narvikk

Q3 highlights and Thesis

My last article on Apple (NASDAQ:AAPL) is co-produced with Envision Research last month. The goal of that article is to pay tribute to Jony Ive after I read the news that the former Chief Design Officer has officially ended his relationship with AAPL. In this article, with its Q3 earning release (“ER”) just posted, I wanted to shift the focus and review the ER.

In particular, I wanted to deep dive into the impact of foreign exchange rates. Indeed, all tech giants, with FAAMG pack as examples, have reported strong currency headwinds and are anticipating even stronger headwinds for the rest of the year. Take AAPL and Meta Platforms (META) as examples, they both experienced about 3% currency headwinds in the past quarter and are anticipating 6% for 2022, as you can see from their comments during ER:

AAPL Q3 ER: I mentioned in my prepared remarks that we expect some deceleration from the 12% that we’ve had in the June quarter. Keep in mind, we’re going to see, on a year-over-year basis, 600 basis points, 6% impact from foreign exchange so that is a big element for us.

META Q2 ER: Foreign exchange trends had a significant impact in Q2, in particular, the depreciation of the euro relative to the dollar. On a constant currency basis, we would have seen 3% revenue growth year-over-year.

Our guidance assumes foreign currency will be an approximately 6% headwind…

To wit, AAPL’s Q3 sales of $83.0 billion would have been even more impressive without the headwinds. It is up 2 percent YoY, but could have been about 5 percent because the foreign exchange headwinds caused about 3 percent headwinds.

In the remainder of this article, we examine this issue more closely. I will use AAPL’s Q3 results to illustrate the complications of foreign exchange rates and their impact on global businesses like the FAAMG stocks. I will also use historical data to show why I think AAPL’s guidance is on the conservative side, setting the stage for a positive surprise for incoming quarters.

Now, let’s dive in.

Foreign exchange rates 101

You can take a graduate-level course on the topic (which, for better or worse, I did) and still come out of the class with no clear answer. The impact of foreign exchange rates is so complicated and relies on so many details like how you buy, sell, invoice, and pay. And even widespread wisdom, like the one I’m going to quote next, should be taken with a grain of salt.

For global businesses like AAPL, the most widespread theory works like this. As the dollar strengthens, if they choose to keep the prices of their products in constant dollars, then their products would become more expensive in local currency and hence less competitive. And if they choose to keep the price constant under local currency, then their profit would take a hit when they report them in dollars. The theory feels to me as some mix of oversimplification and questionable assumptions (e.g., the assumptions about competitiveness and pricing power). And, companies like AAPL use a range of strategies besides pricing such as currency hedging programs.

Hence, it is easier (and more useful) to directly look at the data without too much theorizing, which is what I will do next.

AAPL: A truly global business

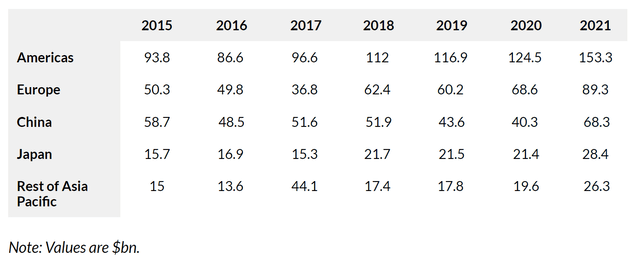

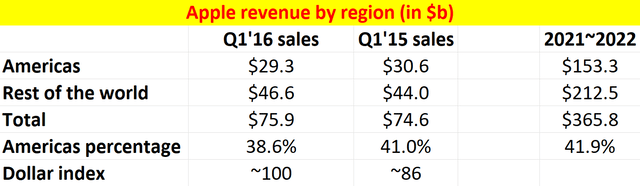

The following chart shows Apple sales by region from 2015. As seen, it has been successful both in the US and also abroad. Since 2015, its sales composition has been quite stable, with the Americas being responsible for 40% percent of all revenue (hence a relative minority). And the majority 60% of its revenues are generated overseas. Within the Americas, the U.S. plays a dominant role. As you can see in more detail from the second chart, contributions from the Americas varied in a narrow range over the years. It represented 41.6% in 2015, 38.6% in 2016, and about 41.9% in 2021~2022.

Source: www.businessofapps.com Author

AAPL: Historical context

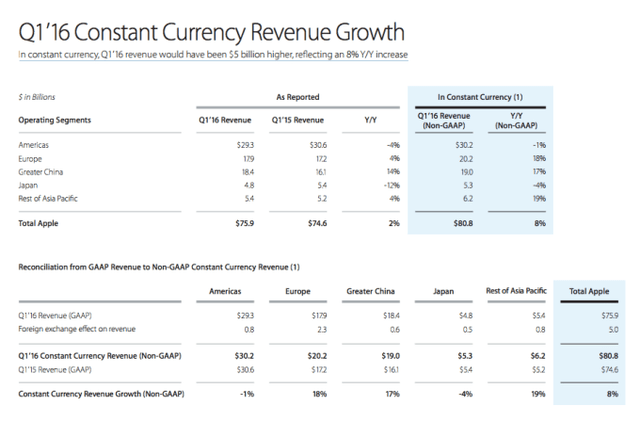

In the previous chart, I picked the 2015 Q1 and 2016 Q1 results for a strategic reason: the dollar strengthened by about the same amount then as we are experiencing now. As you can see from the chart below, during 2015 Q1 and 2016 Q1 (note that AAPL’s fiscal calendar is shifted by 1 quarter), the dollar index climbed from about 86 to 100, strengthening by about 14%. And as of this writing, the dollar has strengthened by 12.9% in the past year.

And as you can see from the second chart below, AAPL reported a 2% revenue growth YoY after adjusting for foreign exchange rates. And in constant currency, the growth would have been 8% YoY. In other words, the currency headwinds caused by a 15% dollar strengthening was about 6%.

AAPL: What to expect next?

With this context, it is easy to see the logic behind its 2022 Q3 guidance for a 6% impact from foreign exchange rates in 2022. The reasoning must be really linear. Its sales mix by region has not changed much from 2016. The dollar has strengthened by about the same amount (14% vs 12.9%). And hence there is no reason to expect differently.

However, my view is that such a linear model might be flawed. There are differences this time versus the 2016 episode. First, I see the Fed’s rate hikes losing steam and the dollar strengthening unlikely to continue consequently. And furthermore, the global geopolitical landscape is also very different today than it was in 2016. The tension between China and the US has heightened since then (and China now plays a much large economical role globally role today than in 2016). And China has been systematically trimming its dollar holdings. The detailed arguments are in my other article here, and a brief summary is quoted below. And the net result is that I see it unlikely for the dollar to maintain its current level and even more unlikely to further strengthen. As a matter of fact, the dollar has retreated from its peak level of 109 to the current level of 105 shortly after the recent Fed rate announcements.

I see short-term treasury rates (1-year, 2-year, and 3-year) have all reached their target ranges already. These rates have all reached their target range already in my view. The short-term rates are currently high enough to cause a yield curve inversion already. As a result, the dollar strengthening is losing steam as we go forward.

Final thoughts and other risks

In summary, I see the current assumptions surrounding the currency headwinds as too dramatic for Apple (and potentially for the rest of the FAAMG stocks too). For AAPL, the assumption implies that the current dollar strength would persist or even worsen from here. If the 2016 episode is of any guidance, the dollar index indeed has lost its strength and reverted to a lower level shortly after it reached 100 in 2016. And this time, I see catalysts to reverse the trend too. Thus, I think the guidance for a 6% headwind is on the conservative side, setting the stage for a positive surprise for incoming quarters.

Finally, risks. Besides the uncertainties associated with foreign exchange rates, there are a couple of other risks associated with AAPL at this point. Macroeconomic difficulties such as COVID and inflation can impact AAPL’s margins in the near term. And AAPL, just everyone else, is seeing some price pressure on some commodities and silicon components.

Be the first to comment