William_Potter

Thesis

I’ve been reviewing investments I made in the first half of the year and looking for lessons I can learn. I originally wrote about VICI Properties Inc. (NYSE:VICI) in January of 2022. My thesis was that VICI offered ultra-reliable cashflows due to its long-term triple-net lease structure. In addition, several near-term catalysts appeared to offer opportunities for improving business fundamentals. If you are new to VICI, I recommend reading my original article.

However, I believe I got one part of my analysis wrong. I thought that VICI might underperform during inflationary times. I wrote:

“[I]nflation could cut into their real profit growth. Since their leases are for very long terms, the lease payments may fail to keep up with inflation. Their leases do have escalators that match inflation. But, the inflation match is capped at 3% for every lease except the CZR master lease. This isn’t a risk of capital loss for the investor, but is a risk of under-performance during inflationary periods. “

While the facts in this paragraph are true. I’m seriously discounting the leverage inherent in VICI’s economics. I’ll explore them in more depth later in the article.

VICI compared to other REITs

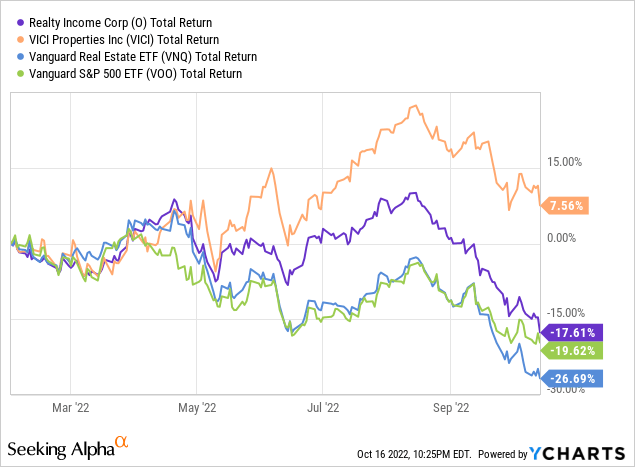

If VICI was not well suited to an inflationary environment. Why has VICI outperformed both the market and real estate investment trust (“REIT”) peers since my article was published? Inflationary concerns and the secondary effects of inflation have been the primary narrative driving the market.

It’s a common claim that real estate and REITs are good inflation hedges. Why, then, have Realty Income (O) and Vanguard Real Estate ETF (VNQ) failed to serve as hedges in the current environment? I believe that many REITs like O trade as quasi-bond proxies. As interest rates rise, the value of the future dividends decreases, just like any other investment. In theory, O can raise the rents on its leases, and that increase in payments should flow through to the dividend. But inflation is not a static number that applies equally to all monetary transactions. O won’t be able to ask for an 8% increase in the leases they renew, just because CPI has gone up 8% over the last year. In addition, it will take time for O to renew all of their leases.

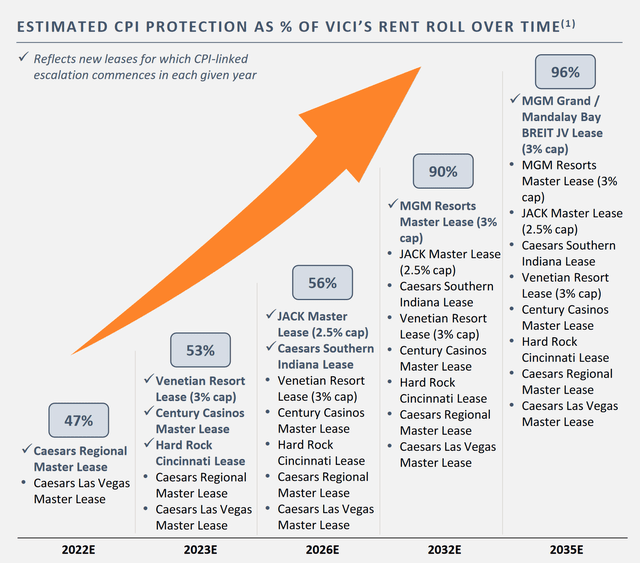

VICI, on the other hand has lease escalators on over 40% of their leases that are fully lease-protected. If inflation remains high, VICI’s rents will increase contractually.

The inflation protection in VICI’s leases has helped them raise their dividend this year by 8%. VICI had one of the largest dividend increases among its larger REIT peers. VICI also announced that the rent payments on their Caesars Entertainment (CZR) master and regional leases would be going up by 8% in Q3 due to the rent escalator. The CPI protection flowed right through to the dividend. O, on the other hand, only raised their dividend by 0.2%.

Taking a look at VICI’s leases

VICI’s leases are an important part of the investment thesis in. I’ve broken out the parts of each lease that are relevant to rent escalation

| Annual Rent | Current Escalator | Year changed | After Change |

Variable Rent |

|

| MGM Master Lease | $860M | 2% | 2032 | 2-3% | no |

| Caesars Regional Master Lease | $649.6M | 2%-CPI | yes | ||

| Caesars Las Vegas Master Lease | $422.2M | 2%-CPI | yes | ||

| The Venetian Resort | $250M | 2-3% | no | ||

| Pro Rata Share of MGM Grand / Mandalay Bay | $152.2M | 2% | 2035 | 2-3% | no |

| JACK Entertainment Master Lease | $69M | 1.50% | 2032 | 1.5%-2.5% | no |

| Greektown Lease | $51.3M | 2% | yes | ||

| Hard Rock Cincinnati Lease | $44M | 1.50% | 2023 | 2%-Uncapped | yes |

| Century Master Lease | $41M |

1.25%-CPI |

no | ||

| Caesars Southern Indiana Lease | $32.5M | 1.50% | 2026 | 2%-Uncapped | yes |

| Margaritaville Lease | $23.8M | 2% | yes |

The table above shows the current escalator in each lease, the years the escalator will change, and the escalator after the change. For leases with variable rents, there are certain years where the rent paid changes based on the performance of the underlying casinos. The details of variable rent vary, but generally allow VICI to share partially in the economics of the Casinos they own. Any escalator with a range is determined by CPI.

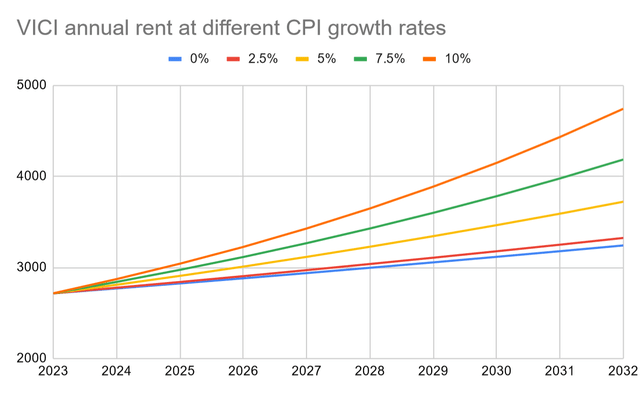

If we ignore the variable rent escalator, we can determine future rent growth at different amounts of CPI growth rates.

The leverage inherent in VICI’s cost structure

By far VICI’s largest expense is the interest it must pay on its debt. All of VICI’s debt is fixed rate and long term, with an average yield to maturity of 7.2 years. When VICI’s rent grows, almost all of the rent increase falls straight through to the bottom line. If VICI’s overall rent increases by 5%, its funds from operations (“FFO”) should increase by about 6.7%.

The leverage inherent in VICI’s operating model partially offsets the fact that not all of their leases are fully CPI-protected. The following table shows the projected FFO growth of VICI’s current portfolio at different CPI levels.

| CPI growth |

VICI FFO Growth |

| 0% | 2.6% |

| 2.5% | 2.9% |

| 5% | 4.6% |

| 7.5% | 6.1% |

| 10% | 7.6% |

This partial inflation protection is uncommon for a REIT. I believe it is quite valuable. With the market’s persistent focus on inflation, it has enabled VICI to outperform its peers. It has acted as an offset to rising interest rates that otherwise would have dragged down VICI’s value. It should continue to act as a steadying function for VICI’s intrinsic value. If inflation persists, VICI will continue to benefit from the CPI-linked escalators. If inflation comes under control, it should benefit when the FED inevitably pauses and lowers interest rates.

Valuing VICI

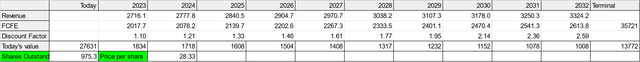

I decided to use 2.5% as my assumption for the long-term inflation rates when doing the discounted cash flow (“DCF”). But, as I’ve noted throughout the article, this cash flow is at least partially protected from inflation. If we assumed a higher inflation rate, we’d have larger future cash flows, but we’d also use a higher discount rate since the future money we receive would be worth less. It’s also worth noting that this is based on a moment in time and assumes management makes no further acquisitions. This is not going to be what actually happens. But, I still believe the current implied future cash flows are an accurate way to value VICI.

This DCF shows the current fair price per share is $28.33 if we are looking for a 10% rate of return. The current stock price implies a required rate of return between 9 and 10%.

While this might not seem like the most exciting return on its face. I think it is actually compelling. I feel VICI has a below-average risk for a stock. Its leases and CPI-linked rent escalators make this a business with reliable cash flows. Not many other investment opportunities have this reliability and inflation protection built in.

Final thoughts

I think VICI should appeal to investors who are looking for a less risky security. I don’t think VICI is an investment that has as high of an upside as some other opportunities currently in the market. But it also has more downside protection than many stocks.

I continue to own VICI. I haven’t added since the first quarter. Partially because the market has been offering other more interesting opportunities. Partially because the stock had a large run-up after it was added to the S&P 500. But the stock is once again approaching a range where I’m interested in adding more.

Be the first to comment