smshoot

Regeneron (NASDAQ:REGN) will report a decline in revenues this year, but that reflects the lack of COVID-19 antibody sales which provided a temporary revenue boost of $7.57 billion in 2021 and which are making for tough year-over-year comparisons. Revenues excluding COVID-19 antibody sales have continued a steady growth trajectory and the company is likely to return to revenue growth in 2023 when the year-over-year comparisons get easier.

In this article, I provide an overview of the potential growth drivers for the company in the following years, and some of the challenges the company may face.

Dupixent – strong growth profile and increasing profitability

With global net sales expected to exceed $8 billion this year, Dupixent is already one of the largest products in the industry. But it still has a long runway with low market penetration in existing indications and with additional indications expected to be approved in the following years.

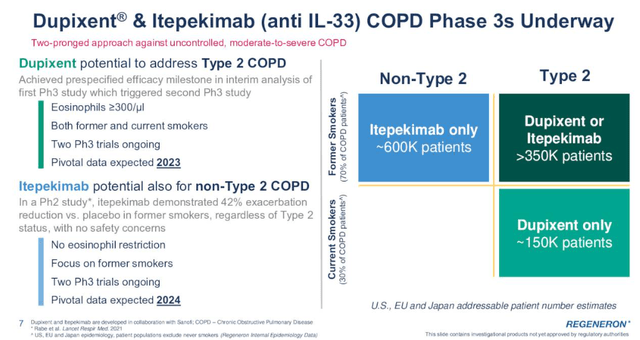

The approval for the treatment of prurigo nodularis is expected next month, and the most meaningful additional shot on goal is chronic obstructive pulmonary disease or COPD.

And there are actually two shots on goal because Regeneron and partner Sanofi (SNY) are also developing itepekimab, an IL-33 antibody, which has the potential to reach a broader COPD population than Dupixent as itepekimab could also address non-Type 2 COPD which would essentially double the addressable market.

Regeneron Investor Presentation

Dupixent has achieved the prespecified efficacy threshold at the interim analysis of the first phase 3 trial and this has triggered the start of a second phase 3 trial in COPD patients.

Itepekimab demonstrated a 42% reduction in exacerbation versus placebo in the phase 2 trial in former smokers regardless of Type 2 status and with no safety concerns. If these results are confirmed in the phase 3 trial, Regeneron and Sanofi would have another multi-billion-dollar blockbuster.

Pivotal COPD data are expected in 2023 for Dupixent and in 2024 for itepekimab.

If successful in COPD, I believe Dupixent’s peak sales could exceed $20 billion, and maybe this can be achieved even without COPD considering Dupixent’s growth rates and low market penetration in approved indications.

Regeneron and Sanofi are splitting the profits equally in the United States and there is a sliding scale outside the United States starting at 65-35 in Sanofi’s favor and ending at 55-45 in Sanofi’s favor. The profit margin of the antibody collaboration is now in the mid-20s but should continue to expand as revenues increase. I can see the profit margin rising to at least the low 30s and potentially up to the mid-30s. And there is a precedent for even higher profits as Regeneron gets 38% of Eylea’s revenues generated in territories controlled by partner Bayer. This should result in substantial cash flows to Regeneron in the following years.

The oncology business is in the early stages of growth

Regeneron is making a significant push into oncology and the acquisition of global rights for Libtayo underscores this ambition. I wrote about the efforts in oncology in my previous article, although it mostly centered on the acquisition of the global rights of Libtayo. As covered, Libtayo represents the backbone of Regeneron’s oncology pipeline, and it is just getting started.

On the hematology side, odronextamab and REGN5458 are the most advanced candidates.

The results from the potentially registrational trial of odronextamab, the company’s bispecific CD20xCD3 antibody in both types of relapsed/refractory non-Hodgkin lymphoma are expected this year with a potential BLA submission in 2023.

REGN5458 is a bispecific BCMAxCD3 antibody, and the company expects to report updated data from a potentially registrational phase 2 trial in relapsed/refractory multiple myeloma later this year with a regulatory submission planned for 2023.

Regeneron also plans to test this candidate in earlier lines of multiple myeloma in combination with other products and candidates, including with the internal costimulatory bispecific TAAxCD28 candidate.

Business development and existing collaborations

Regeneron ended Q2 with $13.9 billion in cash and equivalents ($13 billion if we exclude the Q3 upfront payment of $900 million to Sanofi for Libtayo) and it generated $2.37 billion in free cash flow in the first half of the year. The company has mostly used the cash flows to buy back shares with $8 billion in repurchases since 2019, but going forward, we should see Regeneron make more deals.

The acquisitions of Checkmate Pharmaceuticals and of worldwide rights for Libtayo represent small but important steps in this direction.

Regeneron also has existing collaborations with substantial upside potential in the second half of the decade. One of them is with Alnylam (ALNY) and covers a liver-directed C5 RNAi candidate cemdisiran, additional liver-directed candidates focusing on NASH and metabolic diseases, and ocular and central nervous system (‘CNS’) programs.

Cemdisiran has recently been successful in a phase 2 trial in IgA nephropathy and Alnylam is in charge of monotherapy programs while Regeneron is in charge of the combination program with its C5 antibody pozelimab. The combination has the potential for more potent C5 inhibition than a monoclonal antibody like pozelimab could accomplish on its own and the increased potency could also lead to less frequent administration. Regeneron is running phase 3 trials of pozelimab and cemdisiran in PNH and generalized myasthenia gravis with the intention of competing with AstraZeneca’s Ultomiris and Soliris.

Regarding the CNS part of the collaboration, it will hit a key inflection point later this year when partner Alnylam will report preliminary phase 1 results of ALN-APP in early-onset Alzheimer’s disease. The early data should show whether Alnylam’s CNS candidates can achieve significant and durable target knockdown in the central nervous system and could lead to significant expansion of the CNS-focused pipeline for both Alnylam and Regeneron.

If Regeneron decides to do large-scale M&A, I think it would be great if it merged with Alnylam. I believe Alnylam is a great fit and that the combined company would offer powerful upside in the next 5-10 years.

The other notable collaboration is with gene editing company Intellia Therapeutics (NTLA) to advance CRISPR/Cas9 gene-editing technology for in vivo therapeutic development. The initial deal was signed in 2016 and was expanded in 2020 to provide Regeneron with rights to develop additional therapeutic targets and for the companies to jointly develop potential products for the treatment of hemophilia A and B. While this is an important field for the future of the biotech industry, I am not as bullish on the commercial prospects of gene editing candidates, but if it is to be successful, the upside potential is also very decent for a company like Regeneron.

Overall, business development is the part that has the most potential to enhance Regeneron’s growth profile in the following years.

Eylea – still growing but with a set of challenges going forward

Regeneron owes its success to Eylea. And it is remarkable that Eylea is still a growth product. Eylea generated $9.4 billion in global net sales in 2021 and global net sales grew 9% Y/Y in the second quarter of 2022 to reach $2.49 billion. Regeneron records Eylea sales in the United States and partner Bayer is in charge outside the United States with Regeneron receiving a share of the profits.

There are opportunities ahead for Eylea. The company is developing the 8mg version as opposed to the approved 2mg version with the goal of extending the dosing period to every 12 weeks or every 16 weeks as opposed to the current regimen of every 8 weeks for the 2mg dose.

Results from the phase 3 trials in wet AMD and DME are expected in late Q3 or early Q4. In the phase 2 trial in wet AMD, the 8mg Eylea demonstrated improved efficacy trends compared to the standard 2mg dose, but the trial was small and the results were not statistically significant.

However, there are also challenges for Eylea going forward. Increased competition is one factor as Eylea’s success has attracted competitors. Roche’s (OTCQX:RHHBY) Vabysmo was recently approved for the treatment of wet AMD and DME, and it is the first bispecific antibody for the eye (in addition to the VEGF blockade that it shares with Eylea, it also blocks angiopoietin-2 or Ang-2). It can be dosed for up to four months and this convenience could lead to market share losses for Eylea. That is why the success of the 8mg dose will be important for the continued strength of Eylea.

Some of Eylea’s patents are also being challenged through the interpartes review and post-grant review processes, but it does not seem likely that there will be biosimilars on the market in the medium term.

Another longer-term threat to Eylea is drug pricing – Regeneron may be forced to offer significant discounts for Eylea later this decade as it could qualify for the drug discount program as one of the larger products.

Overall, given the set of challenges, I assume Eylea is likely to face some erosion due to increased competition in the following years. The extent of erosion will mostly depend on the results of the 8mg dose as it is likely necessary to fend off competitors like Vabysmo.

Valuation and upside potential

With so many moving parts and uncertainties, it is hard to arrive at a reliable valuation range. But I do think Regeneron is undervalued at current levels.

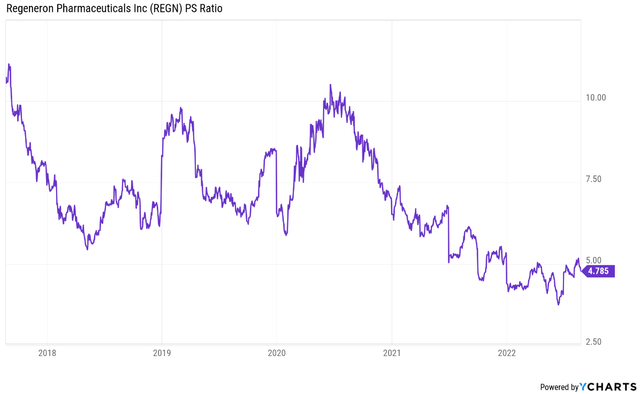

The company is trading at a compressed price to sales multiple of just under 4.8. That is well below its historical average. It partly reflects Regeneron becoming a more mature and larger company, but I still think it is still a relatively young enterprise, in terms of what it has accomplished and where it is headed.

Regeneron’s Price To Sales Ratio In The Last Five Years (Ycharts.com)

And unlike other larger biopharma companies, collaboration profits represent a large and growing part of revenues and that itself deserves an above-average sales multiple. Collaboration revenues from partners Sanofi and Bayer exceeded $4 billion in the last four quarters, and these are recurring revenues.

I should also mention the low forward P/E ratio of just below 15, but at this stage, earnings as such are understated due to the significant pipeline investments.

But going back to the price to sales multiple, I believe Regeneron’s should be in the 7 to 8 range, and that it could revisit the highs of 10 during expansionary periods (which would likely be a good time to sell). Applying the 7-8 P/S multiple range to this year’s sales estimate results in a valuation range of $770 to $880, or close to 30% upside from current levels at the low end of the range and up to 45% at the high end of the range.

Regeneron is well-positioned to continue to deliver top and bottom-line growth

Dupixent remains the key growth driver in the near term with increased penetration in existing markets and with the expansion to new markets. Libtayo’s contribution should continue to increase going forward, though I think its growth will be more pronounced in the second half of the decade thanks to the multiple combination approaches that will set it apart from competitors.

In the medium-term, I expect decent and growing contributions from pozelimab and cemdisiran in autoimmune diseases, and from the hematology pipeline with odronextamab and REGN5458 leading the way. Business development activity should also pick up, but it is not possible to quantify the potential contribution as we do not know what kind of deals Regeneron will make.

I believe the company is well-prepared to address the potential erosion of Eylea, even if it is more significant than the market is assuming at the moment. Dupixent alone has the potential to add more than $3-$4 billion in additional profits in the following years, on top of the expected $2 billion this year and this could address substantially all the profits and cash flows Regeneron could lose from Eylea, even under very aggressive erosion assumptions.

And the other products and candidates, including those the company will in-license or acquire, should add to the top and bottom-line growth in the second half of the decade.

Overall, Regeneron has multiple and potentially significant growth drivers in the following years that could address the headwinds Eylea will encounter going forward and drive continued top and bottom-line growth for the company.

Be the first to comment