Galeanu Mihai

Overview

Recruit Holdings (OTCPK:RCRUY) is not the first name to come to mind when thinking of Japanese large caps such as Nintendo (OTCPK:NTDOY), Sony (SONY), or Toyota (TM). After all, the company is no legacy name, going public only in 2014. Nevertheless, Recruit is the company behind the most popular and well-known online job boards Glassdoor and Indeed. Over the past few years, the company has grown into a household name in the HR software industry, increasing both revenue and profits at an impressive rate. As the company is facing multiple secular tailwinds in the future, Recruit could be set to rebound after falling 40% year-over-year.

Recruit Group was launched in 1960 as a small job-hunting magazine for university students called ‘Invitations to Companies’ with the goal to create an open job market for new graduates by publicly disclosing recruitment information. After the second world war ended, Japan was one of the fastest-growing economies in the world, translating into unprecedented demand for labor. In 1962, it expanded its business model with the main focus on creating a platform to connect businesses with individual users. By introducing new tools, the company shifted to mobile platforms to address mid-career recruiting, placement, and staffing needs.

Recruit Holdings

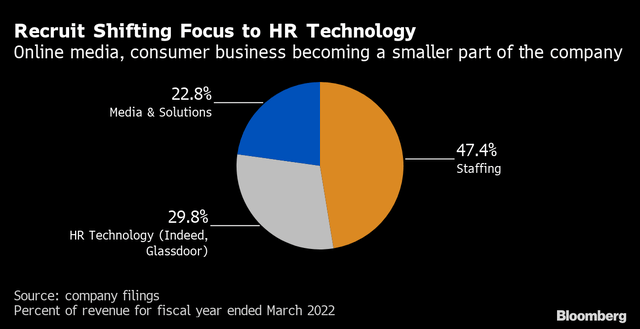

Recently, the company introduced software as a service (SaaS) business tools to support operations within small to medium-sized enterprises (SMEs), including restaurants and retailers. That said, Recruit consists of three autonomous Strategic Business Units and Holdings. Namely, these entities are made up of HR Technology, Matching Solutions, and Staffing.

HR Technology

Recruit’s HR Technology consists of Indeed and Glassdoor, which have been acquired in 2012 and 2018. With over 300 million unique visitors and 225 million resumes uploaded, Indeed is the world’s largest online job board. Although the platform is free of charge for job searchers, the company charges businesses for posting vacant positions. Thus, Indeed allows recruiters to increase their visibility through several paid tools. These tools include sponsored posts, Indeed Resumes, and Targeted Ads. Here, companies can sponsor their job listings through paid ads to increase their visibility, starting at a minimum of $5 per day. Job seekers can also upload their resumes to Indeed where it can be found by recruitment staff. Indeed monetizes these resumes through subscriptions, costing $100/month per 30 contacts, or $250/month for 100 contacts in a more advanced plan. Finally, in addition to sponsored job ads, Indeed allows companies to address potential employees through targeted ads.

Recruit also owns and operates Glassdoor.com, which it acquired in 2018 for $1.2 billion in cash. The site aims to increase workplace transparency by offering insights to ratings and reviews, such as salary reports, CEO approval ratings, interview reviews, etc. It allows job seekers to easily apply to posted job listings. The fast-growing website counts 59 million monthly visitors and over 2.2 million registered employers. Similar to Indeed, Glassdoor sells premium packages to employers through a freemium model. After the first three free listings, Glassdoor charges $249 per uploaded job listing. Similarly, employers can promote individual job listings to drive additional traffic to the listings.

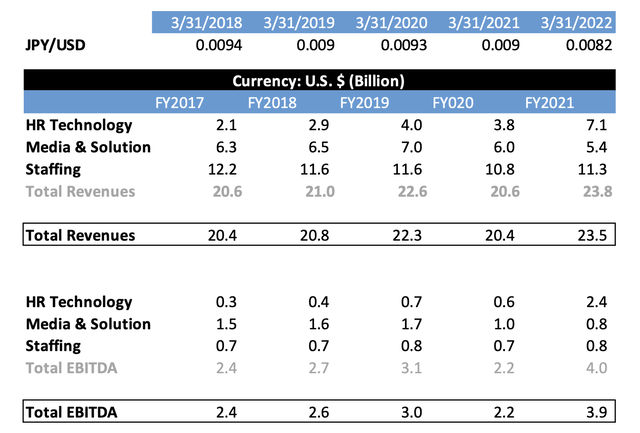

Compiled by Author

HR Technology is by far Recruit’s fastest-growing segment, posting 53.9% growth in Q2 2022 compared to the year prior. On a currency-adjusted basis, Recruit’s HR Technology grew 25% from $1.3 billion to $1.61 billion in Q1 2022, as the Japanese Yen sold off significantly over the last year. The rapid growth in Recruits HR Technology is demonstrating Recruits’ successful monetization of its acquisitions. In the future, its HR Technology segment will likely remain a major growth driver for the company, as recruiting continues to shift online. By 2030, the global online recruiting market size is anticipated to grow to over $43 billion, nearly doubling from 2020. As more companies are switching to online platforms to recruit employees due to the convenience and having a larger potential audience, demand will likely further increase, especially for SMEs.

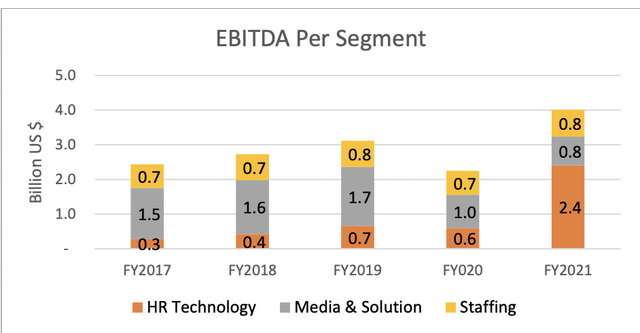

Compiled by Author

However, the space will remain competitive with LinkedIn controlling the largest market share at the moment. After Microsoft’s $26 billion acquisition in 2016, LinkedIn’s revenue grew to $13.8 billion in 2022, a 34% year-over-year increase. Considering, Recruit’s HR Segment stands at ‘only’ $7.6 billion in annual revenue, the company has a long runway for growth if it monetizes its opportunity effectively. It’s also worth mentioning that its HR segment is by far Recruits’ most profitable segment, making up over 50% of its EBITDA, despite only accounting for 30% of its total revenue.

Matching & Solutions

The segment comprises of two main business areas: Marketing Solutions provides SaaS solutions supporting SMEs through management tools, while its HR Solutions support businesses in recruiting and hiring through job advertising services and placement services. Here, the company provides assessment, consulting, and training services to address management and HR needs. Besides HRS services, Recruit also operates various subsidiaries and marketplaces for housing, travel, dining, and automobiles. Recruit also owns AirBusiness Tools, which provides cloud-based solutions such as cashless payments, POS systems, and reservation technology.

Staffing

Favorable Valuation

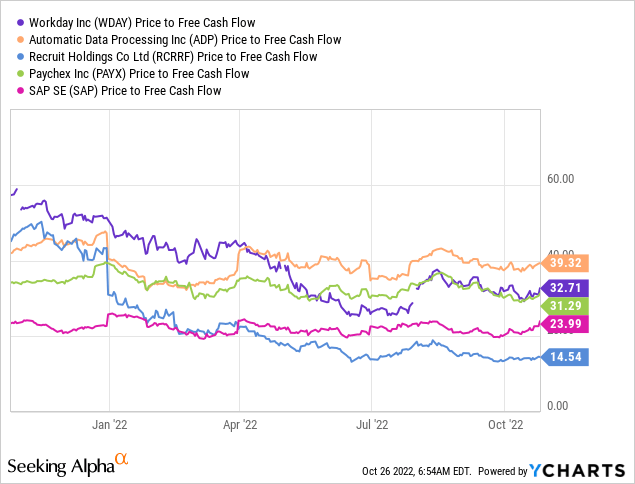

After falling nearly 40% year-over-year, Recruit’s valuation has become more attractive. With $3.4 billion in TTM Free Cash Flow, Recruit currently trades at 14.5 times Price to Free Cash Flow. Compared to other major HR software vendors, investors are currently paying a discounted price. In this regard, Automatic Data Processing (ADP) trades at nearly 40 times Free Cash Flow after increasing 100% in the last five years, whilst Workday (WDAY) and Paycheck (PAYX) trade at around 30 times Price to Free Cash Flow. Certainly, Workday holds higher growth rates than Recruit, yet SAP (SAP) with similar growth rates also demands a much higher valuation premium. Thus, although Recruit is up by more than 300% since 2016, its steady revenue growth allowed it to grow into its valuation.

Compiled by Author

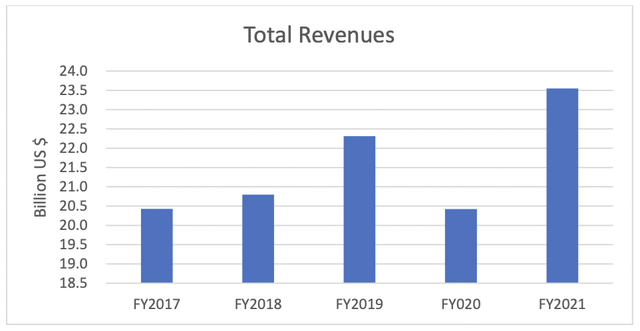

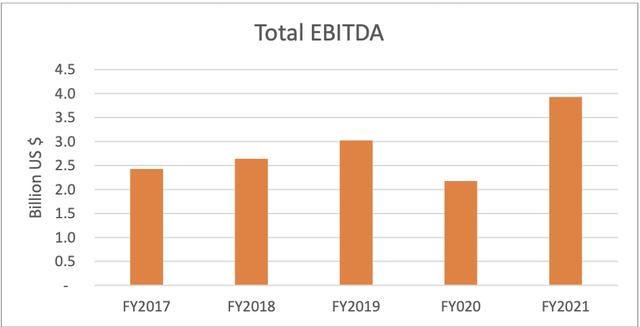

Thus, the company currently trades at 1.9 times Price to Sales, slightly higher than during its valuation low in 2016 when it traded at just 1.6 times Price to Sales. However, it is important to note that Recruit also grew its EBITDA impressively over the last five years as a result of expanding its high-margin HR Technology segment.

Compiled by Author

Here, it grew its annual EBITDA from just $1 billion in 2015 to $4.9 billion in 2022. Thus, at a market cap of $50 billion, Recruit currently trades at 10 times TTM EBITDA, which appears a fair price, considering its EBITDA growth rates. In the future, CEO Idekoba sees great potential in offering matching tools, which also apply to travelers, home buyers and online shoppers. It is therefore likely that Recruit will keep its eyes open for more acquisitions in the future to grow its addressable market.

Bloomberg

However, apart from $1.2 billion purchase of Glassdoor in 2018, Recruit hasn’t done any major acquisitions, despite having $5.5 billion in Cash & Equivalents on hand. While the company does have targets in mind, Idekoba says it’s better to start with partnerships to get a better understanding of the opportunity for Recruit, “The absolute priority is whether it’s good for the user, good for the client, and good for society,” Idekoba said.

Conclusion

I believe buying shares of the best companies around the world is important to build a successful portfolio strategy. Although the U.S markets offered many profitable opportunities in the past and still do, foreign markets may also hold interesting investment opportunities. While investors may be more cautious to invest in Asia due to political risks and a large recent sell-off in Chinese equities, the Japanese market remains stable. The political landscape in Japan is governed by the liberal democratic party, which means regulatory issues are likely to be a smaller risk factor.

As a major HR leader, Recruit offers a compelling investment case with strong innovative brands that will continue to drive growth in the future. Moreover, as the company is already deeply profitable, the current valuation offers investors a margin of safety.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment