William_Potter/iStock via Getty Images

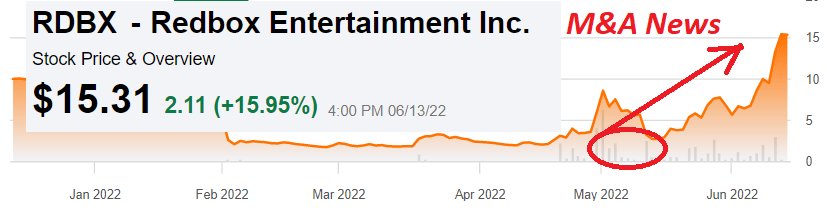

Redbox Entertainment Inc. (NASDAQ:RDBX) and Chicken Soup for the Soul Entertainment, Inc. (CSSE) recently announced a merger combination. Many traders seemed to be acquiring shares of Redbox because the stock price increased significantly. The companies announced a combined EBITDA close to $150 million. With that, in my view, traders are overestimating the amount of cross-selling opportunities and economies of scale that the transaction could create. I studied carefully the debt obligations reported by Redbox Entertainment and Chicken Soup. In my opinion, even considering the best-case scenario, the new combined entity may not be able to pay its debts in 2024. I believe that RDBX is also a bit overvalued.

Redbox And Chicken Soup for the Soul Entertainment

Redbox went from running a pure-play DVD rental business model to a multi-faceted entertainment company:

The Company also generates service revenue by providing installation, merchandising and break-fix services to other kiosk businesses. Redbox Free On Demand, an ad-supported service providing free movies and TV shows on demand, Redbox Free Live TV, a free, ad-supported television service giving access to over 130 linear channels. Source: 10-K

With that about the company’s current business model, the most interesting right now is the merger agreement. According to a recent announcement delivered in May 2022, the combined entity would profit from cross-selling opportunities and would enhance future EBITDA thanks to economies of scale. The reaction of the market was very impressive. The stock spiked up from less than $5 to around the $15 mark.

The combination is expected to be accretive to Adjusted EBITDA in 2023, with numerous opportunities to cross-sell each company’s customer base across digital properties. Source: Chicken Soup for the Soul Entertainment to Acquire Redbox

Our acquisition of Redbox will accelerate the scaling of our business as it combines complementary teams and services to create the streaming industry’s premier independent AVOD. Redbox has 40 million customers in its loyalty program and high-potential digital television assets including carriage of over 130 FAST digital channels on its Free Live TV platform, as well as a robust TVOD and PVOD platform. Source: Chicken Soup for the Soul Entertainment to Acquire Redbox

SA

The expectations about the new entity include revenue exceeding $500 million and adjusted EBITDA around $100-$150 million. In the past, Redbox reported significantly worse financial figures, so I became interested in the transaction.

The company expects to deliver annual-run rate cost synergies in excess of $40 million in 2023. Chicken Soup for the Soul Entertainment expects that the combined company will exit 2022 with a run-rate exceeding $500 million of revenue and $100 – $150 million of Adjusted EBITDA. Source: Chicken Soup for the Soul Entertainment to Acquire Redbox

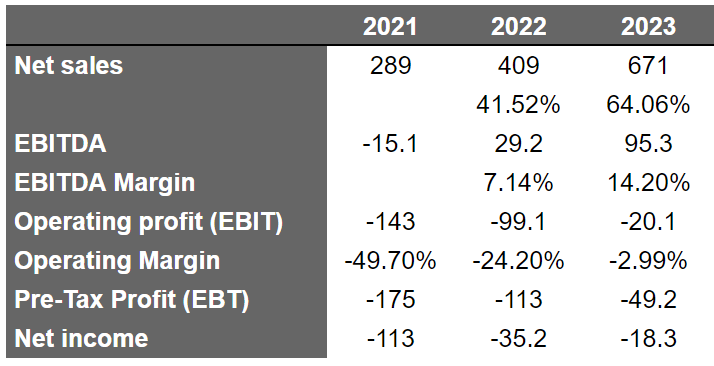

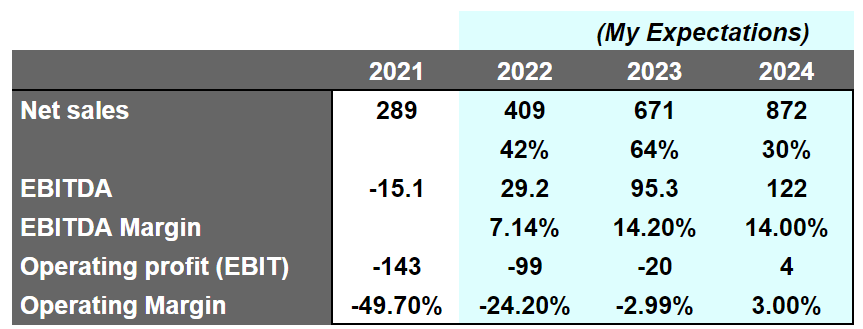

Analysts Believe that Redbox Could Deliver $671 Million In Sales and An EBITDA Of $95 Million

Investment analysts believe that Redbox could deliver 64% sales growth in 2023 and net sales of $671 million. They also assumed an EBITDA margin close to 14% with 2023 EBITDA of around $95 million. Let’s note that the figures are even better than the guidance given by management about the combined entity after the acquisition.

marketscreener.com

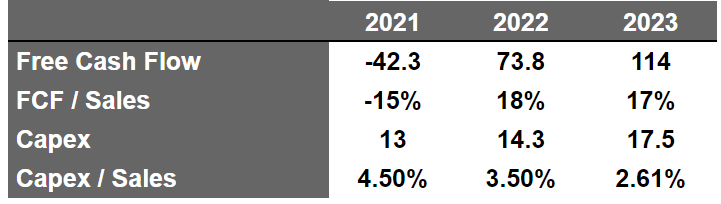

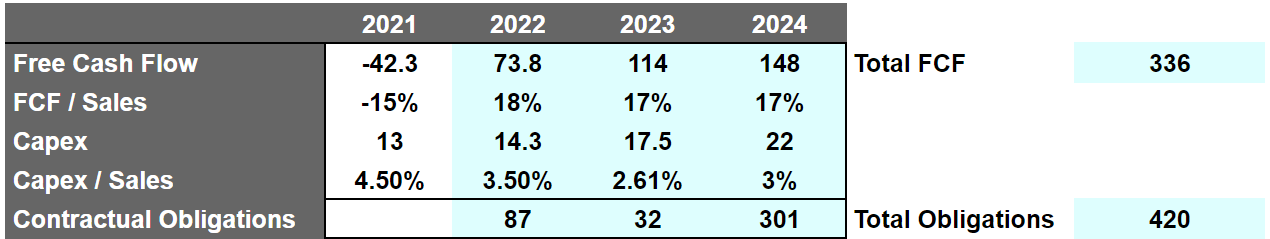

Estimates also include free cash flow close to $115 million in 2023 and 17% free cash flow margin. Have a look at the figures below because I took into consideration some of these figures for my research.

marketscreener.com

Balance Sheet: I Don’t Think The Combined Entity Will Be Able To Pay

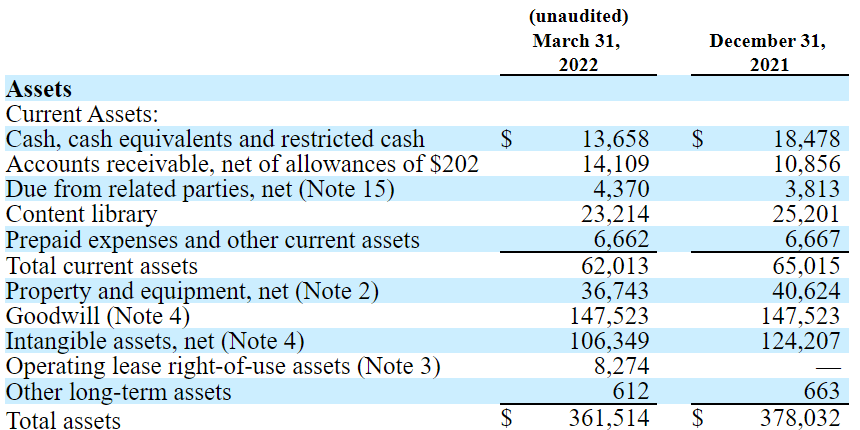

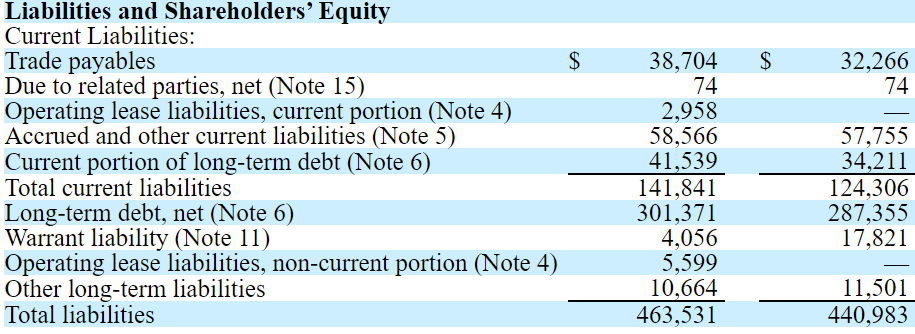

As of March 31, 2022, Redbox reported an asset/liability ratio under one and only $13 million in cash. In my view, management does not have cash in hand to pay for large marketing campaigns, or to hire many more employees.

10-Q

The most worrying is the company’s debt. Redbox reports $301 million in long-term debt among other liabilities. I don’t believe that Redbox will be able to pay its contractual obligation alone without a merger or a financial partner.

10-Q

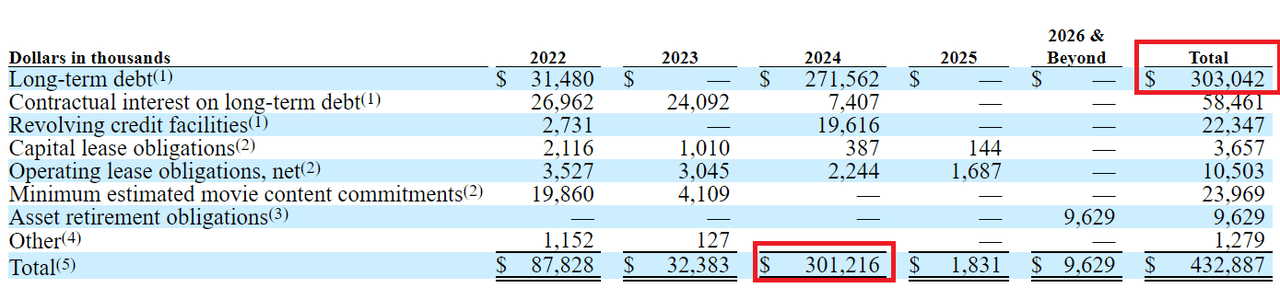

According to the last annual report, Redbox has contractual obligations worth $87 million in 2022, $32 million in 2023, and $301 million in 2024. The total amount of cash in hand is not sufficient to pay future obligations.

10-K

Besides, even assuming very optimistic future financial expectations, I wonder how Redbox and Chicken Soup would pay the debts. With an EBITDA margin around 7%-14.2% and double-digit sales growth, I believe that 2024 EBITDA would stand at $122 million.

Arie Investment Management

Like other investment researchers, I expect free cash flow to grow significantly, but I wonder how the new combined entity would pay the amount of money due. The sum of the contractual obligations of Redbox from 2022 to 2024 is equal to $420 million. My free cash flow projections and those of other analysts don’t exceed $336 million.

Arie Investment Management

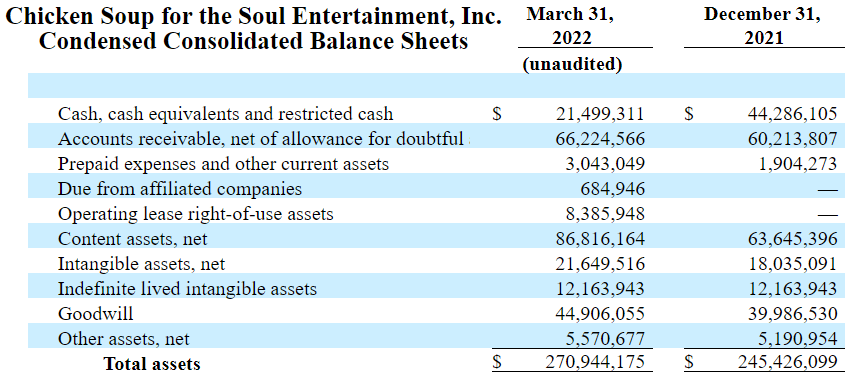

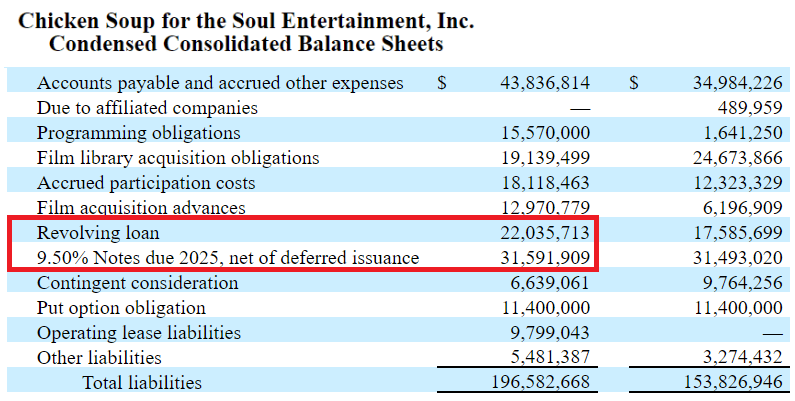

I also checked the financial statements reported by Chicken Soup. The company reports $21 million in cash along with a revolving loan of $22 million, notes worth $31 million, and put option obligations, among other liabilities. The new entity will be larger and may negotiate with banks. However, I don’t think that it will be able to pay the entire debt on time.

Chicken Soup’s 10-Q Chicken Soup’s 10-Q

An Increase In The Share Count May Lower The Free Cash Flow Per Share And Push The Stock Price Down

If Redbox cannot pay its debts, management will likely sell equity to pay to the debt investors. They may also try to convert a significant amount of debt into shares. Either way, the shares outstanding will likely increase, which may lead to a decrease in the intrinsic valuation of each share. In the worst-case scenario, investors could notice this situation and would sell their stakes. As a result, I would expect a decrease in the demand for the stock along with a decrease in stock price.

Valuation

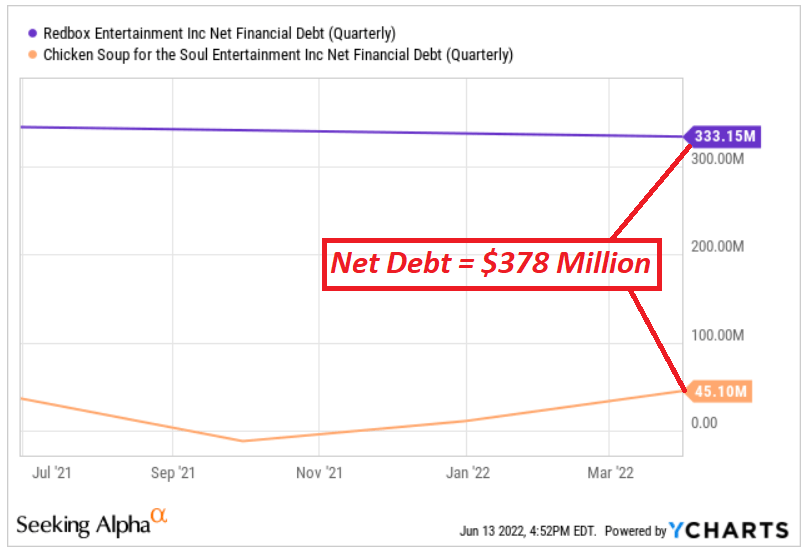

I assumed an adjusted EBITDA of $150 million in 2023 and used a multiple of 4x for the assessment of the valuation because the company’s debt is quite significant. The result is an enterprise value of $600 million. The sum of the net debt of Redbox and Chicken Soup is close to $378 million, which means that the implied equity would stay close to $222 million.

The market capitalization of Redbox is equal to around $150 and $200 million, and Chicken Soup’s market capitalization is close to $113 million. With all these figures in mind, in my view, it appears that Redbox is too expensive.

YCharts

Redbox Receives 5.8 Million Visits Per Month

Redbox is operating an entertainment business model, which has to compete with modern peers operating in the streaming entertainment industry. Peers have more resources and receive a lot more traffic than Redbox. According to Similarweb, Redbox receives 5.8 million visits per month. In my view, it will be difficult for the company to obtain more visibility than other competitors. In sum, revenue growth may slow down in the near future.

The market for streaming entertainment is intensely competitive and subject to rapid change. We compete against other entertainment video providers, such as multichannel video programming distributors, streaming entertainment providers, video gaming providers and more broadly against other sources of entertainment including video-on-demand, subscription and ad-supported services. We compete against streaming entertainment providers and content producers in obtaining content for our service, both for licensed streaming content and for exclusive and original content projects. Source: 10-k

Even If Redbox and Chicken Soup Merge, The Integration May Not Be Done Properly

Redbox and Chicken Soup may merge, and they may receive more financing from sale of equity. With that, the transaction may not be that successful. Besides, if management didn’t correctly forecast the synergies expected or the merger integration is not successful, future sales growth may be lower than expected. Considering the stock price increase that followed the acquisition announcement, M&A failure could create a significant decline in the stock price.

Any transactions that we enter into could be material to our financial condition and results of operation. The acquisitions may not result in the intended benefits to our business, and we may not successfully evaluate or utilize the acquired products, technology, or personnel, or accurately forecast the financial impact of an acquisition transaction. The process of integrating an acquired company, business or technology could create unforeseen operating difficulties and expenditures. Source: 10-K

Conclusion

The transaction announced by Redbox and Chicken Soup created a significant demand for the stock of Redbox. In my view, the market is too optimistic about the potential cross-selling opportunities and economies of scale that the transaction could bring. I carefully studied the EBITDA expectations after the transaction, and believe that Redbox and Chicken Soup may not be able to pay their debts. In my view, Redbox is quite overvalued at the current price.

Be the first to comment