Luis Alvarez/DigitalVision via Getty Images

Regency Centers Corporation (NASDAQ:REG) is a real estate investment trust (“REIT”) that has been a component of the S&P 500 Index since 2017. Its operations are primarily focused on leasing space to necessity, service, convenience, and value retailers in top markets within the U.S.

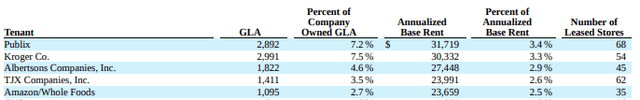

Some of its top tenants include Publix, Kroger Co. (KR), Albertsons Companies, Inc (ACI), and TJX Companies, Inc (TJX), to name a few. Collectively, with Amazon/Whole Foods (AMZN), these top five tenants represented approximately 15% of total annualized base rent (“ABR”) as of December 31, 2021. With no single tenant accounting for more than 3.5% of ABR, the company’s portfolio is well diversified. Additionally, its top tenants are concentrated in the grocer industry, which is inherently defensive due to the industry’s essential nature.

2021 Form 10-K – Summary of Top Tenants

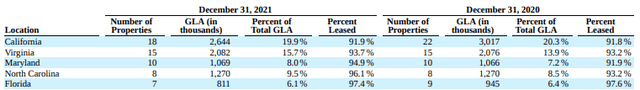

Geographically, REG has a presence in most top markets, with an emphasis on California. However, their exposure to more business friendly states, such as Virginia and North Carolina, has ticked up in recent periods. Virginia, for example, now accounts for 15.7% of gross leasable area (“GLA”) versus 13.9% at the end of 2021.

2021 Form 10-K – Summary of Geographic Concentration

In Q1FY22, REG reported solid results that was paired with favorable revisions to their full-year guidance. With their Q2 earnings set for release next week, REG is positioned on fundamental strength. Blended spreads are increasing, cash collections continue to improve, and occupancy is holding comfortably above 90%. The balance sheet also remains equipped to weather any broader macroeconomic downturn, should one occur.

Down 17% YTD, shares have performed roughly in-line with the S&P. But they are up over 3% in the past month versus a 1.5% increase in the broader index. Still, with the stock closer to their lows and at a forward multiple lower than their close peer, Federal Realty Investment Trust (FRT), there is some upside potential for long-term investors.

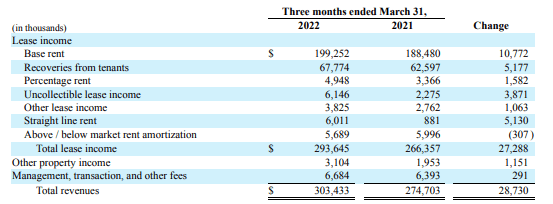

Increasing Base Rents and Improving Cash Collections

In the most recent filing period ended March 31, 2022, REG reported total revenues of +$303.4M. This was up 10.4% from the same period last year and in-line with expectations. Driving revenues higher was a +$10.8M increase in base rent, +$8.4M of which was attributable to same-store properties. In addition, REG also realized +$5.2M in contractual operating cost recoveries from their tenants. These recoveries pertain to their tenants’ pro-rata share of operating, maintenance, insurance, and real estate taxes that REG incurs to operate their shopping centers.

Q1FY22 Form 10-Q – Breakout of Total Revenues

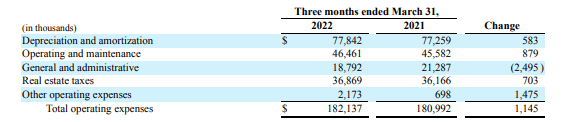

Adequate Expense Control

Though operating expenses were higher during the period, they were largely held under control. Operating and maintenance expenses were up +$879M due to an increase in general property maintenance and tenant utilities as their centers return to normal operating levels. However, the less than 2% increase was more than offset by the 5.7% increase in base rents.

In addition, REG saved +$2.5M in general and administrative (“G&A”) expenses as a result of a +$3.4M decrease in the value of participant obligations within their deferred compensation plan, attributable to changes in the market values of those investments. This decrease, however, was accompanied by an offsetting charge within net investment income in the other income/expense section of the income statement.

Q1FY22 Form 10-Q – Total Operating Expenses

Steadily Growing Earnings

During the quarter, REG recorded a gain on the sale of real estate of +$102M, primarily related to the sale of the Costa Verde Center. This, in addition to strong rent growth and adequate expense control contributed to an increase in net income available to common stockholders of 143%.

Similarly, both funds from operations (“FFO”) and same-property net operating income (“NOI”) were also higher during the period, with each up 14% and 7.8%, respectively. At $1.03/per share, Q1 FFO came in $0.09 better than expected. This beat was due in part to the collection of previously reserved rents and the continued conversion of previously cash-based tenants back to accrual-basis, which triggers a reversal of straight-line rent reserves reflected in FFO. The impact of the collections and reversals in the current quarter was $0.04/share and $0.02/share, respectively.

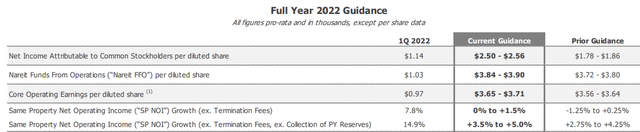

Stronger Portfolio Supports Favorable Revisions to Full-Year Guidance

Overall leasing during the quarter remained strong with 377 total leasing transactions, 289 of which were renewals. This level of volume was up 40% over historical first quarter averages. Additionally, blended spreads were 6.5% at a weighted average lease term of 5.5 years, with new leases averaging about 8.3 years and 5.1 years for renewals.

Total leased occupancy stood at 93.9% at period end. Though this was lower sequentially, it was 170 basis points (“bps”) better than the same period last year. Same-store occupancy also held at 94.3%, the same as Q4 and 170bps better than last year. In addition, same-properties were 92% commenced, a 120bps improvement YOY and 30bps sequentially. The sequential increase is notable given the historical trend of the quarter being seasonally lower.

Looking ahead, management revised guidance higher to reflect an $0.11 increase in FFO at the midpoint on higher average commenced occupancy due to favorable lease-up progress and lower turnover. In addition, guidance was updated to show the accrual effects of continued recoveries of previously uncollected rent.

June 2022 Investor Presentation – Full-Year Guidance

Sizeable Free Cash Flows Anchored by Sector-Leading Balance Sheet

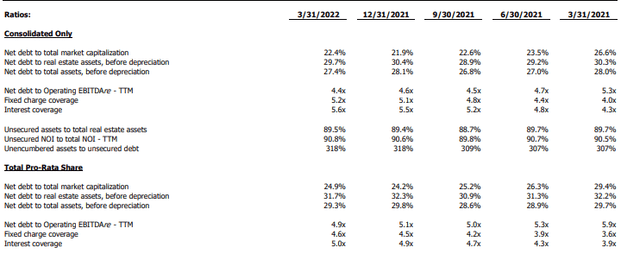

At the end of March 31, 2022, REG had total assets of +$10.8B and total liabilities of +$4.6B, comprised principally of +$3.1B in fixed rate unsecured debt with a weighted average interest rate of 3.83% and an average age to maturity of nearly 10 years.

Overall leverage is low, with a net debt to total capitalization of just 22.4% at period end. This is down 420bps from the same period last year and 50 basis points sequentially. As a multiple of EBITDAre, net debt amounted to a sector leading 4.9x. This is down significantly from the 5.9x reported last year and is on the lower end of management’s target of 5-5.5x.

Q1FY22 Investor Supplement – Comparative Summary of Various Debt-Related Metrics

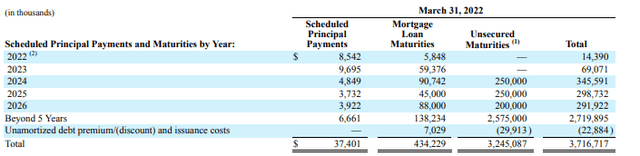

With limited near-term maturities and nearly 75% of total obligations due after five years, investors can be assured of minimal rollover risks relating to the current interest rate environment.

Q1FY22 Form 10-Q – Summary of Debt Maturities

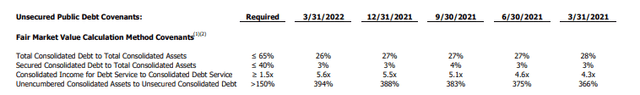

Strong compliance with their debt covenants further minimizes the company’s debt-related risks in the near-medium term. As of the current period, for example, REG had $5.60 for each dollar required for debt service versus a covenant requirement of $1.50

Q1FY22 Investor Supplement – Summary of Debt Covenant Compliance

Steadily increasing occupancy levels and continued improvements in collections of previously reserved rent has boosted recent growth in NOI and FFO, and this is expected to continue moving forward. Quality tenants with business models that are essential in nature is another strength that will further enable cash flow stability and predictability.

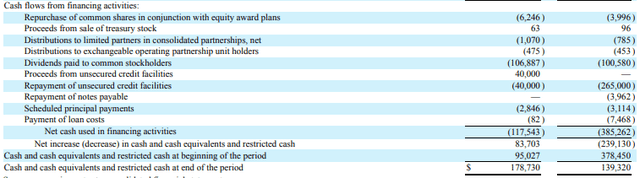

In the first three months of the year, REG generated +$142.9M in operating cash flows. This was enough to cover their quarterly dividend payments by 1.3x. Additionally, the company also generated free cash flow (“FCF”) of nearly +$60M. After repaying +$265M in debt in the prior year, REG was able to end the current period with a net increase in cash of +$83.7M. Coupled with their undrawn credit facility, this brings their current liquidity position to over +$1B.

Q1FY22 Form 10-Q – Partial Cash Flow Statement

For income-focused investors, REG has a solid track record of dividend growth, with a reported dividend compound annual growth rate (“CAGR”) of 3.6% from 2014-2021. Given the company’s conservative financial profile and strong cash flows, another dividend hike is likely around Q3 or Q4 of this year. At current pricing, any future dividend hike would bring the yield above 4%. For an S&P component, this yield would be nearly 250bps greater than the index average.

Worth Adding on Share Price Weakness

REG is a quality REIT with a portfolio of tenants with nearly recession-proof characteristics. 80% of its open-air shopping centers, for example, are anchored by grocers and community centers. The essential nature of necessity-based retail provides one element of downside protection against a broader macroeconomic downturn.

In addition, though the company’s tenants include several highly rated grocers, such as Kroger and Whole Foods, they are not overly exposed to one single tenant, with their top tenant, Publix, accounting for just 3.4% of ABR as of December 31, 2021.

A strong balance sheet consisting of a low degree of leverage and ample liquidity is another defensive attribute of the stock. Net debt as a multiple of EBITDAre, for example, is just 4.9x. This compares favorably to the 6.1x reported by close peer, FRT.

At about 16x forward FFO, one can certainly argue that shares are fairly valued. However, the company is reporting continued occupancy gains on favorable leasing terms. Yet shares have yet to reach the midpoint of their 52-week range. Additionally, the current multiple is just shy of the 17x given to FRT.

For investors seeking an entry point, it may be best to wait until fresh data is released next week on the company’s earnings release. But given the limited volatility in the shares, it’s unlikely the stock will move significantly in either direction, barring any major developments. For existing shareholders, REG remains a quality long-term holding that warrants additional positioning on any further pullbacks.

Be the first to comment