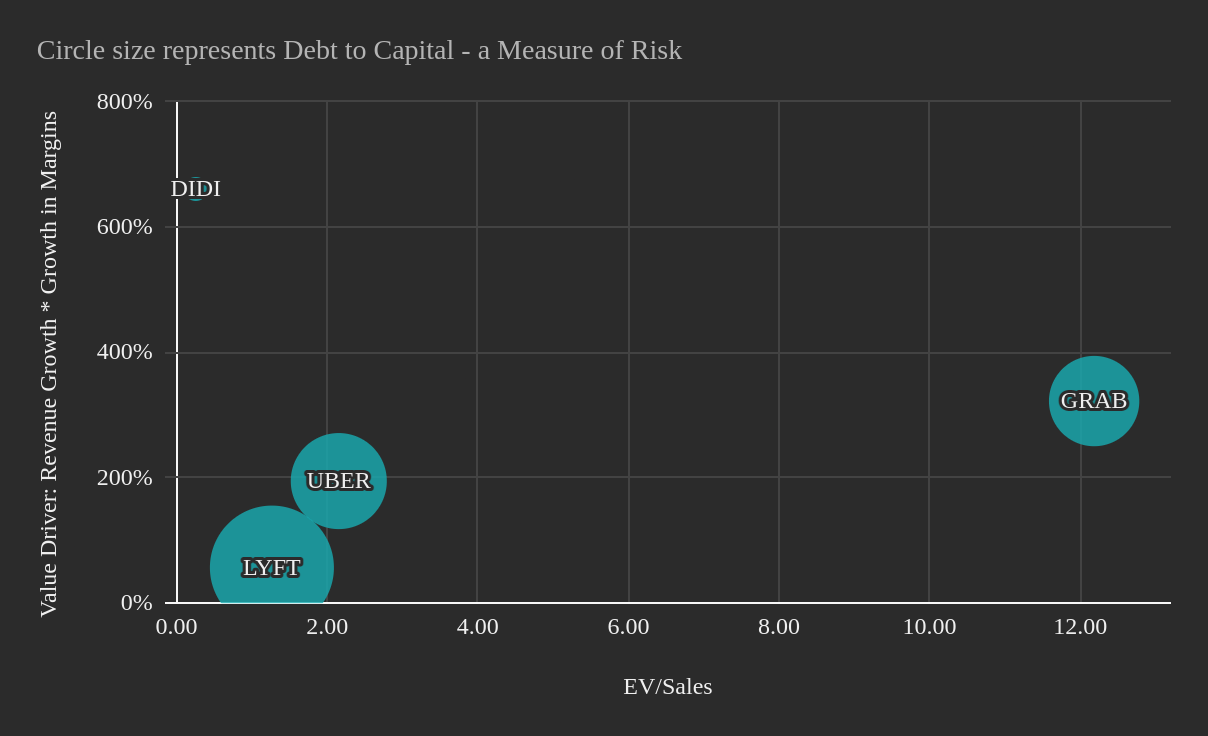

I selected the closest international peers that fit Lyft’s business model and charted their pricing against the fundamentals. We can see that while Lyft is on the cheap side, it also has increased business risk stemming from its $1.1 billion of total debt, or 15% market debt to capital.

Lyft’s peer comparison (Author image with data from FMP)

There are also a number of companies developing autonomous vehicle technology that may compete with Lyft in the future, including Alphabet (GOOGL) (Waymo), Amazon (AMZN) (ZOOX), Apple (AAPL), Aurora, Baidu (BIDU), General Motors (GM) (Cruise) and Tesla (TSLA) as well as many other technology companies and automobile manufacturers and suppliers. However, as discussed previously, the industry is likely to converge on the safest standardized solution, and platforms that have the driver and fleet networks will likely be the beneficiaries – if the business survives till then.

Valuation

Given all the assumptions above, here are the fundamentals drivers of my intrinsic valuation model for Lyft:

-

Growth deceleration between 2023 and 2025 with 12% to 20% revenue growth. A pickup of growth as the economy recovers and consumers use more discretionary spending for mobility: 30% to 35% between 2026 and 2028.

-

Converging on a market share of 8% from an estimated $300 billion TAM in year 10.

-

Breakeven in 2029 (7 years away), with EBIT margins converging at 12% in year 9.

-

High-risk cost of capital at 9.83% converging to 8.13% at maturity.

-

$1.2 billion in free cash flows to the firm at maturity.

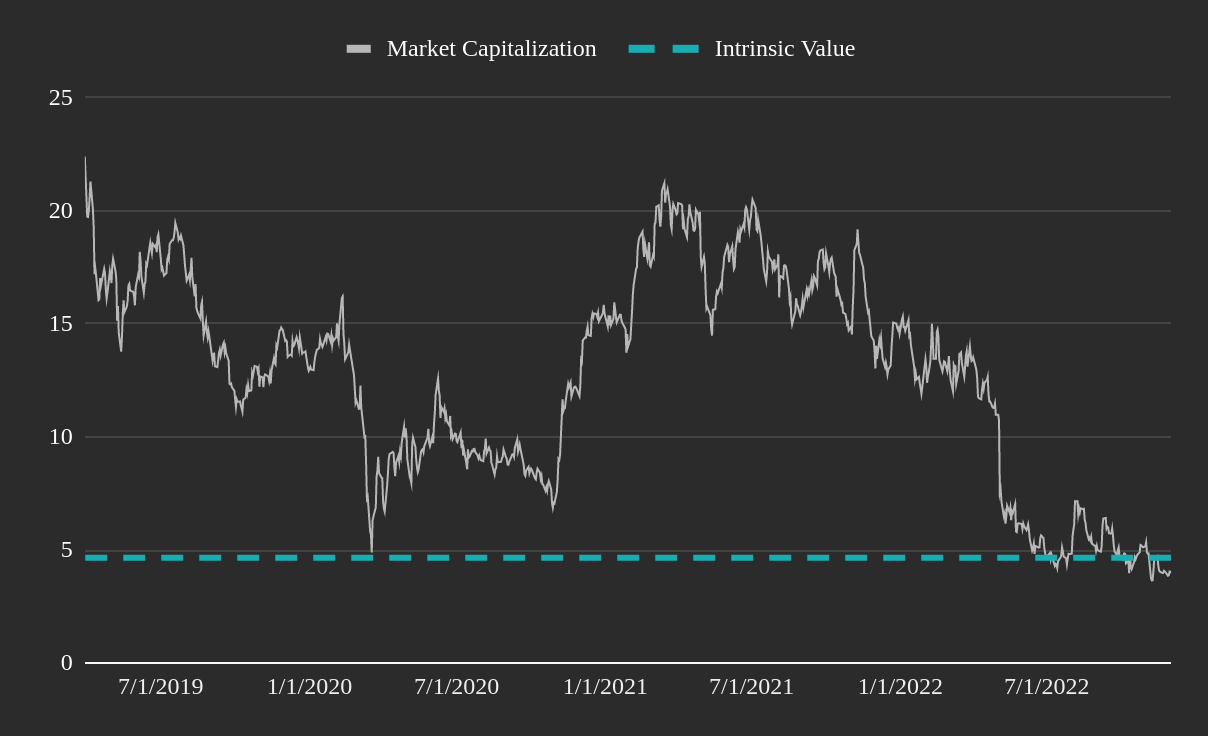

Summing up, we get a present value of the current free cash flows at $-6.5 billion and a present value of the terminal value at $10.5 billion. With adjustments for debt and cash, we get an intrinsic value of $4.7 billion for Lyft.

Estimated Intrinsic Value for Lyft (Author image with data from FMP)

Should we value the company with the expected cash flows at year 10, we get an intrinsic value around $26 billion. This discrepancy between value indicates the expected future volatility of the stock. When investors are under fear of missing out, they are likely to value the full potential of Lyft at $26 billion, however in this landscape investors are under the fear of losing money and are valuing the equity at the present value of their cash flows.

Feel free to tweak the valuation and come up with your own value of Lyft by using my model.

This gives us the following valuation table:

Valuation table for Lyft (Author image with data from FMP)

Investment Approach

In summary, I estimate the intrinsic value of Lyft at $4.7 billion or $13 per share, with a 1-year price target of 14.3% representing an upside of about 30%. Lyft is a very risky investment, which has more value in its optionality to grow into something different than today.

There is also a possibility of bankruptcy as the business seems to have taken on too much debt. Note, that while a low interest environment like 2021 is appealing for debt, management can’t use that excuse as they were never producing enough cash flows to justify the leverage. Additionally, the competition pressure and regulatory environment may make the business barely profitable for many years.

Investors with high-risk affinity may find Lyft to be cheap, but the stock may be appropriate for portfolios that are structured to absorb high volatility like a Barbell Portfolio.

Be the first to comment