blackdovfx

REGENXBIO Inc. (NASDAQ:RGNX) is a developer of AAV (Adeno-associated virus) gene therapeutics for eye diseases. They have a collaboration with AbbVie (ABBV) for retinal diseases. Their two lead assets are RGX-314 and RGX-121.

314 is targeting wet AMD and Diabetic Retinopathy. Their most advanced phase trial is a phase 3 trial called ATMOSPHERE using the subretinal delivery mode in wet AMD, followed by a phase 2 trial each using the suprachoroidal delivery mode in wet AMD, called AAVIATE, and diabetic retinopathy, called ALTITUDE. There is also a second pivotal trial called ASCENT.

121 is targeting Hunter Syndrome (MPS II) in a phase 3 trial (the text says phase I/II, however the graphics indicate phase 3 – here). The truth is, this trial, known as CAMPSITE, is a phase 2/3 trial. They also have an ongoing 6-patient open label phase 1/2 trial. See here. The company intends to file for an accelerated review for the molecule – albeit in 2024 – with the FDA’s agreement having been received in June this year.

A decade ago, two thirds of the 11 million American AMD patients, wet and dry together, could expect to become legally blind within two years of the disease. However, the development of anti-VEGF therapies has brought in a sea change in treatment options. There are four of these – avastin (bevacizumab), Eylea (aflibercept), Lucentis (ranibizumab) and newly approved Beovu (brolucizumab) – and they require repetitive therapies, ranging from every four to eight weeks in frequency, except for brolucizumab, which is given every 13 weeks. These are also inconvenient intraocular injections; as a result, compliance is low, so while the treatments are effective, noncompliant patients, increasingly larger in number, experience vision loss.

Another aspect of the wet AMD story is that while Avastin and Lucentis are both manufactured by Roche, Roche has never sought approval for Avastin for wet AMD. However, ever since it was approved for colon cancer, the drug has been used off-label by ophthalmologists, with great effect. In fact, more than 50% of wet AMD patients get Avastin as a first line treatment for wet AMD. Besides its efficacy, another factor that informs the decision is costs. The three approved treatments cost anywhere between $1500 to $1800 per treatment, while avastin costs only $50. Although avastin for colon cancer costs much more, only 1/40th of the quantity is needed for the eye, so the cost is much less. That could lead to considerable savings for patients. So a gene therapy for wet AMD will need three things – non-inferiority to anti-VEGFs, much, much reduced dosing regimen with easier delivery, and easy pricing.

RGX-314 is planned as a one-time gene therapy. The phase 3 trial is for subretinal delivery, but the phase 2 trial is targeting the even more convenient SCS mode of delivery. My previous articles have discussed these elements in a lot of detail. You will need to read those to understand where we are at right now. Which is that we are waiting for cohort 4 of AAVIATE to finally prove that RGX-314 SCS works. Like I noted earlier:

Data from cohort 4 in the ongoing AAVIATE trial, which is critical for assessing how effective and safe is the suprachoroidal space (SCS) drug delivery mechanism that is being adopted by RGNX, should be available before year-end.

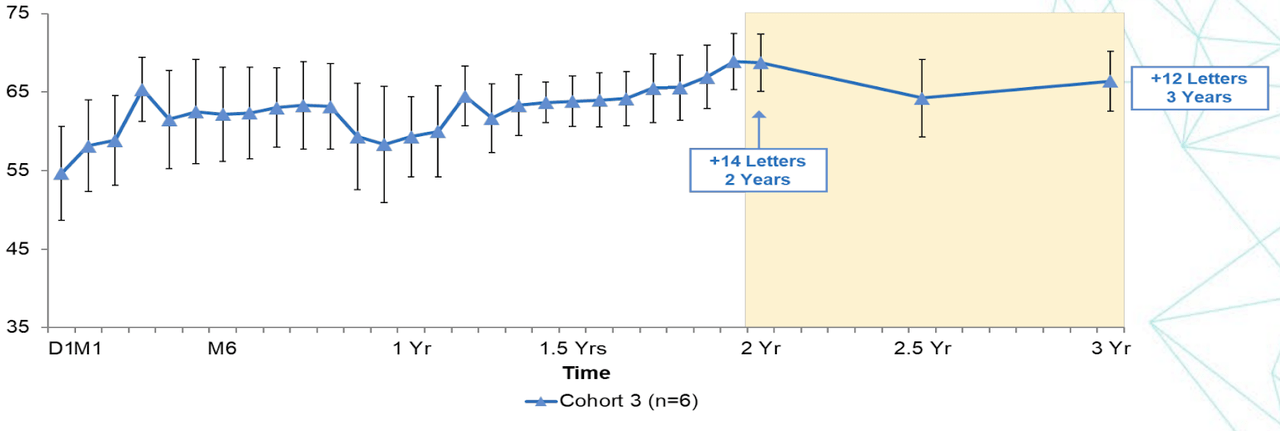

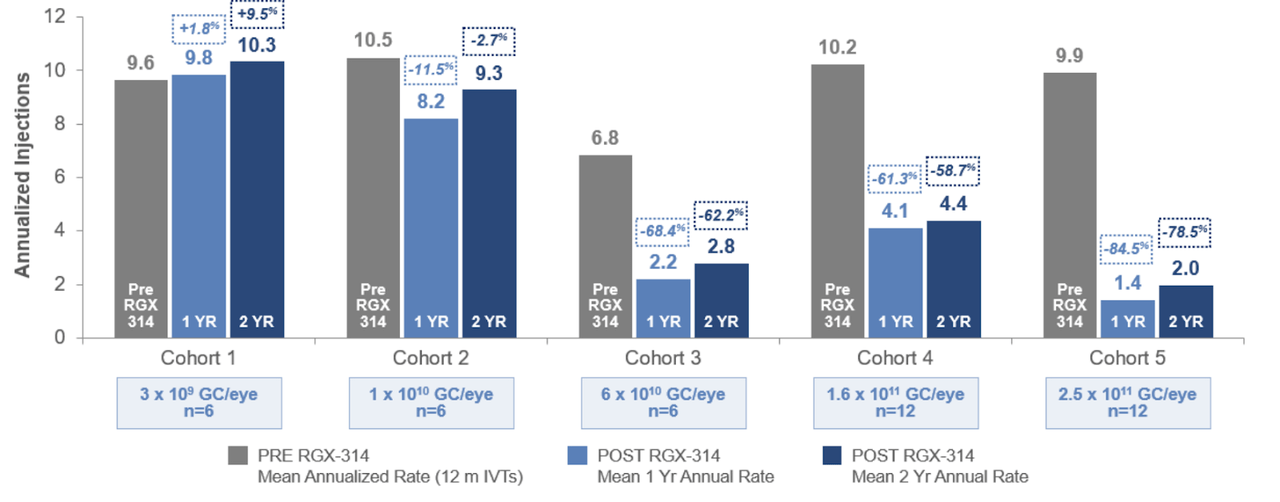

Earlier, data from the phase 1/2a SC trial showed the following:

1. Best Corrected Visual Acuity (BCVA) remained stable at 14+ letters at 2 years and 12+ letters at 3 years.

BCVA scores (Company Presentation)

2. Proportionately, anti-VEGF treatment burden was reduced by ~80% in 2 years at the highest dosage cohort.

Anti-VEGF comparison (Company Presentation)

So, also, in DR, the company states that the FDA has accepted a 2-point improvement in DRSS (diabetic retinopathy severity scale) as a valid endpoint in a pivotal DR trial. Now, in cohort 1 of the ALTITUDE trial, at 6 months, 47% of patients have seen a 2-step improvement in DRSS, while there was 0% improvement in the control arm. This compares very well with anti-VEGF treatments; for example, a single RGX-314 injection had non-inferior improvement in DRSS compared to 5 and 6 injections of Aflibercept and ranibizumab, respectively. The drug was also well-tolerated, with no drug-related SAE.

RGNX’ NAV technology platform is used by many companies, big and small, for its broad tissue selectivity, improved manufacturability, higher gene transfer and longer gene expressions. Companies that use the technology include Novartis, Bayer, Eli Lilly, Ultragenyx, Pfizer and Takeda. The company has more than 100 patents worldwide for its AAV gene technology.

Financials

RGNX has a market cap of $917mn and a cash balance of $617mn as of September. R&D expenses were $63.3 million for the quarter, while G&A was $20.9mn. Revenues were $26.5 million, primarily zolgensma royalty revenue. At this rate of expense, and given the small uncertainty surrounding royalty revenues, the company has a cash runway of about 6-7 quarters, or up to 2025.

The AbbVie deal led to a $370mn upfront payment and may produce another $1.4bn in milestone payments. AbbVie and RGNX will split the US profits, and in the rest of the world, AbbVie will get all the revenues, paying RGNX tiered royalties. RGNX will complete ongoing trials, and then the two companies will collaborate in the US for future trials, while AbbVie will handle development, manufacturing and commercialization in the RoW. AbbVie is a leading eye care company.

Recently, RGNX got into a legal tussle with collaborator Novartis over a patent for zolgensma. According to Endpts:

Novartis told the FDA in August that REGENXBIO should not have filed for a patent term extension last April for the patent in question because that application should have come from Novartis, which brought the treatment up for FDA review. The patent is listed as gene therapy pioneer Jim Wilson’s invention and Wilson cofounded REGENXBIO.

Novartis ended up losing the case at the FDA, who told them they do not have jurisdiction on the issue. This was a major if temporary boost for RGNX. Meanwhile, zolgensma sales have declined, producing less than expected royalty revenue for RGNX in the previous quarter.

Bottomline

RGNX has been a disappointment as a stock for a while now, mainly because of their trouble with Novartis, lack of a regulatory catalyst, and lack of major revenue streams in the near term. However, the company is doing critical medicine for eye diseases, and investors need to patiently wait for profit, while making sure to average down to a decent price.

Be the first to comment