Stephen Brashear

It’s no secret that a confluence of headwinds are headed for the housing market. For one, interest rates have returned to multi-year highs above 6% for the benchmark 30-year fixed loan. For another, supply remains tight and many sellers are unwilling to budge on price, which has created a major affordability problem in areas throughout the United States. All of this bodes toward far fewer transaction volumes, which will be a heavy blow to real estate brokerages.

Though it often likes to style itself as a technology company, Redfin (NASDAQ:RDFN) makes its money like any classic real estate brokerage: by taking commissions on buying and selling homes. And more recently it has started to flip homes as well through its Redfin Now arm, which is a business that competitor Zillow (Z) has already shed.

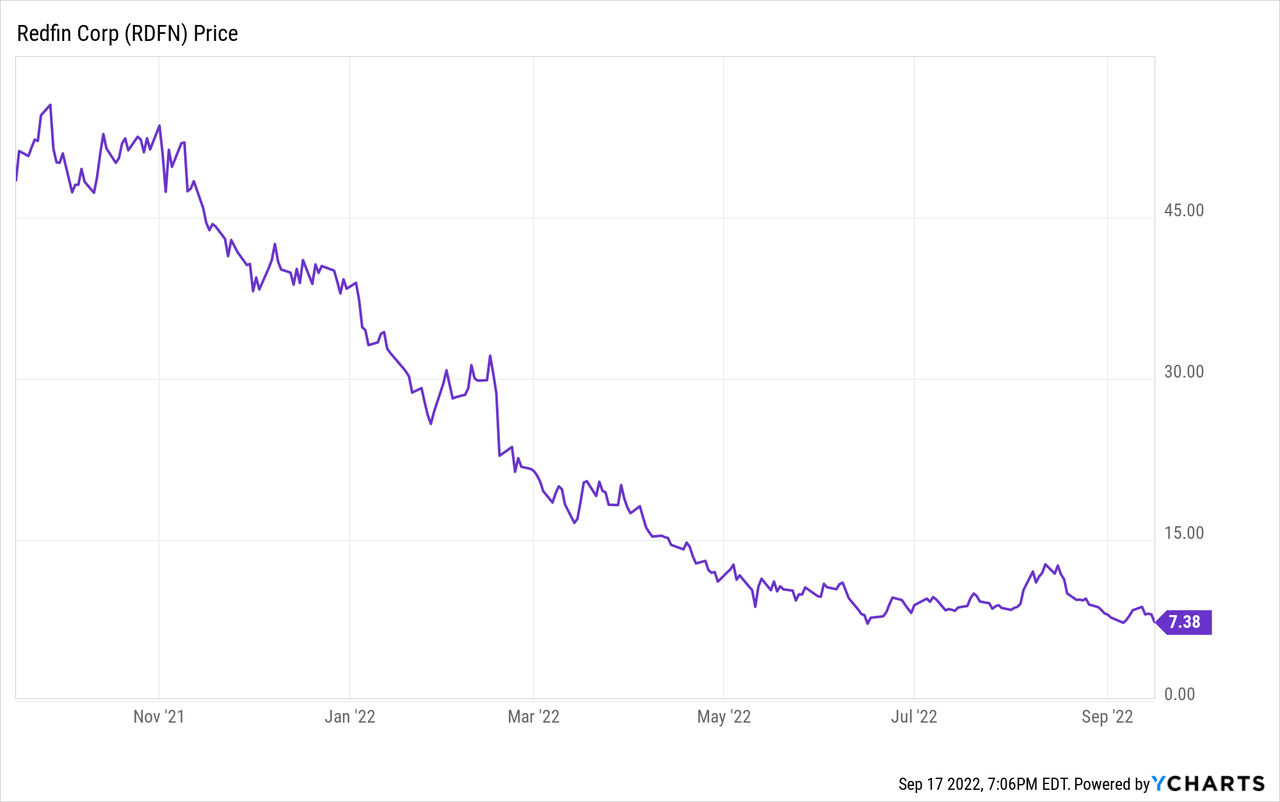

Year to date, shares of Redfin have lost an astounding ~80% of their value. In spite of this, I think there’s further pain down the road.

I remain bearish on Redfin: this is a company that is ill-equipped to deal with a housing market slowdown.

Without deep layoffs, Redfin will be challenged to suffer through transactional slowdown

First, for investors who are newer to Redfin: one of the company’s core principles is that it does not pay its real estate agents via commission. Its typical tagline for consumers is that because agents are not incentivized based on the value of a home’s sale price, they can give true unbiased advice to both buyers and sellers.

Unlike most brokerages which compensate agents on a commission model, Redfin directly employs its agents and pays them salaries (which, by the way, have gone up due to wage market inflation). Vis-a-vis other brokerages, this means Redfin will bleed more as real estate fees dry up.

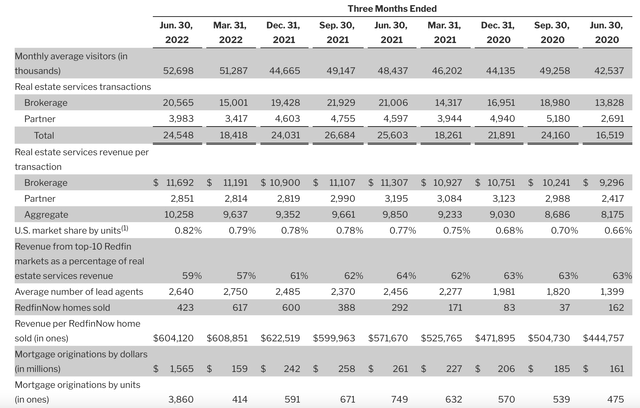

The indicators for this have already appeared in Redfin’s latest Q2 results through June. As seen below, real estate transactions in the June quarter totaled 24.5k, down from last June at 25.6k. The only reason Redfin still managed to keep real estate services revenue flat y/y is the fact that home prices and average transaction prices crept up – which will be a headwind as home prices cool and we lap last year’s home price surges.

Redfin key metrics (Redfin Q2 shareholder letter)

At the same time, note that the company’s number of lead agents grew to 2,640, an 11% increase from last year. Since the pandemic, the company has nearly doubled its number of lead agents as it aggressively sought to expand during the real estate frenzy. But as real estate activity shrivels, the fee volume to support this headcount will fade.

In mid-June, Redfin announced a layoff covering 8% of its workforce – but this likely won’t be enough to stem the loss of revenue.

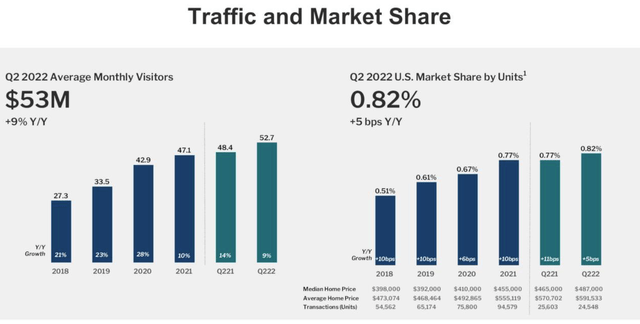

More disappointing indicators: both the pace of Redfin’s traffic growth (measured by monthly visitors) as well as market share growth have slowed tremendously compared to prior years:

Redfin traffic and market share data (Redfin Q2 shareholder letter)

One more note here: Redfin has eliminated its buyers’ incentive in many markets, where it paid a commission refund to Redfin customers who used a Redfin buyers’ agent. Per CEO Glenn Kelman’s prepared remarks on the Q2 earnings call:

But we’ll likely stop trying to convince buyers they should save money on their own agent, since buyers aren’t the ones who pay that agent directly.

On July 26, we eliminated the commission refund we offered homebuyers in 22 markets with few objections from customers or agents. If this pilot continues to be successful, will eliminate the refund entirely as early as January 2023, improving full year gross margins in our core business by more than 500 basis points. In the nine small markets that already eliminated the refund in 2019, we kept taking share.”

This move will likely hamper market share growth and transactional activity for Redfin even further, as many buyers and sellers are drawn to Redfin for the discount brokerage element and financial incentives for buying and selling with Redfin.

We note that the continued rise in interest rates after the end of Redfin’s second quarter, plus growing fears of a recession and the pullback in consumer confidence, will likely make results in Q3 sequentially worse than in Q2.

Profitability sinking amid heavy debt load

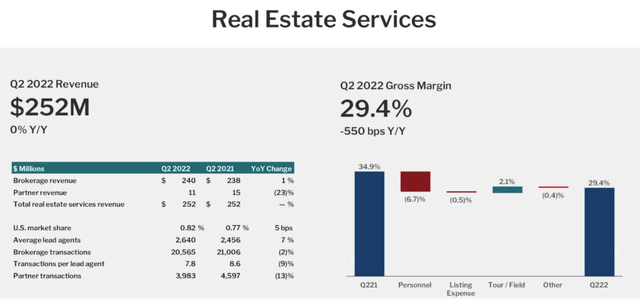

Also take note of the fact that Redfin’s margins are shrinking. In the real estate services business, gross margins fell 550bps y/y to 29.4%, largely driven by an increase in wages and the higher number of lead agents to support fewer transactions:

Redfin real estate services gross margin (Redfin Q2 shareholder letter)

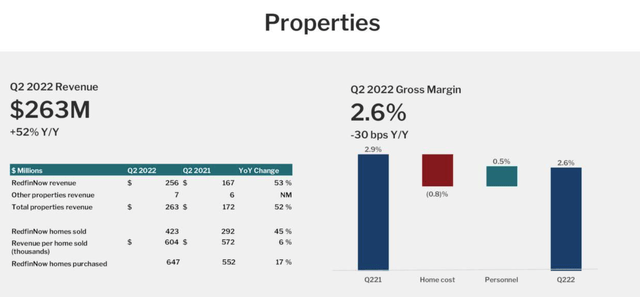

Likewise on the properties side, gross margins fell 30bps, driven by home costs. We worry that home price deflation will mean Redfin’s recently-acquired homes may either have to be cleared at a loss or be held on the balance sheet for longer than planned.

Redfin properties gross margin (Redfin Q2 shareholder letter)

Adjusted EBITDA in Q2 hit a loss of -$28.6 million, despite a gain of $2.8 million in the year-ago Q2. Redfin expects this trend to worsen in Q3, where it is now expecting adjusted EBITDA losses of between -$39 million and -$47 million.

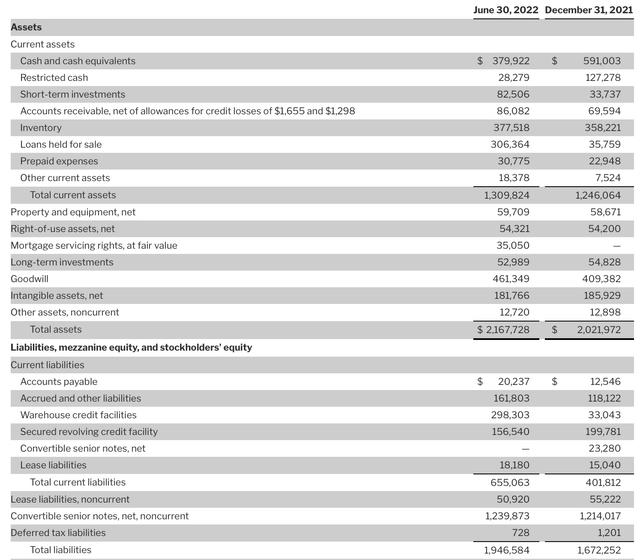

Recall that Redfin is quite a leveraged company already. Its latest balance sheet has $379.6 million of cash against $1.69 billion of convertible debt and credit facilities.

Redfin balance sheet (Redfin Q2 shareholder letter)

With such thin liquidity and a large debt load under its belt, there’s not much room for error here.

Key takeaways

There are a slew of problems facing Redfin right now. The company has a relatively inflexible cost base heading into a housing market slowdown of undeterminable length. Homes on its balance sheet might undergo devaluation, and the expectation of piling losses doesn’t bode well against a heavily indebted balance sheet. This is not a “buy the dip” situation – continue to steer clear here.

Be the first to comment